Drew Angerer/Getty Images News

Given the complexity and mysterious nature of the business, this Palantir (NYSE:PLTR) deep dive is probably the most difficult piece that I’ve written compared to other company deep dives that I’ve covered so far. I hope you find value in this article. Enjoy!

Investment Thesis

Palantir: the meme stock, the cult stock, the black box company. There’s a lot of chatter about Palantir on the Internet and I’ve come to notice that there’s a lot of love and hate for the company. Regardless of what others say, it is undeniable that Palantir is one of the most mission-critical companies today.

Palantir is building the central operating system of the modern world, turning chaos into order. The ultimate bull thesis is that Palantir will replace legacy data and operations infrastructure, and Palantir’s technology and management are more than capable of achieving this ambition.

The selloff has also created a wonderful opportunity to accumulate shares of Palantir. Palantir is a Buy at these levels.

Value Proposition

On 11th September 2001, 19 terrorists hijacked four commercial airlines during what seemed to be a normal working day for corporate America. What followed left the world at a standstill — things happened so slowly and so quickly that billions of people all over the globe were paralyzed by what they were seeing on their TV screens.

Two planes struck both the North and South Towers of the World Trade Center, only to leave both skyscrapers crumbling down a few hours later. Another plane crashed on the west side of The Pentagon, the home of the US Department of Defense, which left question marks on the true strength of the US military. The last plane, fortunately, failed to demolish its intended building target as a passenger steered the plane to an open field.

2,977 people lost their lives that day.

Undoubtedly, 9/11 left a huge scar on America. For one, the World Trade Center crash site was dubbed Ground Zero. While America work its way to recover and regain its confidence after the attacks, five entrepreneurs — Peter Thiel, Joe Lonsdale, Stephen Cohen, Nathan Gettings, and Alex Karp — joined forces to form Palantir. The name of the company resembles palantíri or “seeing stones” from the movie The Lord of the Rings. These stones were balls of crystal that enable the users to communicate with one another and to see afar, much like what Palantir was designed to do — to identify, anticipate, and prevent future attacks.

In essence, Ground Zero became the stepping stone to Zero to One — One being Palantir.

This is a good segway to the first topic of this article: what does Palantir do as a business?

In a nutshell, Palantir builds and deploys the foundational software of tomorrow that serves as the central operating system for its customers.

Traditionally, government and commercial institutions need to invest millions and even billions of dollars to build their own digital infrastructures, enterprise data warehouses, and digital twin models, which are incredibly difficult, complex, and risky to execute. But for Palantir, the more difficult, complex, and risky it is, the bigger the opportunity and the more likely it is for Palantir to succeed.

With that in mind, Palantir aims to help organizations to accelerate their digital transformation by integrating their data, decisions, and operations at scale. In other words, Palantir is a big data platform that helps companies make sense of their data to make data-driven decisions.

This is achieved through Palantir’s three core products: Gotham, Foundry, and Apollo.

Gotham

Palantir Gotham is the operating system for government decision-making. It has been used by government agencies including the USIC, NSA, FBI, CDC, and Air force to combat terrorism and analyze various highly-sensitive, highly-confidential matters. Rumors have also surfaced about Palantir Gotham playing a certain role in helping the US Navy SEALs locate and assassinate former Al-Qaeda leader, Osama bin Laden.

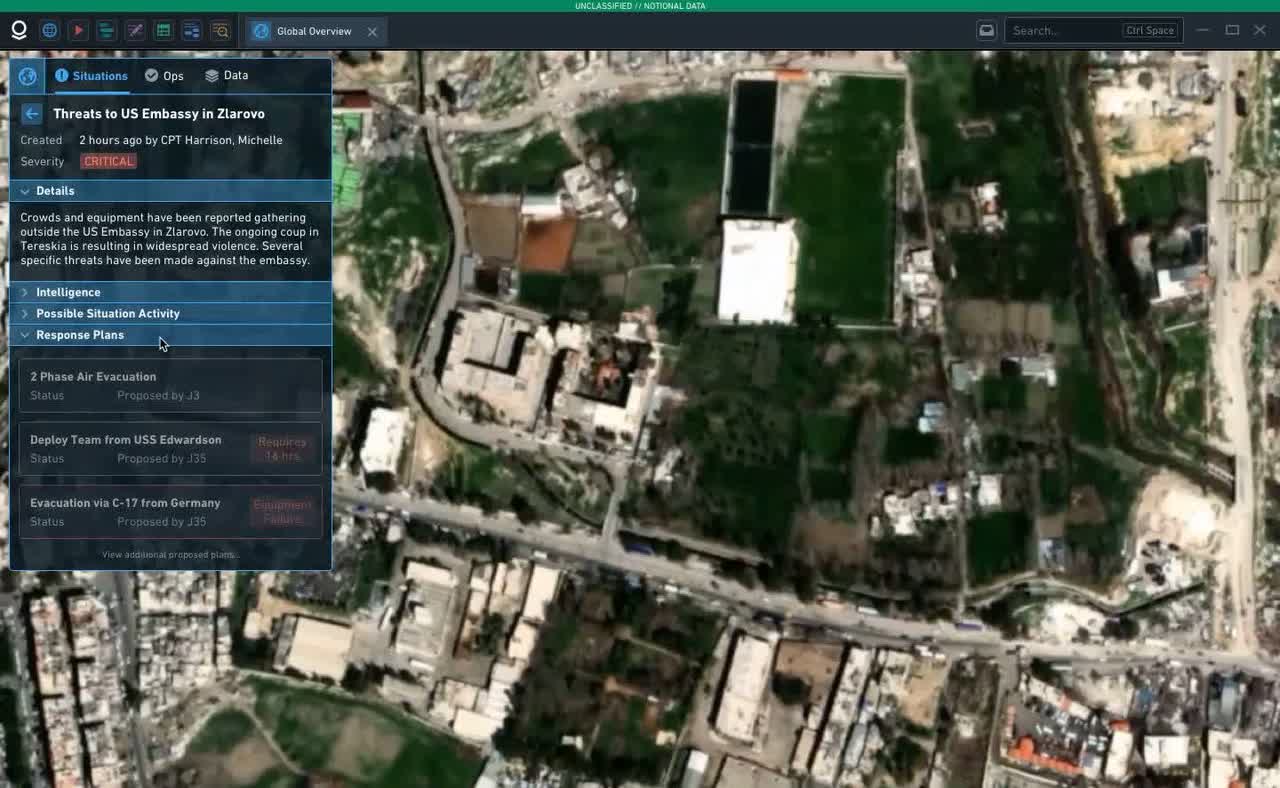

Source: Palantir Website

Aside from government agencies, financial institutions have also adopted Gotham specifically for fraud detection and investigations.

Gotham leverages artificial intelligence to identify patterns, threats, and hidden information deep within cluttered datasets. At the same time, machine learning embedded in its software provides continuous feedback loops which improve its models over time, allowing for smarter and faster decision-making.

Given that Gotham caters specifically to government functions, not much information has been published regarding its technology, thus the black-box nature of the overall business. The company’s S-1 filing does cover a few features but it is quite vague, to say the least. On one hand, we can look at Palantir’s commercial product, Foundry, to at least get some level of understanding of how Gotham works.

Foundry

Palantir Foundry is the operating system for modern enterprises. Foundry has an open architecture and it integrates siloed data sources, analytics, and teams into a common foundation.

Source: Palantir Website

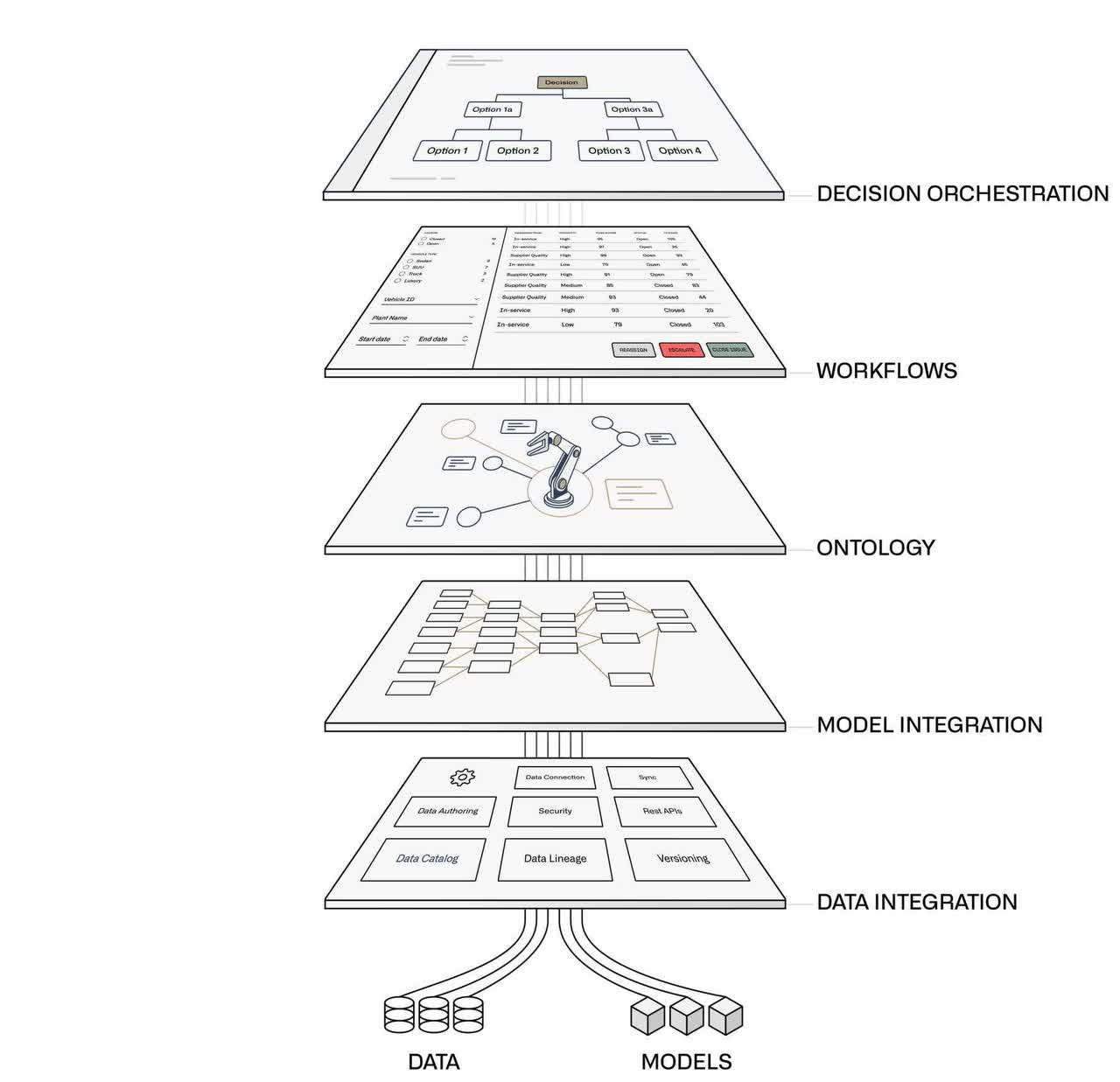

There are 5 layers to the Foundry stack, with each layer bridging the gap between data analytics and operational decision-making:

- Data Integration — Foundry utilizes 200+ data connectors to integrate different data sources, data lakes, and data warehouses across the enterprise, across different types of data points including structured, unstructured, streaming, IoT, transactional, geospatial data, and more.

- Model Integration — Customers can integrate business logic and models by using Foundry’s open, interoperable architecture along with third-party models like Snowflake (SNOW), Microsoft Azure (MSFT), and AWS (AMZN). Foundry can extend these third-party platforms into operations with bi-directional data syncs to ensure that Foundry is always in sync with those existing data systems.

- Ontology — Foundry connects all the data and models, and brings them together into a common foundation that can be used by the entire organization. This is called the Ontology and it is the operational layer of the organization. The Ontology connects all the digital assets (data and models) to their real-world counterparts (such as equipment, products, and customer orders), forming a digital twin of the enterprise that users can interact with.

- Workflows — With the Ontology in place, users can develop custom workflows or use out-of-the-box applications. As more and more objects, actions, and workflows are added, the shared Ontology evolves over time with greater operational knowledge.

- Decision Orchestration — After integrating all the historically siloed data and models, Foundry enables users to take actionable and insightful decisions, whether through manual operations, simulations, or AI.

While this may be an oversimplified explanation of the Foundry platform, it does give us a rough idea of how Foundry works. Perhaps, we can take a look at a case study to get a better grasp of what Foundry does.

For example, here’s how one of the largest utility companies in the US, PG&E, uses Foundry:

- Data Integration — PG&E is facing a massive climate threat as global warming increases the risks of wildfire breakouts. As such, the company needs to leverage the 8-10 billion data points it receives every single day to operate a safe and reliable energy system. Foundry helps to aggregate and make sense of these data.

- Model Integration — Palantir has an open architecture that allows PG&E to integrate Foundry and other third-party models into a single platform. This enables PG&E to utilize all the models and data across various platforms, which ultimately gives richer datasets to combat wildfires.

- Ontology — PG&E has launched the Enhanced Powerline Safety Settings to protect the grid and prevent wildfires. By integrating equipment health data, geospatial location, and network topology, Foundry is able to create a digital representation of PG&E’s entire grid and its 25,000+ miles of wire. This way, PG&E can monitor the various components of the grid, and identify which of them need preventative maintenance.

Source: Palantir YouTube

- Workflows — PG&E can leverage a common set of objects, actions, and relationships to develop custom workflows. Foundry enables PG&E to manage workflows across the lifecycle of the grid including scenario modeling, work planning, scheduling, executing, operating, and closing.

- Decision Orchestration — Based on the new data that Foundry presented, PG&E can now make more informed decisions to protect its grid. For instance, PG&E can automate the switching on and off of certain devices in the grid, based on specific weather conditions, thus decreasing the likelihood of wildfires.

Again, this is just one of many use cases. Foundry is applicable to other industries including auto racing, anti-money laundering, cryptocurrency, financial services, emerging startups, supply chains, telecommunications, and more.

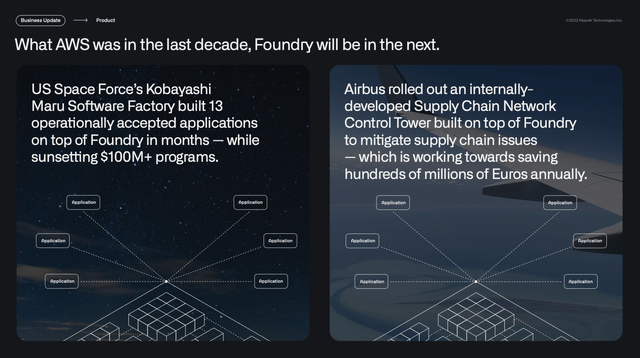

Ultimately, Foundry aims to be the central operating system for modern commercial entities, replacing legacy data infrastructures and operating systems. Palantir has even gone as far as claiming that Foundry will be the next AWS in the coming decade.

Source: Palantir FY2022 Q1 Investor Presentation

Apollo

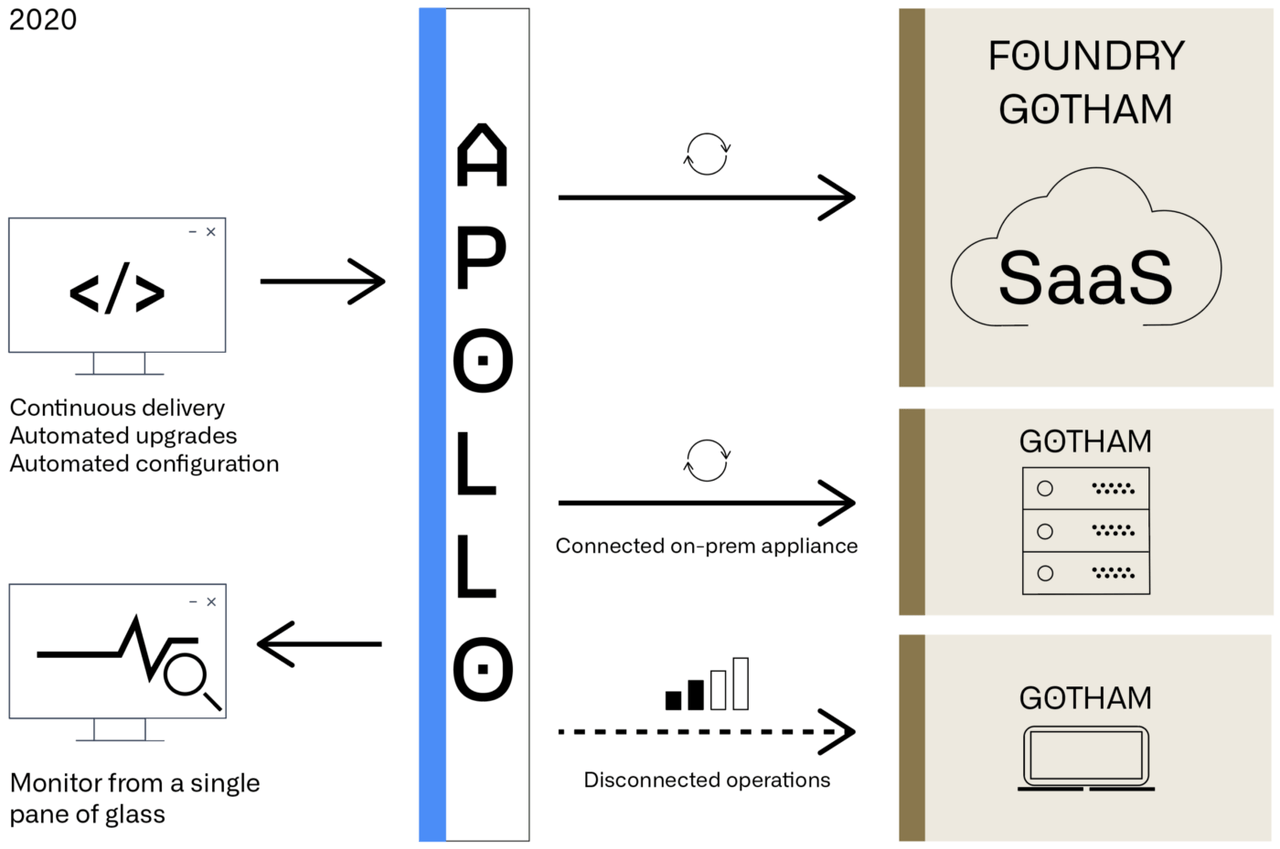

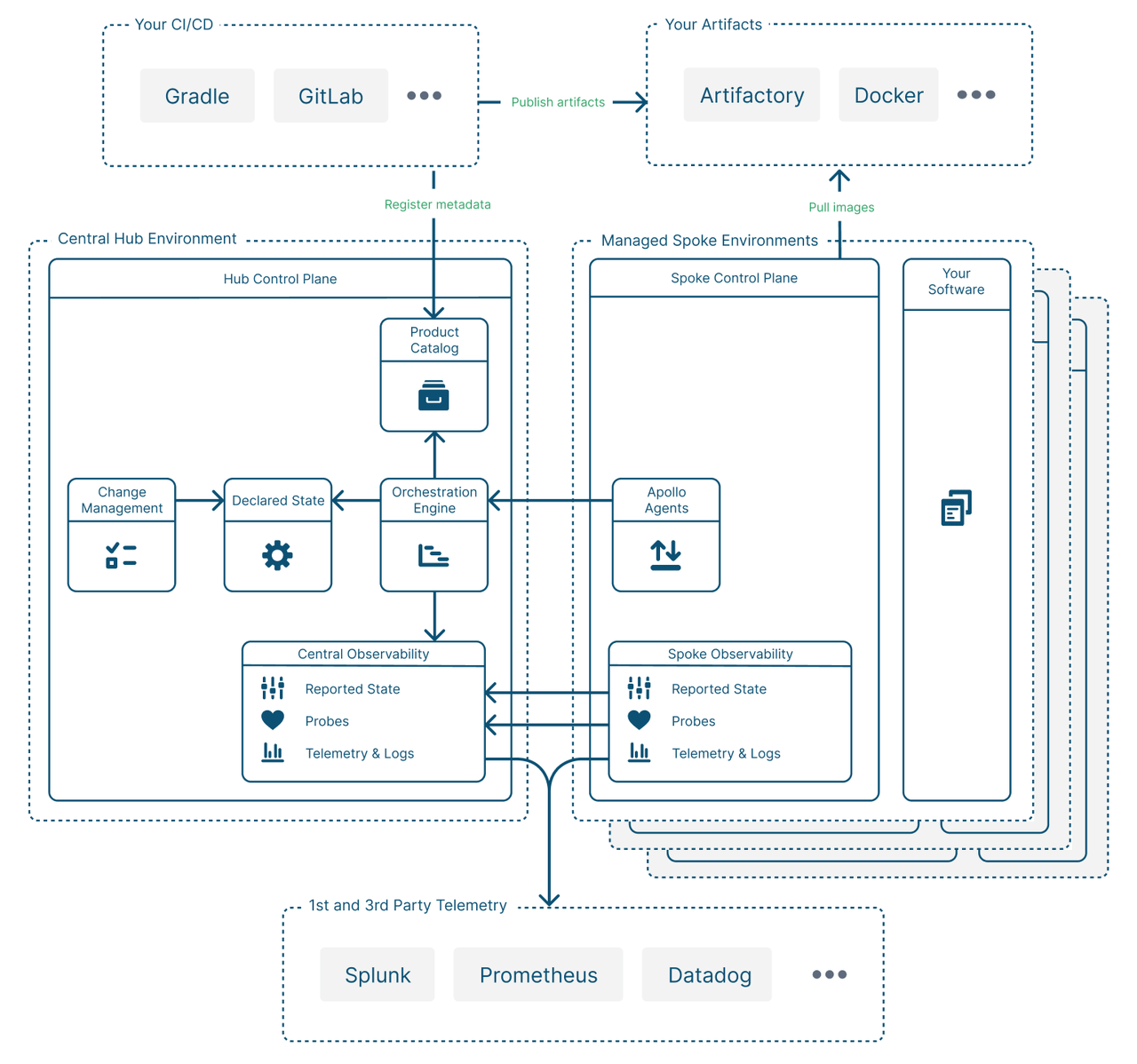

Palantir Apollo is the operating system for continuous delivery. Apollo serves as the software to manage, deploy, and maintain Gotham and Foundry worldwide, across virtually any environment. Before its launch, deploying Palantir’s software involves manual installations, upgrades, and configurations, which is especially true for the non-tech savvy governmental organizations. Back in 2008, Palantir Gotham ran on-premises, which is time-consuming and not scalable, thus leading to few software upgrades or updates.

Fast forward to 2016, Palantir launched the cloud-based Foundry, which gained positive reception from its commercial customers. As such, Palantir also began offering Gotham through the cloud. This allowed for the continuous delivery of Palantir’s user-facing products, and it is made possible through Apollo.

Source: Palantir Blog

Apollo is an autonomous software deployment platform. Developers merge code once and can deploy software across all environments from a single pane of glass. With Apollo, Palantir’s software — whether it be initial setup, new features, or security updates — can be rapidly and securely delivered through on-premise data centers, classified networks, embedded edge devices, the cloud, and more. More importantly, Apollo enables Palantir to bring its SaaS offering to environments where no SaaS has gone before.

Source: Palantir Apollo Documentation

With the ever-growing popularity of SaaS offerings, the launch of Apollo enhances Palantir’s distribution prowess and market adoption. Not only that, but it also accelerates customers’ time to value as well as caters to a broader range of customers given the vast deployment options available.

With all that said, despite its somewhat secretive nature as a public company, it seems that Palantir’s three platforms display top-level interoperability and security, setting high standards to be the central operating system of the modern world. Its 2-decade tenure, solid government exposure, and widening customer base are also testaments to its unique technology offering.

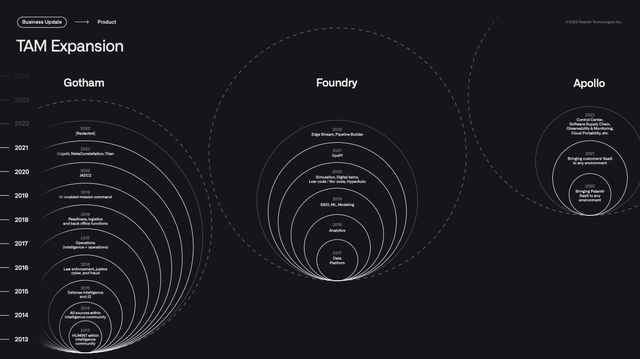

Market Opportunity

According to Palantir’s S-1 Filing, its total addressable market (TAM) is about $113 billion, comprising $63 billion for the government segment and $56 billion for the commercial segment. Breaking it down further by geography, Palantir estimated that the TAM for the US government sector is $26 billion while the international government sector is estimated to be $37 billion in value.

These estimates were calculated back in 2020, and we all know that there have been several important developments over the last couple of years that could mean TAM expansion for Palantir (pandemic, Russia-Ukraine war, cryptocurrency acceptance, SPAC boom, supply chain constraints, etc.). Furthermore, Palantir has rolled out additional features to supplement its core software products, which should also expand its use cases and TAM.

Source: Palantir FY2022 Q1 Investor Presentation

It is important to note that Palantir competes first and for most, with internal software developers where companies usually attempt to build in-house data platforms from scratch. In the fast-changing modern world, companies want speed and certainty — building their own operating systems is too high of a risk to take. That’s where the opportunity is for Palantir.

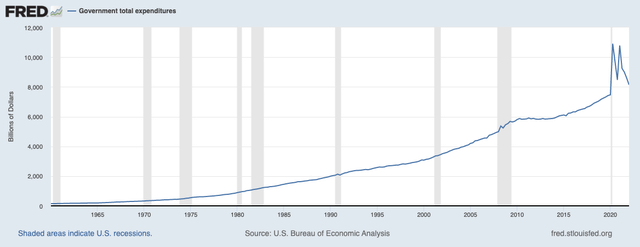

Industry analysts have also sized the Big Data Analytics market to reach $200 to $600 billion+ over the next few years. It is also worth mentioning that the US government total expenditures have been on a long-term upward trajectory, which means higher incremental budgets for defense and intelligence initiatives that can flow to Palantir Gotham.

Source: FRED Government Total Expenditures

Business Model

The company generates revenue from the sale of cloud-based subscriptions and on-premises subscriptions — both of these include ongoing operations and maintenance services. Revenue is generally recognized over the contract term on a ratable basis.

In addition, Palantir also generates revenue from professional services such as on-demand support, platform configurations, training, and data modeling support.

According to the S-1, Palantir’s “pricing is based primarily on the value that we anticipate our software platforms will produce for our customers.” As such, pricing and customer billings vary from contract to contract.

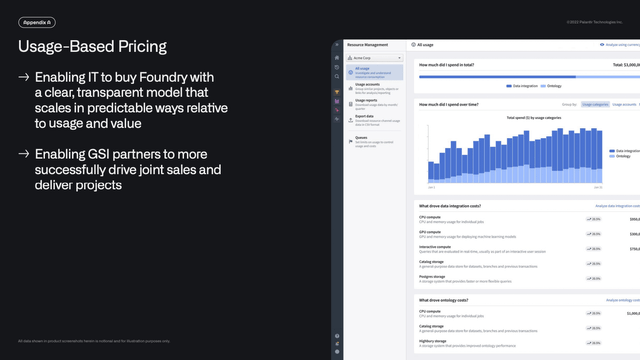

Palantir also incorporates usage-based pricing for Foundry, thus allowing smaller commercial customers to use Foundry without breaking the bank. As these customers scale, Palantir stands to benefit from increased usage of its platform.

Source: Palantir FY2022 Q1 Investor Presentation

Central to its business model is its Acquire-Expand-Scale strategy:

- Acquire — Customers with less than $100,000 in Revenue belong in this category. The Acquire phase involves short-term pilot projects with little to no cost to customers, in an attempt to get them to experience Palantir’s value proposition. Palantir operates at a loss during this phase. However, it is expected to generate significant Revenue over time. For example, the same customers in the 2020-Acquire cohort generated $36.8 million in 2021, as opposed to just $0.3 million in the previous year.

- Expand — Customers with more than $100,000 in Revenue but negative Contribution Margins, fall into this category. The Expand phase is where customers begin to realize Palantir’s value proposition, and therefore, begin ramping up investments in the software. Similar to the Acquire phase, Palantir operates at a loss during the Expand phase. However, Revenue begins to scale at this stage. For instance, 2020-Expand cohort customers generated $83.3 million in 2021, as opposed to just $20.3 million in 2020. On the flip side, Contribution Margin for this cohort was (150)%.

- Scale — Customers with more than $100,000 in Revenue and positive Contribution Margins, belong in this category. In the Scale phase, Palantir’s investment costs relative to Revenue drops as customers become self-sufficient. 2020-Scale cohort customers generated $1.3 billion in 2021, as compared to $1.1 billion in the prior year. Contribution Margin for this cohort was 63% for both 2020 and 2021.

From this Acquire-Expand-Scale strategy, we can see why Palantir may incur short-term losses in exchange for robust, stable Revenue and Contribution Profit generation in the long term.

Growth

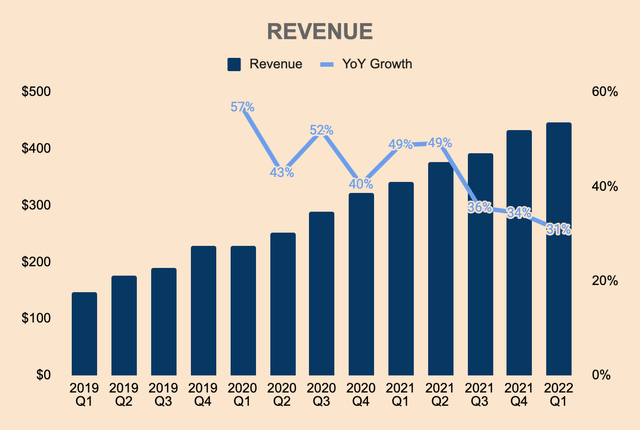

Q1 Revenue came in at $490 million, which is an increase of 31% YoY. As you can see, growth has decelerated over the last few quarters as Palantir grows over a larger base. Suffice to say, we are unlikely to see the 40%+ growth rates that investors are so accustomed to seeing. However, I believe Palantir has what it takes to at least produce 30%+ growth rates over the next few years as new and existing customers continue to adopt Palantir’s breakthrough software.

Source: Palantir Investor Relations and Author’s Analysis

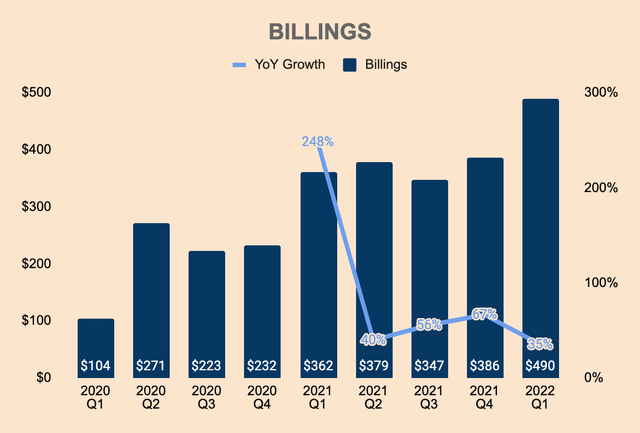

As a supplemental metric, Billings — which is Revenue plus changes in Contract Liabilities — grew faster than overall Revenue. Contract Liabilities consist of Deferred Revenue and Customer Deposits that have not been recognized as Revenue. As such, the 35% growth in Billings means that there’s higher Revenue Growth potential than meets the eye. This is supported by a 157% increase in the number of deals closed in Q1, which totaled 208 deals, compared to last year’s 81 deals. Nonetheless, it is still a deceleration from prior quarters.

Source: Palantir Investor Relations and Author’s Analysis

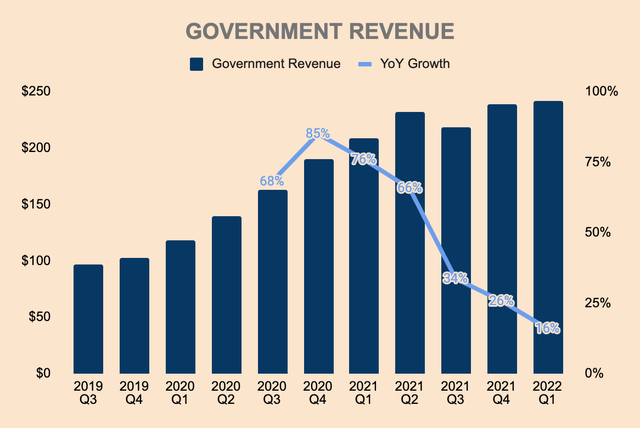

The slowdown in growth was primarily due to the lagging Government segment. Q1 Government Revenue was $242 million, up by only 16% YoY. According to the company’s 10-Q, virtually all of the Government Revenue growth came from existing customers as of Q4. The softness in Government Revenue is clearly a concern given that Palantir’s bull thesis is closely tied to its relationship with government agencies. However, management did mention in the Q1 earnings call that Government Revenue is expected to reaccelerate in the next quarter:

In the face of our customers’ challenges, we have and will continue to incur expenses prior to having contracts in the delivery of mission-critical capabilities. Following these investments, we expect acceleration of our U.S. government revenue into the second half of the year. In Q2 to date, we’ve already seen the reacceleration of U.S. government revenue and expect acceleration of the overall government segment to follow in the next quarter or shortly thereafter — CFO Dave Glazer.

Source: Palantir Investor Relations and Author’s Analysis

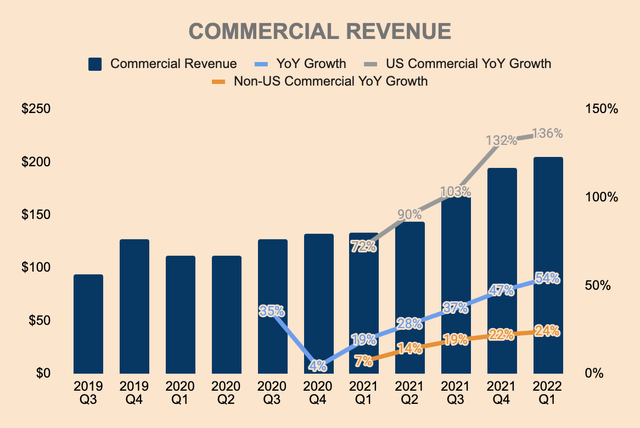

On the other hand, Q1 Commercial Revenue growth remained robust, which saw a 54% YoY increase, to $205 million. This is the 5th straight quarter where Commercial Revenue accelerated. In the chart below, I’ve included overall, US, and Non-US growth rates for reference. As you can see, US Commercial Revenue growth outpaced overall company growth, posting a whopping 136% YoY increase. Furthermore, management expects 2022 US Commercial Revenue to double YoY for the 3rd consecutive year, to $400 million+. This shows the increasing popularity and unmatched value proposition offered by Palantir Foundry.

Source: Palantir Investor Relations and Author’s Analysis

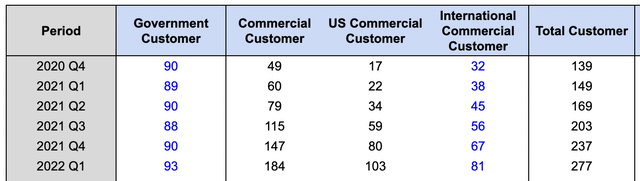

Taking a look at customer count, we can see why there are discrepancies between the two segments. As shown below, Palantir only added 4 new Government Customers, YoY. On the other hand, Palantir added 124 new Commercial Customers. It is also worth noting that despite US Commercial Customers making up 37% of total customer count, US Commercial Revenue only makes up 15% of Total Revenue. This shows high growth potential as Commercial Customers graduate from the Acquire, to Expand, to Scale phases.

Source: Palantir Investor Relations and Author’s Analysis

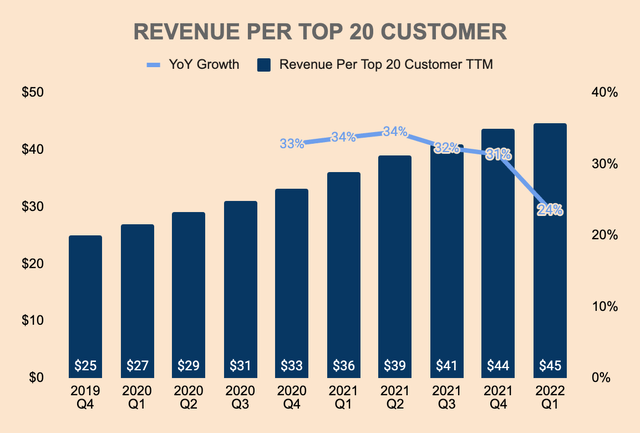

On a side note, Revenue Per Top 20 Customer was $45 million, up 24% YoY. In addition, Net Dollar Retention rate was 124%, a drop from Q4’s 131%. The softness in these metrics may yet be another indication that Palantir’s growth has peaked.

Source: Palantir Investor Relations and Author’s Analysis

All in all, growth for Palantir as a whole remains robust, although we are seeing some significant slowdown in the Government department. However, Foundry and the Commercial segment seem to display a healthy pipeline, which should serve as the next growth engine for the company.

Profitability

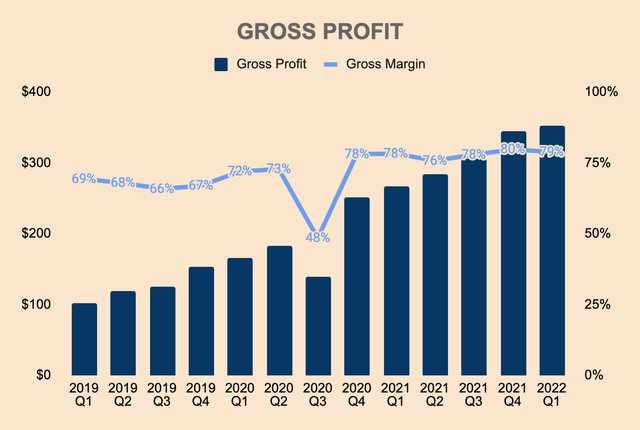

Turning to the profitability of the company, Q1 Gross Profit was $352 million, which is a 79% Gross Margin. We can see that Gross Margins have been improving steadily over the last few quarters, demonstrating economies of scale within the business.

Source: Palantir Investor Relations and Author’s Analysis

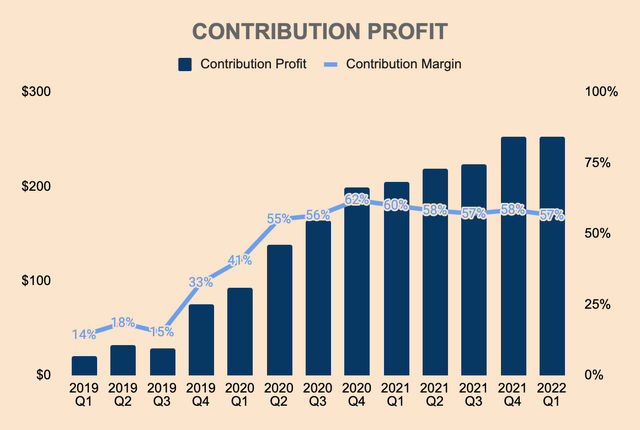

Contribution Profit — which is Gross Profit minus Sales & Marketing Expenses but excludes Share-based Compensation (SBC) — was $252 million in Q1. This is a measure of operational efficiency in terms of deploying its software to customers. Q1 Contribution Margin was 57%, and you can see that it has trailed down as of lately. As discussed in the Business Model section, Contribution Margins are lower for customers in the Acquire and Expand phases. Since Palantir is currently focusing on acquiring new customers, especially in the Commercial realm, we can expect downward pressure on Contribution Margins in the short-to-medium term.

Source: Palantir Investor Relations and Author’s Analysis

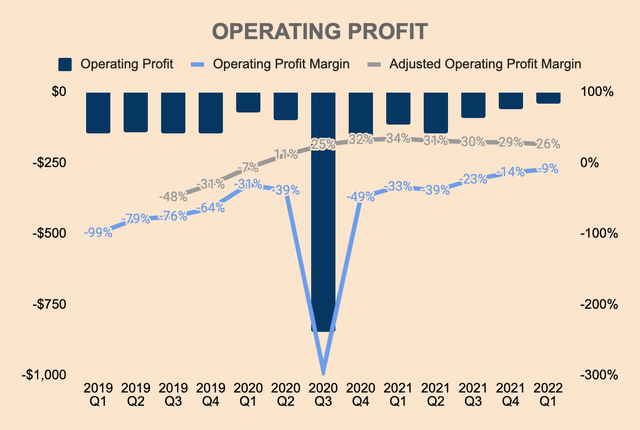

Operating Profit for the quarter was $(39) million, a (9)% Margin. On an Adjusted basis, Operating Profit was $117 million, a 26% Margin. Adjusted Operating Margin has been trending downwards due to management ramping up investments to market its software, including expanding its direct sales team. Management mentioned that this trend should continue in the foreseeable future.

Source: Palantir Investor Relations and Author’s Analysis

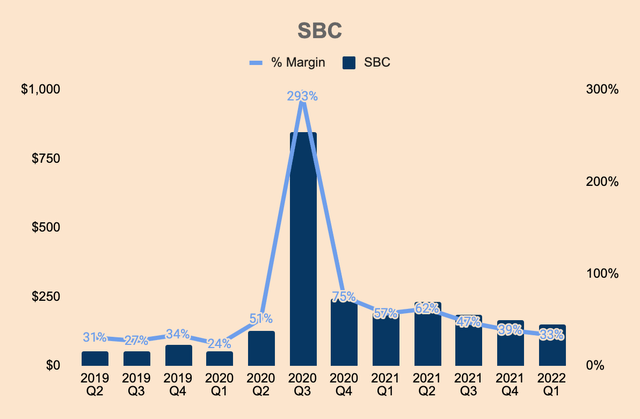

As you may have guessed, the negative GAAP Operating Margin is due to heavy SBC. Despite a stabilization in SBC after its direct listing back in 2020 Q3, SBC as a % of Revenue remains high at 33% as of Q1. However, I expect SBC to continue to drop moving forward, possibly to the 10% level over time.

Source: Palantir Investor Relations and Author’s Analysis

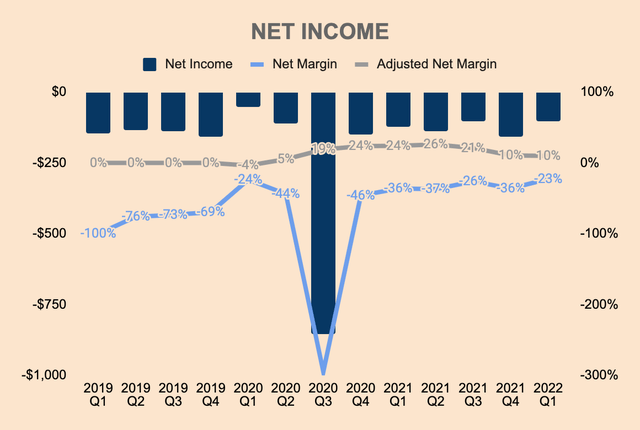

Q1 Net Income is much worse, which was $(101) million, a (23)% Margin. Adjusted Net Income, on the other hand, is positive at a 10% Margin.

Source: Palantir Investor Relations and Author’s Analysis

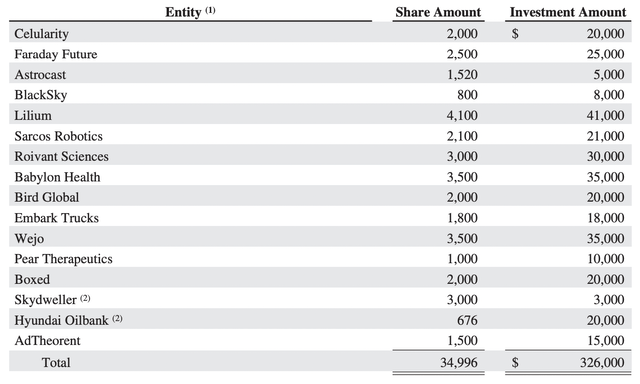

The poor Net Income performance relative to Operating Income is due to Palantir’s realized and unrealized losses from Investments, namely the de-SPACed companies that Palantir partners with. Below are the companies that Palantir has invested in, including its corresponding amounts, as of Q4 2021. There are other SPAC investment commitments as of Q4 2021, but they may not have closed as some of these SPAC agreements did not fall through due to unfavorable market conditions. Nonetheless, some of these SPACs have lost a significant amount of their value relative to their NAV of $10 per share, which explains why Palantir’s bottom line is significantly affected. Here are some examples:

- Lilium (LILM) — $2.69

- Faraday Future (FFIE) — $2.50

- Babylon Holdings (BBLN) — $1.16

- Bird (BRDS) — $0.55

- Wejo (WEJO) — $1.42

Source: Palantir FY2021 10-K

Overall, Palantir has strong earnings potential given its high Gross Margin profile. Furthermore, Gross Margin has been improving, demonstrating economies of scale. However, the company has yet to show operating leverage as management continues to reinvest back into the business. High SBC expenses and losses from investments are also issues to consider.

Financial Health

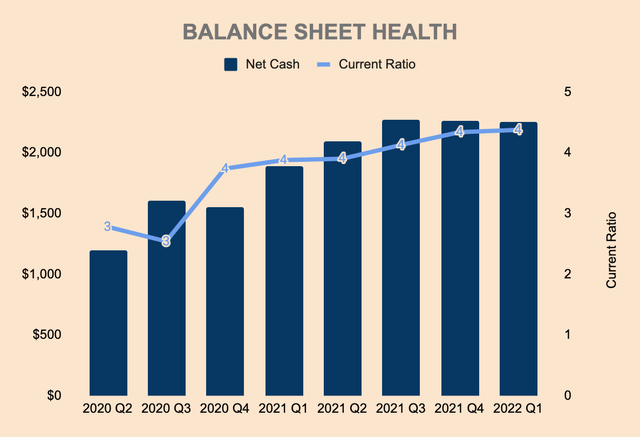

Despite GAAP unprofitability, Palantir has a fortress balance sheet as the company is already cash-flow positive. As of Q1, Palantir had $2.5 billion in Cash and Short-term Investments with $0.3 billion of Total Debt, mostly in the form of Operating Lease Liabilities. As such, Palantir has a Net Cash of around $2.3 billion. Current Ratio is also at a healthy level of 4.0x.

The company also has access to $500 million from its revolving credit facility, if need be. These funds remain undrawn.

Source: Palantir Investor Relations and Author’s Analysis

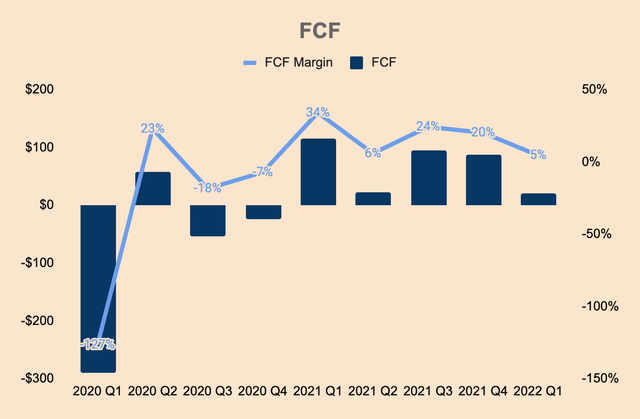

Palantir is already Free Cash Flow positive, generating $225 million of FCF in the last twelve months. FCF Margin dropped to just 5% in Q1, due to the timing of receipt of payments from customers, and timing of payments to vendors. The increase in Operating Expenses to scale the business is also a contributing factor to lower FCF Margins. However, there’re reasons to believe that Palantir can achieve and sustain FCF Margins of 30%+ in the long run.

Source: Palantir Investor Relations and Author’s Analysis

Given its strong balance sheet and cash-generative nature, I do not anticipate any equity raises or risks of bankruptcy. Now that Palantir is a self-funded business, Palantir needs to manage SBC spending to create the shareholder value that many investors sought for.

Outlook

In terms of outlook, management provided the following Q2 guidance:

- Revenue — $470 million, implying a 25% YoY growth. This is quite a slowdown from Q1’s 31% growth. However, I believe this is the most conservative scenario as management cites “a wide range of potential upside” driven by “developing geopolitical events”. US Government Revenue is also expected to accelerate in the next quarter.

- Adjusted Operating Margin — 20%. This is a drop from Q1’s 27% as management ramps up investments “to support our customers’ mission in advance of anticipated contract awards”.

Longer-term, management expects a 27% Adjusted Operating Margin for FY2022. In addition, management reiterated their long-term Revenue guidance of 30%+ growth for this year and the next 3 years through 2025.

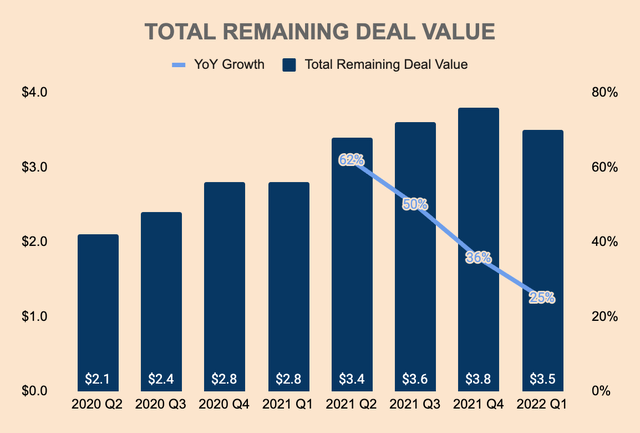

Looking at Palantir’s Total Remaining Deal Value can also give us a rough idea of Palantir’s Revenue Potential. As shown below, Total Remaining Deal Value was $3.5 billion in Q1, up 25% YoY. This is a $0.3 billion decrease QoQ, showing some weakness in deal creation at the moment. Nevertheless, the deal pipeline remains robust and that should support Palantir’s growth story moving forward.

Source: Palantir Investor Relations and Author’s Analysis

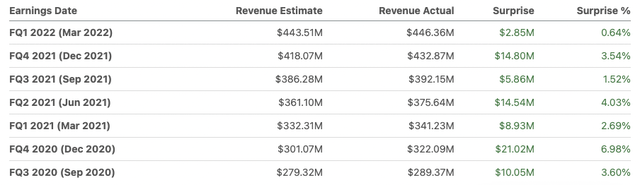

As a public company, Palantir has also beaten analyst estimates in each and every quarter. This could be an assurance that Palantir will continue to outperform expectations.

Source: Seeking Alpha

Competitive Moats

Based on my research and analysis, I identified 5 competitive advantages that Palantir possesses: technology, high barriers to entry, network effects, switching costs, and culture.

Technology

Despite being a publicly-traded company, Palantir is still considered to be one of those mysterious companies that many find difficult to understand. For me, I don’t have a software engineering background, which makes the task of understanding Palantir’s technological value proposition a real challenge. To make matters worst, Palantir’s software has little coverage from industry analysts (Forrester, Gartner, Everest Group, etc.) and business software review sites (G2, etc.). The question is, how do we know if Palantir has a technological edge?

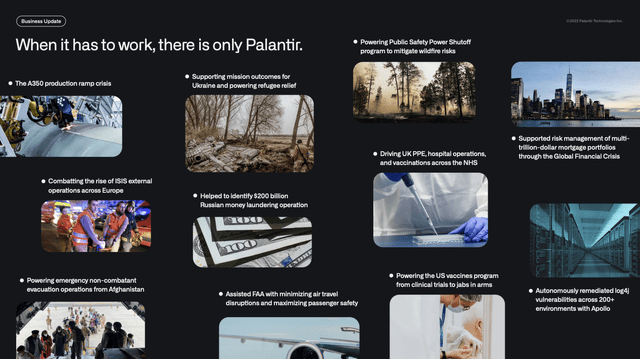

To answer that question, we can look at the types of deals and customers Palantir has established thus far. Below is a list of some of the deals that were signed in just the first half of 2022 alone. Mind you, these are not just some small-scale projects; these deals involve some of the largest and most important players in their respective industries. Such a strong deal pipeline speaks volumes about Palantir’s technology moat.

- US Space Systems Command — $175 million contract value through March 2023.

- Stellantis (STLA) — A leading automaker and mobility provider with $170 billion of Revenue in FY2021, will leverage Palantir’s Foundry.

- Trafigura — One of the largest multinational commodity trading companies that generated $231 billion of Revenue in FY2021, will collaborate with Palantir to develop a supply chain carbon emissions platform.

- US Department of Health and Human Services — $90 million contract value for five years.

- US Centers for Disease Control and Prevention — Customer since 2010. Extended partnership to modernize data management for disease monitoring and response.

- Scuderia Ferrari — Customer since 2016. Extended partnership to utilize Foundry in Scuderia Ferrari’s Power Unit.

- Hyundai Heavy Industries — The largest Korean auto manufacturer and Palantir will establish a big data platform for its business, with the potential of forming a joint venture to commercialize the platform.

Source: Palantir FY2022 Q1 Investor Presentation

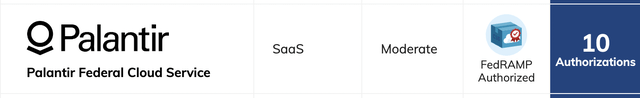

Palantir has also been recognized as a Leader in the Dresner Wisdom of Crowds BI Market Study. Moreover, Palantir is part of FedRAMP, a government-wide program that empowers government agencies to adopt and use cloud services, particularly for information security and protection purposes. As of this writing, Palantir has 10 FedRAMP authorizations.

Source: FedRAMP Marketplace

High Barriers to Entry

Building a central operating system of that caliber, of that complexity — that is trusted by key industry players — is no easy feat. It requires years and decades of investment, development, and refinement, and Palantir has been doing so for two decades, which gives them a strong head start. Based on my research, I haven’t come across any other company that comes close to what Palantir offers. These things put together creates high barriers to entry for emerging players to compete effectively with Palantir.

Palantir is also one of the most active names in the government sector, amassing a total of 93 Government Customers. Keep in mind that building such a large network requires substantial due diligence, relationship building, and lobbying, some things that not many companies are able to do or afford. As such, as it pertains to the government business, Palantir is setting high barriers to entry that practically eliminates most competition.

Network Effects

Despite its mysterious nature, Palantir has recently made its Foundry and Apollo documentation available to the general public. This will help individuals, companies, investors, and the media to understand Palantir’s software better, which should increase publicity. More importantly, this development should spur discussions in the developer community, thus increasing awareness, and ultimately, the adoption of Palantir’s products.

As mentioned earlier, Palantir has 200+ data connectors and it works with major cloud platforms such as AWS, Snowflake, and Google Cloud (GOOG), which have network effects of their own. Just recently, Palantir and Google Cloud announced their partnership to make Foundry available on Google Cloud and Google Cloud Marketplace. This gives Palantir access to Google Clouds customers, including PayPal (PYPL), Twitter (TWTR), and Etsy (ETSY).

Source: Google Cloud

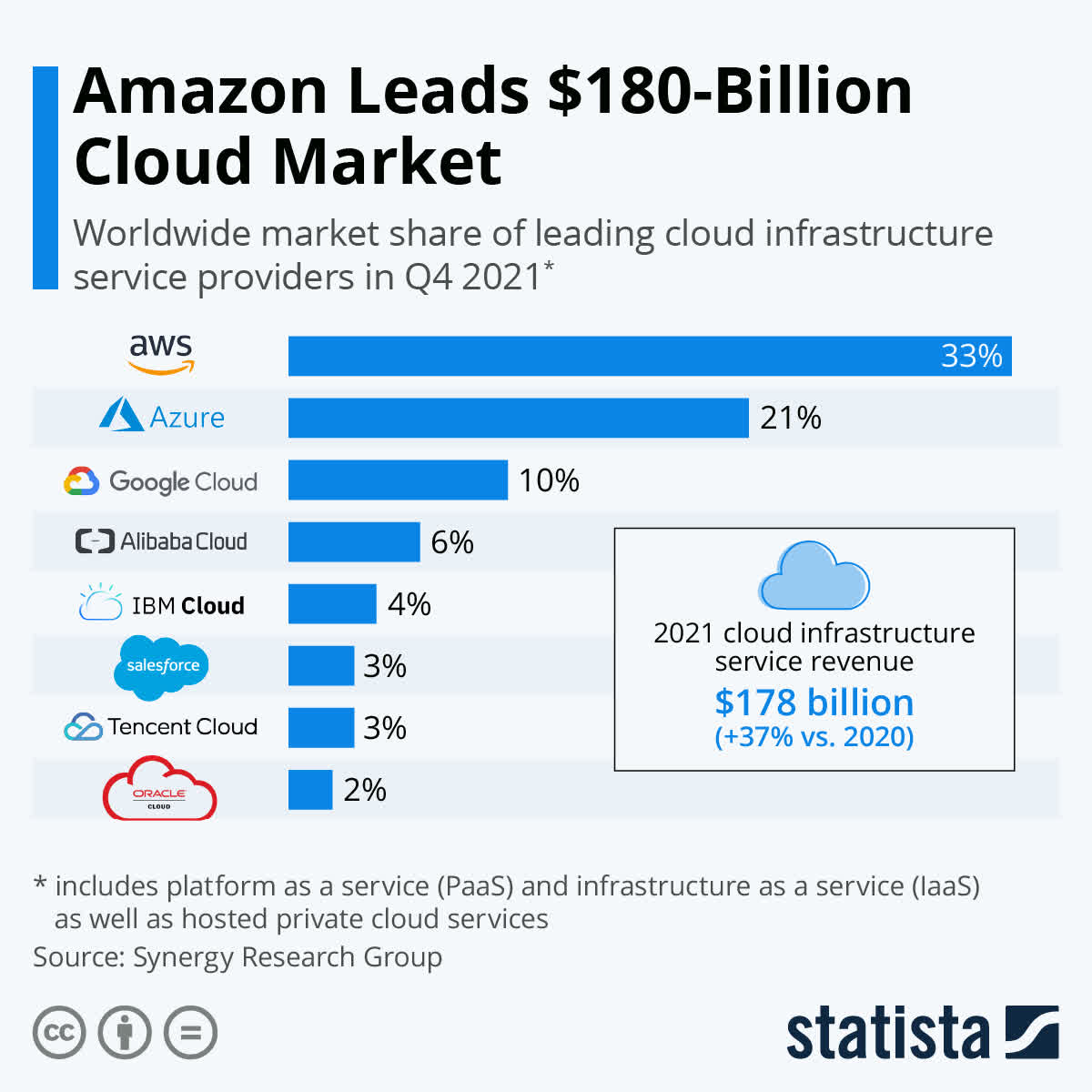

Not only that, but Palantir also works with other cloud infrastructure service providers, including the top 3 providers listed in the chart below. This should amplify product distribution, leading to powerful network effects.

Source: Statista

On a side note, Palantir has also partnered with Carahsoft, which creates a channel program to increase Palantir’s reach within the US Federal sector, solidifying its position in the government side of the business. One more thing, Palantir has also recently launched the Palantir Certification Program, encouraging users to learn how to use Foundry as well as highlight their technical expertise in Foundry.

Because of all the developments mentioned above, powerful network effects should ensue.

Switching Costs

Through its Acquire-Expand-Scale business strategy, Palantir inevitably creates high switching costs among its customers. As customers graduate to the Expand and Scale phases, they have already invested millions in the platform and experienced the full benefit of Palantir’s central operating systems. As a reminder, Palantir offers a software infrastructure for data and operations, and infrastructures are very difficult to replace.

Let’s take a look at an example. In 2016, through a Palantir-Airbus partnership, the aviation platform Skywise was formed. Skywise also serves as the medium to distribute Foundry across the aviation industry. Today, Skywise connects more than 9,000 aircraft across more than 100 airlines on the platform. If Airbus decides to abandon this program, the entire aviation value chain would be in a state of limbo, and that is something 100+ airlines would not want to deal with.

Source: Harvard Business Review

Put simply, once customers use Palantir’s software, they are hooked into it for the long run as switching providers (if there’s even a solution better than what Palantir provides) would mean a radical change in the customers’ data/operations infrastructure. Moreover, developing in-house operating systems from scratch is difficult, time-consuming, and costly. In other words, customers would rather avoid the high switching costs and opportunity costs associated with replacing Palantir’s operating system.

Culture

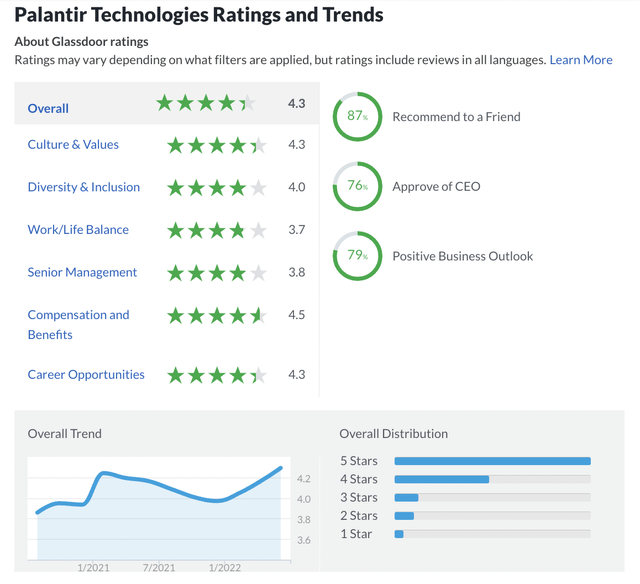

Palantir has a high Glassdoor rating of 4.3/5.0 with 79% of reviewers citing a “Positive Business Outlook” for the company.

Source: Glassdoor

Palantir is also founder-led, with the brilliant, eccentric, and visionary CEO Alex Karp at the helm of the company since day one. According to Comparably, Alex Karp is also a Top 5% based on 680 ratings. Alex Karp and co. are some of the most mission-critical people I get the pleasure of witnessing. And Palantirians are on board with management — the numbers speak for themselves.

Source: Comparably

Valuation

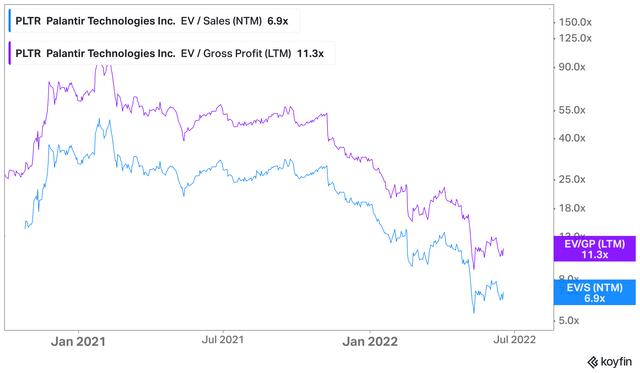

The last few quarters have been one of the most difficult times for growth investors. Growth stocks have lost 50%-90%+ of their values as raging inflation, rising interest rates, and quantitative tightening punish all things growth stocks. Palantir has not been spared from this rout. Since November 2021, Palantir has lost 70% of its value.

In terms of EV/Sales, Palantir traded as high as 50x. Today, it trades at just 6.9x. In terms of EV/Gross Profit, Palantir traded as high as 100x. Today, it trades at just 11.3x.

Source: Koyfin

After the selloff, Palantir now trades at a market cap of roughly $16 billion. To put further context to this number, investors can buy Palantir at a cheaper valuation than its 2015 funding round, which closed at a $20 billion valuation.

While the stock may look cheap today, further downside is possible given recession fears, raging inflation, rising interest rates, supply chain constraints, and a slowdown in growth. However, there seems to be a large margin of safety for long-term investors interested in partnering up with a high-quality, wide-moat business with a long growth runway ahead.

Catalysts

- GAAP Profitability — Perhaps, one of the biggest milestones that Palantir can achieve is GAAP profitability. Much of the bear theses against Palantir is the insurmountable losses on a GAAP basis. Sure, Palantir is already profitable on a Non-GAAP and FCF basis, but in the long term, stock prices go up based on improvements in the bottom line of the income statement as well as the strong non-dilutive cash flow generation of the company. As such, flipping into GAAP profitability will most likely be a boost to Palantir’s bull thesis.

- Government Reacceleration — As mentioned earlier, Palantir’s growth story is largely predicated on its ability to retain and expand its ecosystem of government customers. As we have seen over the last few quarters, Government Revenue growth has decelerated to head-scratching levels. To recall, Q4 and Q1 Government Revenue growth was only 26% and 16%, respectively. Such a huge deceleration is probably the reason why Ark Invest dumped shares of Palantir. Despite the plateau in the Government segment, management does expect growth in the segment to reaccelerate in the next quarter. Returning to consistent 20%-30%+ growth in this department should welcome more bulls into the camp.

- Buyback Program — A big concern at the back of some investors’ minds is the fact that there have been no insider purchases ever since Palantir went public. Instead, we’re only seeing selling after selling by insiders. That is certainly not a confidence booster for investors. However, given the recent selloff of the stock, management may be inclined to put their capital to good use. With Palantir’s large cash in hand of $2.5 billion, management may start a share repurchase program, a well-needed silver lining during what seemed to be the gloomiest market environment we’ve seen since the dot-com bubble and great financial crisis.

Risks

- Revenue Concentration — In FY2020 and FY2021, Palantir’s top three customers accounted for 25% and 18% of total Revenue. While Revenue concentration is getting better, it is still a risk worth considering. On a side note, Palantir has a long sales cycle of six months to more than a year. Therefore, if Palantir loses major customers, it will take time for the company to recoup the losses as a result of customers leaving the platform.

- SPAC Investments — During the Q1 earnings call, management mentioned that Revenue contribution from SPAC investments is expected to be about $30 million per quarter. That is an annual run rate of $120 million. With that said, some of these de-SPACed companies are trading like penny stocks. Most of these companies are also unprofitable and worse, some of them are concept companies generating zero Revenue. As such, there’s a strong likelihood that some of them will eventually go bankrupt. When this happens, Palantir’s: 1) Revenue is negatively affected, 2) customer count decreases, and 3) earnings per share takes a hit as the company faces higher losses from investments.

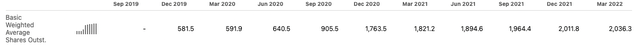

- Dilution — This is perhaps the most controversial topic when it comes to investing in Palantir. While SBC as a % of Revenue is gradually improving, there’s no denying that SBC spending has been high and continues to be high. This makes dilution a real problem, no matter how much growth the company can bring into the business. As shown below, Shares Outstanding more than tripled in the last two years.

Source: Seeking Alpha

Conclusion

Palantir is building the central operating system for the modern world, powered by its three platforms: Gotham, Foundry, and Apollo. The company is posting strong growth numbers, particularly fueled by its Commercial segment, which will be the primary driving force of growth in the years to come. On the other hand, the Government segment is showing some weakness, although management expects a reacceleration of growth in that department. Nevertheless, Palantir has technology, network effects, switching costs, high barriers to entry, and culture moats that should support its growth trajectory.

The past few months have not been easy for the stock, but the valuation reset is well needed and I think it has overshot to the downside. While we may see new lows due to a tough macro environment and the risks mentioned above, I believe there’s a substantial margin of safety for long-term investors. I believe it is an opportune time to accumulate shares of this high-quality, wide-moat, black box company.

Thank you for reading my Palantir deep dive.

Onward and Upward.

Be the first to comment