We Are

WNS Holdings (NYSE:WNS) has been increasingly moving towards increasing its revenue from non-linear or non-headcount linked offerings to enhance margins and overall returns. While the current macro environment poses certain risks, we think should the company execute well, the stock can provide a 20%+ return.

Business

WNS is a business process management (or BPM) company that provides professional services and solutions across industries and geographies.

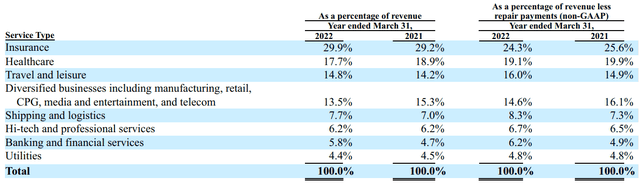

Revenue by service type (Company filings) Revenue by Geography (Company filings)

WNS takes pride in its ability to deliver business value through the co-creation of solutions with clients by leveraging advanced tools (such as robotic process automation (or RPA), hyper-automation, artificial intelligence (or AI), cognitive computing, natural language processing (or NLP) and machine learning (or ML), blockchain, Internet of Things (or IoT), business process-as-a-service (or BPaaS) platforms, embedded analytics, and process re-engineering frameworks).

Market

According to Gartner (IT Services, Worldwide, 2020-2026, 1Q22 Update), the global Business Process Services (or BPS) market is expected to reach $191 billion in 2022 from $181 billion in 2021 and is further expected to reach $256 billion in 2026. The industry trends continue to drive BPM providers to be more innovative, strategic, and forward-thinking, as evidenced by the growing market and size.

While businesses continue to seek process and cost efficiencies from their BPM solution providers, the everchanging requirements have led to an increased emphasis on domain-led, technology-enabled, and innovative value creation. Customer experience, data-driven insights, and digital innovation are critical to business success, and enterprises are increasingly expecting their BPM solution providers to play a more significant role in driving ground-breaking outcomes.

BPM firms are likely to be expected to leverage a diverse geographical footprint and deliver continuity solutions that allow clients to maximize operational agility, scalability, and sustainability. In addition, these solutions could increasingly rely on technology and automation while capitalizing on the potential for greater adoption of “work-from-home” models.

Thus, the differentiation for BPM providers is becoming domain expertise, technological proficiency and demonstrated experience in executing technology and services.

Competition

The nature of BPM services is such that every process efficiency initiative taken in-house is competitive to the likes of WNS. However, from an external competition standpoint, WNS competes with:

- BPM divisions of numerous Indian information technology service companies, including Cognizant Technology Solutions (CTSH), Infosys Technologies Limited (INFY), Tata Consultancy Services Limited, and Wipro Technologies Limited (WIT).

- The likes of Accenture Limited (ACN), Capgemini (OTCPK:CAPMF, OTCPK:CGEMY), Electronic Data Systems Corporation, a division of Hewlett-Packard, and International Business Machines Corporation, offer a wide range of products and services such as information technology, software, consulting, and business process outsourcing

- BPM service providers with a focus on offshore locations (primarily India), such as ExlService Holdings, Inc. (EXLS), Firstsource Solutions Limited, and Genpact Limited (G).

- Global financial services and consulting firms like Deloitte Private Limited, niche technology players like InterGlobe Enterprises Limited and Accelya Holding World SL, and speciality analytics service providers like Mu Sigma Inc.

Market position

WNS differentiates itself through the company’s geographical presence spread across the globe with a focus on low-cost centres of India, the Philippines etc.

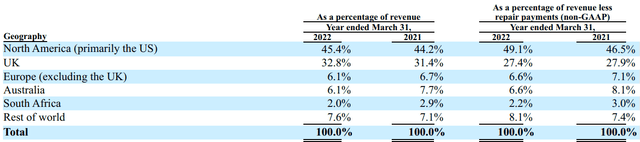

Revenue by Location of Delivery Centers (Company filings)

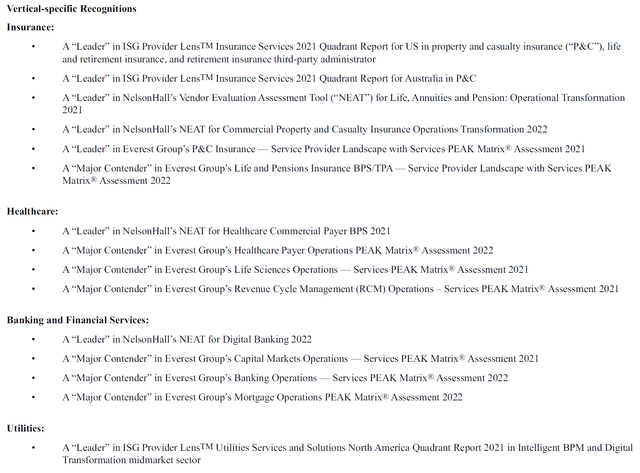

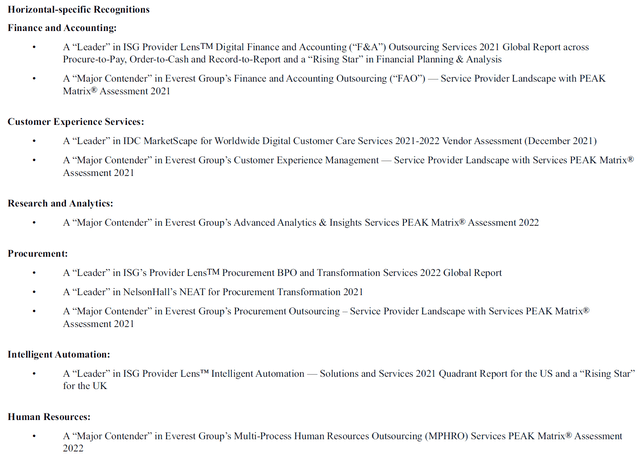

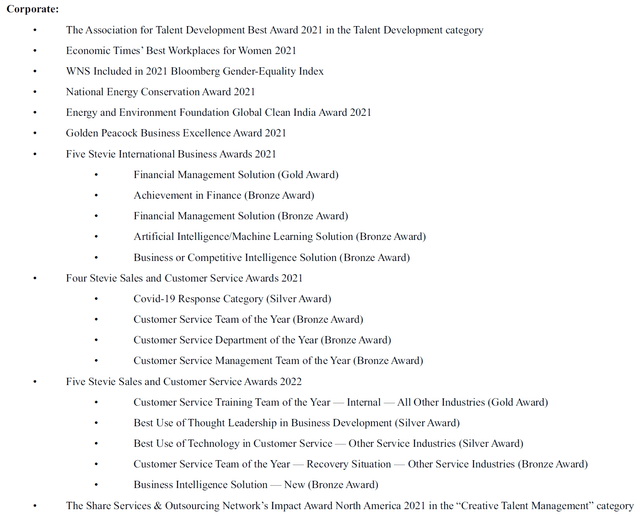

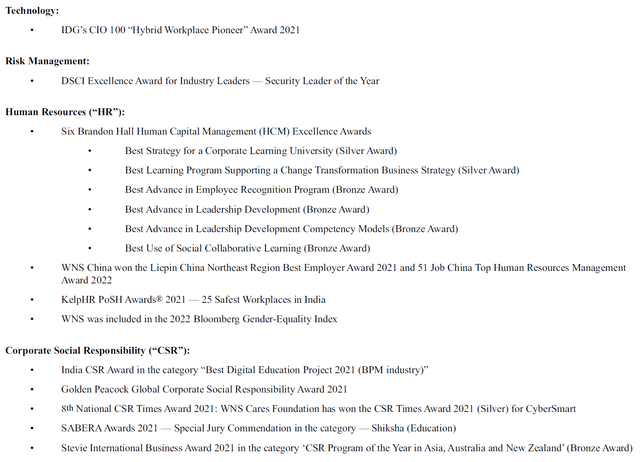

Due to the company’s presence and abilities across segments, WNS has been the recipient of numerous awards and associations.

Company filings Company filings Company filings Company filings

Investment thesis

- Stable cash flow generation machine with margin improvement: WNS has always maintained a relatively steady free cash flow or FCF profile. As travel has resumed post COVID, revenue growth and the ensuing cash flows are expected to become stronger. In addition, new client additions are expected to help further bolster the cash flows.

digitization is a part of every new logo that we’re adding, period. Some have more analytics involved on the front end than others depending on the type of work that we’re doing, but I would say even for the stuff that’s industry specific or it’s F&A driven, there’s a component to analytics to everything that we’re doing.

Source: 4Q22 Earnings Call

These newer deals tend to be of higher margins and are likely to help lift the cash flow profile.

- WNS is increasingly becoming a play on productization of services: While the company does not have significant deferred revenue on its books, the growing focus on digital transformation projects that necessitate productization of services is likely to make soon a larger portion of WNS’ revenues non-linear (or less proportional to headcount). Per the management, clients are:

looking for predictable outcomes in unpredictable times and business variability. All of them want to leverage tech to build completely new business models for themselves.

Source: 4Q22 Earnings Call

For fiscal 2021, the non-FTE (or non-linear) revenue was 35% of the company’s total revenue (or $319 million), which grew to 36.6% in fiscal 2022 (or $406 million). The 27% growth in revenue is one of the highest amongst WNS’ businesses, and at the scale, it demonstrates the management’s focus on moving more towards solutions. In addition, we think the overall outsourcing/IT services/BPM market is undergoing a rapid transformation. WNS’ size and spread of delivery centres can allow the company significant leverage over the coming quarters.

- Valuation does not appear to be expensive

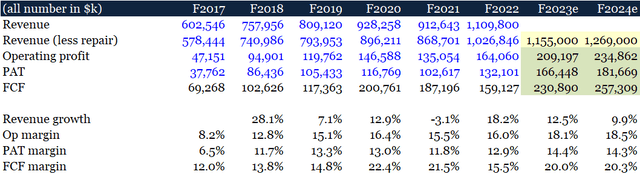

Financials (Company filings, Author’s analysis)

Note:

For financial statement reporting purposes, WNS has two reportable segments: WNS Global BPM and WNS Auto Claims BPM. Revenue less repair payments is a non-GAAP financial measure that is calculated as (A) revenue less (B) in the auto claims business, payments to repair centers for “fault” repair cases where WNS acts as the principal in its dealings with the third-party repair centers and its clients.

Source: 10-K

We expect the company to continue growing at around double-digits, which, coupled with the leverage from non-linear revenues, is likely to result in solid margin growth and cash generation. The management also expects an 8-14% growth rate, which is substantial considering the broader sentiment of monetary tightening-led contraction in economic activity.

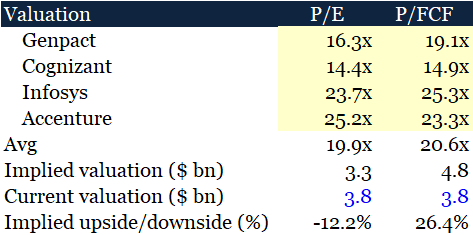

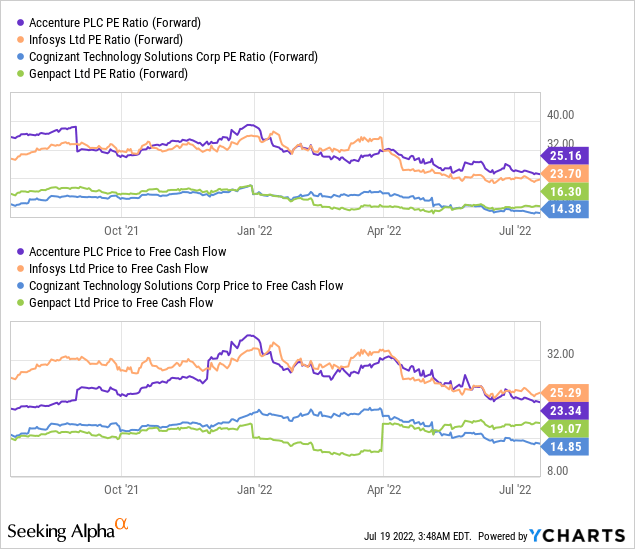

To account for the risk of the macroeconomic environment and the ensuing execution challenges, we think it is appropriate to value the company on an earnings and free cash flow basis.

Seeking Alpha, Company filings, Author’s analysis

Our analysis suggests a downside risk of around 10% versus an upside of 25%, which makes the risk-reward positive.

Risks to our thesis

- Attrition: WNS has witnessed an elevated level of attrition, which can dent margins. Over the last three months, the hiring market has mellowed to a certain extent which could help alleviate margin pressures.

- Geopolitical: WNS’ solutions are offered from distributed delivery centres spread across ten-plus countries. The current geopolitical challenges (not limited to the Ukraine-Russia crisis, Sri Lankan crisis etc.) can severely impact profitability. However, the work-from-home paradigm can significantly alleviate challenges

- Shrinking client budgets considering concerns over rising inflation and potential economic recessions: While this has been a traditional challenge, the increasing non-discretionary nature of transformational initiatives is likely to reduce the impact of a possible hard landing. Also, the company’s growing focus on non-FTE work should help further.

Conclusion

The growth and advancement in technology have led to the commoditization of BPM offerings; for example, chatbots have taken over a large part of the customer calling for mundane tasks. As a leading player in the BPM market, WNS’ pivot toward value-additive revenue streams is an encouraging sign. Not only can the company’s focus on product-centric offerings enhance margin, but it can also lead to significant shareholder rewards.

Be the first to comment