straga/iStock via Getty Images

The Weather

Last week

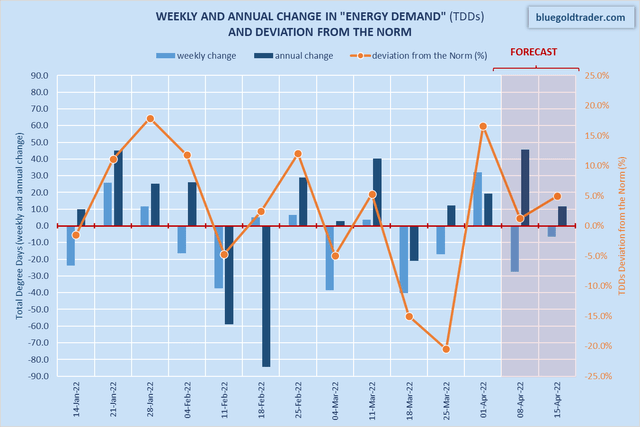

Last week (ending Apr. 1), the number of heating degree days (HDDs) surged by 31% w-o-w (from 91 to 119). The total “energy demand” (as measured in total degree days or TDDs) was up 18% y-o-y. The deviation from the norm was positive (+17%).

This week

This week (ending Apr. 8), the weather conditions in the contiguous United States have been warming up. I estimate that the number of nationwide HDDs will plunge by 27% w-o-w (from 119 to 87). The average daily consumption of natural gas (in the contiguous United States) should be somewhere between 76 bcf/d and 79 bcf/d. The total “energy demand” (measured in TDDs) will rise by as much as 83% y-o-y – but mostly due to base effects. The deviation from the norm will moderate substantially but will remain positive (+1.2%).

Next week

Next week (ending Apr. 15), the weather conditions are currently expected to continue to warm up. The number of nationwide heating degree days (HDDs) is currently projected to drop by 5% w-o-w (from 87 to 82). In annual terms, the total “energy demand” (measured in TDDs) should rise by 14% y-o-y. The deviation from the norm will moderate substantially but will remain positive (+4.9%).

U.S. Energy Demand (NOAA, ECMWF, Bluegold Trader)

Market Variables

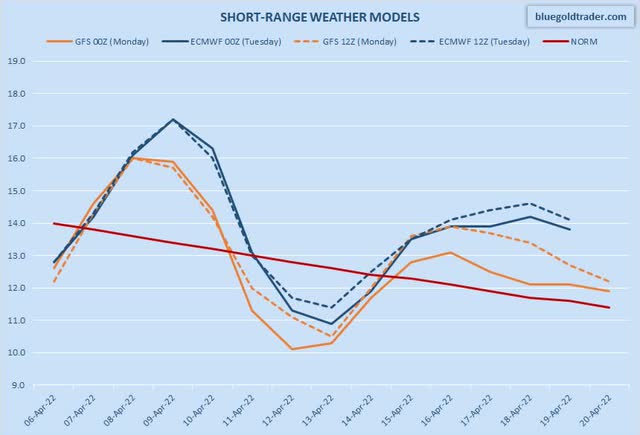

The latest numerical weather prediction models (Wednesday’s short-range 00z runs) agree that over the next 15 days, TDDs will be trending lower but will remain largely above the norm. However, there is a minor disagreement between the models in terms of scale. The latest GFS model (00z run) is projecting 67.3 bcf/d of potential natural gas consumption (on average, over the next 15 days) while the ECMWF model (00z run) is projecting 68 bcf/d over the same period.

U.S. Short-Range Weather Forecast (NOAA, ECMWF, Bluegold Trader)

In relative terms, the latest short-range weather models were bearish (vs. the previous update). Specifically, ECMWF 00z Ensemble has “removed” some 7 bcf of potential natural gas consumption compared to yesterday’s 12z results. In absolute terms, projected short-range TDDs are 26% above last year’s level and 2.8% above the norm.

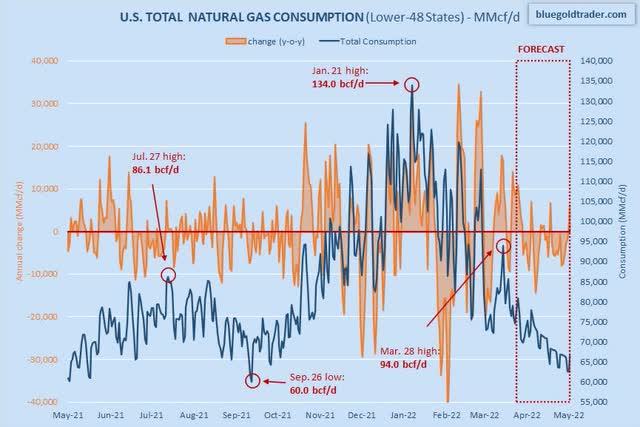

U.S. Natural Gas Consumption (Bluegold Trader)

Over the next 30-day period, total natural gas demand (consumption + exports) is expected to average 91.7 bcf/d (adjusted for probability), 0.4 bcf/d less than a year ago. A major near-term high in daily consumption was reached on March 28 (94 bcf/d). Consumption is now projected to trend lower and should reach a seasonal low in mid-May (see the chart above). Please remember that domestic consumption is an extremely volatile market variable because it is primarily driven by the weather forecast, which is highly unpredictable.

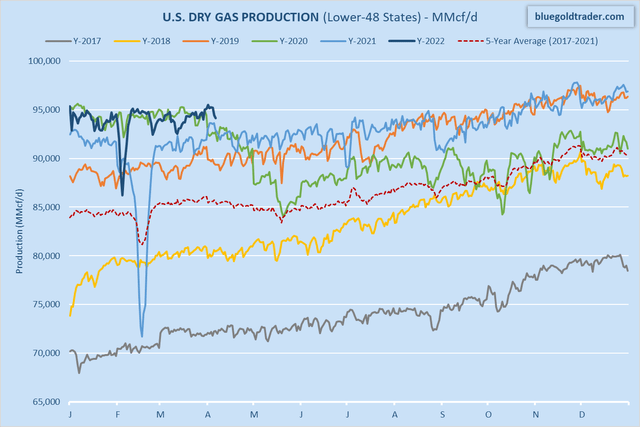

I estimate that dry gas production currently stands at 94.1 bcf/d.

U.S. Dry Gas Production (Bluegold Trader)

Storage Report

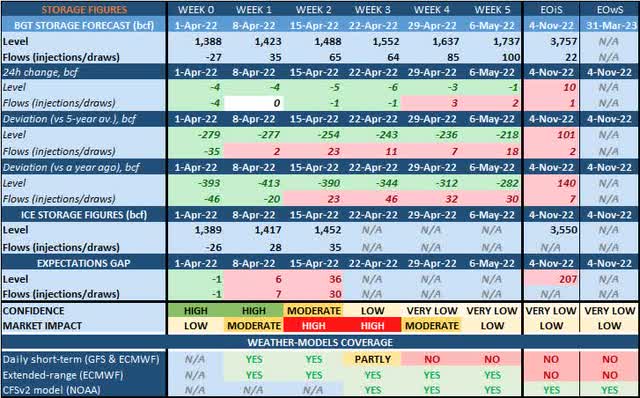

This week, the U.S. Energy Information Administration should report a similar change in natural gas storage compared to the previous week. I anticipate seeing a draw of 27 bcf (46 bcf larger than a year ago and 35 bcf larger vs. the five-year average for this time of the year). The annual storage deficit is currently projected to shrink by 81 bcf by Apr. 29. The storage deficit relative to the five-year average is projected to shrink by 43 bcf over the same period.

My end-of-injection-season storage index (EOiS) was up 10 bcf this morning as higher natural gas prices have a negative impact on future consumption. My EOiS storage index currently stands at 3,757 bcf (207 bcf above the ICE figure) – see the table below.

Be the first to comment