iantfoto/E+ via Getty Images

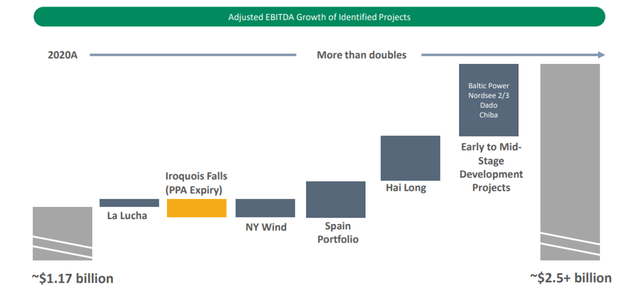

During the recent energy crisis, exacerbated by the conflict in Ukraine, we have seen oil prices spike to around $130 per barrel and gas prices to €295 per MWh in Europe. This situation is increasingly pushing European regulators and others to reduce their dependence on Russia and fossil fuels. Initiatives such as the Next Generation EU are providing billions of euros to EU states to further accelerate the energy transition to renewables, which is essential for Europe to achieve its energy autonomy and environmental goals. In this context we think that Northland Power (OTCPK:NPIFF), a company producing energy from renewable sources, could be a good long-term investment to ride this ten-year trend. The Canadian company is well diversified geographically and has a strong presence in Europe, where it has built and owns together with Siemens, Van Oord and HVC NV one of the largest offshore wind farms in Europe, with a capacity of 1.2GW. It is also in advanced stages of construction of a similar plant in the Baltic Sea, with full operation estimated for 2026. Moreover, observing the market trends and the efficiency of the individual renewable sources, it can be seen that in northern European countries, due to the lower presence of sunshine, wind power is the most efficient renewable source in terms of investment cost and energy produced. Northland Power currently has an installed capacity of over 3240 MW and 2840 MW under construction or at an advanced stage of planning, 90% related to wind projects and 10% to solar farms. According to the company’s strategies, these projects, whose completion is scheduled for 2025-2026, will allow it to double its current EBITDA, bringing it to the CAD$ 2.5B area.

Adjusted EBITDA growth (northland power)

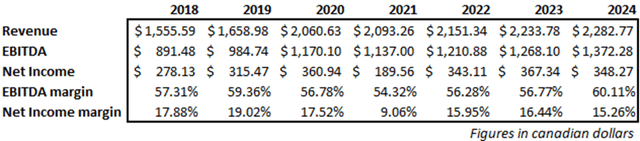

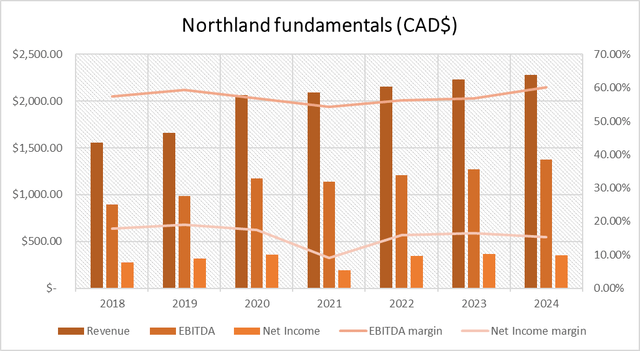

These ambitious results must, however, come up against the recent events linked to the energy crisis, which had and are still having a significant impact on the company’s margins, which fell sharply in FY21. A continuation of these conditions may further increase the company’s costs and due to the inelastic mechanism of energy sales through PPA contracts, this has a negative impact on the company’s profits. But let’s look at it in more detail.

FY 21 and Outlook

During FY21 the company saw its operating costs increase by 9% vs. FY20, a factor that contributed to the reduction in EBITDA margin to 54% in FY21 (vs. 56% in FY20 and 59% pre-pandemic). However, the higher increase in costs compared to last year is primarily attributable to depreciation and amortization which increased by over 15%, resulting in a negative impact on profitability. Profit almost halved compared to FY20, with net income margin down from 17.5% to 9.0%; the company’s revenues were, in fact, up just above par, in contrast to property, plant and equipment up 10.4% to CAD$9.5B.

Mare Evidence Lab Mare Evidence Lab

Source: Thomas Reuters Eikon & Mare evidence Lab analysis

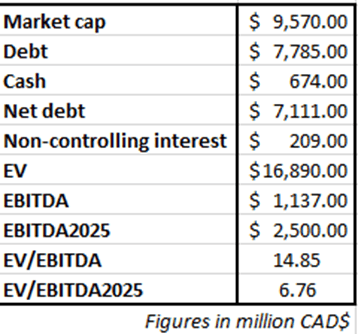

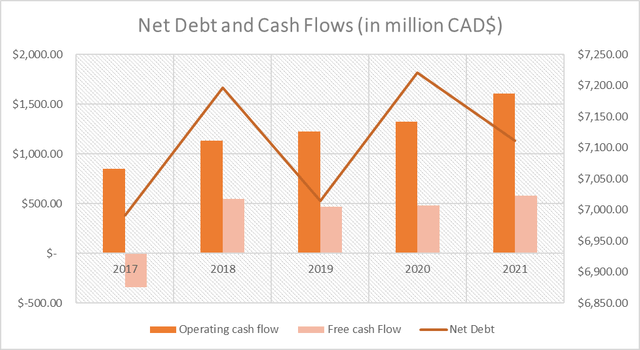

In addition, during FY21, stable interest expenses are reported, equal to the total debt stock which remains stable at CAD$ 7.78B, with a high Net Debt/EBITDA ratio of 6.25x but with a fairly sustainable interest coverage ratio of 2.21x. Over the last 5 years, the debt stock has remained essentially stable, aided by the steady growth in OCF, which has reached CAD$ 1.6B. This large amount of cash is being used to fuel the large investments the company needs to implement to finalize its wind farms with a total value of just over CAD$1B during FY21. This surplus between income and expenditure generates a positive free cash flow, allowing the company to keep its debt needs stable despite the continuous growth of investments and, at the same time, to pay a dividend with a yield of around 3%, certainly not bad for a company in moderate but constant growth.

Source: Thomas Reuters Eikon & Mare evidence Lab analysis

Over the next 3 years, revenues will return to growth at a slightly faster pace, aided by the completion of some smaller works in terms of size. These serve Northland to keep its revenue growth steady while it is completing large projects that require huge investments and cash. This strategy was explained in more detail in the November 2021 presentation.

In addition, the energy crisis is likely to support Northland’s increased backlog in the coming years, primarily driven by green investments ready to go in Europe aided by exorbitant Russian gas prices. However, if near-term conditions worsen, and inflation continues to rise, Northland could be subject to further margin deterioration during FY22, disillusioning analysts’ estimates of it returning to pre-pandemic levels. They could also experience a decline in cash flows and a likely need to increase its debt level, an element that, with rates rising, could drive Northland’s interest expense to a very high, if not unsustainable, level. In the long term, however, with the completion of two of the largest global projects in the wind key (Taiwan and Poland) between 2025 and 2026, Northland’s installed capacity could nearly double, making its ambitious plans to double EBITDA by 2026 possible. Finally, an increase in energy prices could have very positive results on the new PPA contracts signed by Northland, giving a further boost to growth. On the other hand, however, as we will see better in a moment, this is currently having a decidedly negative impact on the company’s energy sales.

Risks

Currently Northland Power, despite its good economic results in recent years, has some major risks that must be taken into account in order to buy this stock:

- The high level of indebtedness, as already mentioned several times, represents a possible problem, especially following a possible worsening of the geopolitical and inflationary situations. In fact, if inflation, on the one hand, has a positive effect in reducing the real value of debt, on the other, it has negative effects on revenues that are regulated by PPA contracts, which are usually quite rigid and predetermined, and therefore very negatively affected by high inflation that reduces their real value. In order to correct this problem, Northland makes use of multiple hedging derivatives, both forex and on commodity prices, a factor, however, that increases the risk of incurring further losses if not used exclusively for hedging purposes.

- The increase in interest rates, as announced by the FED and other central banks, can have quite a heavy effect on Northland’s economy. Despite the company has proven to be able to keep its total debt stable, worsening economic conditions may lead the Canadian company to have to further increase its debt, possibly reaching an unsustainable situation. Also, partially in favor of the company, is the fact that a large part of the debt is denominated in euros, a positive factor due to the more accommodating policy that Europe is pursuing with respect to the United States in terms of interest rates.

- The construction of one of its largest wind projects in Taiwan, a few hundred kilometres from China, an area characterized by increasing geopolitical risks. Any intervention by China to annex Taiwan could have serious to catastrophic effects for Northland. At the moment, the risk has a relatively small probability, but when you consider that the project will only be built between 2025 and 2026, it’s a factor that should definitely be considered.

- The other major project under construction by Northland, the Baltic Power Project, is located in Poland, not far from the Russian border. Again, further deterioration in geopolitical conditions could negatively impact the project’s profitability and timeline.

Conclusions

Northland represents an excellent opportunity to invest in the wind power sector in a well-diversified company, with a particular focus on Europe. This latter factor will enable the Canadian company to further increase its already substantial portfolio of wind farm projects and to grow further in the long term. In addition, thanks to the realization of two very large wind farms in the Baltic Sea and Taiwan, as well as smaller projects, it is very likely that Northland will be able to double its EBITDA by 2026 as announced by management. This would make the company’s valuation extremely attractive with an EV/EBITDA of 7.76x, undervalued by 70% compared to the current industry multiple. However, the current energy crisis is having a very heavy effect on the company’s margins and, with such a large amount of debt, it will be necessary to pay attention to the future production of cash flows; a decrease in cash flows, in fact, would force Northland to increase its request for capital in order not to sacrifice investments and, with rising rates, such an increase in debt could be unsustainable for the company.

Mare Evidence Lab

Be the first to comment