5./15 WEST/iStock Unreleased via Getty Images

Investment Thesis

We were cautious toward Pinterest (NYSE:PINS) in our previous article, as we believe the platform has lost its edge. Coupled with a still expensive valuation, we couldn’t justify owning a stock set for slower growth moving forward.

PINS stock lost a further 26% since our April article, underperforming the market. However, we think the digestion should be near its end soon, as its valuation is much more reasonable now (but not undervalued).

Furthermore, we have not noticed a double bottom bear trap that could help set the stage for a sustained reversal of its bearish momentum. As a result, investors should expect further volatility.

Notwithstanding, given its more attractive valuation, we are ready to revise our rating from Hold to Cautious Buy. However, given the lack of a bear trap price action, we urge investors to consider layering in over time. More conservative investors can also watch for a re-test of its near-term support before adding exposure.

Is Pinterest Stock Undervalued?

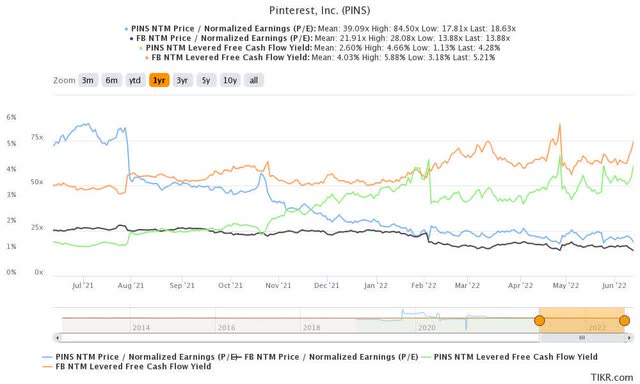

PINS valuation metrics (TIKR)

PINS stock last traded at an NTM normalized P/E of 18.6x and an FCF yield of 4.28%. Although its FCF yield and P/E have improved markedly, we don’t consider PINS stock undervalued.

Its P/E of 18.6x is still above the S&P 500’s (SPX) forward P/E of 17.3x. However, its NTM EPS is set to fall by about 17.9% against its TTM EPS, in contrast to the S&P 500’s 9.8% NTM EPS growth rate.

In addition, it still traded at a premium above Meta’s (META) valuations, as seen above. However, the growth premium has also normalized significantly over the past year. Therefore, the market expects Pinterest to execute its growth story ahead of Meta, even at its current valuation. However, we find it challenging to consider PINS stock as undervalued.

| Stock | PINS |

| Current market cap | $11.43B |

| Hurdle rate (CAGR) | 20% |

| Projection through | FQ2’26 |

| Required FCF yield in FQ2’26 | 3.5% |

| Assumed FCF margins in FQ2’26 | 17% |

| TTM revenue by FQ2’26 | $4.88B |

Pinterest reverse cash flow valuation model. Data source: S&P Cap IQ, author

Given its implied growth premium, we used an above market-average hurdle rate on PINS stock, with a reasonable FCF yield requirement. Therefore, we need Pinterest to post a TTM revenue of $5.57B by FQ2’26.

The revised consensus estimates suggest that Pinterest could post revenue of $3.02B in FY22. Therefore, we require Pinterest to post a revenue CAGR of 14.74% from FY22-FQ2’26. We think it’s achievable if Pinterest continues executing accordingly and meeting the consensus estimates for FY22. Of course, if Pinterest sees further weakness due to weaker macros, it could weaken our thesis’s validity.

Is Pinterest Stock Expected To Rise?

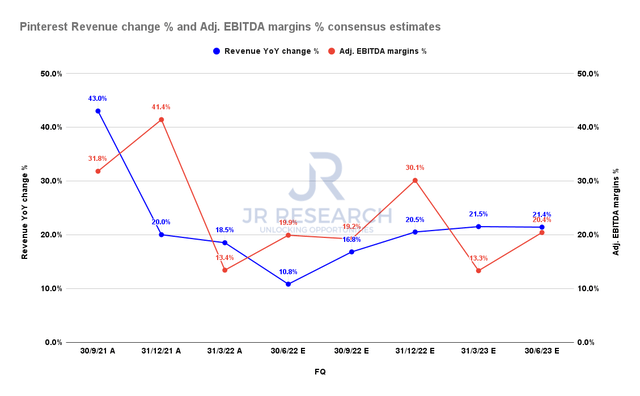

Pinterest revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

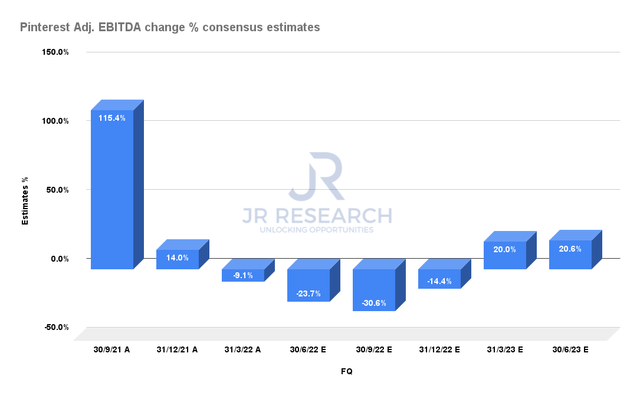

Pinterest adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Pinterest’s revenue growth is estimated to reach a nadir in FQ2, reaching 10.8% YoY. However, it’s expected to recover remarkably through FY23, as it laps less challenging comps from FY22.

However, it’s incumbent on management to execute well against a weaker macro backdrop. We believe that the current estimates have been revised accordingly, given Snap’s (SNAP) warning in May. Therefore, we believe the weakness has been priced in unless the market expects a further reduction in guidance from the leading ad tech players. Consequently, investors need to monitor closely against further weakness in guidance in the next few quarters.

Notably, its adjusted EBITDA is expected to climb out from its steep decline in H2’22 and is estimated to return to a 20% growth rate by FQ1’23. Therefore, we believe the market has astutely priced in the excesses from 2020-21 and the weakness seen in FY22. But we think if Pinterest can execute its game plan accordingly, the potential for a re-rating is increasingly likely moving ahead.

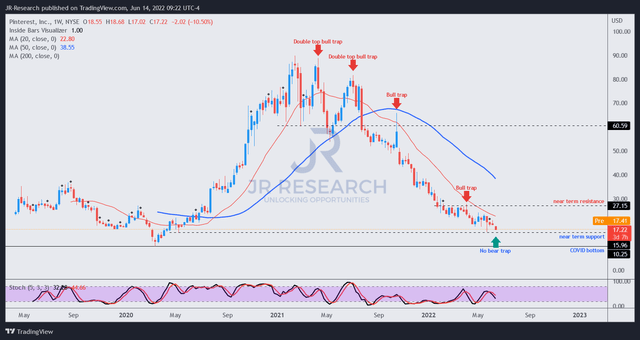

PINS price chart (TradingView)

PINS stock has been beset by several bull traps in 2021. The market drew in buyers at the double top bull traps, which helped stall its buying momentum.

The stock is also facing a bull trap that formed in May, undergirding its near-term resistance. However, we didn’t observe a highly effective bear trap price action that could help reverse its dominant bearish bias. Therefore, investors should consider a stop-loss risk management strategy if they add at the current levels.

Otherwise, investors can consider adding after watching a successful re-test of its near-term support or when a double bottom bear trap is validated.

Is PINS Stock A Buy, Sell, Or Hold?

We revise our rating on PINS stock from Hold to Cautious Buy. But we must emphasize that Pinterest needs to execute well, as we don’t think its stock is undervalued.

Furthermore, there isn’t a bear trap price action that could help support its near-term bottom and reverse its bearish momentum. Therefore, investors should consider appropriate risk management strategies to reduce the potential for outsized losses.

Be the first to comment