Warchi

Dear readers/followers,

Fluor (NYSE:FLR) deserves a bit of an update here. The company saw a massive upward spike of no less than double digits following the market reversal due to CPI that we’ve been seeing. This seems to have caused the market to view the 2023-2024E results for Fluor as somewhat indicative and tiered the valuation in accordance with this.

Justified?

Let’s see what’s happened with Fluor since I last wrote about the business.

Updating on Fluor

The holding company that is Fluor and its various subsidiaries and JVs is one of the more significant professional services firms you can own. This is a global company in the future-proof segments of EPC, Fabrication, and modularization services found especially in fuels, LNG, Chemicals, nuclear, infrastructure, mining, and project management. The company’s markets are global, and both private and government-oriented, with plenty of contracts that have the US government as a partner.

Its negatives have not significantly changed as of yet though – even if indications are that they may be doing so. It lacks any dividend yield, is barely BBB anymore, and saw its earnings collapse during COVID-19. As I see it, it has little business trading at the level it did during the last article, and even during this article. At a cursory glance, the bounce-up seems to be an overreaction – because result forecasts for 2022E have not materially improved from the negative EPS development that’s expected for the business.

The company also remains BBB-rated, making it a lower tier IG-rating which is attractive only insofar as valuation permits here.

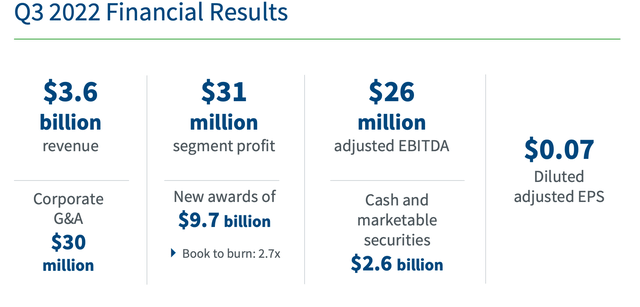

3Q22 is the latest results we have here, and it coincides with the company’s significant bounce. However, these results weren’t at all that positive to justify this sort of bounce. Profits were impacted by over $100M in charges on various infrastructure projects, and the company is still working with legacy projects to turn them more profitable here.

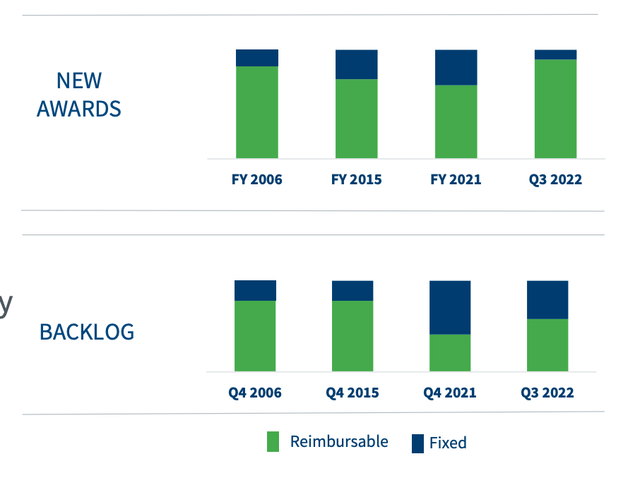

On the positive side, we have significant contract awards which could have influenced these trends, with a nearly $10B award in 3Q22, which is the second-largest award amount the company has ever recorded, with a 2.7x book-to-burn ratio. 91% of these new awards are reimbursable, which is what the company has put its energy toward making certain.

However, we cannot disregard the challenges that the company does face. Urban solutions saw a segment loss of $54M, Mission solutions saw a profit of around $30M and Energy solutions at around $60M. The company’s focus is forward-facing, with a better backlog quality than we’ve seen, and a focus on securing quality contracts that are reimbursable at good margins. When looking at that, the company is very similar to European companies in the same sector.

However, it doesn’t take much to understand that a $31M profit on a $3.6B revenue is in fact, not a good result.

So the bounce was definitely not due to company results. The company’s debt structure, however, is vastly improved with a debt/capital ratio down to 36.5% compared to 54.8% back in 4Q20. The company also means to reduce this further, retiring some notes with available cash. The company did provide some 4Q22 guidance, and they don’t yet expect full normalization of all segments, with a relatively meager single-digit below 5%-margin.

Let’s not completely take away from the high level or long term though.

How good the company is working is fairly easy to put into mathematical terms. The company managed margins of 550 basis points above the new, planned ambition going forward, and despite overall slowdown continues to see strong demand for technical and construction services. All segments showed impressive trends, including new pipeline and refinery awards in the rare earth sector. It’s all about those new awards, almost all of which are at high quality. The company reminds me quite a bit of Skanska (OTCPK:SKSBF) a few years back, when it too was working through a legacy, low-quality backlog of terribly-considered building projects it had signed on to do.

Much like with Skanska – where I’ve made over 30% this year by investing – this company should be viewed as forward-looking – and when viewing it on a forward basis, things are actually looking very well.

The company’s expertise and world-class experience across multiple fields see it having massive advantages. The overall global post-pandemic recovery is not unlikely to have the company reverse its negative earnings trend.

This is a necessity following the trends during 2020-2021, which saw EPS drop to actual negative levels.

I wrote in my last piece that governments are expected to shift to sustainable infrastructure and the energy transition as well as commodities, which directly ties into the company’s operations and ambitions. There are strong pricing trends and signals throughout the commodities space, indicating massive upside for chemicals, mining, and other areas. This is currently materializing, with the company’s share of sustainable investments increasing significantly.

The company has continued to pull its levers to make sure that its positioning and operations have the required resilience to manage inflation and current trends which are causing project uncertainties.

It’s also about hedging inflation and costs, which the company handles by locking in commitments with suppliers. This brings risks to contracts where things aren’t locked in, but where the company has commitments that might have to be met at a loss. Aside from this legacy risk, the company, like aforementioned Skanska and other players in infrastructure around the world, is now extremely picky with the sort of infrastructure projects it works on. It also works by having the client take quantity responsibility, like with a recent project the company is delivering. This is what we’ll see more on – clients having to take responsibilities for parts of projects, which previously was quite different.

Like with any construction company, there are ways in which revenue flows through the company when we’re talking about multi-billion dollar infrastructure projects.

This is an entire article in itself for an important quality that needs to be understood if you’re serious about investing in the sector. I have been investing in, and I have also been burned by the sector once before, where two of my investments remained at close to zero or negative profit for years because I understood too little was investing in or how the cycles flowed.

That is not a lack I currently have.

Like before, Fluor remains an attractive play on infrastructure. These markets go up and down in a more volatile manner than ancillary or different markets.

The general trends, which also apply to Fluor at this time, is that the forward-looking order books are looking very attractive. So the question is how we value the company with the current trends and under current plays.

Fluor’s Valuation

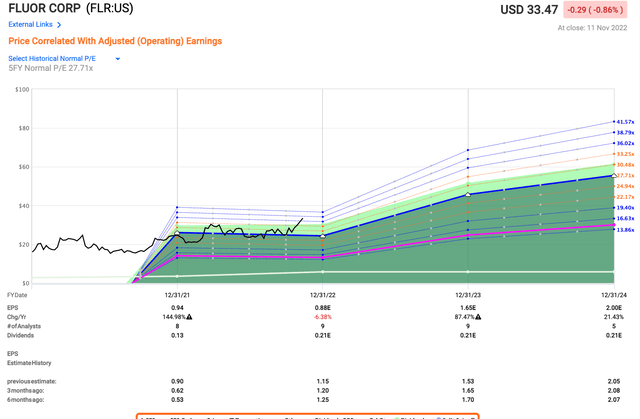

If we look back at this particular time to my last article, the reaction we’ve seen does not make much sense. Such is the way of the market. In the last set of forecasts, we were expecting a 2022E adjusted EPS growth – now that’s down to a decline.

Fluor valuation (F.A.S.T Graphs)

Fluor remains a bit of a high-risk investment. Not because the company is in a threatened position in terms of survival, but because of the relative historical volatility this business sees. Even these forecasts aren’t exactly certain, and it wouldn’t be unfair or wrong to say that this company has already recovered to a level where, on a 2021-2022E EPS level, it has reached the valuation that it should be, based on historical multiples.

An upside exists only on a premium-adjusted forecasted multiple. You need to put Fluor at above 25x P/E, and that’s not something I’m willing to do here. On a 15x P/E, the forecast here is negative – even with the company’s estimates growing over 80% for the coming years.

The company still has no yield – and no plans or forecasts for reinstating that yield. In the latest earnings call, management spoke in a relatively ambivalent/unclear manner about that reinstatement, putting it in context to key project opportunities. While a dividend will be coming back, it will be neither high nor significant in its impact – at least not as I see things.

There’s a massive amount of forecast uncertainty to the company when you look at the forecast success ratio – meaning it’s more than a 50% negative miss ratio for forecasting the company’s EPS.

Investing in a business like this takes a very strong stomach and high conviction. I know these sorts of businesses as I’ve been investing in them for years. They’re businesses like Skanska and NCC AB, both construction companies with very similar trends.

Remember what I said in my previous pieces. There are many superior options available to investing in Fluor at this particular time.

Why?

Because there are many better investment options out there, based on the qualities of:

- Fundamentals, including but not limited to credit rating.

- Dividend Yield, coverage, and dividend tradition.

- Overall conservative upside and forecast accuracy.

It is, of course, impossible for me to say that “HOLD” was the right option given where we are now. Market-beating returns and missing out on them is never “right”. But I don’t believe that climb is repeatable – at least not in the near term, and I do believe in a near-term downside in conjunction with the 2022E Fiscals.

Because of that, my stance stays where it is.

S&P Global’s targets for the company are interesting – because they agree with this assessment. Usually, S&P Global targets are exuberant. In this case, they’re no higher than $32/share, meaning according to analyst targets, this company is slightly overvalued. At this valuation, only 1 out of 9 analysts have a “BUY” target – the rest are at “HOLD”. These were the same targets as in my last article, with the one difference that the analysts have raised their overall estimates.

I don’t see a reason for doing so without better visibility, which I don’t believe we yet have. So before we go anywhere, that’s what I want. If the company drops below $25.90/share, then I would consider this company a “BUY” – but even then, it would only be a buy-in of what I would consider a “vacuum”. And that’s not really how the market works.

Thesis

Here is my thesis on Fluor:

- Fluor has a similar problem to most construction and engineering companies. They’re great companies – and I do mean great companies to invest in during an upswing.

- However, when and if these companies go into the doldrums, they can stay there for several years, and once earnings crash, they can do so to negative levels and be there for several years as well. This is more or less what happened to some of those construction companies I invested in.

- For now, I remain tepid on this company – my PT is $25.9 and I’m at a “HOLD” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you, however, want to grow your money conservatively, and safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Fluor is a “HOLD” here due to poor valuation and some lacking qualities

Here are my criteria and how the company fulfills them (Bolded):

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment