Nikada/iStock Unreleased via Getty Images

All Big Tech companies are facing regulatory challenges across the globe. Apple (NASDAQ:AAPL) is in the front trenches of this regulatory pushback as it controls a massive “walled garden” ecosystem within which apps are developed. By controlling the rules of app development, Apple can effectively limit new business models from evolving. The biggest challenge faced by Apple is the massive commission rates charged by the company on its App Store.

Regulators and legislators are trying to rewrite the rules within the App Store in U.S. and in international regions. Recently, a Dutch watchdog has ordered Apple to allow other payment options within the App Store for dating apps in Netherlands. This change is likely to be applied within all EU countries that will ask for similar treatment for app developers in their territories. South Korean regulators have gone a step further by asking Apple to allow other payment providers for all apps.

The Services segment has been the key driver for higher valuation multiple in Apple stock. This segment provides stable revenue at high growth rates. The backbone of this segment is the App Store which will be facing massive regulatory challenges as the App economy matures. Apple is also facing challenges in the lucrative licensing deal with Google (GOOG) which gives prominent real estate to apps developed by Google within Apple devices. The entire valuation thesis for Apple will change if either of these two main revenue streams requires a significant change in the business model. This is not priced in Apple stock and we could see further corrections in the near term.

Apple is in the front trenches

We have seen a number of companies cross the trillion-dollar valuation in the last few years. This has increased the regulatory pushbacks on these Big Tech companies. There have been hundreds of millions of dollars’ worth of fines on several tech companies including Amazon (AMZN), Google, Meta (META) and others.

However, investors should not focus on the dollar value of fines and instead look at the overall impact of a change in business model on the company’s revenue and profits. Amazon is fined by Italy $1.28 billion as it has been promoting its own logistics network compared to other local sellers. While the fine is big, Amazon can easily rectify this issue by lowering the reliance on its logistics network without causing a big drag on its overall profitability.

Similarly, Google and Facebook have faced fines for issues that can be easily corrected without hurting the core business of the company. However, in the case of Apple, the fines have been relatively low but the regulators want the company to allow other payments option within its App Store. This would change the complete business model of its App Store and also the way it prices its Products including iPhones, iPads, and others. Apple is able to monetize its users within the App Store through heavy commissions as high as 30%. If other payment options are allowed within App Store, it could limit Apple’s commission rate to low single-digit.

Another big challenge for Apple is the licensing deal with Google which brings in close to $10 billion annually which is mostly pure profits due to very high margins. This limits the ability of any new platform to rival Google. Apple has been advocating privacy for a long time and has even caused a $10 billion loss in Facebook’s revenue due to new rules. Google also uses customer data to show ads. The Apple-Google deal can lead to doubts about Apple’s claim that it wants more privacy for its customers. The regulatory headwind toward this lucrative deal will increase substantially in the near term as antitrust sentiment increases within United States Congress and other international legislators.

Impact on Services revenue

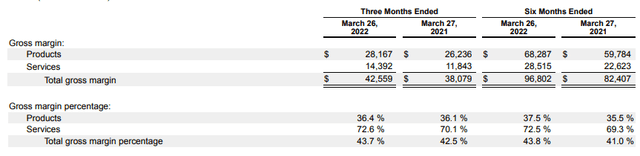

Apple’s valuation is based on the higher multiple placed on revenue and profits generated within the Services business. The Services segment had gross margin of 72.6% in the recent quarter. It also contributed over 33% of the total gross margin for the company.

Figure 1: Gross margins in Products and Services business of Apple.

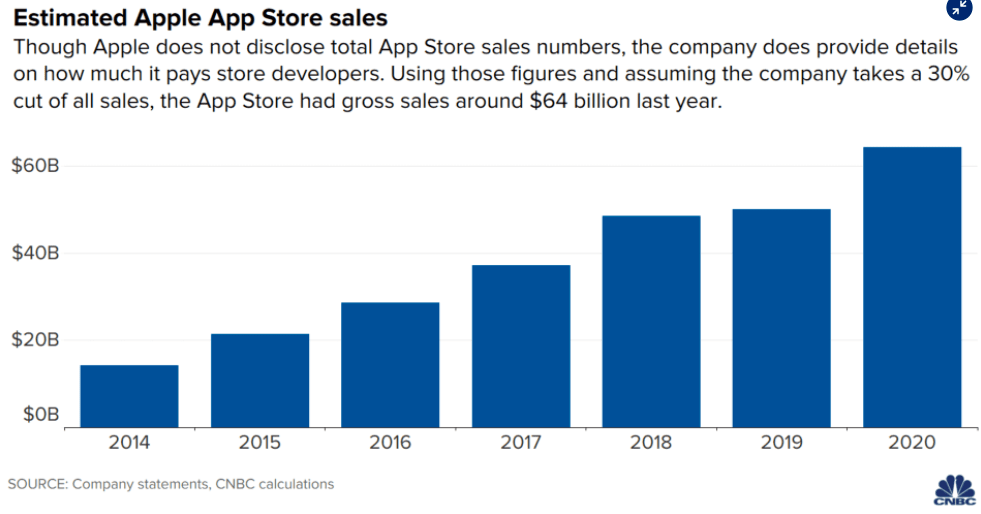

Any major headwind within the Services segment will be viewed negatively by Wall Street. The core growth business within the Services segment has been the App Store which has seen its revenue increase massively in the last five years. The company does not give a breakdown of actual annual sales but CNBC has made an estimation of these which shows rapid growth in this business.

CNBC, Company Filings

Figure 2: Growth in App Store sales.

The estimated App Store gross sales was around $64 billion in 2020 and is still growing rapidly. At this scale, Apple has started affecting the overall app development and tech ecosystem in U.S. and other international regions. It is very likely that we will see more regulations in the domestic as well as international regions that want to limit the control of Apple on the app environment.

Not priced in

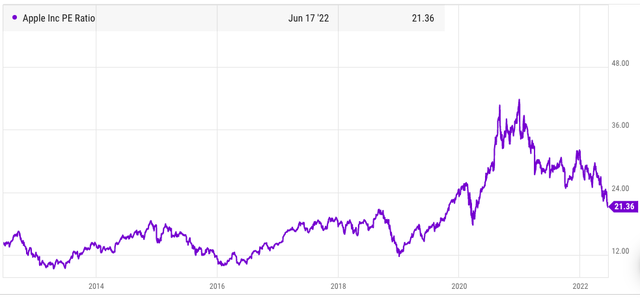

Apple’s regulatory headwinds are not priced in the stock valuations. Wall Street believes that the future Services growth will be a smooth ride for the company, allowing better multiple for the stock. However, we could see a domino effect of negative regulations in a single region spread all across the globe.

Even after the recent correction, Apple stock is still trading at P/E multiple which is above the historical average. The future direction of Apple stock depends heavily on how these new regulations impact its business model. There is a significant downside risk for Apple stock and any major regulatory move in US or other important international regions can build a bearish momentum for the stock.

Figure 3: Apple is trading above its historical average P/E ratio.

As mentioned above, Apple has already decided to allow other payment options on dating sites within the Netherlands. This will likely require Apple to give the same treatment to other dating sites within all EU countries. If Apple does not follow a similar rule for dating sites based in U.S., it would put a massive challenge for app developers in U.S. who compete with EU-based developers. This would not be allowed by regulators. Hence, we can see that negative regulation in a small market can impact the global revenue stream across all regions where Apple operates.

Investor Takeaway

Apple’s regulatory challenge is the greatest among Big Tech companies. The reason is that Apple receives a bulk of its profits from App Store which is facing new regulations across the globe. If Apple is forced to allow other payments options within its App Store, it will significantly reduce the commissions charged by the company. There is also a strong domino effect within the regulatory world which means regulations in a single region would need to be replicated in other parts of the world in order to give a fair playing field to app developers.

Apple could face challenges in its licensing deal with Google which limits competition. It also limits the ability of Apple to claim that it is “privacy-first” company as it uses revenue from Google’s ads. The company is currently trading at above its historical average in terms of P/E multiple. A bulk of the valuation premium in the stock comes from the future growth potential of the Services segment. A massive headwind for App Store or licensing revenue with Google will limit the growth runway of Services segment and also change the valuation thesis for the company. Long-term investors should price in this headwind and look at the future challenges to Apple’s business model due to new regulations.

Be the first to comment