Justin Sullivan

Retail Investors Get Creative

Market volatility, monetary policy, and plunging stocks are a lot to bear. But, where there’s a will, there’s a way, and investors have gotten creative as the market continues its slide. From fear to greed and greed to fear, going to cash, and buying dips that keep dipping. Now, retail investors are about-facing to bet against the market, opening short positions. The investor rollercoaster ride is nothing short of amazing, especially as investors strive to recoup losses.

Stocks Continue to Plunge

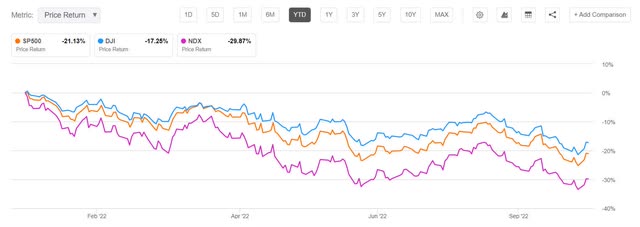

Major U.S. Indexes Plunge (S&P 500, Nasdaq, Dow Jones)

Major U.S. Indexes Plunge (S&P 500, Nasdaq, Dow Jones) (Seeking Alpha Premium)

As the major U.S. indexes slide, this year’s market volatility has resulted in a reported $9T in losses from Americans’ portfolios, with YTD declines from the S&P 500 of -21%, Nasdaq -30%, and DJIA -17.25%. And while some retail investors are changing tactics by pursuing short positions to recoup portfolio losses or buying cheap stocks in hopes of a relief rally, risky equities with more than 40% declines that carry negative analyst ratings, poor fundamentals, and lag in their sectors do so for a reason: they perform poorly!

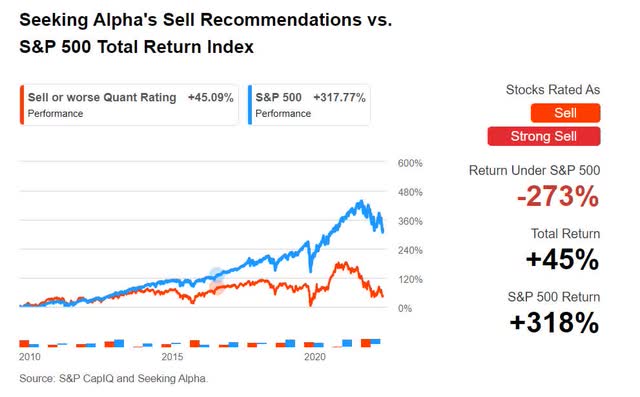

Quant Ratings highlight stocks that will perform well while also giving investors warnings about stocks likely to perform poorly. Seeking Alpha’s Sell Recommendations below have underperformed the S&P 500 for over a decade using quantitative data. We want investors to know which stocks possess poor fundamentals and outlooks.

Seeking Alpha Sell Recommendations vs S&P 500 (Seeking Alpha Premium)

The macroeconomic environment is riddled with uncertainty that has all but the energy sector (XLE) taking a beating. Record equity outflows have some investors excited about buying opportunities at attractive valuations. Many retail investors simply want cheap stocks. The irony is that when a stock becomes cheap – especially in this environment – people want to sell. Conversely, when stocks are at their peak prices or ‘on fire,’ people want in on the action. Fear and Greed are the emotions that drive the markets, which is why I want investors to heed the warnings of a Strong Sell stock like Roku, whose questionable performance has rated it a strong sell rating since February of this year.

ROKU Inc. (NASDAQ:ROKU)

-

Market Capitalization: $8.22B

-

Quant Sector Ranking (as of 10/5): 227 out of 249

-

Analysts’ Downward Earnings Estimates Revisions: 20

-

Quant Rating: Strong Sell

In an April article titled 5 Stocks to Avoid Right Now, I included ROKU when its market cap was $15.07B. Tech stocks and consumer demand for communications and streaming services have been experiencing a downward shift, and we continue to see an increase in competition in movies and entertainment. Roku, the TV streaming platform’s market cap is nearly half of what it was in April, despite an upgrade by Pivotal Research, following ‘encouraging’ news on inflation.

“Against what we view as a more encouraging backdrop and a retrenchment in the valuation, we no longer view ROKU as a fundamental short at current valuation levels and therefore increased our rating to HOLD.” – Wlodarczak

Yet somehow, ROKU has continued its slide. Not even ARK Invest’s Cathie Wood could turn things around. Buying in on the action, Wood purchased more than 58,000 shares of the streaming company in June, which now accounts for her third-largest holding in ARK Innovation ETF (ARKK). Just when you thought this news would boost the stock, ROKU’s unique software and hardware business model released its high-end Ultra player in Canada a week after announcing former Fox Entertainment Group CEO Charlie Collier as its new President of Roku Media. And while all this good news sounds like a case for the stock, Seeking Alpha’s Quant Ratings maintain the stock as a Strong Sell.

ROKU Stock Valuation

Roku is on a downtrend; over the last month, the stock’s price has dropped more than 5%. Year-to-date, ROKU’s share price has fallen nearly 75% and over the past year, -80%.

ROKU Stock Valuation Grade (Seeking Alpha Premium)

With a D- valuation, the stock is severely overvalued. I last wrote that ROKU traded more than 300% above its sector peers. Currently, ROKU has a forward Price/Sales of 2.76x, a 138.80% difference to the sector, and a forward Price/Book of 3.3x, a 78% difference to the sector. With its 80% loss in share price, ROKU is currently trading at $59.70/share, down from a 52-week high of $350.60, showcasing that the stock’s underlying valuation metrics are unimpressive.

ROKU Growth

ROKU has a unique business model that captures both software and hardware business. It had great success with subscriber growth in the last few years, continuing to scale, despite supply chain issues and a slowdown in its growth rate. Vying for market share, competition is also becoming stark from names like Apple TV, Amazon Fire TV, and Google Chromecast that may eat into top-line growth.

ROKU Warning Banner & Price Performance (Seeking Alpha Premium)

The economic environment poses headwinds for ROKU, especially as some of the more popular streaming providers have experienced falls in subscribership followed by earnings misses. ROKU’s subscriber growth as of June 2021 was 55 million monthly active users, but the company has yet to generate operating income. Q2 2022 results were dismal, with an EPS of -$0.82 missing by $0.13 and revenue of $764.41M missing by $40.24M.

“In Q2, we saw a significant slowdown in TV advertising spend due to the macroeconomic environment, which is pressuring Roku’s platform business growth in the short term…The current economic state is causing TV advertisers to pause and reconsider spend, which is painful in the short term, but it also causes them to seek greater efficiency and ROI,” said Anthony Wood, ROKU CEO.

Although Communications Stocks are popular, limited profits and operating costs are headwinds. Inflation is a global problem, and the strengthening U.S. dollar adds to my thoughts about this company being a bearish bet, supported by the 20 analysts that recently gave downward revisions in the last 90 days. If you’re considering bearish stocks or investment in ROKU, which possesses characteristics that have historically been associated with poor future stock performance, heed our warning banners.

Spot Bearish Stocks and Avoid the Falling Knife

It’s tempting after portfolio losses and in times of uncertainty to want to recoup losses and jump on the bandwagon of headline stocks. Before buying the dip, or opening up a short position, or jumping into bearish ideas, consider evaluating stock picks by creating a Seeking Alpha portfolio. You can add as many or few stocks as you like and evaluate their features like valuation, growth, profitability, momentum, and EPS revisions using our Factor Grades that rate investment characteristics on a sector relative basis.

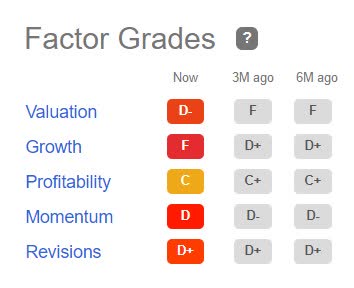

Roku, Inc. Factor Grades

ROKU Factor Grades (Seeking Alpha Premium)

It’s easy to see if your stock’s metrics receive an ‘A’ or ‘F’ grade or somewhere in between. Roku’s factor grades above showcase terrible Growth and Revisions. Determining the losers in a portfolio can help save you from catastrophic losses. ROKU has had a Strong Sell rating since February 2022. Merci beaucoup Roku! We have the tools to help you avoid catastrophic losses. Good luck.

Be the first to comment