Vladimir Zapletin

Investment thesis: As the global economy barrels towards an ever more likely downturn, steel producers like Algoma Steel (NASDAQ:ASTL) are likely to see a worsening of the business environment, due to demand destruction issues. With that, its stock price is likely to see more downward pressure perhaps for the rest of the year and into next year. At some point, economic recovery will take hold, and steel demand will recover as well. In fact, steel prices might see a period of robust spot prices as most of the EU steel production capacity is likely to shut down if the current energy crisis continues. Continued sanctions on Russian steel will further contribute to a tight global supply situation once we get past the impending slowdown in the global economy. As is the case with most of its North American peers, Algoma will continue to enjoy a significant energy price advantage over steel producers that may still be left standing in Europe as well as Asian producers, most of which are net energy importers. Given the global geopolitical situation, things will break in the favor of North American steel producers, and Algoma stock is a good candidate to be considered as an investment opportunity if one considers this thesis to have a high probability of being accurate.

Algoma’s financial results missed expectations, but those results are fundamentally sound and on an improving path.

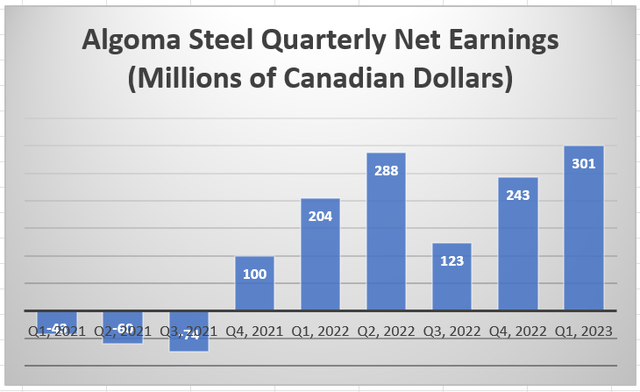

Algoma’s quarterly results have been improving steadily in the past few years.

It should be noted that Q1, 2023 ends at the end of June of this year, in other words, it was its latest published result. Even though Algoma has been posting positive net earnings results in the last quarter, it missed expectations, which is to a great extent responsible for a rather steep decline in its stock price. A recent temporary setback in terms of production and deliveries is also bringing down expectations in terms of its next quarterly report, and it brought down its stock price with it.

Looking at its other financial metrics, it has a government loan of 85 million Canadian dollars, 180 million dollars in pension liabilities, and other non-current liabilities that add up to 680 million dollars, which amounts to less than the 934 million Canadian dollars it collected in revenues in the last quarter. Overall it is a company with a healthy financial profile.

Notwithstanding political risks, Canada is a great place of refuge for an energy-intensive company to be located within the context of current geopolitical trends as well as the global energy market outlook.

As I pointed out in a recent article on Steel Dynamics (STLD) if one wants to bet on steel producers beyond the impending global economic slowdown, North-American producers are the best bet, given the geopolitical as well as global energy market trends we currently see unfolding. Canada in particular, which is of most relevance to current and prospective investors in Algoma stock is perhaps one of the most secure places for an energy-intensive company to be.

Canada is a net exporter of oil, gas as well as electrical power, with most of the exports headed South to the United States. It has ample resources, especially when looked at on a per-capita basis. The environmentalist trends are a reason to worry. In other words, Canada may opt to artificially push energy prices higher either directly or indirectly, in order to discourage energy consumption. As of 2021, Canada had cheaper electricity prices than most EU countries as far as I can tell, and they were slightly cheaper on average than they were in the US. Some countries in Asia such as India did have cheaper electricity prices. I do believe that in time, the energy price advantage will shift significantly in the favor of net energy exporters, or at least countries that can be self-sufficient. Canada’s current climate policies are a risk to that thesis, but we should keep in mind that Canada has a decades-old record of not meeting its self-imposed climate goals on repeated occasions. In the end, economic interests tend to win.

Global steel demand factors could push the price higher within the context of a global economic recovery.

I want to briefly touch on some of the potential demand factors that could push steel prices higher within the context of a global economic recovery taking hold, perhaps within a year or two. One of the main factors that I see is an effort to increase rail transport wherever it is feasible, instead of relying on trucking. I believe that energy prices will be globally much higher in the foreseeable future, and the global economy will strive to adapt accordingly. Just to put it into perspective, US rail is estimated to be able to move a ton of freight 480 miles on a galon of fuel.

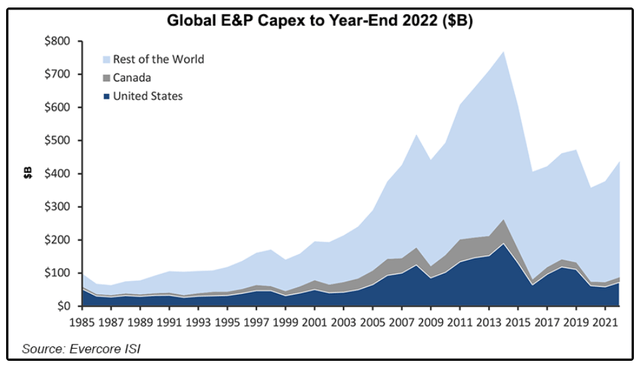

There are also other factors, such as the growing capital intensity of commodities production. For instance, global crude oil production increased by about 30% since 1999, but global CAPEX in the industry grew about three-fold since the beginning of the century.

While in the short to medium term there can be a lot of fluctuation, with industry over-investing then under-investing for many years, clearly this century we entered a period that requires growing resource allocation per unit of oil & gas being extracted. This includes the growing demand for steel as the number of wells, active rigs, and other capital that it takes to extract these resources keeps increasing. The entire mining sector is faced with a very similar situation, due to the low-hanging fruit effect of the industry, where the easiest to recover resources are always extracted first, with the effort needed to extract future production always growing, despite the innovations that come along.

Investment implications:

While it may still be a bit early to invest in steel producers overall, within the current context of the economic cycle, where a global economic slowdown is now widely perceived as a near-certain outcome at the end of this year and going into next year, Algoma is already an interesting potential buying opportunity. The short-term factors that caused its stock to decline recently already provide for a decent buying opportunity, which I decided to use to take a small nibble, even though I am overwhelmingly convinced of very high odds that there will be better opportunities to buy going forward. The company currently trades at a forward P/E ratio of about 3, which is not very expensive by any means.

As the longer-term advantage of North American steel producers in terms of energy prices and security will become more evident, it will start to look increasingly cheap within the collective perception of the investment community. Those same advantages should lead to a long-term improvement in its financial performance, therefore this is a stock with significant long-term upside going forward, even though in the short term it may still have a few months of downside going forward.

Be the first to comment