krblokhin

Bed Bath & Beyond (NASDAQ:BBBY) is in deep distress. Their most recent 10-Q (“the 10-Q“), filed 9/29 in respect of their second fiscal quarter (which ended 8/27/22) showed a massive 3-month loss of $366 million, compared to the prior loss of $73 million (all comparisons are to the quarter ending 8/28/21), a per share loss of $4.59, compared to a $0.72 loss, sales of $1.437 billion compared to $1.985 billion, negative cashflow (capex & operating) of $809 million compared to negative $103 million, and a debt load of $1.730 billion compared to $1.180 billion. This actually understates the debt since BBBY reveals in the 10-Q that they borrowed an additional $175 million subsequent to 8/27/22 and so the debt load is now $1.905 billion.

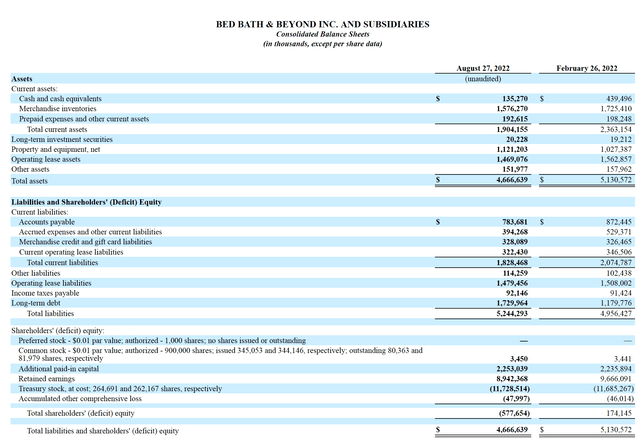

The shareholders’ deficit/negative net worth as of 8/27/22 stood at $577 million while there was a positive balance of $934 million at the end of the comparable period. The company has parted with its former CEO, Mr. Mark Tritton, and, more unfortunately, with its CFO, Mr. Gustavo Arnal, who recently committed suicide.

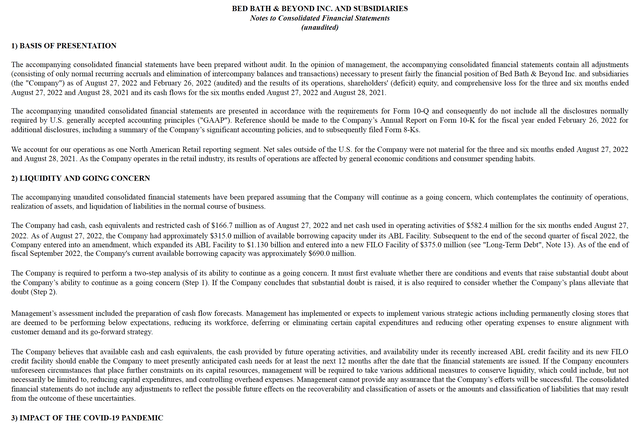

In fact, BBBY is in such deep trouble that new “going concern” language has been added to the 10-Q.

BBBY Q2 22 10-Q (BBBY Investor Relations)

This language is typically added to filings by management where there is sufficient risk of a company being unable to pay its debts over the next 12 months that management is required to perform a review of cashflows and balances specifically focussed on that risk. It is not standard and has not appeared in BBBY’s previous filings. Here, for example, is the comparable section of the immediately preceding (filed 6/30/22) 10-Q.

BBBY Q1 22 10-Q (BBBY Investor Relations)

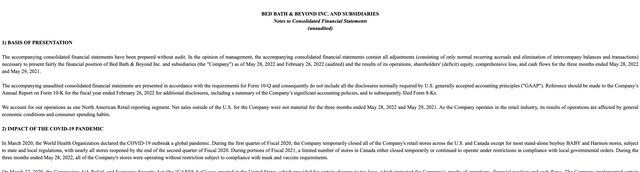

In addition, it appears that BBBY has had trouble complying with some of its loan covenants. These are not financial covenants – they refer to the perfection of security over some of its pledged assets – and the problems appear to have been solved, since the lenders have now waived the defaults. However, this is extremely risky behavior for a company in financial distress, since allowing the company to go into default effectively gave lenders a right to accelerate the debt.

Waiver of defaults (Loan amendment attached to BBBY Q2 10-Q )

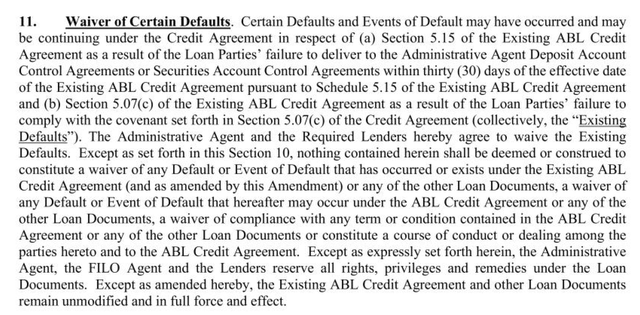

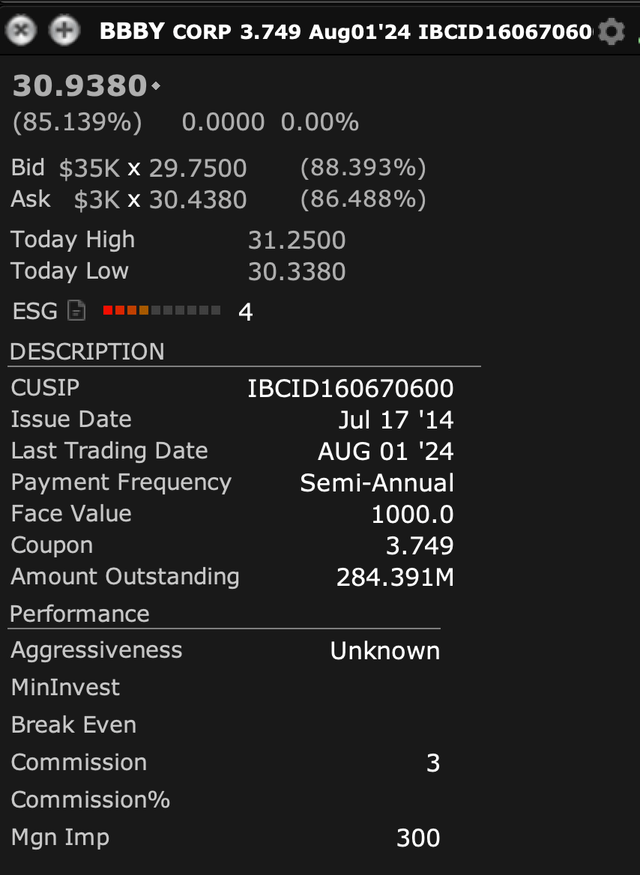

The bond market has reacted violently to BBBY’s situation with the yield of BBBY’s near-term bonds (8/24) rising from around 5% annualized in March to almost 90% annualized today.

BBBY 8/24 Note yield (IBKR)

This price level implies not only default before bond maturity (8/24), but also limited recovery for bondholders, and, by extension, nothing for shareholders. However, BBBY still has about $850 million in liquidity (as of the end of September), according to management’s statements on the Q2 conference call. So why are the credit markets pricing in disaster? To understand this, we have to look at the structure of BBBY’s debt.

Debt details

BBBY Balance Sheet (BBBY Investor Relations)

Although BBBY’s $5.2 billion of liabilities are comprised of more than just debt, it is the debt which is of most interest in determining BBY’s near term prospects. Most of the other long-term liabilities are operating lease liabilities to the landlords of their stores which are off-set by the operating lease right-to-use assets and thus will largely disappear if and when BBBY returns the stores or landlords take them back.

BBBY currently has two important classes of debt outstanding – senior secured & senior unsecured. Let’s review each in turn.

Unsecured: The unsecured debt consists of three tranches of notes (the “Notes“). All were issued in August 2014 pursuant to the same indenture (the “Base Indenture“), which can be found among the July 2014 filings on BBBY’s investor relations page. The tranches come due in the Augusts of 2024, 2034 & 2044, and were originally in the amounts $300 million, $300 million and $900 million respectively. BBBY has (in more prosperous times) repurchased some of the notes and so the outstandings (according to IBKR) are now $284.4 million for 2024 (the “Near Tranche“), and $225 million for 2034 & $675 million for 2044 (together the “Longer Tranches“).

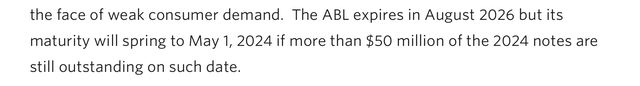

Secured: The secured debt currently consists of two portions – an asset-based loan (the “ABL“) and a first-in last-out loan (the “FILO“). Both are secured against BBBY’s (a) inventories, (b) credit card receivables and (c) some of the cash deposits (collectively, the “Collateral“). The ABL is a revolving credit facility (so can be drawn, repaid & drawn again) and can also be used to provide guarantees of BBBY’s liabilities (e.g. by letters of credit issued to suppliers).

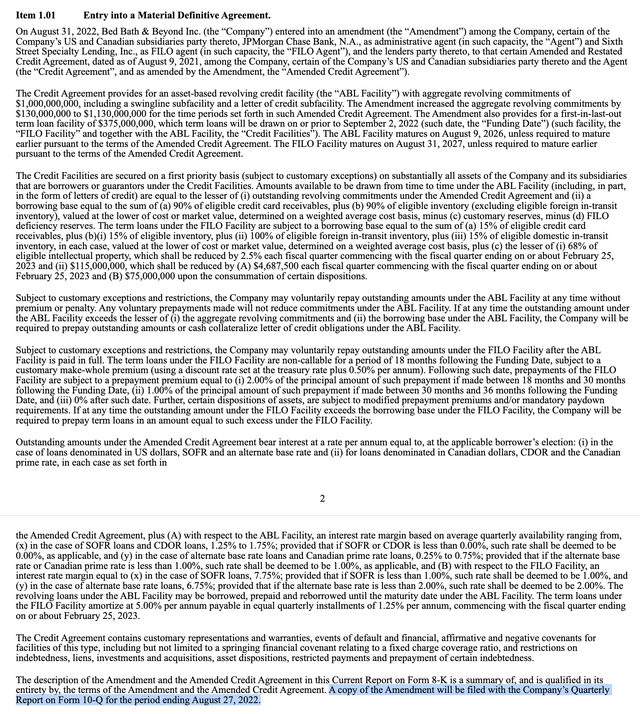

At the end of August, 2022, the secured debt facility was amended and substantially expanded. The ABL was increased from $1 billion to $1.13 billion and the $375 million FILO loan (which had previously been contemplated but not committed) was agreed, executed and, at the beginning of September, drawn in full. The then-CFO announced the amendment in a press release on 8/31, filed with SEC on 9/01 (the “8-K Filing“). Here are the relevant portions.

BBBY 9/01 8-K extract (author’s highlight) (sec.gov)

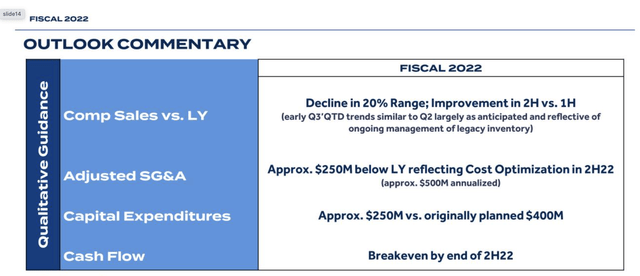

This change, together with management’s expectation of a reduction in cash burn, has been widely credited among retail investors (judging by Twitter, Reddit and stocktwits.com) with providing BBBY a path to avoid bankruptcy. Although cash burn continued at a rate of roughly $150 million per month in September (as shown by the $1 billion of liquidity as of 9/01 in the Q2 investor presentation, and the $0.85 billion as of 9/27 announced in the Q2 conference call (the “Q2 Call“)), management’s announced objective of cashflow break-even by February (end FY22) and the increased availability of funds under the amended ABL suggested to many that BBBY will be able to last until at least 8/2026 (the scheduled maturity of the amended ABL) – past the 8/24 repayment of the $284.4 million of the Near Tranche Notes, and so giving management plenty of time to restructure the company and, possibly, realize substantial value from the spin-off of their flagship buybuy BABY brand.

BBBY management H2 2022 outlook (BBBY Q2 investor presentation)

The bond market, however, has not been so sanguine, with the price of the Near Tranche Note falling in price to only 30.938 cents on the dollar as of Oct 7.

2024 Bond Price (IBKR)

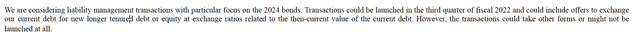

This is despite the fact that management announced that they were considering a purchase or exchange of the Near Term Notes.

Shareholders who, based on the above, believed that BBBY was planning to open a voluntary tender/exchange offer for the Near Term Notes will have been surprised to read in the Wall Street Journal on October 3 (the “WSJ Article“) that the Note holders were worried about a “potentially coercive” exchange.

Moody’s rating

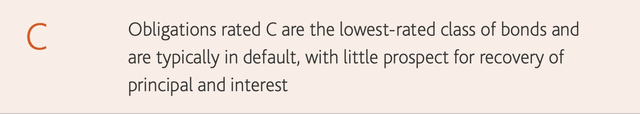

On Friday, October 7, Moody’s downgraded BBBY‘s corporate family rating to Ca and the Notes to C. Here is how Moody’s defines C.

Moody’s C Rating (Moody’s Investors Service)

But why did Moody’s do that? There are only $284.4 million of the Notes coming due over the next few years, and, as discussed above, BBBY has $850 million of liquidity.

The answer lies in the last paragraph of the downgrade press release.

Moody’s downgrade extract (Moody’s Investors Service)

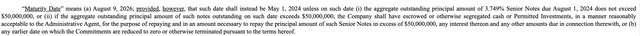

This accelerating maturity date was not detailed in the 10-Q by management. However, if we go back to an earlier filing (the 8/2021 previous amendment to the ABL), we find this:

ABL Acceleration Clause (BBBY 8/21 8-K filing)

So the ABL may come due in May 2024 – much earlier than scheduled – and probably the FILO as well (we do not know the full current details of the current ABL/FILO terms & conditions, since the annexes to the latest ABL amendment, which document those terms, do not seem to be in the 10-Q, and I cannot find them elsewhere – for the purposes of this article I am assuming that they track, or, at least, are no more lax than the August 2021 amendment). Can BBBY generate the approximately $1.5 billion cash necessary to repay them. I do not believe so. Remember BBBY have told us (in the Q2 Call & associated presentation) they just hope to break-even in Q4 and since (due to BBBY’s somewhat idiosyncratic fiscal year) Q4 includes not only the Christmas season and the January sales, but also part of the Thanksgiving/Black Friday season, it seems likely that other quarters will be worse.

Chicken

This sets up a multi-million dollar game of chicken between the holders of the Near Tranche Notes and BBBY management. The Near Tranche holders know that management MUST buy the great majority of the Near Tranche Notes because the consequence of them not doing so is that the $1.5 billion ABL & FILO will come due in May 2024. If that happened & BBBY does not repay the ABL, the ABL & FILO lenders could seize the Collateral, and no mass-market retailer can survive without inventory. Therefore the Near Term Tranche holders can hold out for a higher price.

On the other hand, if management pays too much, they run the risk of having insufficient cash to make the periodic amortization payments under the FILO loan which, as the 8-K filing described, amount to approximately $4.6875 million per quarter commencing 2/23, and so causing default/acceleration of the ABL & the FILO.

As described above, management told us, in the 10-Q, that they are planning to offer to buy back the Near Tranche, but, so far as this author can establish, they did NOT specifically spell out the potentially disastrous consequences of failing to do so in the 10-Q or anywhere else..

Chicken with extra spice

To add extra drama to this face-off, there is another factor to consider.

We have not yet considered the holders of the Longer Tranches. They face the risk that $1.13 billion of ABL, $375 million of FILO loan and whatever is necessary to buy/redeem the Near Term Notes are all extracted from the company before they get paid. (Unusually, the Base Indenture does not provide for default/acceleration of the Longer Tranches upon a distressed exchange of the Near Tranche Notes, or even upon default/acceleration of the ABL/FILO/Near Tranche – only bankruptcy, or default under the Longer Tranche Notes themselves will allow acceleration of those tranches). It is likely that the Longer Tranche Note holders will take steps to mitigate this risk.

Probably some of the Longer Tranche Note holders (generally institutions or bond funds) already hold some of the Near Tranche Notes. It would not be hard for them to combine those holding with Notes acquired in the market to reach $50 million of Near Tranche face value (which would only cost $15.469 million at October 7’s prices). That would put them in a position to demand concessions for their longer-term holding – perhaps even pari passu treatment – in order for them to allow the repurchase to continue and avoid ABL/FILO acceleration. So instead of buying back $284.4 million of Notes, BBBY would be forced to repurchase $1.1844 billion.

Consequences to noteholders

The Note holders have come off badly in the recent creation & expansion of the Secured debt. The original ABL, signed in June 2020, was for $850 million. As described in the 10-Q, this was expanded to $1 billion in 8/21 and to $1.505 billion (including the FILO) in 8/22. All this secured debt is now ahead of them in the line for BBBY’s assets, but also, by means of the accelerating maturity date added in 8/21, the ABL (and probably the FILO) have leap-frogged the Near Tranche Notes in the maturity structure. They have some leverage, as described above, in their negotiations with the company, I believe that ultimately they have the weaker position. I do not suggest that they will get nothing – I am sure a substantial payment will be made to them, but if they push too far, they will be left with almost nothing since, as the company says, the ABL and the FILO are secured against substantially all of the company’s assets, and so little will be left to unsecured lenders in a liquidation.

This, of course, explains not only the Moody’s downgrade but also the WSJ Article.

Whatever Note holders do get (over than cash redemption payments) will, I believe, have to be effectively subordinated to the Secured debt – for example a step up in interest rate effective after the repayment of the ABL & FILO. However, there is one thing they can require which would not dis-advantage the secured lenders. They can perhaps take any future upside in the business away from shareholders. They could do that, for example, by requiring warrants as partial compensation for their agreement to the repurchase or re-negotiation of their Notes, and this is not an uncommon provision of debt restructurings.

Consequences to shareholders

I see no prospect for any substantial recovery for shareholders in this battle between creditor classes. The ABL/FILO amendments have effectively accelerated the Near Tranche Notes, and probably all of the Notes. the company is very unlikely, in my view, to have enough cash to pay, particularly in the current sales falling/inventory discounting situation of most large retailers. The only thing it can offer to the unsecured lenders is the company equity, and they will likely not fail to take it, whether by warrants/dilution, or by cancelation & reissuance of shares in Chapter 11.

Upside Risk

it is difficult to see how this could turn out well for BBBY shareholders. A sudden recovery from the recession to return sales to pre-pandemic level is certainly possible, but seems unlikely to me (and to the Wall Street Journal). Perhaps a sale of the buybuy Baby brand will raise sufficient funds to pay off the Near Tranche (although the bond market is clearly not expecting this), or perhaps the Note holders or other lenders will prove more tractable than I expect.

Some retail shareholders hope/expect that Ryan Cohen, Chairman of GameStop and a shareholder of BBBY until August, will return to inject cash & save the company. I have no information to judge the likelihood of that & I will leave it for readers to assess.

Conclusion

I recommend shareholders consider selling BBBY.

More sophisticated/risk-tolerant investors looking at the $435 million market capitalization may consider realizing some of that value by shorting and/or options. Obviously that is not cheap, with borrow rates at 10.75% pa (IBKR) and option premiums proportionately high, but I believe that the potential gain is also substantial. As always, shorting stock carries potentially unlimited loss, and this is still a meme/momentum stock so beware of spikes, and set stops.

Be the first to comment