The face-off between RNP, VNQ, and SCHH is competitive but with one clear winner. gorodenkoff

Making Investing More Accessible To The Average Investor

It wasn’t long ago that every trade made required a $4.95 fee (or higher depending on the platform) regardless of the number of shares that were purchased. When the $4.95/per trade fee was still active I would typically trade in quantities of no less than 25 shares at a time in order to minimize the cost associated with the transaction. It used to be that the only way to get free trades was to have enough money or to switch from one platform to another and request as many free trades as they are willing to give you. Even before platforms like Robinhood (HOOD) existed, major brokerages began offering free trades when purchasing platform-sponsored exchange-traded funds (“ETFs”) (this model was popularized by Vanguard), so it became necessary for The Charles Schwab Corporation (SCHW), TD Ameritrade (now part of Schwab), and other leading platforms to develop similar products.

Robinhood became the first credible check on the $4.95 trading fee that was being charged on every purchase transaction, and it definitely gained popularity starting with the millennial generation. The $4.95 fee charged by most of the industry was a key factor in the rapid acceptance of platforms like HOOD that could target its marketing at Millennials and Gen Z who already lack the funds to make substantial purchases. As all of us now know, the elimination of trading costs through a platform like Robinhood meant that they would find compensation from high-frequency trading firms through a practice called payment for order flow.

Setting aside Robinhood’s business model, the previously mentioned platforms decided to eliminate the trading fees which were a much smaller portion of earnings than I would have expected. The elimination of this fee has made it so that anyone can buy 1 share of anything with no costs involved. There are two distinct benefits that come from this:

- Instead of waiting to save up $1,250 to purchase 25 shares of a $50 stock, an investor can now easily buy one $50 share, which means they can invest sooner.

- Access to the full breadth of stocks and financial products means that investors are no longer limited to only purchasing certain ETFs. In other words, the rules are uniformly applied.

This event marked the democratization of the investment world because it removed barriers that previously prevented the average person from achieving results that were only available to those with means.

Cohen & Steers REIT – A Closed-End Fund For The Average Investor

So what does this have to do with RNP exactly?

Cohen & Steers REIT and Preferred and Income Fund (NYSE:RNP) is a closed-end fund (“CEF”) that offers a reasonably priced solution to help income investors overcome the challenges of establishing a diversified portfolio of stocks when the price per share is high. When a stock’s value increases, it becomes more difficult for the average investors to accumulate shares of those companies, especially if they don’t have a large amount of capital readily saved.

Let’s look at an extreme example of what it would take to buy one share of 10 high-flying stocks that recently achieved new 52-week highs.

- AutoZone (AZO)

- O’Reilly Automotive (ORLY)

- Regeneron (REGN)

- Fair Isaac Corp (FICO)

- Grainger (GWW)

- Humana (HUM)

- Northrop Grumman (NOC)

- UnitedHealth (UNH)

- Elevance Health (ELV)

- Lockheed Martin (LMT)

At market close on December 5, 2022, purchasing one share of the above 10 stocks would have required a total of $8068.16. Simply put, it would be impossible for the average investor to consider purchasing these individual stocks for their portfolio because of the demanding capital requirements involved. Even if an investor was trying to purchase one share, it would still come at an average price of $806/share.

Although this may be an extreme example, it demonstrates the same problem the average investor would face when it comes to building a diversified holding of real estate investment trusts (“REITs”) if they are buying individual shares. The list below contains the top ten holdings of RNP (there is a total of 310 holdings), but the holdings below make up almost 28% of the entire fund’s value. It should be noted that Duke Realty is listed as position #10 on Seeking Alpha, but this company no longer exists after it was acquired by Prologis (PLD). We replaced it with another large fund holding Equinix (EQIX) since this would represent an even more diversified fund and because EQIX was in 11th place previously.

- American Tower Corp (AMT)

- Prologis

- Welltower (WELL)

- Public Storage (PSA)

- Invitation Homes (INVH)

- Realty Income (O)

- Crown Castle (CCI)

- Simon Property Group (SPG)

- Extra Space Storage (EXR)

- Equinix

Based on the value of the stocks at the market close on December 5, 2022, the total amount needed to own one share of each stock would be $1881.33. Although the dollar amount isn’t nearly as substantial as the first example, this is still a large amount of money for the typical investor. On average, an investor would need to save $188 before they would be able to purchase just one share. It would be challenging for the average investor to save enough money to cover the average price of one share (this doesn’t even consider how long it would take to save for an outlier like EQIX, which comes at a price that is 4X the average cost of $188/share).

Fortunately, there are funds like RNP, Vanguard Real Estate ETF (VNQ), and Schwab U.S. REIT ETF (SCHH) that offer an alternative for investors looking to establish a diversified portfolio while avoiding the challenges of saving hundreds or even thousands of dollars before they could have enough to create a diversified portfolio. The rest of the article will focus on which fund makes the most sense based on historical and expected future performance.

RNP Or VNQ – Which One Makes The Most Sense?

RNP offers exposure to many of the same REITs in the VNQ portfolio. Still, it is not a 1:1 comparable, because the fund also has significant assets in non-REIT holdings such as financial, utility, insurance, and telecommunications preferred stock.

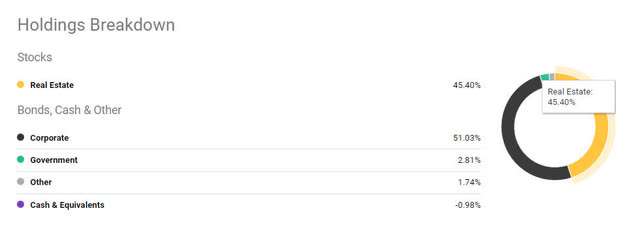

RNP – Holdings Breakdown (SeekingAlpha)

When compared to VNQ, it becomes apparent how different the composition of these funds really is.

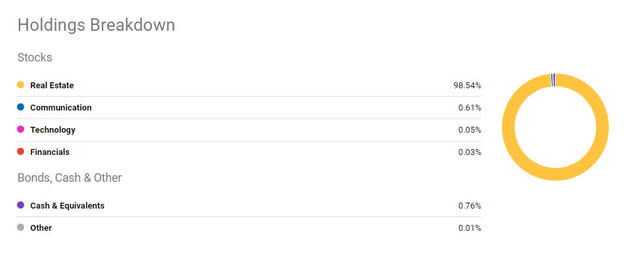

VNQ – Holdings Breakdown (SeekingAlpha)

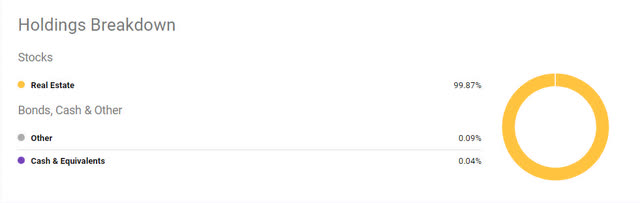

SCHH looks similar in composition to VNQ but it is even more solely focused on estate and has 135 positions compared to VNQ’s 171 positions.

SCHH – Holdings Breakdown (SeekingAlpha)

VNQ & SCHH – Investors who are more concerned about pure-play exposure to REITs and are looking for capital appreciation with the added benefit of a dividend would be better off considering VNQ or another fund like Schwab US REIT ETF (SCHH). VNQ or SCHH offer strong growth, with the secondary benefit being the dividends generated.

RNP – This fund is going to be targeted toward investors who are looking to generate a higher level of income with capital appreciation being a secondary benefit. RNP is able to offer a dividend yield that is currently more than double that of VNQ because it uses leverage which often means there is more volatility involved.

Price, Total Returns, and Dividend Potential

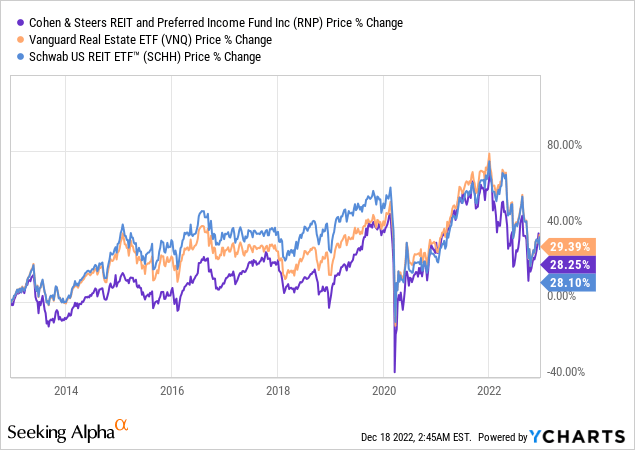

Ironically, when we look at the price change of each fund we can see that the current price after 10 years the share price is nearly identical. I find it interesting that VNQ and SCHH’s prices prior to 2020 often outperformed RNP, but since 2020 we have seen both funds move in a much tighter pattern.

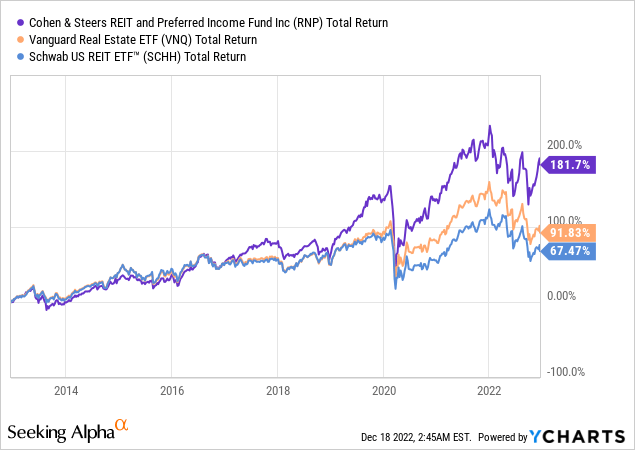

If we look at the metric of total returns (which would include the reinvestment of dividends), we see a very different picture painted where RNP blows both REIT ETFs out of the park.

Another lens to consider these graphs through is that you could have owned all three for the last decade and if you didn’t reinvest dividends the growth of the share price would be nearly identical. Once we factor in the dividend income generated it would mean that RNP achieved the same price performance while providing around 100% more dividend income.

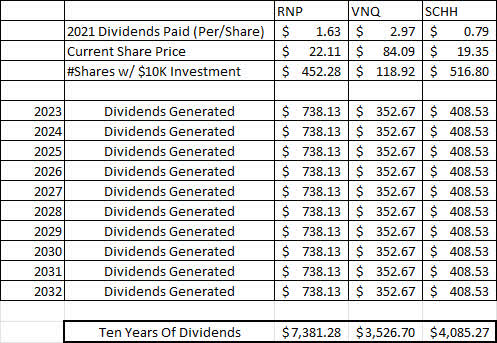

If these funds produced the same exact results over the next decade with no dividend increases the results would be pretty compelling in RNP’s favor since the dividend generated would be icing on the cake. Below is a table using FY-2021 dividends paid to show how much would be paid with a $10K investment. **This example also excludes any benefit from special dividends.

Future Dividend Income Comparison (CDI)

It should be noted that even though SCHH would produce more dividend income using 2021 figures, this benefit would likely render the price improvement of VNQ to be nearly the same amount as the benefit SCHH receives in extra dividends.

Conclusion

Even though RNP comes with a whopping expense ratio of 1.78% (VNQ’s is .12% and SCHH’s is .07%), the fund’s performance compared to the ETF alternatives is strong enough that I am willing to accept the higher expense ratio. I would be lying if I didn’t say I was surprised at the strong stock price performance from RNP relative to VNQ and SCHH. VNQ and SCHH are focused on common stocks while RNP has significant exposure to preferred stock which is more likely to limit price appreciation.

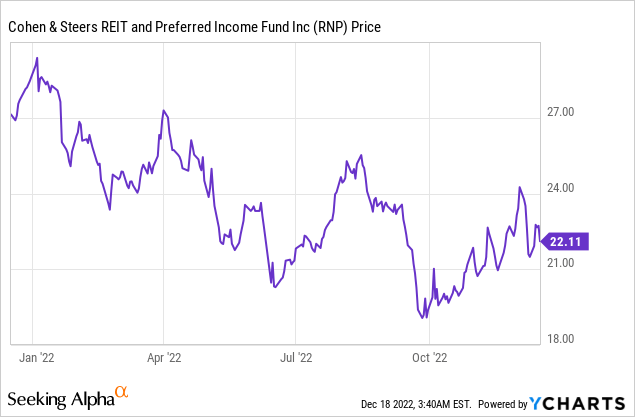

RNP is becoming attractive again after the price made a recovery after reaching a post-COVID low in the month of October.

I am a fan of RNP at $22/share and we have continued to add more shares at these levels. Investors need to expect further pressure on stock prices after the Federal Reserve announced the most recent rate increase. In my recent update “The Retiree’s Dividend Portfolio – Jane’s November Update: Federal Reserve Stirs The Pot,” I provided the following summary.

The announcement from the Federal Reserve of a .50% rate increase was something I think most reasonable investors would agree was expected. What the market didn’t plan for was their message of needing unemployment to rise more, inflation increasing, and expectations of lower GDP growth.

Even worse, the Fed has now signaled that things need to get much worse and that means interest rates will need to increase until that happens. This means that we can expect to see more weakness in the stock market because the returns of safer investments have grown so quickly that many investors would be willing to exchange many of their current investments for bonds and CDs.

In short, this recent meeting has sent a clear signal that those who were optimistic about rate improvements starting by the end of 2023 are likely very wrong.

Be the first to comment