Khanchit Khirisutchalual

Despite being a key, “table stakes” tool for digital marketers (including social media marketing), Semrush Holdings, Inc (NYSE:SEMR) traded down to all-time lows last week. It seems the pressures of mounting costs, slow deterioration in the demand environment, and pending clarity for next year’s prospects are weighing down shares. Moreover, digital marketing is a highly competitive and fragmented industry with a mind-boggling number of tools and services all vying to help businesses get noticed. Even Semrush fights an on-going battle getting notice. Despite a substantial sales and marketing budget (up 48% year-over-year in Q3), at the time of this writing, a Google search on “SEO software” does not include Semrush on the first page of results (your results may vary of course). Moz is the only software company on that first page of results. Semrush has paid for a search ad with a #2 placement.

SEO (search engine optimization) and social media tools are critical for anyone doing digital marketing, especially small businesses. While these tools cannot make everyone a winner, they do help businesses hold their ground in the digital marketing arms race. Semrush has made a name for itself as one of those important tools. Seeking Alpha article “Semrush: An All-In-One Platform To Manage Digital Presence” provides a great review of the business and the digital marketing sector. Commentary in the Shopify (SHOP) Q3 earnings results provide a snapshot of the marketing challenges for small businesses. From the Seeking Alpha transcript:

“Advertising is rapidly evolving, and it’s hard to predict exactly where things are going, like the types of ad units that are available to small and medium businesses and enterprise businesses rapidly evolving. Sometimes certain things work really well, and the next day, they don’t. And sometimes, certain things are being done for a couple of years. And through a change somewhere else entirely and deep architecture, suddenly, as things — like certain completely unrelated things end up becoming high-converting.”

In other words, just as you find a winning formula with a particular digital marketing tool or technique, you can find yourself forced to pivot all over again.

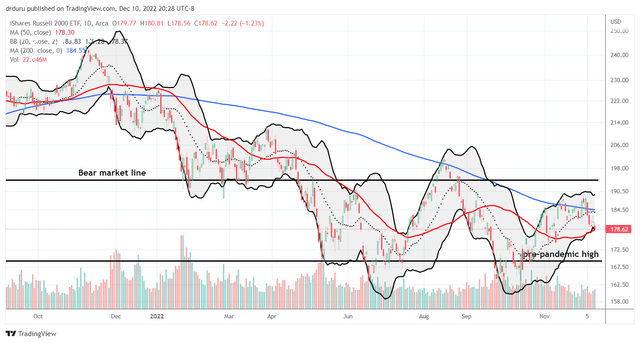

Shopify became a key selling platform for small and medium businesses. So assuming SHOP’s 78% crash from last year’s all-time high is indicative of the challenges for this part of the economy, then perhaps no wonder SEMR is down 74% from its all-time high. The iShares Russell 2000 ETF (IWM) is also still in a bear market; at several points this year, IWM lost all of its pandemic-era gains. This ETF of small cap stocks is another indicator of the challenges faced by small and medium businesses.

The iShares Russell 2000 ETF (IWM) has been in a bear market for most of this year. (TradingView.com)

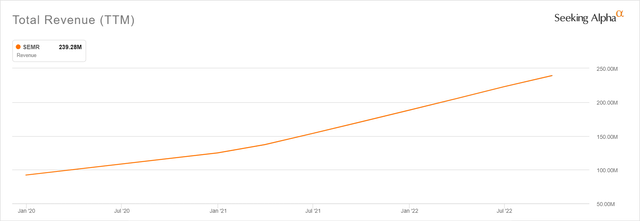

The good news for SEMR is that revenues are still growing: up 34% year-over-year and up 5% from Q2 to Q3 2022. So, if the company can continue some momentum, at some point next year when the economy hopefully is on the cusp of a post-inflationary turn, SEMR should represent great value. Semrush has a high (albeit slowly growing) gross profit margin of 80%, so the financials substantially benefit from top-line growth.

Semrush continues to grow revenues. (Seeking Alpha)

Even with all the indicators revealing challenges for smaller businesses, Semrush reported that its demand pressures are NOT from smaller companies. Instead, the company sees weakness with higher-end customers who are not expanding services as they were previously. From the Q&A section of the Seeking Alpha transcript for the Q3 earnings conference call:

“So, in terms of macro, we see impact in larger accounts. But in terms of performance of our core base, we don’t see that much difference. So, I would say actually, and somewhat surprisingly, our small business segment is holding pretty well, which is — I think was counterintuitive for many app stores that we talked to. But yes, right now this is largely limited to larger transactions, mostly existing customers going through the renewal process…But small business segment, when we look at total number of expansions, is pretty — doing pretty well…

…some of those high subscription tiers, they are a little bit reluctant to buy more where previously they would be much more eager to do that.”

Investors must be worried about the impact around the corner when (if?) these smaller customers finally feel the pinch enough to curtail usage and purchases of even critical tools like Semrush. The company reports a “a large and growing cohort of free active users on the platform”, so converting these users will be a key for future growth (over 750,000 free users versus 94,000 paying users). The Semrush AppCenter is positioned to unlock that growth. However, as management cautioned “it’s too early to say.” Moreover, the company needs to work on increasing its technical capacity to launch new partnerships for the AppCenter.

Wary Guidance

Management also raised the specter of coming deterioration in the business when it reported guidance: “although the fourth quarter is typically a strong quarter for Semrush, we believe it is prudent to be slightly more cautious given the more challenging economic environment which we believe impacts the demand for our products.” The expected year-over-year revenue growth numbers of 26% for Q4 and 34-35% for 2022 are still relatively strong, but they were sobering given this commentary from the previous quarter: “we expect the current economic conditions to persist and therefore we’re guiding for slower growth in the third quarter, before abounding in the fourth quarter.” Accordingly, I am expecting yet more cautionary commentary to come in the Q4 report and maybe even the Q1 report. Again, the price action in SEMR suggests investors are bracing for more sobering observations on growth.

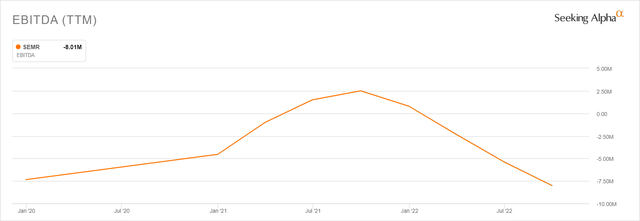

Cost Pressures

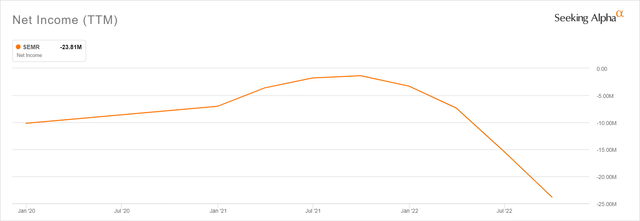

During a period of extreme monetary tightening, profitless companies have a disadvantage. The stock market becomes more risk averse and is less apt to assume that today’s business blemishes are temporary speed bumps. Semrush has unfortunately returned to negative EBIDTA and in parallel net income suffered a big setback. After enjoying a brief spell of positive EBIDTA last year, Semrush quickly dove back into negative territory this year. Net income has yet to turn positive since the company went public. (Return on equity also suffered a setback and has yet to turn positive).

A setback for EBITDA back into negative territory. (Seeking Alpha)

The net income setback ended a promising trend towards positive income. (Seeking Alpha)

This increasing red ink acts as a weight on the stock price.

The expense of relocating employees out of Russia is a large driver of this negative EBIDTA. Management did not provide specific information on what to expect as a normalized cost structure except to say “we expect to incur higher payroll and benefits expenses, as well as increases related to supporting multiple new office locations.” So analysts likely are finding it hard to model the timing for a return to positive income. Semrush is definitely doing the right thing for its relocating employees, but the stock market unfortunately rarely rewards honor. Moreover, the company says it is not considering layoffs, so analysts cannot anticipate cost savings on the labor side. The bottom line is suffering and that creates a drag on the stock price.

The story on Russia quickly evolved and created a negative surprise on operating costs. A week after Russia invaded Ukraine, Semrush reported Q4 2021 earnings. At that time an analyst asked “given the sizable employee footprint in Russia, are you anticipating any operational disruption there or could sanctions have any issue on hiring or any just overall operations of that side of the business?” (Semrush had about 800 employees in Russia out of a total company headcount of 1200 to 1300). Management responded “we don’t expect any significant impact on our business.” In less than a quarter, the fog of war transitioned into the urgency to take action. In the Q1 2022 earnings report, management explained its decision to relocate its Russia-based employees:

“Bank sanctions were first announced by the United States and other countries. We quickly developed mitigation strategies and hope that the situation would get better and would not last long. However, it has become clear that there is potential for a long conflict and further decline of the business environment in Russia.

…we need to prepare the possible new sanctions and reduce the potential impact to our operations. I believe ending our operations in Russia will not only help us to reduce these risks but help remove the uncertainty for all our stakeholders.

…Our goal is to wind down our operations in Russia by the end of September, but I’m hopeful that we can accelerate that time line.”

Semrush was indeed able to accelerate its timeline. During the Q2 2022 earnings report, management announced it completed the entire relocation process. Semrush sold local subsidiaries and opened multiple offices across Europe to accommodate the relocated employees.

The Trade

Semrush is an attractive company in a highly competitive industry. The valuation is substantially de-risked at a 5.0 price/sales ratio, very reasonable for a software company with strong future growth prospects. However, the current investing environment is unfavorable for a company like Semrush operating in the red. SEMR could even hit fresh all-time lows in coming weeks. So, I am keeping SEMR on my shopping list for 2023 in anticipation of a substantial return on shares starting with a turn in the monetary environment.

Be the first to comment