BaldoT83/iStock via Getty Images

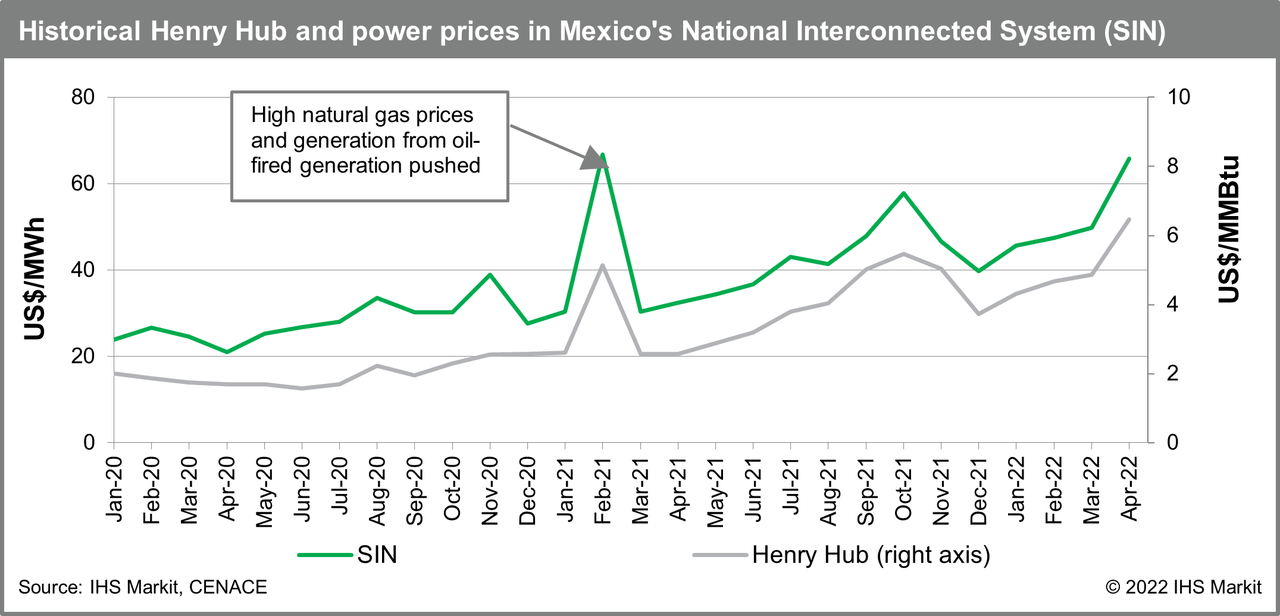

The recent natural gas price increase in the United States is inevitably spreading to Mexico’s gas and power markets. A lower-than-expected supply response in the United States, combined with strong natural gas demand for both domestic and export markets, has led Henry Hub prices to nearly double year to date. Mexico is currently importing about 65% of its total gas needs from the United States and has limited resilience to the price fluctuation in its northern neighbor. This situation was evidenced in February 2021 when storm Uri severely disrupted gas supply in Texas and prices spiked.

The national natural gas price index (IPGN) in Mexico broke the $6/MMBtu mark in April 2022 and might be close to $8/MMBtu in May based on price increases in the main US reference hubs. Most importantly, the US gas market is expected to continue operating in a tight situation through 2023 resulting in an extended period of high gas price benchmarks for Mexico.

Mexico’s power prices are also following an upward trend as gas-fired generation represents about 65% of the total power supply, making it the most important fuel in the power mix and settling the marginal cost most of the year. Given the ongoing period of high gas prices, fuel switching is a possibility that can help replace some gas generation, as seen in February 2021 when combined cycle generation dropped to its lowest level since 2018. The main challenge is the economic limit as alternative fuels, such as coal or fuel oil, have also increased in price and cannot provide relief. Year to date, coal generation has increased by 30% suggesting some fuel switching already. Conventional thermal generation is at levels like those seen during August 2021, the peak demand month in 2021. On the contrary, wind and solar generation from January through May 2022 is down 6% year on year according to the system operator’s data.

Regardless of the supply mix, Mexico’s power sector will continue to experience high power prices in the wholesale market likely hurting end consumers. Particularly concerning is the situation of the Federal Electricity Commission-Basic Supplier (CFE-BS), as a government decree imposed a link from retail tariff increases to inflation rates. According to the Regulatory Energy Commission (CRE), CFE-BS bought about 30% of its total power needs at spot power prices since January 2022. This situation combined with the use of high-cost CFE-owned power plants is expected to increase financial pressures on CFE and likely require additional subsidies from the government to keep retail tariffs from rising.

The natural gas price increase adds to an already complex policy environment in Mexico’s gas and power sectors. Although the risk of a major power sector reform has now dissipated because of the rejection of the President’s constitutional power sector reform, the 2021 changes to the power industry law (LIE), currently halted, are hurting business sentiment in the power industry.

Despite a recent announcement from CFE to build new gas-fired capacity throughout the country, the potential risk of power demand growth accelerating and outpacing new power generation builds might further constraint the Mexican economy, already affected by high natural gas prices. The winter storm of February 2021 and the ongoing tightness in the US gas market are two events that are increasingly evidencing the exposure of Mexico’s gas and power markets to imported gas from the United States. The expected period of high gas and, consequently, power prices could also reinforce the competitiveness that other generation alternatives such as wind and solar might offer to end-power consumers in a world where renewable energy procurement is becoming more relevant across the globe.

This article was posted as a follow-up to our most recent research insight, “Mexico’s natural gas and power prices short-term update: Increasing pressures from high natural gas prices in the United States, Mexico’s main source of supply“, available to ConnectTM clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment