NicolasMcComber/E+ via Getty Images

Elevator Pitch

My Buy rating for Korea Electric Power Corporation (NYSE:KEP) [015760:KS] stays unchanged. This is an update of my prior article for KEP written on January 4, 2022, which touched on the potential impact of the “tariff hike” and South Korea’s “hydrogen economy plans.”

The short-term pain for Korea Electric Power is unavoidable. The rise in commodity and energy prices are hurting KEP’s bottom line, and Korea Electric Power is expected to stay in the red for fiscal 2022 and 2023.

On the flip side, KEP’s current woes set the stage for regulators and policy makers to implement changes to energy policies that could be favorable for the company in the long-term. Such potential changes could include electricity pricing that is aligned with market factors and a more gradual pivot away from nuclear energy. In addition, Korea Electric Power’s shares are very cheap, implying that negatives in the near term are factored into its stock price to a considerable extent. These factors warrant a Buy rating for Korea Electric Power’s shares.

Short-Term Pain

According to financial projections extracted from S&P Capital IQ, Korea Electric Power is expected to see its losses at the EBIT level widen from -KRW7.4 trillion in fiscal 2021 to -KRW10.4 trillion in FY 2022. Over this same period, KEP’s normalized net loss is forecasted to go from -KRW8.3 trillion last year to -KRW15.4 trillion this year.

At the company’s Q4 2021 results briefing on February 24, 2022, Korea Electric Power already acknowledged that “there has been a big surge in energy costs recently.” KEP also mentioned that it is “working to sell off our non-core assets to cope with the situation”, which gives an indication of the extent of the cost pressures it is facing.

It is also worth reviewing KEP’s recent Q4 2021 financial performance as indicated in its February 2022 investor presentation slides. Korea Electric Power’s revenue expanded by +6% from KRW14,692 billion in the fourth quarter of 2020 to KRW15,518 billion in Q4 2021, which exceeded the sell-side consensus top line forecast by +1%. But KEP turned from a net profit of +KRW566 billion in Q4 2020 to a net loss of -KRW3,892 billion in the recent quarter, and this was much worse than the -KRW3.2 trillion net loss that the market was expecting. This is a sign of higher expenses more than offsetting revenue growth.

Notably, these all happened before the escalation of the Russia-Ukraine conflict into a war in late-February, which has sent the prices of energy and commodities surging. A recent news article published on April 13, 2022 in a local Korean news outlet, Pulse, citing a sell-side report from Hana Financial Investment noted that KEP’s Q1 2022 operating losses could be as high as -KRW8.4 trillion as a result of “surging coal costs on top of the soaring oil price.” This is aligned with the widening of losses for Korea Electric Power in 2022 as per consensus financial estimates that I referred to earlier.

In summary, there is a lot of short-term pain in store for KEP.

Long-Term Gain

Notwithstanding the expected short-term pain for Korea Electric Power in terms of rising costs and wider losses, the company’s shares have done reasonably well in the past few months. This indicates that investors are focused on the long-term outlook for KEP and not necessarily overly concerned about challenges for the company in the short-term.

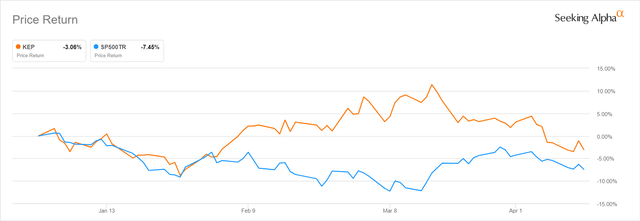

Korea Electric Power’s Stock Price Performance For 2022 Year-to-date

Korea Electric Power’s shares are only down by -3% this year thus far as per the chart presented above, and the stock has outperformed the S&P 500 over this period. In my opinion, KEP’s share price has been resilient because of its long-term outlook and valuations (discussed in the next section).

I think the current headwinds for Korea Electric Power and the election of a new president in South Korea might prompt changes that are favorable for the company in the medium to long term.

One key change is a renewed focus on nuclear energy for South Korea which is good for Korea Electric Power.

The Korea Herald published an article on March 13, 2022 highlighting that the country’s new president, Yoon Seok-yeol “has vowed to make a U-turn from the Moon Jae-in (former president) administration’s nuclear energy phase-out policies.”

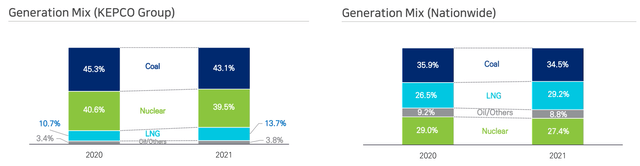

Power Generation Mix For Korea Electric Power And South Korea

Korea Electric Power’s Feb 2022 Investor Presentation

As per the chart presented above, nuclear power accounts for 40% and more than a quarter of the power generation mix for Korea Electric Power and South Korea, respectively. Earlier, the market had expected the revenue and earnings contribution from KEP’s nuclear power business to decline significantly in the intermediate to long term based on the former president’s policy direction focused on reducing nuclear power’s contribution to the country’s energy mix. Korea Electric Power had also projected its nuclear power capacity (17% of total capacity in 2021) to decrease from 23,250MW as of end-2021 to 19,400MW as of end-2034 as indicated in its February 2022 investor presentation.

But it appears that South Korea will not pivot away from nuclear power that soon which is positive for Korea Electric Power, and this is driven by both a change in political leadership (as highlighted above) and elevated oil prices. A March 3, 2022 Bloomberg article highlighted that “soaring fossil fuel prices and rising demand for clean energy have governments around the world reconsidering nuclear power programs.”

Another key change for the future is ensuring that future electricity prices in South Korea are set in an equitable manner and not be driven by political factors.

Korea Electric Power has historically been unable to pass on cost increases to consumers as a result of political pressures i.e. easing electricity cost burden for consumers. This could change going forward with Korea Electric Power’s losses ballooning and the change in political leadership in the country.

A January 20, 2022 Business Korea news article cited a sell-side report from NH Investment & Securities which highlighted Yoon Seok-yeol’s comments during his presidential election campaign. Yoon Seok-yeol had previously said that “we will establish a power supply plan based on fairness and common sense” and “electricity rates should be decided based on science and common sense”, according to the NH Investment & Securities report.

If there are future changes to South Korea’s system of determining electricity tariffs that are deemed as fair and transparent, it will be a good thing for Korea Electric Power.

In a nutshell, the short-term pain that Korea Electric Power is suffering from now might prompt policy makers to have a re-think about the energy-related policies in South Korea, and this could possibly transform into long-term gains for KEP.

Valuation And Concluding Thoughts

The market currently values Korea Electric Power at 0.22 times trailing P/B and 1.5 times consensus forward next twelve months’ Enterprise Value-to-Revenue based on valuation data sourced from S&P Capital IQ.

KEP’s current depressed valuations are understandable, considering that the sell-side analysts see Korea Electric Power remaining loss-making for FY 2022 and FY 2023 and only turning profitable again in FY 2024. Korea Electric Power’s future profitability is heavily dependent on the future of energy policies in Korea.

I am of the opinion that new policies in South Korea relating to nuclear energy and electricity tariffs turn out to be more favorable than expected, which will allow KEP to generate positive earnings in a shorter than expected period of time. This justifies my Buy investment rating for Korea Electric Power.

Be the first to comment