PM Images

By Anu Ganti

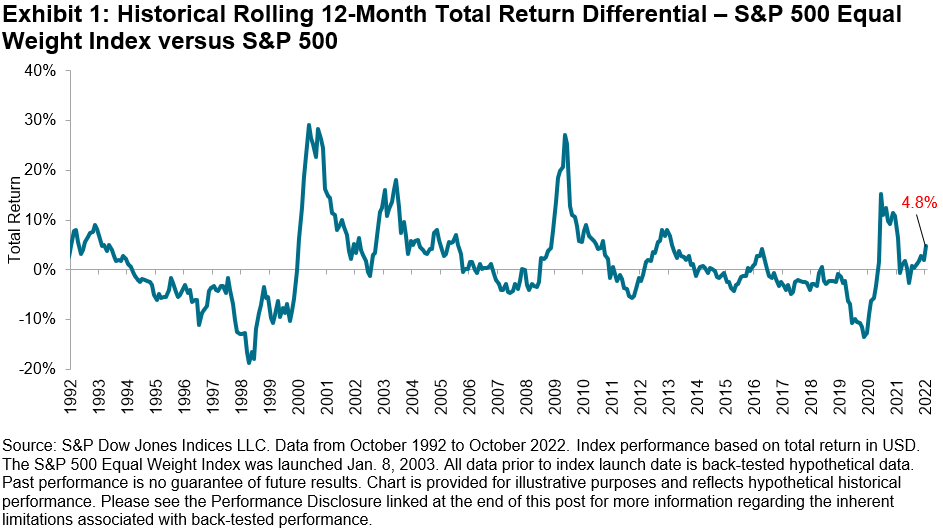

In this tumultuous market characterized by Fed rate hikes, elevated inflation and a strong dollar, mega-cap growth companies have suffered heavy losses, paced by recent “Big Tech” earnings disappointments from Meta, Microsoft, Alphabet, Amazon and others. The S&P 500® Top 50 declined by 19% over the past 12 months, underperforming the S&P 500 by 5%. The unsurprising result is that S&P 500 Equal Weight Index, which by definition is underweight these mega-cap names, has outperformed. Exhibit 1 shows that the equal weight index beat the S&P 500 by 5% in the 12-month period ending October 2022.

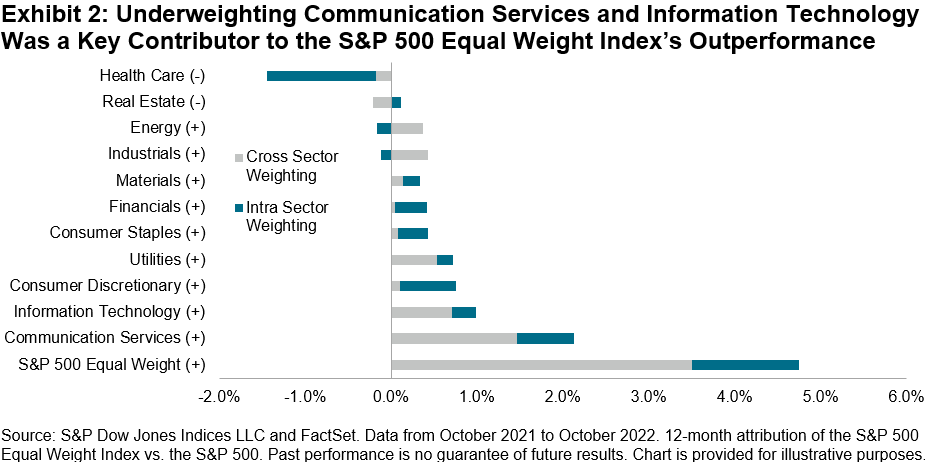

Exhibit 2 shows that the S&P 500 Equal Weight Index’s underweight to Communication Services and Information Technology, sectors that posted substantial losses so far this year, was a key contributor to the index’s recovery.

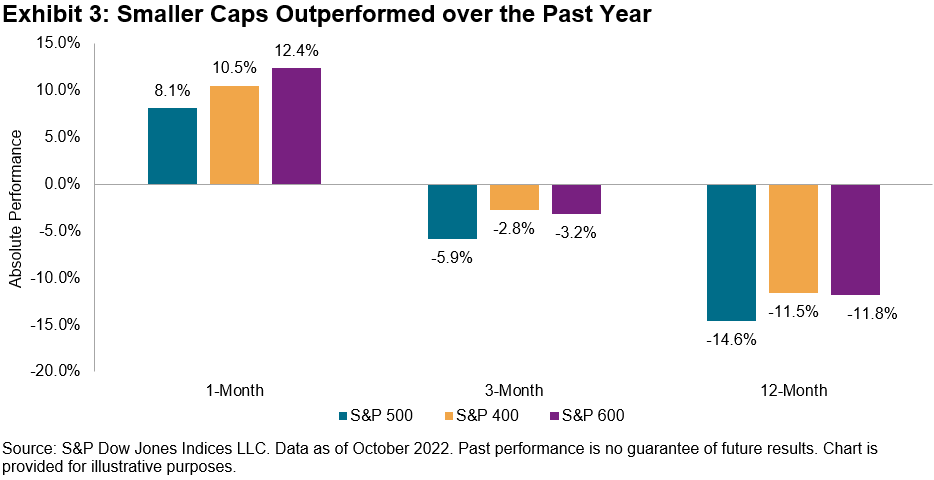

In addition to favorable sector exposures, the importance of which my colleague discusses here, the S&P 500 Equal Weight Index’s inherent factor tilts have proven beneficial as well. The strategy’s small-cap bias has been a tailwind, since smaller-cap companies, whose revenues are more domestically generated, have been less vulnerable to the macro headwind of a stronger U.S. dollar. Exhibit 3 illustrates the recent strong outperformance of the S&P 400® and the S&P 600® relative to their large-cap counterpart.

The S&P 500 Equal Weight Index’s anti-momentum bias, the product of selling relative winners and purchasing relative losers at each rebalance, has aided outperformance as a result of the momentum factor’s weakness for most of this year. The strategy’s implicit value bias has also been a source of outperformance, given the strong turnaround in the performance of value strategies this year.

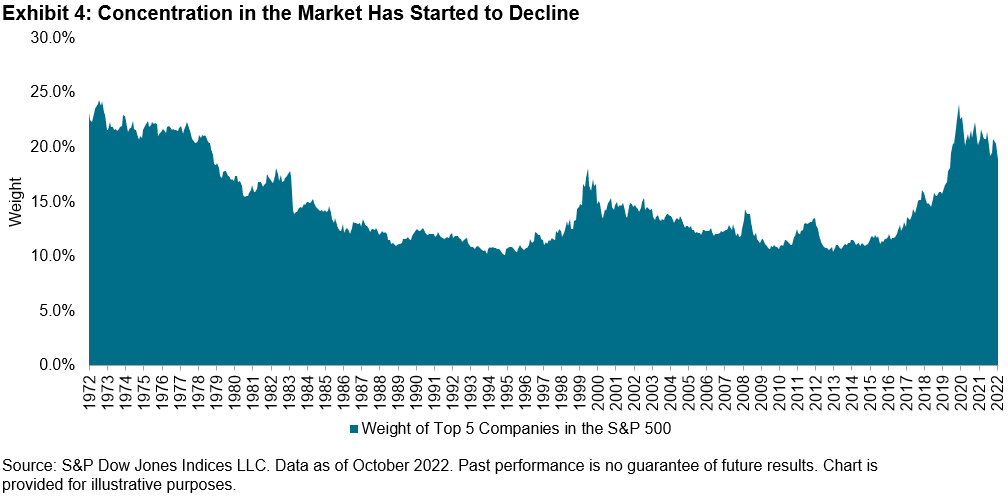

A natural outcome of the outperformance of the S&P 500 Equal Weight Index is that concentration levels in the market have begun to decline, as we observe in Exhibit 4. This is not surprising given the inverse relationship between concentration and equal weighting.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment