Justin Sullivan/Getty Images News

United Airlines (NASDAQ:UAL) stock has been one of the best performers among U.S. airlines in 2022. Its execs made a number of strategic decisions during the pandemic that paid off handsomely, particularly this summer. As the final quarter of 2022 nears closure which included strong guidance from UAL for the fourth quarter, now is a good time to examine the reasons for UAL’s strong performance in the third quarter, evaluate the likelihood of solid performance for the fourth quarter, and look further down the road into 2023 and beyond to determine if the bases for United’s performance in the latter half of this year will continue into the new year.

First, it is worth evaluating United’s covid-era strategies since each U.S. airline took different approaches to dealing with the first-ever disruption of its kind for the airline industry. Several key characteristics defined United’s covid strategies:

- While other carriers adopted medical guidance to the public to maximize distance between people to reduce the possibility of disease spread by blocking some seats on their flights, United never blocked seats but instead conducted studies to show that the air filtration systems on modern jets virtually eliminated virus transmission. Many public health officials considered airplane travel to be risky despite the evidence that United helped uncover but the company still sold 100% of its capacity throughout the pandemic.

- United, like Delta (DAL), took a very conservative approach to maintaining capacity during much of the pandemic by operating significantly reduced schedules. However, by December 2021, United began to aggressively restore capacity.

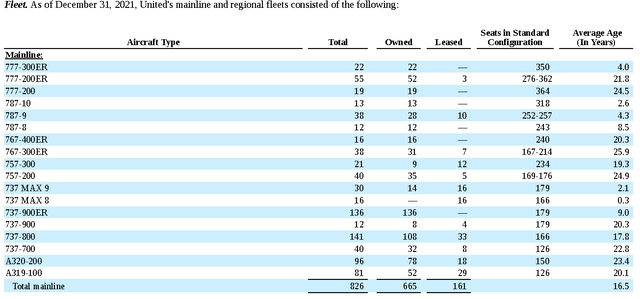

- United determined that it would not retire aircraft fleets as some airlines announced they would do. Airlines frequently use major external shocks as opportunities to advance their fleet strategies which require continual replacement of aircraft and the inevitable regular retirement of certain aircraft models among airlines that operate a diverse fleet as United does.

- United complied with federal airline aid requirements to maintain staffing levels but reduced the pay of some workers such as its pilots to reduce costs since government aid did not cover all labor-related expenses and revenues for many quarters were not sufficient to cover remaining costs.

Each of these strategies was unique in the industry and resulted in unique outcomes for United, some of which it has benefitted from and some of which have resulted in prolonged and magnified impacts which UAL now has to resolve.

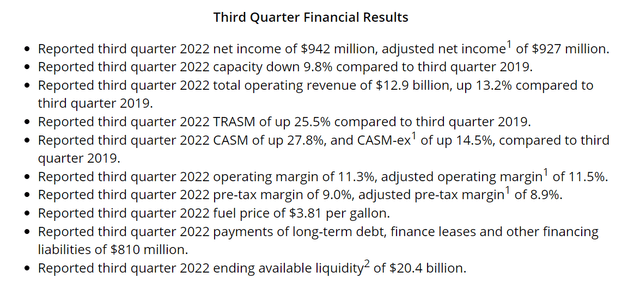

United’s Sterling Third Quarter and Strong Outlook

United’s strategies came together beautifully in the third quarter of 2022. They laid the framework for an expectation of strong demand recovery in the second quarter but their turnaround hit full stride in the third quarter. United’s performance was summarized best by its bottom line profit which was just 8% lower than it was three years ago pre-pandemic despite operating about 10% less capacity and seeing unit costs increase by nearly 30%. For the first time in years, United’s operating margin nearly met Delta’s, which has long been the most profitable global airline. UAL’s operating revenue increased by 13% with the strongest performance seen in its global regions. Directly attributable to its decision to keep its international fleet ready to serve global markets when demand returned, United benefitted with high revenue generating efficiency on its international network which dropped directly to the bottom line. United was the only major airline that flew more capacity across the Atlantic even as most of Asia, where United has long been the largest airline, remained limited in traffic growth. United’s passenger revenue grew in the domestic, transatlantic and Latin America regions with unit revenues up by 20% or more in every region except for its Middle East/S. Asia/Africa region, a United global subdivision that does not correlate with DOT reportable regions. United also had good labor cost control, reducing its labor costs compared to the summer of 2019 and matching its labor cost growth to its capacity generation; no other large U.S. airline did as good of a job in that regard as United.

United Airlines 3Q2022 results (ir.united.com)

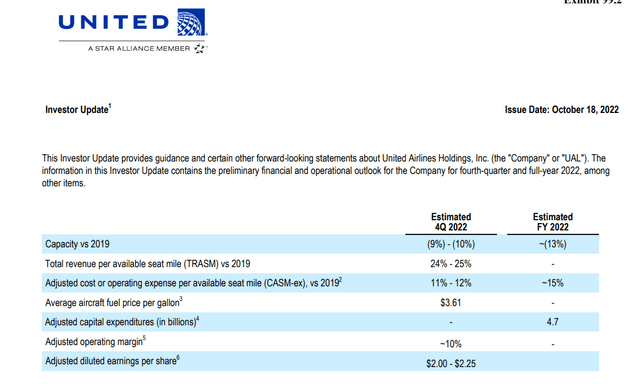

UAL’s guidance for the fourth quarter of 2022 is nearly as strong. United traditionally does not do as well in the first and fourth quarters because of its relative weakness in Florida and the Caribbean compared to other U.S. airlines. In addition, United’s transatlantic and transpacific regions historically are less strong in the coming two quarters. United’s expectations are for a strong 2023 summer international season; while they have not provided investor guidance, they should be well-positioned to have another strong summer season. They also appear to be capable of managing their costs through the winter to ensure they adequately match costs with revenues.

UAL 4Q2022 guidance as of Oct 2022 (ir.united.com)

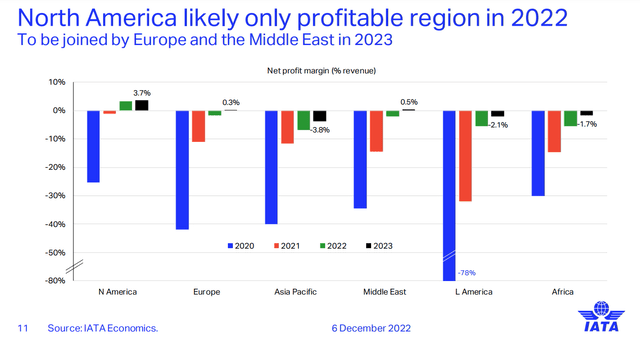

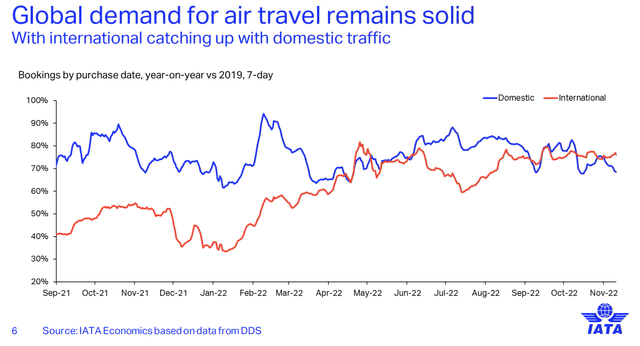

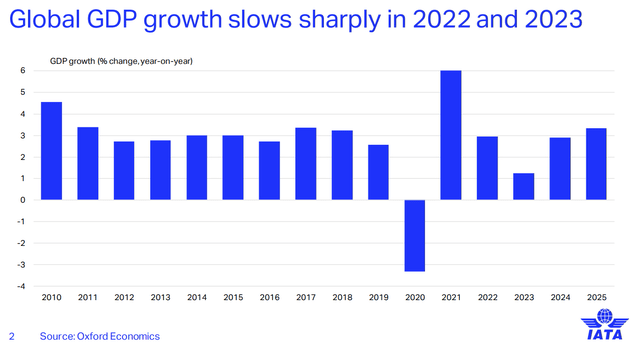

UAL’s CEO noted during the pandemic that he expected that United would be in a very good position to increase international revenues when markets reopened – and evidence seems to indicate he was right. The International Air Transport Association recently released a report indicating that the U.S. market is expected to be the only global region which will return to profitability in 2022 and that profitability will expand in 2023 and remain well above Europe and the Middle East, the only two regions that IATA expects to return to profitability in 2023 – but at much lower margins than for U.S. airlines. During the end of the third quarter into the fourth quarter, the Japanese and S. Korean markets both reopened to U.S. passengers. Both countries are home to major global airports that serve as connecting hubs for traffic deep into the rest of East Asia; the reopening of the Japanese and S. Korean markets facilitate the return of air travel throughout the region.

IATA profits by global region (IATA Economics)

IATA Global Demand (IATA Economics)

Past performance is not a guarantee of future results

As is true with all investing, United’s strong third quarter 2023 results will not necessarily translate into lasting financial advantages; it is United’s strong financial performance in the MRQ that has helped make UAL stock one of the best performing global airline stocks and also outperforming many other stocks outside of the airline industry. Yet, in comparing the reasons for UAL’s strong performance relative to its competitors highlights that United’s positive outlook and well-timed preparation for revenue trend was not shared by its largest competitors. Delta and Southwest (LUV) are consistently more profitable than United and both, for various reasons did not do well based on their own assessments in the summer of 2022 – but both are expected to significantly improve their performance going into 2023.

As I have previously noted, Delta and United are shaping up to be the two dominant U.S. global airlines, also ranking among the top five airlines globally. Delta has long been stronger domestically while United’s network strength has been in the international arena. However, Delta made a number of decisions during the pandemic that hindered its ability to quickly recover, even if they might have limited their losses during the pandemic and improved their longer-term prospects as I highlighted in this Seeking Alpha article. Delta was the least recovered U.S. airline in 2022 from a capacity standpoint, withholding capacity growth to address operational challenges creating significant inefficiencies in its network. By next summer, however, Delta expects to be flying more capacity than in 2019 which will significantly increase their profits since many of their costs for 2022 were in place but not being used efficiently. Delta has been the largest airline across the Atlantic for a number of years but ceded that title to United in 2022. While there continue to be schedule changes that make it impossible to determine future capacity levels, Delta is expected to put more than a dozen new generation widebody aircraft in service by next summer, the most of any U.S. airline and one of the highest levels of new aircraft in the global airline industry; it has already announced several new routes that will use some of that capacity but still appears to have the capacity to be deployed; both Delta and United – which currently are operating the same number of very limited pre-covid flights to China are expected to finalize their schedules to that country as reopening plans are announced. While Delta and United could both thrive with significantly increased levels of capacity in 2023, Delta’s performance in 2023 relative to both United and Delta’s 2022 financials will make United less of a standout.

Southwest also had significantly depressed results but for very different reasons. The nation’s largest low-cost carrier continues to be limited in fleet growth because of delivery problems with Boeing’s (BA) 737 MAX. Southwest only operates 737 aircraft and its entire order book is for MAX aircraft. However, Boeing has not received certification for the MAX 7 and MAX 10 models, the smallest and largest in the 737 MAX family. Southwest has the largest outstanding order for the MAX 7 but has substituted MAX 8s in order to keep new aircraft arriving. However, the lead time for converting orders from uncertified models to those MAX models which are certified is lengthy and Boeing has dozens of MAX 7s which it cannot deliver to Southwest. All carriers use growth to limit their unit cost growth and LUV has been inhibited in its ability to grow capacity and limit unit cost growth for years. Southwest, like Delta, hired thousands of employees that it could not efficiently used in 2022 and faces continued cost pressures until it can start receiving MAX 7s. However, the MAX 7 is the first model that Boeing will get certified, so it is possible that Southwest’s efficiencies could improve by the summer of 2023.

Globally, other airlines are expected to return capacity to the marketplace, including in Europe. Many European airports struggled to manage the increased capacity in 2022 and that is expected to be resolved in 2023, improving the efficiency of their operations and connectivity of their networks. While there are some regions of the world such as Australia where capacity has shifted in favor of U.S. airlines, some airlines such as Delta and its partners in Latin America will be stronger than they were pre-pandemic in a region where United was the #2 carrier.

Cost Control Will Get Harder

While United did a very good job of managing cost growth in the summer of 2022, it will be much more difficult for them to do that in two major areas – labor and fuel. As I noted in my most recent SA article, Delta just reached a new Agreement in Principle with its pilot union which will increase that carrier’s pilot costs by more than 30% over the next four years. United’s CEO stated earlier this year that it would lead the industry in negotiating new labor contracts post-covid and needed to do that in order to ensure that UAL had enough pilots for its aggressive fleet renewal and expansion program. However, United’s pilots rejected their new contract proposal upon voting and also continue to recall many of the pilot leadership that considered the contract proposal sufficient before sending it out for a vote. American and Southwest are both also negotiating new pilot contracts while Spirit (SAVE) also just negotiated a new AIP with its pilots which could see equally large pay raises for its pilots; Alaska (ALK) preceded Delta in the process, highlighting the urgency for airlines to set new pilot costs as a determinant not just of ensuring pilot supply but also in determining future costs. While United’s pilots are expected to resolve their internal leadership issues and be in a position to negotiate a new contract, the industry pilot shortage could not only make it difficult for United to reach its hiring goals with a lower value contract. In addition, United has amendable labor contracts with several other labor groups meaning that the pilot contract will set the bar that United must meet as it negotiates with its other labor groups. Unlike Delta which raised pay rates for its predominantly non-union workforce during the pandemic, United has not increased any pay rates – and frustrations among United employees are growing with the pace of labor negotiations.

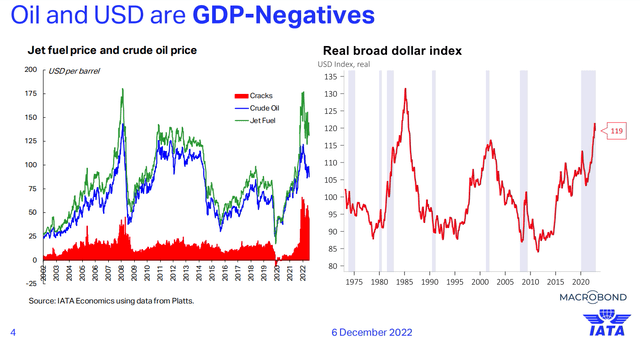

Fuel has seen one of the largest cost increases for airlines and that was also true for United. UAL’s fuel costs increased by over 60% even though it purchased 13% less jet fuel than in 2019. For years, United has paid the most among the big 4 for jet fuel, a reflection of the high cost of jet fuel in the Northeast U.S. and also because United has no fuel cost mitigation strategies. Southwest hedges fuel and has consistently had the lowest fuel cost among U.S. airlines; LUV is also the smallest of the big 4 in the NE U.S. Delta and United have similarly sized Northeast U.S. operations – although at different airports and Delta has a cost advantage because of its own refinery outside Philadelphia which provides jet fuel Delta’s Northeast operations. Delta’s fuel cost advantage relative to United was 24 cents/gallon in the third quarter but has exceeded 50 cents/gallon in some quarters over the past 18 months. On a quantity adjusted basis, Delta’s fuel bill was over $400 million lower than United’s, also driven by Delta’s 7.5% better system fuel efficiency in 2021 compared to United. Because jet fuel crack spreads are elevated worldwide and expected to remain that way for the foreseeable future due to shifts in refined product supply and demand relative to refinery capacity, United’s fuel bill is expected to remain elevated compared to its peers.

IATA Fuel and Dollar Tracking (IATA Economics)

Global GDP Growth (IATA Economics)

Fleet

United, which operates the oldest fleet among U.S. airlines, is expected to address is fuel inefficiency through its fleet renewal products. It has more than 500 aircraft on order for 2023 and beyond and most of those aircraft are narrowbody domestic aircraft that are expected to replace many of its 50 passenger regional jets; United for years has had a higher percentage of its domestic network operated by pay regional jets than any other airline. United announced its NEXT program during the pandemic to replace hundreds of its regional jets including the majority of its small 50 passenger regional jets which are not only some of the least fuel-efficient aircraft per passenger but also are increasingly difficult to staff because of the pilot shortage which is leading to growing pay rates for regional jet pilots, further eroding the profitability of those aircraft.

UAL Fleet (ir.united.com)

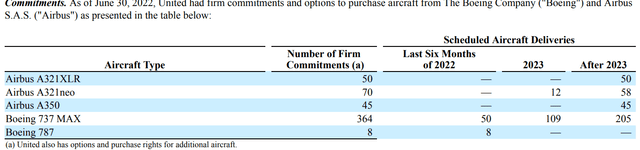

United is scheduled to receive over 100 new aircraft in 2023, the majority of which are versions of the Boeing 737 MAX. While Southwest is the largest customer for the MAX 7, the smallest variant of the MAX family, United is the largest customer for the MAX 10, the largest variant of the aircraft family. Like the MAX 7, the MAX 10’s future is in limbo because the MAX does not have cockpit warning systems that are standard on other aircraft. Congress previously provided Boeing with an exemption for the MAX 8 and MAX 9 models but that exemption expires in weeks, before Boeing is expected to receive certification for the MAX 7 and 10. There continue to be attempts by some in Congress to provide Boeing with a further exemption but the change of control in Congress is expected to further delay the process of certifying the remaining two models. While it is not known exactly how many MAX 10s United has due for delivery in 2023 out of its total order book, it is known that Boeing has MAX 10s built for United which it cannot deliver, just as is true for the MAX 7 for Southwest. The significance of the MAX 10 certification delays is that United will begin to experience the same labor inefficiencies that Southwest has experienced since both airlines have built their network and staffing plans around the schedules for MAX deliveries which have repeatedly been pushed back.

UAL Aircraft Orders (ir.united.com)

United also is a major customer for Boeing’s 787 which also experienced delivery delays due to production problems at BA’s Charleston, S. Carolina plant. The 787 is being delivered again and United has received some of its delayed 787s but is expected to receive the final 787s it has on order. United’s CEO is expected to travel to Boeing’s S. Carolina plant on Tuesday December 13 to announce a potentially large new order for 787s. As I noted in this Seeking Alpha article, UAL’s CEO teased a massive widebody order to its pilots months ago as part of the contract negotiation process; Delta execs did the same thing and is also expected to announce a follow up order for Airbus’ A350. United also has the A350 as its only remaining widebody aircraft on order but is expected to place its next order for the B787. News services indicate that United is focused first on replacing its fleet of 38 767-300ERs which average 27 years old. United has an additional 16 larger model 767s which are not as old but also has 74 Boeing 777s which are not only aging but becoming increasing less cost competitive from a fuel efficiency standpoint; the 777-200ER is the least fuel-efficient aircraft per seat on a per seat basis. Thus, United has the potential to place an order to replace over 100 widebody aircraft in the remainder of this decade for potentially the largest aircraft order in U.S. airline history. If United places an order for all 100 of those aircraft replacements plus a modest amount of growth capacity, it will become the largest global operator of the 787.

Balance Sheet Stress

Replacements for all of the 100+ aircraft that United could be due to replace could result in an order worth $12-15 billion even with industry discounts and depending on which of the three models in the 787 family that United selects. It is possible if not probable that United will not place firm orders for all of those aircraft but will exercise options that it will exercise throughout the decade. United’s CEO says that he is willing to pay the penalty to cancel the A350 order, which it has held on its books and delayed for years.

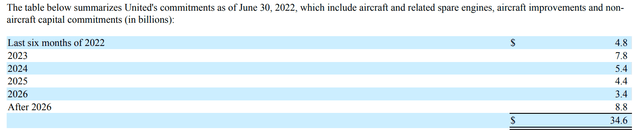

UAL Capex (ir.united.com)

United already has the largest aircraft order book among U.S. airlines and one of the largest in the world, totaling almost $35 billion on June 30, 2022. That amount is more than twice the value of American’s order book and almost twice Delta’s order book. An additional $12-15 billion or even a portion of that will swell UAL’s financial commitments to match UAL’s current and near term expected annual revenues for a uniquely precarious position among the big 4 U.S. airlines. American has long underperformed the remainder of the big 4 in part because of its high debt service expenses which are a result of its massive refleeting, which was nearly as large as United has on order now but spread over a longer period of time. While United has been more profitable than American, higher interest rates now will result in higher expenses for United. The Chicago-based airline likely has large credits with Boeing as a result of delays from both its 787s and 737 MAXs so will get very favorable pricing on its order.

One final competitive consideration that will affect investor decisions regarding UAL is Southwest’s decision to reinstate a dividend. UAL did not pay a dividend prior to covid and no airlines paid a dividend during the pandemic, in part due to losses but also due to restrictions attached to federal government aid to the airline industry during the pandemic. Delta also paid a dividend prior to the pandemic and is expected to follow Southwest in reinstating its dividend.

UAL Stock has had a Great Run

2022 has been a great year for UAL stockholders and that performance accelerated in the second half of the year driven by the company’s strong third quarter results.

UAL Chart YTD 8 Dec 2022 (Seeking Alpha)

However, the factors that made United perform very well relative to its peers in the second half of this year will swing in the favor of other carriers in the next few years. United’s competitors will improve the efficiency of their operations allowing them to benefit from the same strong revenue environment that has benefitted United. UAL’s labor costs will rise as it will have to increase labor rates while its fuel cost disadvantage will not be offset by larger revenue advantages. UAL’s already massive capex will likely be supplemented by a large order for Boeing 787s, improving some operational inefficiencies but at the cost of much higher aircraft ownership and balance sheet costs. Further, continued Boeing delivery delays will likely erode the near-term cost advantages that UAL expects to get from its large order book.

Investors in UAL were in a uniquely favorable position over the past six months but UAL stock will settle back into its historic relative position in the airline industry, leaving other airline stocks with better recovery potential and other non-airline stocks potentially poised to better adapt to the macroeconomic challenges that the global and U.S. economy will face in the next few years.

Be the first to comment