PhonlamaiPhoto

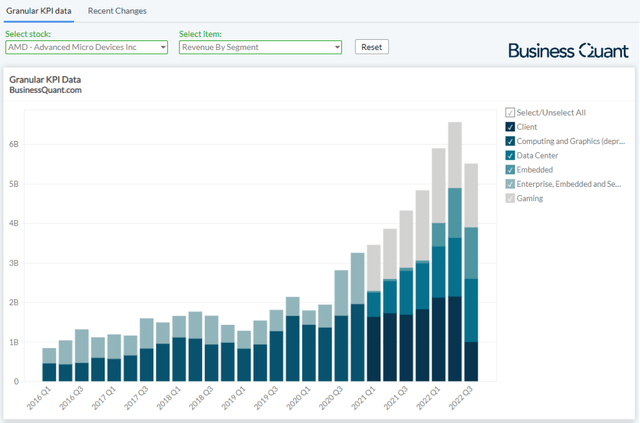

AMD (NASDAQ:AMD) announced a weak set of preliminary Q3 results late last week. Its management slashed their revenue growth estimates to nearly half, down from 55% to 29% for the said quarter. They did not provide color on when the business will return to normalcy or to its usual pace of growth, which fueled panic selling and drove its shares 15% lower since then. But while the reasons behind the selloff are understandable, I opine that the stock is now attractively valued after its recent correction, especially for investors with a long-term time horizon. Let’s take a closer look at both sides of the story.

Understanding the Issue

Let me start by saying that rising interest rates, inflationary pressures and slowing down GDP growth rates across major markets have led to demand destruction for computing products amongst other industries. As far as AMD is concerned, it shipped CPUs and GPUs to channel partners, but they weren’t able to sell at their usual momentum due to slowing consumer demand. As a result, its channel partners faced an inventory buildup and also experienced inventory losses as the price of several SKUs declined in the last few months, leading them to cancel and/or defer orders with the chipmaker.

This market dynamic adversely affected AMD’s financials in Q3. Although its revenue is estimated to be up 29% year-over-year, it will be the first quarter in the last 10 quarters that its sales would decline on a sequential basis. What exacerbates the problem, as I mentioned earlier, is the fact that its management has not provided any future guidance on when they will be able to reinvigorate growth. This situation now forces every investor to reassess why to invest in the chipmaker when we do not know how far along the sales decline will continue for this popular “growth company.”

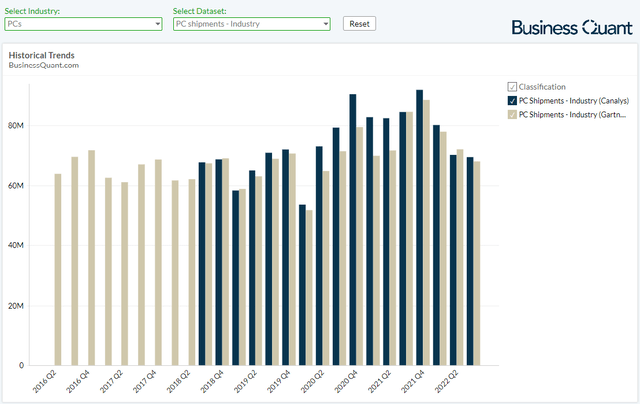

If it’s some respite to shareholders, then AMD’s sales decline isn’t something that’s company-specific but rather an industry-wide phenomenon. Canalys and Gartner have issued their PC shipment figures for Q3 and both the research firms conclude that industry-wide shipments have sequentially declined by 1.1% and 5.6%, respectively, during Q3.

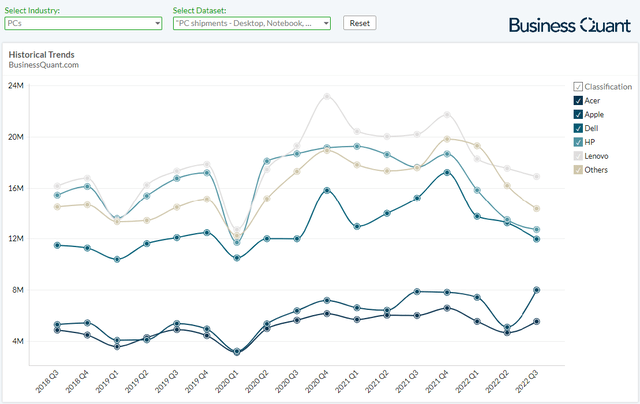

Looking at granular shipment data reveals an interesting picture. It’s evident that nearly all the major x86-based PC vendors saw their shipments decline during Q3. Apple’s (AAPL) shipments rose to record levels during the quarter but it now uses ARM-based M-series processors and doesn’t rely on x86 chips from AMD or Intel (INTC) anymore. This should come as a relief to AMD’s shareholders that at least the sales decline isn’t due to market share losses but rather because of cyclical demand trends for computing devices.

All this might suggest that AMD’s good days are over and that the stock will continue to plummet going forward, but that’s not necessarily a given. If anything, the ground reality isn’t as dire and there is reason to believe that AMD’s shares make for a buy on the current weakness.

The Return to Growth

For starters, I want to emphasize that this slowdown isn’t specific to just AMD but it’s rather a cyclical weakness. I had warned investors about this very inventory buildup and average selling prices (or ASPs) declines in a prior article during Q2, but received a lot of flak for going against the popular opinion at the time. This dynamic was later corroborated by the managements of Micron (MU) and SMIC. So, my frequent readers were already apprised of this impending slowdown. (Read – Nvidia: We Have a Problem)

It’s important to understand that inflationary pressures and a rising interest rate environment won’t be perpetually present and would eventually return to normalcy sooner or later. So, while the demand for consumer computing products may be weak for the time being, the channel inventory and demand is likely to return to its usual pace of growth once these macroeconomic pressures eventually subside.

Having said that, AMD seems well-positioned to continue growing its top line despite these macroeconomic headwinds. It released a slew of highly anticipated 5nm-based Zen 4 CPUs in the last week of September, replacing its over 2-year-old Zen 3 CPUs, which are now trading blows with Intel’s finest. Early benchmarks reveal that these Zen 4 CPUs outperform Intel’s finest 12th gen SKUs in a number of workflows.

Besides, AMD is also gearing up to release its 7000-series GPU line-up starting November. These, too, will be based on Taiwan Semiconductor’s (TSM) 5nm process and will replace the chipmaker’s dated 5000-series SKUs that were released nearly 2 years ago. It remains to be seen how these GPUs will stack against Nvidia’s (NVDA) upcoming 4000-series GPU lineup, but I contend that it’ll result in a buying spree amongst the gaming community that was priced out of the market due to bloated GPU prices over the last 2 years.

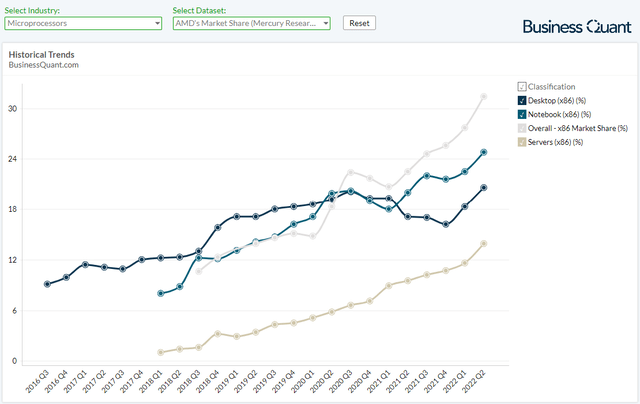

As far as its datacenter segment goes, it, too, has its own share of growth catalysts that I’ve detailed in a prior article here. It includes the prospect of integrated product launches and rapid market share gains against Nvidia and Intel. So, overall, we can expect these new chip lineups to boost AMD’s sales and its ASPs in the coming months, as they gradually become available in major markets across the globe. The chart above highlights that AMD’s market share continues to grow across different product categories and these new launches will only support the ongoing trend in coming quarters.

Final Thoughts

The takeaway here is that the slowdown in AMD’s Q3 sales is an industry-wide cyclical event. I believe the softness will last for a quarter or two at best, and AMD’s revenue will eventually scale new highs thanks to its new product releases and continued market share gains in nearly all of its product categories.

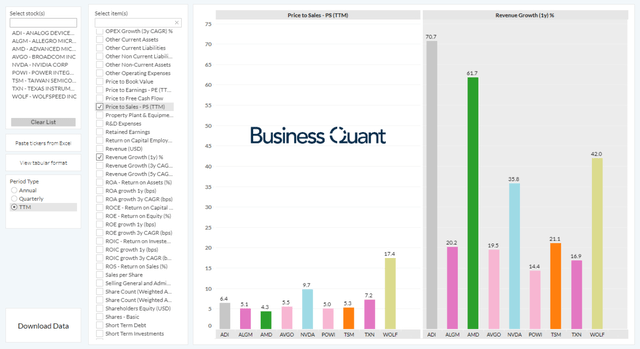

So, investors with a multi-year time horizon may want to take advantage of the market capitulation and scoop AMD’s shares at discounted levels. The stock is trading at just over 4-times its trailing twelve-month sales at the time of this writing, which is considerably lower than many of the other rapidly growing semiconductor stocks. These factors make AMD an attractive buy at current levels. Good Luck!

Be the first to comment