vchal/iStock via Getty Images

Investment Thesis

Yellow Cake (OTCPK:YLLXF) is a passive investment company focused on owning uranium, which has its primary listing on the London Stock Exchange. Most of the uranium is stored in Canada and a small amount in France as of the last update.

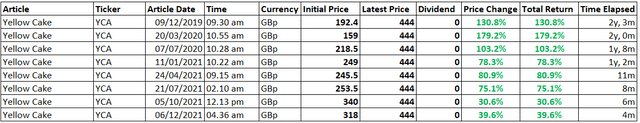

I have owned the stock for a few years and have covered it here on Seeking Alpha several times. If you would have bought the stock at the time of the prior articles, you would have had a good return considering it is a lower risk alternative in the uranium industry.

Figure 1 – Source: Returns from My Prior Articles

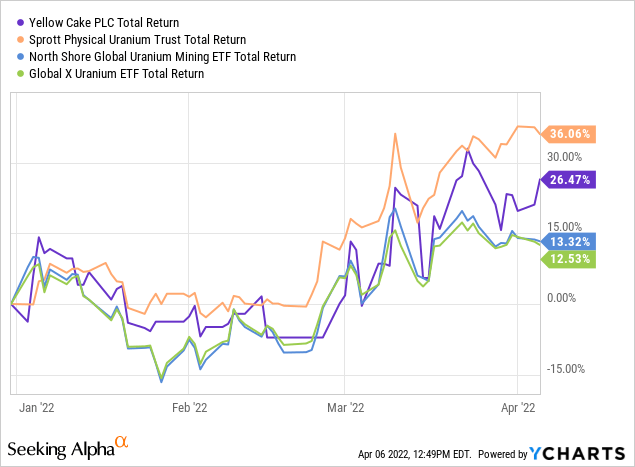

When it comes to uranium equities, the miners have had the highest returns from the lowest levels in 2020. However, in 2022, the investment vehicles have outperformed the miners so far, and I continue to think the investment vehicles like Yellow Cake offer a very good risk-reward going forward.

Yellow Cake is after the recent price increase still trading with a decent size discount to net asset value, around 8%, which makes it an attractive alternative in the uranium industry.

Uranium Market

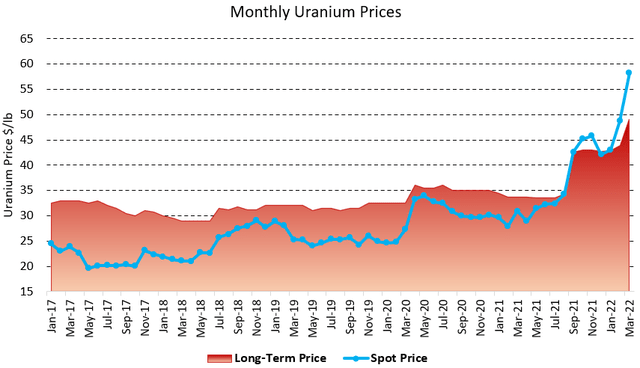

The uranium price has seen an impressive increase lately, both in the spot market and the long-term market as illustrated in the chart below. We have also seen the price of uranium go just above $60/lb in the last few days.

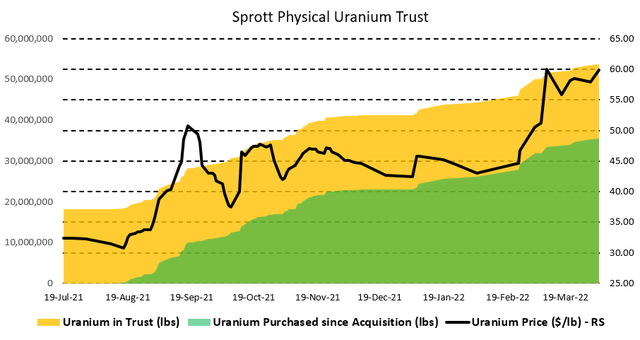

The strong uranium price performance over the last year is likely due to a very large supply/demand deficit at the moment together with very aggressive uranium buying from the Sprott Physical Uranium Trust (OTCPK:SRUUF), other industry players like Yellow Cake and some miners have also bought uranium in the spot market. The Sprott Physical Uranium Trust has been the largest buyer in the market and has added 35Mlbs of uranium in less than a year.

Figure 4 – Source: Data from Sprott

More recently, the Russian invasion of Ukraine has naturally had an impact as well. In part from proposed sanctions from Western countries on uranium and threats from Russia that the country might ban the export of uranium. It does not help that Kazakhstan, which is the largest producer of uranium globally, normally ships via Russia as well.

While it is extremely difficult to predict the outcome of the war and what politicians might do. I have a hard time seeing this not benefitting a company like Yellow Cake, which is a lower-risk investment vehicle in a market that might be exposed to a prolonged period of turbulence.

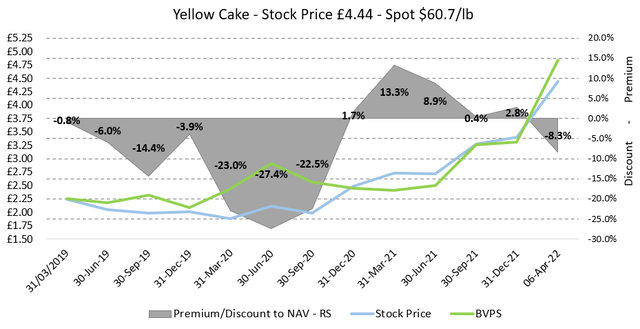

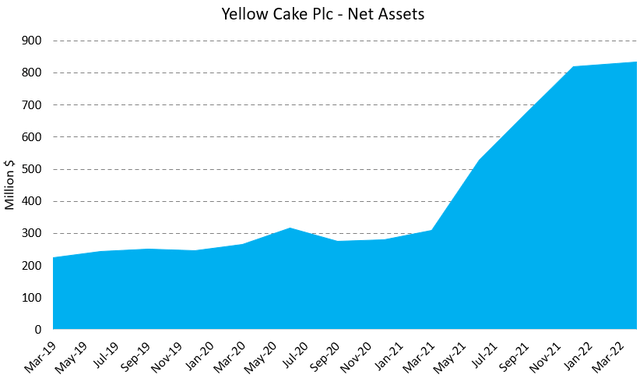

Buybacks & Valuation

Yellow Cake has over the last few years traded with both a discount and a premium to the net asset value of the company. Earlier this week it was announced that the company will employ a small $3M buyback program over the coming 30 days. This together with an improving sentiment can hopefully get the stock to trade closer to NAV going forward, which we see for the Sprott Physical Uranium Trust for example.

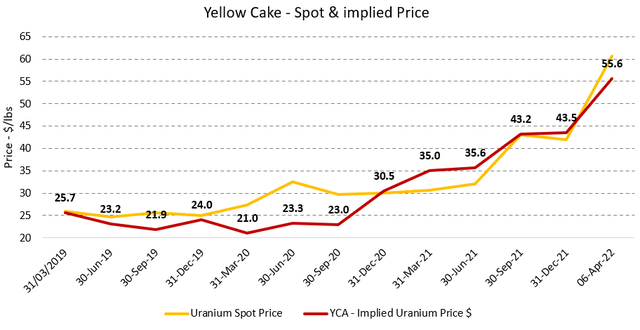

When a larger buyback program was used during 2020, we eventually saw the stock catch up with the underlying valuation. The stock is at the time of the writing being offered at an 8.3% discount to NAV, which is equivalent to buying uranium exposure at $55.6/lb.

Figure 5 – Source: My Calculations – Data from Quarterly Reports Figure 6 – Source: My Calculations – Data from Quarterly Reports

Conclusion

Yellow Cake does not have the same efficient ATM offering that the Sprott Trusts employ, because that is not as straightforward on a UK listing. However, as an investor in the company, it does not have a material impact to existing shareholders. Yellow Cake is now large enough in terms of total assets, that the management cost is a relatively small part of total assets.

The stock continues to be a good low-risk investment in the uranium market being offered at a discount to net asset value.

Be the first to comment