piranka

Thesis

Leading data center REIT Digital Realty Trust, Inc. (NYSE:DLR) has seen its stock crater since forming its overvalued highs in December 2021. With growth slowing as Digital Realty couldn’t sustain its momentum, we believe the battering is justified.

As a result of the nearly 45% haircut, DLR’s valuation is more reasonable now but still not undervalued. We prefer to use its EBITDA multiples to evaluate its valuation levels, which indicate its overvaluation zones back in late 2021.

As a result, we think the market has gotten its de-rating on point, as Digital Realty is still expected to commit high CapEx spending to sustain its tepid revenue growth. Coupled with more intense competition from the hyperscalers moving forward, we believe it’s appropriate for investors to demand a more significant margin of safety to mitigate their risks of potential underperformance.

Accordingly, we rate DLR as a Hold for now, even though we postulate that it should be consolidating at a robust near-term bottom.

DLR Was Clearly Overvalued

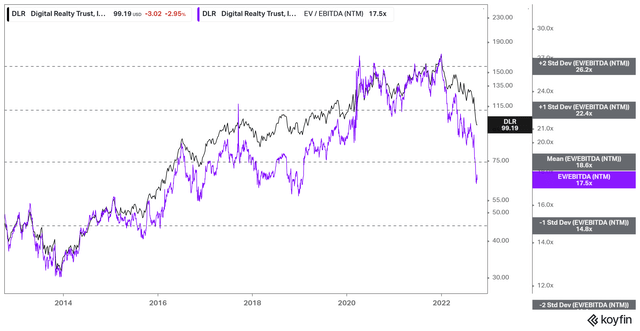

DLR NTM EBITDA multiples valuation trend (koyfin)

As seen above, DLR surged well above its 10Y mean at its highs in 2021, as its NTM EBITDA multiples reached the two standard deviation zone over its 10Y mean.

Therefore, we assess that DLR was clearly overvalued, as investors piled on to its unsustainable growth rates in 2021. However, as its growth slowed markedly in 2022, it could no longer hold on to those valuations.

However, despite falling nearly 45% from its highs, DLR last traded at an NTM EBITDA multiple of 17.5x, close to its 10Y mean of 18.6x. Hence, we deduce that DLR remains far from undervalued. Therefore, investors looking for a more generous margin of safety may find it unattractive at the current levels.

High CapEx Spending Demands Further Caution

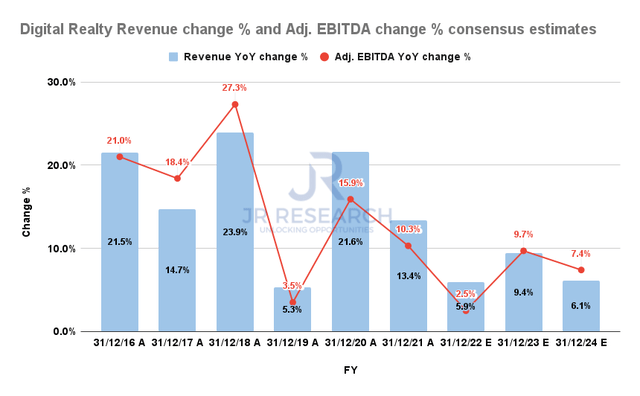

Digital Realty Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Digital Realty expects its business model to be pretty resilient through the economic cycle and therefore does not anticipate a marked deterioration in its bookings moving ahead.

The consensus estimates (bullish) also corroborate management’s optimism, suggesting a reacceleration in growth through FY23. However, even the bullish Street analysts do not expect its growth cadence to reach its heights in FY20/21.

We also believe that the cloud providers could continue to offer intense competition moving ahead as they bid to move more companies toward the cloud. Notably, cloud services spending still increased by 33% in Q2, highlighting that companies were advancing rapidly with their cloud transition.

Coupled with the hyperscalers moving further into specialized business verticals to expand their TAM, it could be a structural impediment against Digital Realty’s growth opportunities in the medium term.

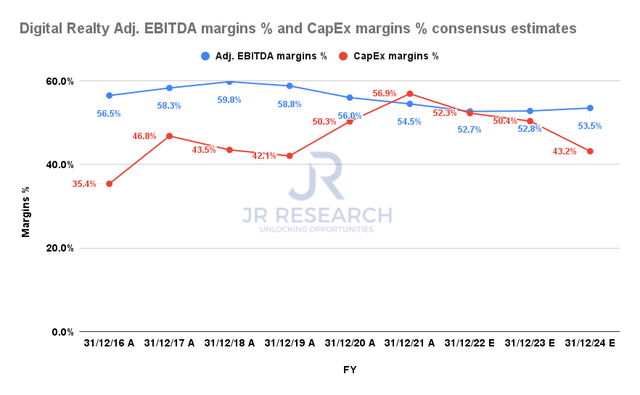

Digital Realty Adjusted EBITDA margins % and CapEx margins % consensus estimates (S&P Cap IQ)

Furthermore, we believe the CapEx commitments to sustain its business model are very high, reaching nearly 57% in FY21. Therefore, we are concerned about whether Digital Realty’s business model can be sustainable if the competition from cloud providers turns out to be more intense than anticipated. As such, it could impact its cash flow profitability markedly, leaving the company with legacy data center assets that could face significant impairments.

Hence, we don’t find the underlying profitability of Digital Realty attractive enough at the current valuations.

Is DLR Stock A Buy, Sell, Or Hold?

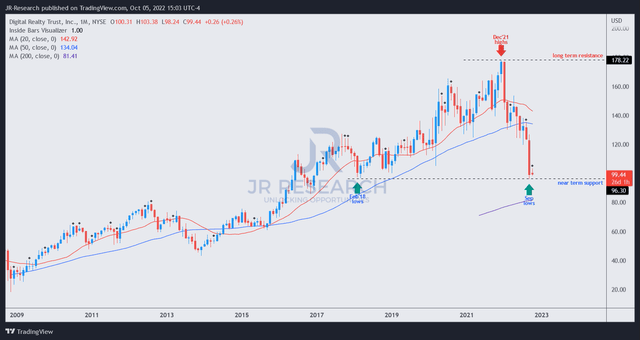

DLR price chart (monthly) (TradingView)

DLR’s NTM dividend yields have improved to 4.96%, above its 10Y mean of 4.12%. But, we don’t find its yield particularly attractive, which we believe reflects its premium valuation, given its secular growth opportunities.

Also, DLR has a robust long-term uptrend over time, with its price action consistently supported above its 50-month moving average (blue line).

However, the steep selloff since July sent it tumbling well below its critical 50-month support and still quite a distance from its 200-month moving average (purple line; last line of defense).

We also gleaned that the waterfall decline took out DLR’s lows all the way back to February 2018, as the market sent investors fleeing rapidly to protect their gains.

Therefore, we postulate that DLR should consolidate at the current levels in the near term. However, that doesn’t mean we think DLR represents a solid long-term mean reversion opportunity due to the reasons we presented earlier.

As such, we rate DLR as a Hold for now.

Be the first to comment