Justin Sullivan

Advanced Micro Devices, Inc. (NASDAQ:AMD) reported results for the third-quarter yesterday and the chip maker missed expectations on the top and the bottom line. However, AMD still managed to generate 29% year-over-year revenue growth due to strong products and customer adoption in the Data Center business. Because AMD is suffering from a weakening PC market and inventory adjustments that led to lower volume shipments in the third-quarter, the chip maker also submitted a disappointing outlook for the fourth-quarter. With persistent uncertainty in the PC market and clouds gathering over the global economy, I believe AMD will have a hard time staging a break-out!

AMD missed estimates

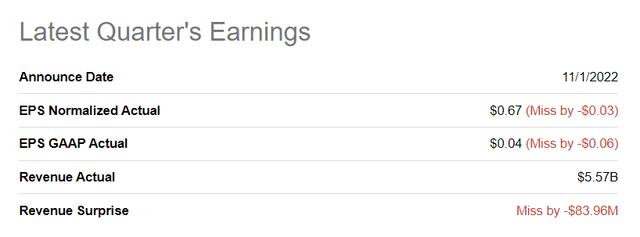

AMD missed earnings and revenue expectations despite guiding for lower revenues in a profit warning in October. AMD had $0.67 per-share in adjusted earnings in Q3 2022, which was below the $0.70 per-share estimate. Regarding revenues, AMD reported a top line of $5.57B, which was also below predictions.

Seeking Alpha: AMD’s Q3’22 Results

In the first week of October, AMD corrected its guidance for Q3 2022 and lowered its total revenue forecast from $6.7B +/- $200M to $5.6B, a down-grade of about $1.1B due to an accelerating down-turn in the PC market. According to consulting firm Gartner, PC shipments of major vendors declined in the double-digits in Q3 2022, with global PC shipments estimated to have dropped almost 20% compared to the year-earlier period. AMD’s third-quarter revenues totaled $5.6B, which met AMD’s preliminary guidance from early October.

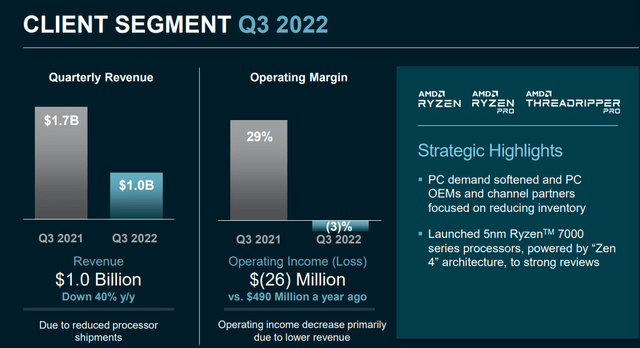

The key reason for the weak earnings card was the slow-down in the PC market, which is responsible for the moderation of AMD’s revenue growth, especially in the Client segment. The Client segment represents revenues stemming from the sale of Ryzen desktop and mobile processors, which expectedly declined by a lot in the last quarter. AMD’s Client segment saw a 40% year-over-year decline in revenues to $1.0B and an operating income loss of $26M.

AMD’s Data Center business, however, kept performing well and will likely continue to do so as AMD gets ready to launch new server processors in the fourth-quarter. Data Center revenues soared 45% year-over-year to $1.6B due to strong demand from corporate customers for EPYC server processors. According to AMD, the fourth-quarter was the 10th straight quarter of record EPYC processor sales, and I see this momentum continuing as AMD gets ready to debut the Genoa-dubbed server chip which is set to launch on November 10, 2022.

The “Genoa” server CPU is AMD’s next-gen processor iteration that is based on Zen 4 CPU cores. According to WCCFTECH, AMD’s newest EPYC processor is 2.6x faster than Intel’s Xeon… which is set to help AMD gain further ground on Intel in the server market. AMD is already benefiting from Intel’s delays of the Sapphire Rapids server CPU, which is now expected to come to market in the first half of FY 2023. According to Trendforce, AMD’s server market share is expected to grow from 15% in FY 2022 to 22% in FY 2023… which is both the result on Intel’s delays as well as a strong product line-up for which AMD is already reporting strong demand.

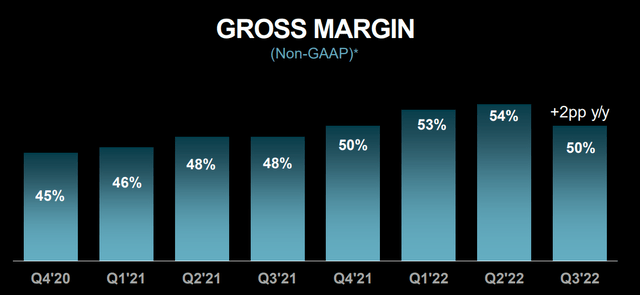

Gross margin trend signals trouble

What I am really concerned about is the decline in AMD’s gross margins, which is the result of lower processor shipments and pressure on average selling prices. AMD’s gross margin, on a non-GAAP basis, was 50% in the third-quarter, showing its first quarter over quarter decline in years. The sequential decline in gross margins strongly indicates that margins have indeed peaked.

Outlook for Q4’22

The outlook for the fourth-quarter is built on the assumption that the PC market will continue to weaken. AMD sees $5.5B +/- $300M in revenues and a gross margin of 51% in Q4’22. The guidance for the full-year is $23.5B +/- $300 Million and a gross margin of 52%. AMD’s full-year guidance is about 11% below its forecast from August which is when the chip maker projected revenues of $26.3B +/- $300M. AMD’s top line growth is therefore expected to slow from 60% (based off of the August forecast) to 43% based on yesterday’s forecast. While AMD’s gross margin is expected to trend up 1-2 PP in the next quarter, I believe that pressure on margins will continue to build, largely because the downturn in the PC market accelerated in the third-quarter.

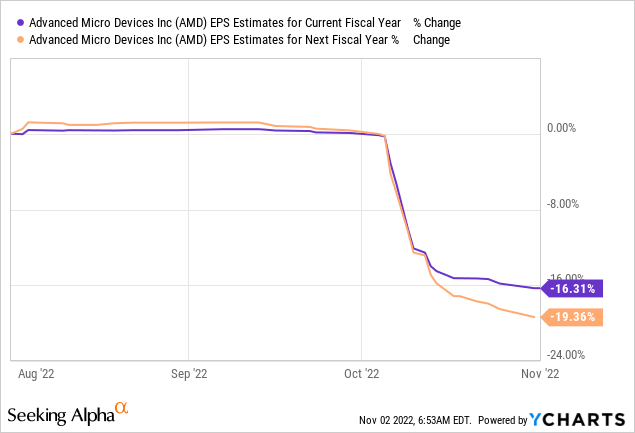

Pressure is building on AMD’s EPS estimates

After AMD submitted its preliminary Q3’22 earnings, estimates for AMD’s revenue and EPS started to drop sharply and they will likely continue to drop as clouds gather over the global economy. High inflation, high interest rates and slowing economic growth are representing serious challenges for chip makers and may result in more hesitancy in capital spending decisions going forward.

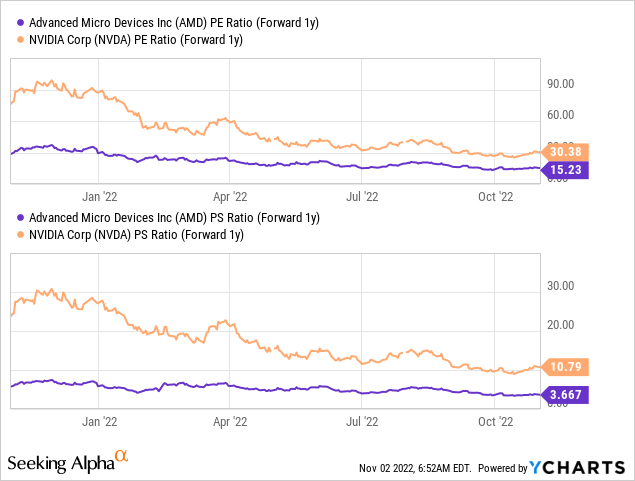

Estimates currently call for AMD to achieve EPS of $3.64 in FY 2022 and $3.92 in FY 2023, implying 8% year-over-year growth. Based off of P/S and P/E, AMD is still a lot cheaper than Nvidia (NVDA), but that alone is not a good reason to buy the stock. With earnings estimates likely to come further under pressure, AMD’s P/E ratio is set to revalue higher.

Risks with AMD

The biggest commercial risk for AMD is a continual slowdown in the PC market, which could lead to lower volume shipments of processors. AMD has been chiefly evaluated based off of its potential to grow its top line, so slowing revenue growth will be a good reason for investors to sell AMD shares. What I also consider to be a risk is the decline in gross margins, which looks to get worse if the PC market continues to decelerate. AMD’s gross margins declined 4 PP quarter-over-quarter in Q3 2022, indicating that the current semiconductor expansion cycle has ended and that margins have indeed peaked.

Final thoughts

Although AMD has a catalyst coming up — the launch of its next-gen EPYC server processors in November — the chip maker is likely to grow a lot slower going forward than it did in the past. Client revenues are almost guaranteed to come further under pressure if the PC market continues to weaken throughout the fourth-quarter… which is what I expect. AMD’s guidance for Q4’22 was also weak. The risk profile, at least for now, remains skewed to the downside!

Be the first to comment