Michael Gonzalez/Getty Images News

Thesis

Tesla, Inc. (NASDAQ:TSLA) investors continue to monitor TSLA’s consolidation with bated breath. We presented in our pre-earnings update reminding investors of the perils of TSLA’s overvaluation as macro headwinds intensified.

Accordingly, TSLA has held on to its October lows relatively well, even though it didn’t participate in the recent broad market recovery. We anticipated that the selling momentum could subside at the current levels, as nothing falls in a straight line.

Hence, we have been assessing whether a potential counter-trend opportunity is possible in the current context, even as high P/E stocks like TSLA come under significant pressure.

Our analysis indicates that TSLA is not likely to be re-rated to its 2021 levels in the near term, with the Fed still hawkish. However, the potential for TSLA to continue consolidating before staging a rally is still possible if CEO Elon Musk & team can achieve a robust Q4.

Management’s commentary on its Q3 earnings suggests that it could continue gaining incremental operating leverage as commodity costs continue to abate. Moreover, coupled with further easing in global supply chain pressures, it could help mitigate the impact of a subscale Giga Berlin and Texas ramp.

As such, we believe a speculative opportunity is possible even as the Fed turned increasingly hawkish.

Revising TSLA from Hold to Speculative Buy, with a price target (PT) of $280 (implying a potential upside of 30%).

All Eyes On Tesla’s Operating Margins Through FY23

Management’s commentary in its recent earnings suggested that Tesla could have experienced the peak in average commodity costs in Q3, as CFO Zach Kirkhorn articulated:

At least of what we know so far, so peak on the commodity side in Q3, I say peak, hopefully, it stays the peak, hopefully, it starts to come down. There is a small amount of production that we’re seeing going into our Q4 cost structure from steel and aluminum primarily, but it’s less than 10% of the total increases we’ve seen so far. (Tesla FQ3’22 earnings call)

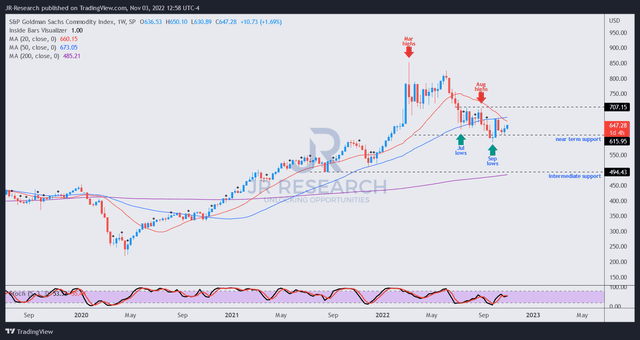

SPGSCI price chart (weekly) (TradingView)

As seen above, the S&P GSCI Commodity Index (SPGSCI) has fallen markedly from its March and June highs through October. Therefore, Tesla’s observation is in the correct direction, even though the positive effects could be more meaningful only from FY23.

Still, it warrants investors to consider that Tesla’s ability to drive significant operating leverage when costs are meaningfully lower should not be ruled out.

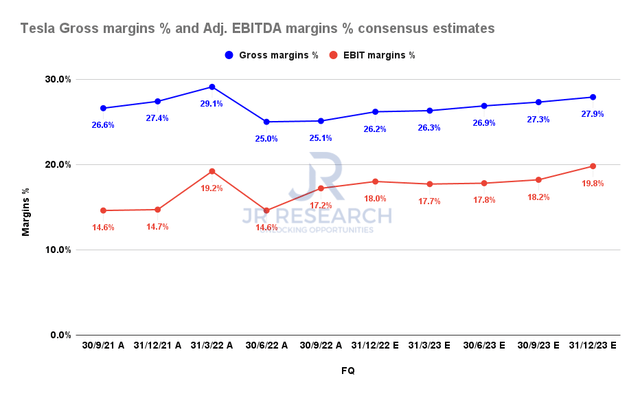

Tesla Gross margins % and EBIT margins % consensus estimates (S&P Cap IQ)

As seen above, Tesla recovered its EBIT margins remarkably in Q3, even though deliveries were lower than the consensus estimates. The leading EV maker posted a margin of 17.2% in Q3, up from Q2’s 14.6%.

Its corporate gross margins also appeared to have stopped falling from Q2’s 25%. Management highlighted its confidence to continue driving leverage, which is also in line with the revised consensus estimates (bullish).

Hence, it forbodes well for TSLA if the company could execute accordingly through FY23.

We believe the market is assessing whether the tailwinds in the global supply chain and weaker commodity prices could help lift Tesla’s profitability moving ahead.

The critical issue is whether the market has priced in the macro challenges accordingly in the near term.

TSLA De-rating Still Underway

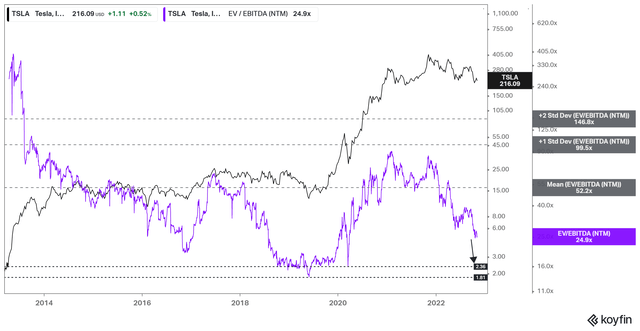

TSLA NTM EBITDA multiples valuation trend (koyfin)

We think there’s no question that the market has de-rated TSLA. It last traded at an NTM EBITDA of 25x, well below its 10Y mean of 52x. We explained in our previous article why TSLA bulls need to temper their target multiple moving forward, as Tesla’s growth is expected to slow.

Furthermore, TSLA remains well ahead of the lows seen in 2019 and 2020. Therefore, TSLA is not just expensive relative to its industry peers or sector sectors but also not undervalued relative to its historical averages.

Notwithstanding, it doesn’t necessarily mean that there are no opportunities to execute a mean-reversion setup if the reward/risk is reasonable.

If Tesla could continue improving its leverage as commodity tailwinds reverse, it could make up for slower revenue growth, even as its China deliveries suffered a MoM decline. Moreover, we believe Tesla cutting prices in China doesn’t necessarily mean it’s doom and gloom if it could take share from China’s leading EV makers.

The critical question is how the market sees it.

Is TSLA Stock A Buy, Sell, Or Hold?

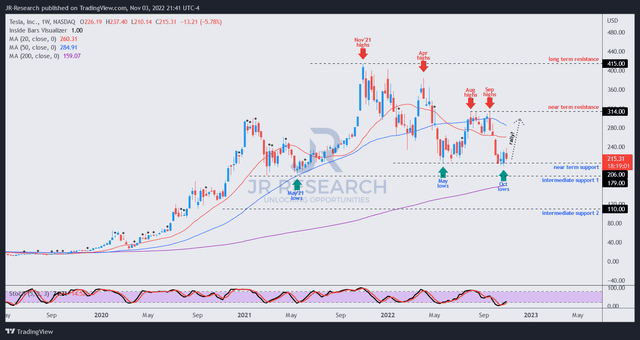

TSLA price chart (weekly) (TradingView)

For a high P/E stock (40x NTM earnings) compared to the S&P 500’s (SP500) (SPX) 16x forward P/E, TSLA’s YTD total return of -32.5% doesn’t look too bad. Compared to the Invesco QQQ ETF’s (QQQ) YTD total return of -33%, with a forward P/E of 18.8x, TSLA performed admirably.

Therefore, even though we think TSLA is not cheap, we can still identify appropriate opportunities to execute on TSLA. We assess that such an opportunity is appropriate at the current levels. So here’s how it goes.

It’s clear that TSLA remains in a long-term uptrend but has lost its medium-term bullish bias. That’s ok, as nothing falls in a straight line. Moreover, buying support appears to be robust at the current levels, as it consolidated over the past four weeks, undergirded by the lows in May 2022.

Furthermore, we postulate that buyers should be looking to defend its “intermediate support 1” vigorously if the sellers attempt to force a decisive downside break of the current levels. Coupled with the support of the 200-week moving average (purple line), we assess that momentum seems to be shifting back to the buyers.

Hence, the market seems confident in Musk & team’s execution in the near term, given the reversal of some critical tailwinds from H1’22. As a result, we deduce that a near-term PT of $280 is appropriate for the current setup, proffering investors a potential upside of about 30%.

However, we urge investors to consider setting up appropriate risk management strategies if the bears managed to force downside beyond its “intermediate support 1,” as it would invalidate our thesis.

As the Fed remains hawkish, further macro headwinds could cause the market to anticipate significant stress on Tesla’s operating leverage, behooving further value compression. As we highlighted earlier, TSLA is not undervalued.

Revising our rating from Hold to Speculative Buy.

Be the first to comment