Justin Sullivan/Getty Images News

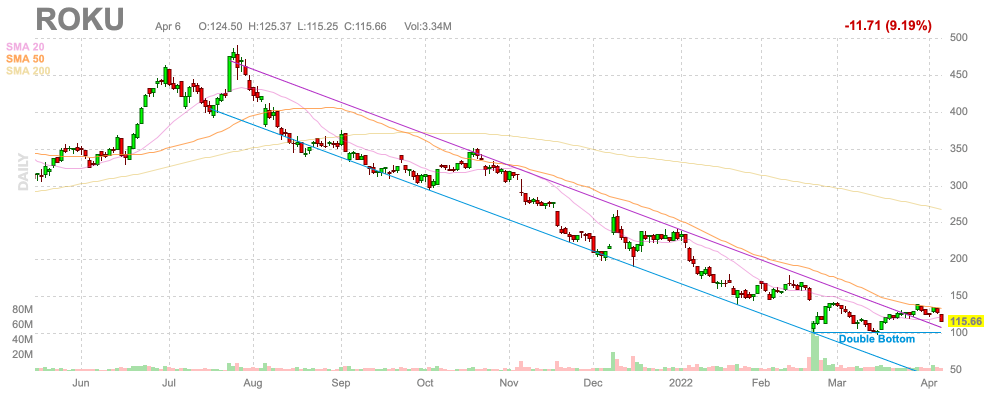

While the streaming video sector reports solid growth rates, the business models of the companies involved haven’t exactly lived up to grand expectations. Roku (NASDAQ:ROKU) is a primary example of where limited profits are paired with strong revenue growth due to the costs to operate in the industry while streaming revenues are cut from the legacy video funnel. My investment thesis is Bearish on the stock despite the potential tradable setup of a double bottom around $100.

Source: FinViz

Large Account Base

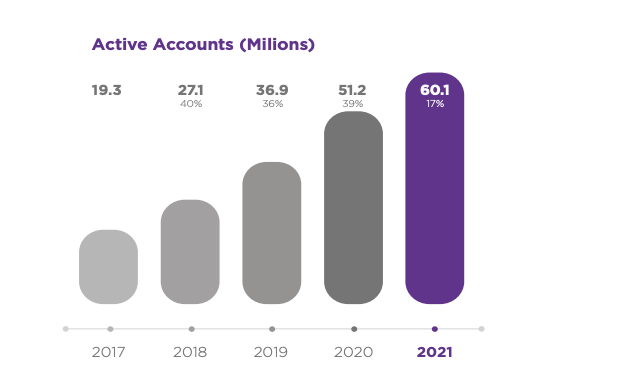

Along with the disappointing Q4’21 earnings report, Roku made some important statements regarding active accounts and legacy users. According to the company, Roku now has more active accounts than the U.S. video subscribers of all of the cable companies combined.

Source: Roku Q4’21 shareholder letter

This number is impressive for the size of the video streaming market, but it also limits the amount of future customers to sign up. After all, Roku saw the user base only expand 17% in 2021 after 3 years of growth in excess of 35%.

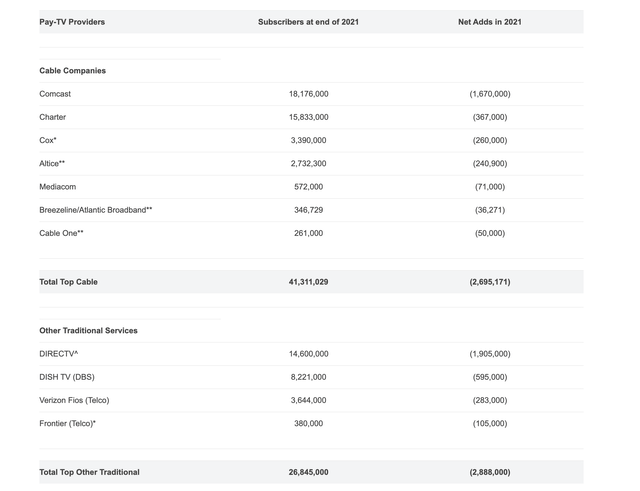

The video streaming platform did report 8.9 million international active accounts, so the company isn’t just reliant on those domestic video subs shifting to streaming. Still, the future customer base is slimming down. According to LRG, the legacy Pay-TV Providers have 68.2 million subs with the cable companies having only 41.3 million subs after losing 2.7 million accounts during 2021 alone.

Also, Roku mentioned that legacy video saw a 23% decline in the key U.S. adults aged 18 to 49. Again, this is another sign of a massive reduction in prime customers to sign up in the future with Roku leaving mostly the 50+ crowd as the majority of people still on legacy video services.

In essence, Roku needs to add 12 million new active accounts in 2022 to grow by 20% this year. The legacy sub base will really start disappearing in order for the video streaming service to grow at a 20% rate while further shrinking the sub balance for 2023 and beyond.

Business Model

The problem with what makes the streaming video service so attractive to customers is what hurts the business model of Roku. The target customer is shifting to streaming video to save from the high cable bills while loving the flexibility to cancel services on a monthly basis.

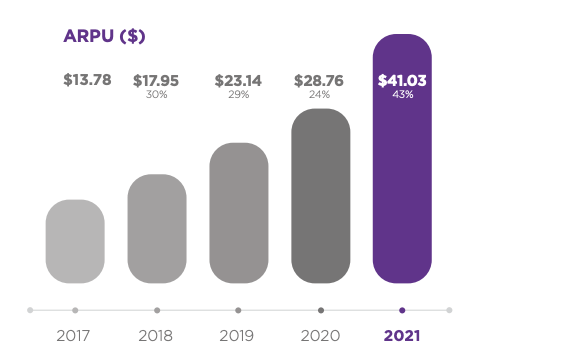

The company has 60.1 million active accounts, but the ARPU is only $41 per year. Most cable services hardly offer a service that only costs $40 per month.

Source: Roku Q4’21 shareholder letter

Roku does manage to grab impressive 60% gross margins on the platform revenues leaving the company with $425 million in gross profits for Q4’21. Total gross margins were only 44% after taking a large hit on Roku Players pushing the total gross profit down to only $380 million.

The company has missed revenue targets in the last 2 quarters, in part due to the steaming platform headwinds. Covid pull forwards have made numbers hard to forecast and guide, but one needs to consider the above account headwinds making fast growth more difficult.

The market is currently too caught up on revenue totals in comparison to cable companies. Roku only forecasts 2022 revenue in the $3.75 billion range while Charter Communications is up at $54.0 billion. The vast difference isn’t the relatively age of the Roku business, but much more related to the low revenue totals of the streaming platform and the cut obtained by Roku for their operating system.

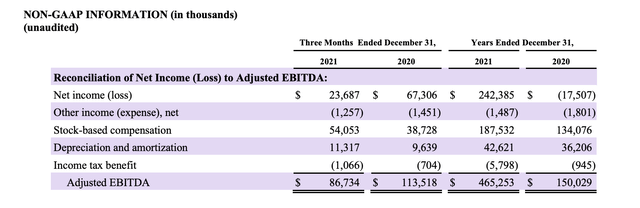

The company has substantial operating expenses that restrict the profits of the business. Roku only reported Q4’21 income of $21.4 million with adjusted EBITDA up at $86.7 million due to stock-based compensation of $54.1 million.

Adjusted EBITDA margins actually fell during the December quarter to only 10%. At the same time that EBITDA is a useful financial metric, the share count is surging. The average diluted shares outstanding in 2021 were up 3.1 million shares. At the current stock price of $115, the market cap rose nearly $357 million while the EBITDA profits generated by the business was only slightly higher at $465.3 million for the year.

Source: Roku Q4’21 shareholder letter

The stock has a market cap approaching $16 billion with targets for Q1’22 EBITDA to dip over $70 million YoY.

Takeaway

The key investor takeaway is that Roku isn’t appealing despite the stock falling to $115. The streaming video sector continues to see a major shift in consumer demand, but the company already has a large portion of the potential customer base. As customers can easily shift services to control costs, Roku continues to face a difficult profit picture where higher ARPUs aren’t leading to higher profits.

Investors should avoid Roku until the business model adjusts to a more profitable, sticky customer.

Be the first to comment