Torsten Asmus

Last Thursday’s CPI drop has given the green light to anyone looking to invest in inflation-linked bonds. The decline in CPI itself is not particularly noteworthy as one month’s figures say next to nothing about the state of the economy when considering the measurement error involved. However, the market’s reaction shows just how much investors had feared another higher-than-expected figure. As CPI comes down significantly over the coming months, we are likely to see a major reversal in long-term real bond yields as investors anticipate an inevitable Fed pivot. Even after the recent gains, the iShares TIPS Bond ETF (NYSEARCA:TIP) still offers strong long-term returns with asymmetric upside potential.

The TIP ETF

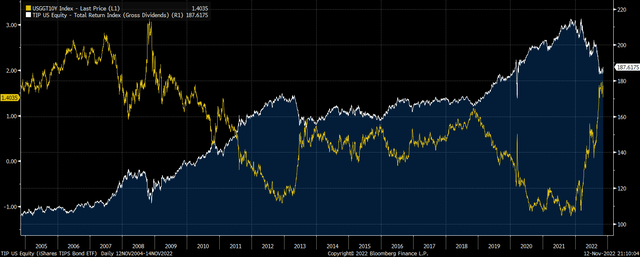

The TIP tracks the performance of U.S. Treasury inflation-protected securities, with a weighted average maturity of 7.2 years and an effective duration of 6.7 years. The current real yield on the TIP is 1.8.%, which is what investors should expect to receive per year over the long term after inflation. However, there is also the potential for significant capital gains if either long-term bond yields fall or long-term inflation expectations rise. The last time real yields on the TIP were as high as they are now, they went on to post 10% annual returns over the following 3 years. I expect to see a similar return over the next three.

TIP Total Return Vs 10-Year Real Bond Yields (Bloomberg)

Lower Inflation In The Short Term Means Higher Inflation Over The Long Term

The huge decline in bond yields following the lower-than-expected CPI print highlighted the extent to which investors had been positioning for inflation to remain elevated. While there is still potential for hawkish Fed comments or subsequent high CPI prints to keep upside pressure on yields, they already appear to be pricing in an extremely steep hiking cycle, creating the potential for yields to crash if CPI continues to move down as is highly likely. 12-month breakeven inflation expectations are now at just 2.5%, and they have tended to be fairly accurate in the past, which suggests sharp CPI declines are on the way.

One interesting market reaction following the CPI print was the fall in long-term inflation expectations, which should have very little do with monthly inflation prints. While I fully expect inflation to fall significantly over the next 12 months, I also see long-term inflation expectations rising as it becomes clear that the Fed’s hiking cycle will be less aggressive than feared.

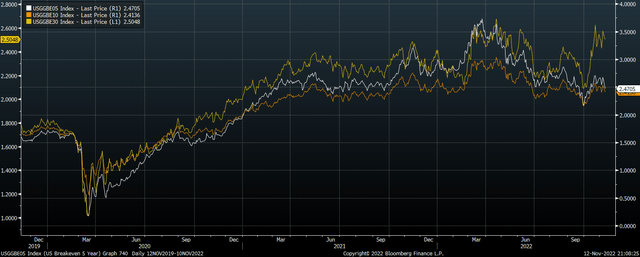

10-year breakeven inflation expectations peaked over 6 months ago despite headline CPI moving higher, and have been declining due to expectations that the Fed will continue hiking aggressively to combat near-term inflation. As headline CPI moves lower, the Fed will have the ability to shift its focus to supporting borrowers whose interest costs have surged. As this occurs, expectations about long-term inflation are likely to rise.

US Breakeven Inflation Expectations (Bloomberg)

We have already seen a disconnect in the breakevens market, with 30-year inflation expectations rising over the past 6 months despite declines in shorter term rates. We should start to see 5 and 10-year breakevens rise in tandem over the coming months as more structural inflation drivers such as fiscal spending dominate the near-term impact of tight monetary conditions.

The Fed Faces Pressure From Growth And The Treasury

Over the next few years, I expect to see both a decline in bond yields and a rise in inflation expectations, which should drive down real bond yields back below zero. As I noted in a previous article (see TIP: Economic Reality Increasingly Supportive), real bond yields are intrinsically linked to the real GDP growth rate of an economy, and the U.S. economy cannot support high and rising real borrowing costs. Furthermore, increasing social spending will necessitate continued high fiscal deficits, which will have to be funded by borrowing, and at current real yields, the fiscal costs would become intolerable. As we have seen in Japan, the Treasury’s concerns are likely to play an increasing role in the Fed’s decision making, keeping real yields suppressed.

Summary

The TIP ETF pays investors a real yield of 1.8% which investors can expect to receive over the 7-year maturity of the index. This positive real return is attractive from a long-term perspective, but the prospect of capital gains is even more appealing. We could easily see 30% gains in this ETF over the next few years due to a combination of lower interest rate expectations and higher inflation expectations.

Be the first to comment