Spencer Platt/Getty Images News

Thesis update

In my previous post, I recommended to buy Sabre Corp (NASDAQ:SABR) and discussed on its competitive advantages in the GDS industry, and how the travel industry is still poised for long-term growth. This post is to update the thesis after the recent 3Q22 earnings.

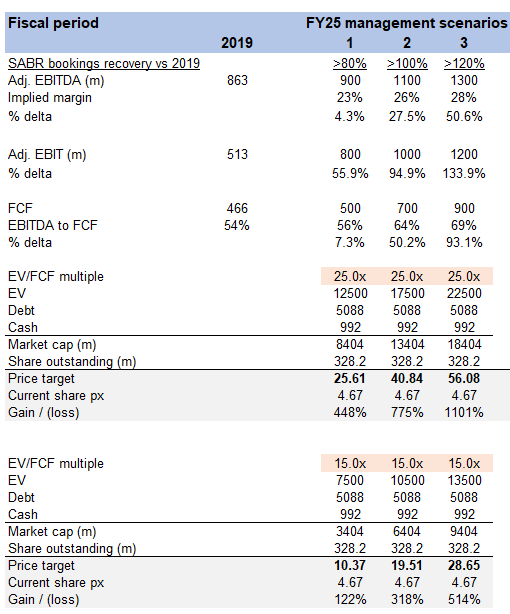

In short, my recommendation remains the same – to continue going long on SABR ($4.67 as of this writing). It is still one of the best risk-to-reward ratios in the current market environment with a near-term catalyst (post-COVID travel recovery). At this valuation, we simply need SABR to hit management’s FY25 guidance—recover bookings to >80% of 2019 levels—and we can make 4.5 times our money based on a 25x FCF multiple.

Earnings update

EBITDA beat and guidance raised (implicitly)

In 3Q22, SABR’s EBITDA was $34 million, which was $4 million higher than expected. On the assumption of a 55% recovery in bookings, the company’s management has revised their FY22 EBITDA forecast to $90 million. Despite FY22 revenues being in line with expectations at $90 million, the implied margin is higher due to lower Q3 revenues and a lower FY22 bookings recovery than expected. The EBITDA of $90 million is closer to the >$100 million in the 60% scenario than the >$0 million in the 50% scenario, despite the fact that the expected bookings recovery is in the middle of the 50% and 60% FY22 outlook scenarios. If the stock price is any indication, the market obviously does no appreciate how good this really is. For me, this is great news because it indicates that EBITDA is growing at a much quicker rate than anticipated. This means that management’s FY25 EBITDA is understated.

Management comments on travel are positive

For me, this appears to be the most important takeaway. While investors have access to all the news and alternative data available, the quality of such data cannot compete with management’s access to real-time data and insights on travel recovery.

It sure does seem that travel is on track to recover to pre-Covid levels. GDS bookings, passengers boarded, and hotel transactions have all increased in the third quarter. Management attributed the re-acceleration of the recovery to the global recovery and the APAC region. According to carrier marketing schedules, total seats available in 2023 will be higher than in 2019, and management reports no signs of a slowdown in leisure or corporate demand in the global economy.

Booking fees growth continues to be sustainable

From Q2 to Q3, the average booking fee went up $0.13, to $5.38. This was a 13% increase in average booking fees from the 3Q19. Since the lower-margin domestic leisure Expedia (EXPE) bookings have shifted away from the SABR, I anticipate that these higher fees will persist as corporate and international travel trends improve.

Update on SABR’s cloud transition

SABR’s technology initiatives continue to advance, which bodes well for both product improvement and cost reduction (SABR anticipates annual adjusted technology savings of more than $150 million in 2025 compared to 2019). As of 3Q22, SABR had moved all of SynXis to Google Cloud, including the Enterprise Central Reservations System and the Property Management System. Hospitality Solutions’ margins, according to management, will improve by 2023 as a result of the impending bursting of the hospitality cost bubble. Sabre also moved its entire air shopping from Amazon Web Services to Google Cloud. In addition, the majority (70%) of the servers in the company’s Plano, Texas data center have been decommissioned.

Tracking data

Revenue

The consensus estimate was for $690 million in revenue, so the actual amount of $663 million was down 4% from that. While IT Solutions and Hospitality came in slightly below expectations, Distribution revenue fell far short.

Travel recovery %

The projected rate of travel recovery for FY22 is 55%, compared to the 50%, 60%, and 70% forecasted in the three original scenarios for FY22. In spite of the fact that the economy showed encouraging signs of improvement through early June, the rate of recovery slowed in the second quarter and the first half of July, according to the company’s management. On the flipside, compared to 2019, net air bookings recovery has been on the rise, rising from 50% in July to 58% in both August and September, with positive trends continuing into October.

Hospitality business profitability

For me, this is a drawback. The Hospitality business adjusted operating loss for the quarter was $11.3 million on revenue of $67.5 million, despite a recovery in transactions to 104% of 2019 levels. That said, the company is currently feeling the pinch of technology transformation’s duplicative costs, which should ease in the years to come.

Debt

For FY22, net interest expense is now projected to be $295 million, a $10 million increase year over year from the $285 million projected in Q2 guidance. At the current interest rate, Sabre’s annual interest cost is $319 million. Given that leverage can cut both ways, this is an issue that needs close monitoring.

Valuation

Price target update

There is no change to my price target in FY25 which suggests a price target range from ~$25 to $56, suggesting an upside of 4.5x to 11x from today’s share price of $4.67. This is based on three different scenarios laid out by the management in the FY21 earnings call. Each scenario represents a different recovery level of bookings vs 2019 (pre-COVID).

My belief remains the same that the market priced SABR as though travel would never recover in our lifetime. Which I believe is extremely unlikely given management confidence on travel recovery momentum.

Own’s estimates

Conclusion

To sum up, I am still of the opinion that SABR’s potential upside is much greater than its current valuation if it can achieve management’s FY25 projections. I find it absurd that the market values this asset as if nobody will ever travel again. SABR is expected to continue growing and return to pre-covid levels if current trends hold. An uptick in tourism as the region begins to recover from the COVID outbreak may act as a near-term catalyst for the stock price.

Be the first to comment