yangna/E+ via Getty Images

Thesis

Oaktree Capital Group is a global alternative investments manager. The company was acquired by Brookfield Asset Management Inc. (BAM) in March 2019 with its common stock ceasing to trade on the NYSE. Technically Brookfield purchased 62% of the company, but for default analysis and pricing, Brookfield is the parent company.

Oaktree was founded in 1995 by a group of individuals from the TCW Group and has developed into a premier alternative asset manager, primarily known for distressed investing. BAM is a Canadian company, and a behemoth in the asset management space, having more than $725 billion of assets under management. By purchasing Oaktree the company acquired an asset manager with a solid investment track record, an experienced management team and a large base of fee-earning assets under management. As a reminder, Oaktree holds a minority ownership in DoubleLine Capital LP. While Oaktree is run as a separate entity under Brookfield’s umbrella, we can certainly run under the assumption that under a very distressed liquidity crunch scenario, the company will benefit from the parent HoldCo implied support and liquidity.

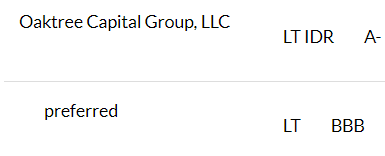

The Series A preferred shares from Oaktree are currently holding an investment grade rating of BBB, and have been issued in 2016:

The preferred shares have a 6.625% coupon and are first callable in June 2023. We do not believe they will be called at that time, as we are of the opinion the economy will be coming out of a recession at the time and we would have peak interest rates as well. We have a weighted average life of 3 years for the preferred shares, expecting them to be called in June 2025 when the interest rate curve indicates lower yields and the credit spreads required by the market will be lower.

Preferred shares do not really need to be called, unless they are issued by banks who like the manage their reputation by calling all capital on time to ensure cheap pricing for the next shelf. OAK.PA is thus now trading at Treasuries plus 300 bps, which is on the wide side in our opinion. We do not see much of a credit default risk here, just rates/liquidity driven pricing. We are also of the opinion that the proximity of the call date will ensure a soft lower barrier in pricing for the preferred shares. In a nutshell, when you price a piece of debt, the closer the maturity date, the lower the sensitivity to interest rates/credit spreads. We like OAK.PA here and we feel its investment grade rating should command a lower risk premium. In today’s liquidity-constrained environment opportunities arise and we feel OAK.PA is one of them. We rate it a Buy.

Credit Quality

The preferred shares are rated investment grade by Fitch:

Oaktree Credit Quality (Fitch)

There are several reasons for which preferred shares have lower rating than the parent company, including seniority in a liquidation and in the case of OAK.PA the fact that the payment is not cumulative:

Distributions on the Series A Preferred units are non-cumulative. Accordingly, if our board of directors does not declare a distribution before the scheduled record date for any distribution period, we will not make a distribution in that distribution period, whether or not distributions on the Series A Preferred units are declared or paid for any future distribution period.

Source: Prospectus

While this is advantageous for the corporate because it can deal more effectively with liquidity crunches, it negatively affects the valuation of the preferred shares via a potential loss in interest payments. This is highly unlikely, unless they are about to default. As we saw with the mortgage REIT (IVR), entities are fierce about protecting their payments on preferred shares in order to indicate solvency.

Fitch does express concerns regarding Oaktree’s leverage, having recently downgraded the senior debt from “A” to “A-” and the preferred stock from “BBB+” to “BBB”:

Oaktree’s leverage, as measured by debt divided by FEBITDA was about 2.5x, for the trailing 12 months (TTM) ended Dec. 31, 2021, pro forma for an opportunistic issuance of $200 million of senior unsecured notes, which were funded in January 2022. Today’s proposed debt issuance will take leverage back above the upper-end of Fitch’s ‘a’ category benchmark range. While Fitch believes Oaktree’s leverage could decline below 2.5x with FEBITDA growth, the firm’s inability to sustain leverage within the ‘a’ category range in recent years given opportunistic debt issuances suggests a more aggressive leverage tolerance. An inability to bring leverage below 2.5x by YE24 would be viewed negatively.

Oaktree Capital’s Performance

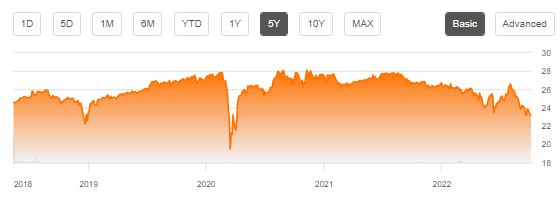

In normalized economic and interest rate environments, the preferred shares trade around the liquidation value of $25/share:

Performance (Seeking Alpha)

This has provided for a nice, upward sloping total return profile:

The downturn during Covid was due to default risk and the propensity for preferred shares to recover very little after a Chapter 11 bankruptcy by the parent entity. We are not going through another pandemic-like event. We are certainly entering a recession, if not already in one, but this one will be a standard, quantifiable event. We do not think the risk factors that existed during Covid when we were questioning the viability of entire industries (with most of the airlines grounding their flights for months, the airline sector viability was raised as an example) are now in play. We are nonetheless approaching price levels last seen during Covid:

Conclusion

Oaktree Capital Group is a global alternative investments manager. Although the majority of the company’s shares were purchased by Brookfield Asset Management in 2019, the group is run as a separate entity. The company has outstanding preferred shares which are currently rated BBB by Fitch. Due to rising rates and credit spreads, the Series A preferred shares now yield in excess of 7% despite their call date in June 2023. We do not believe they will be called and replaced next year but have penciled in 2025 for that. With a 3-year predicted tenor and an attractive yield, we are of the opinion the preferred shares represent a good risk/reward proposition and rate them as a Buy.

Be the first to comment