narvikk

During these difficult times, many companies have been hit rather hard. Some have been hit harder than others. One example of a company that has just been slammed in recent months is Titan International (NYSE:TWI), an enterprise that produces wheel, tire, and undercarriage industrial equipment for players in the agricultural space, mining, military, trucks, and so much more. Earlier this year, I found myself incredibly bearish about the company’s prospects. Long-term, I still am uncertain about the enterprise and its potential. But over the past two quarters through which new data has been made available, the company has demonstrated significant improvements on both its top and bottom lines. Add on top of this the fact that shares look cheap in two out of three ways, and I am no longer as concerned as I was previously. Because of this, I have decided to increase my rating on the company from a ‘sell’ to a ‘hold’ to reflect my view that the stock will likely generate returns that more or less match the broader market moving forward.

A great deal of pain

At the end of May of this year, I wrote an article that took a bearish stance on Titan International. Even though the company had been experiencing a nice resurgence in revenue and profitability over the prior couple of years, this followed a rather rocky few years in which financial results were nothing short of disappointing. Even though the company had been performing better than it was prior, I did find it to be a good idea for investors to approach the business cautiously since I did not feel that the most recent data provided by management represented a new norm. Based on the totality of the circumstances, I ended up rating the company a ‘sell’ to reflect my view that it should underperform the broader market moving forward. So far, that call has worked out quite nicely. While the S&P 500 is down 1.9%, shares of Titan International have generated a loss for investors of 21.8%.

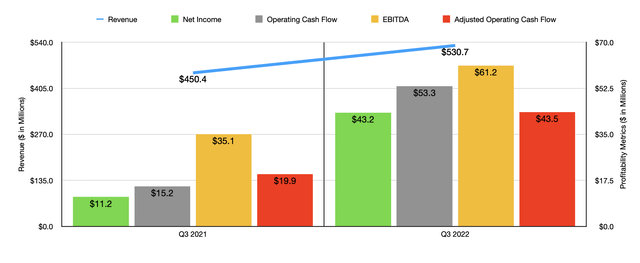

Interestingly, even though share price performance for the business has suffered, actual financial performance has been very strong. In the third quarter of the company’s 2022 fiscal year, for instance, sales came in at $530.7 million. That’s 17.8% above the $450.4 million the company generated one year earlier. According to management, this sales increase was driven largely by improved pricing, a favorable change in product mix, and a higher volume of product sold, spread across all of the companies operating segments. In fact, growth would have been higher had it not been for the fact that foreign currency translation negatively affected revenue by 4.7%.

With revenue rising, profitability for the company followed a similar trajectory. Net income spiked from $11.2 million in the third quarter of 2021 to $43.2 million the same time this year. Much of this improvement came as a result of the firm’s gross profit margin spiking from 13.4% to 16.5%. This, management said, was driven by both higher sales, improved operating leverage in its production facilities, and cost reductions and productivity initiatives implemented by management aimed at reducing cash outlays. Given this significant year-over-year improvement, it should come as no surprise that other profitability metrics followed suit. Operating cash flow jumped from $15.2 million to $53.3 million. Even if we adjust for changes in working capital, it would have risen from $19.9 million to $43.5 million. Meanwhile, even EBITDA increased, rising from $35.1 million to $61.2 million.

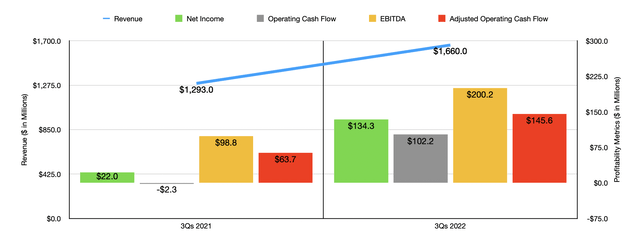

The strong performance that the company achieved in the latest quarter adds to its overall financial performance for the current fiscal year. For the first nine months of 2022, sales came in at $1.66 billion. That’s 28.4% above the $1.29 billion reported the same time last year. Net income skyrocketed from $22 million to $134.3 million. We also saw a massive improvement in operating cash flow, with the metric going from negative $2.3 million to $102.2 million, while the adjusted figure went from $63.7 million to $145.6 million. Even EBITDA improved, more than doubling from $98.8 million to $200.1 million.

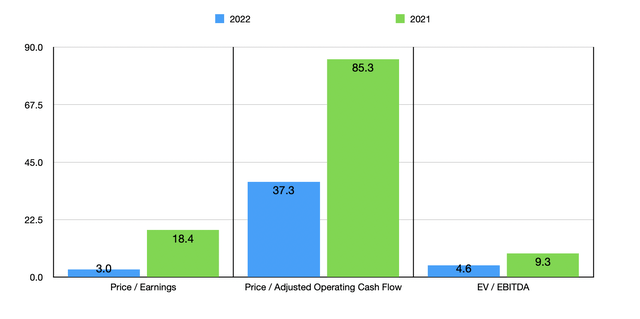

As I pointed out in my initial article on the company, volatility in financial performance can be a major problem. So just because financial performance recently has been encouraging doesn’t mean that investors can expect this to continue. It also makes it more challenging to value the enterprise since we don’t know what the future is likely to hold. Reasonable estimates based on my own assessment of the company for its profitability metrics for this year would involve net income of $302.8 million, adjusted operating cash flow of $24.5 million, and EBITDA of $270.7 million. If the operating cash flow figure looks odd compared to what the company has already generated this year, consider that from the third quarter of 2021 to the final quarter of that year, that metric dropped from $63.7 million to only $10.7 million. A similar decline from where we are at today would see $24.5 million for operating cash flow on an adjusted basis.

Based on these figures, the company would be trading at a forward price-to-earnings multiple of 3. This is down from the 18.4 reading that we get using data from 2021. The price to adjusted operating cash flow multiple would plunge from 85.3 to 37.3, while the EV to EBITDA multiple dropped from 9.3 to 4.6. As part of the analysis, I also compared the company using two of these metrics to five similar firms. On a price to operating cash flow basis, the range was from 17.4 to 641.4. In this case, three of the five companies were cheaper than Titan International. Using instead the EV to EBITDA approach, the range would be from 9.2 to 20.3. In this scenario, our prospect was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Titan International | 37.3 | 4.6 |

| Lindsay Corporation (LNN) | 641.4 | 17.3 |

| AGCO (AGCO) | 31.4 | 9.2 |

| CNH Industrial N.V. (CNHI) | 17.4 | 9.7 |

| The Toro Company (TTC) | 51.1 | 20.3 |

| Deere & Company (DE) | 29.1 | 16.4 |

Takeaway

By pretty much all accounts, things are definitely looking up for Titan International from a fundamental perspective. However, I still maintain that this is a company that will exhibit extreme volatility from a fundamental perspective. But given how much shares have already declined since I rated the company a ‘sell’ and how cheap shares currently look based on projected figures for the rest of this year, it’s difficult to not have some appreciation for the enterprise now. Until we see some degree of stability, I cannot turn bullish on the firm. But given where things are at the moment, I do think an upgrade to the ‘hold’ rating now makes sense.

Be the first to comment