mixmotive

Thesis

Paramount Global (NASDAQ:PARA) stock is now trading too cheap to ignore – currently valued at a TTM P/E of x3.9 and a dividend yield of approximately 5.5%. Although Paramount won’t likely be a winner in the D2C streaming competition, the company’s depressed valuation is hardly justifiable in context of an excellent IP portfolio and continued entertainment successes (e.g., in 2022 Paramount published winning movies such as Top Gun: Maverick, Sonic the Hedgehog 2, Smile, The Lost City).

For reference, Paramount stock is down about 46% YTD, versus a loss of approximately 20% for the S&P 500 (SPY).

About Paramount

Paramount is one of the world’s largest and most successful media conglomerates, with a strong focus on picture entertainment. The company’s brand portfolio includes names such as CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, Paramount+ and Pluto TV.

Paramount operates three major segments: TV Media, Direct to Consumer (think streaming), and Filmed Entertainment. As of late September 2022, TV Media is the largest segment in terms of revenues, accounting for approximately 70% of total sales, followed by Direct-to-Consumer with about 17% and Filmed Entertainment with nearly 13% respectively.

Challenges Are Real …

There are a surely a few good reasons why Paramount stock has sold off sharply in 2022 – I have identified three:

First, investors should consider that almost 30% of Paramount’s revenue is generated through advertising – a monetization vertical that has suffered a very challenging year.

Second, the past few months were not the most favorable for business models that are pushing into DTC streaming. For reference, the major two players Netflix (NFLX) and Disney (DIS) have lost 51% and 43% respectively of their market capitalization year to date.

Third, investors are arguably somewhat worried about Paramount’s substantial debt position. As of late September, Paramount had financial obligations of $17.3 billion versus cash and cash equivalents of only 3.4 billion. Although I consider financial distress very unlikely, I would point out that rising interest rates make debt servicing much more expensive. and thus depress Paramount’s profitability.

Notably, the trend of lower profitability has already started to materialize. For the trailing twelve months, Paramount generated earnings from continuous operations of only $3 billion, versus $4.47 billion in 2021.

… But Markets Overreacted

Although I acknowledge the negativity, Paramount’s challenges should prove temporary: Advertising spent will likely rebound in lock-step with the economy; interest rates will revert towards the structural norm of 2% – sooner or later; and concerns surrounding streaming are already improving. With regards to streaming, all entertainment conglomerates, including Netflix, Disney and Warner Bros. Discovery (WBD), are pushing for more sustainable DTC investments and business models.

That said, as long as Paramount is successful in producing content that people love to consume, I see no reason to challenge the company’s long term value. Investors should consider that in theory it doesn’t really matter whether the distribution medium is DTC streaming or TV media, nor does it matter whether the monetization model is based on advertising or subscription. As long as Paramount’s content provides value, there will be a reasonable and defendable profit margin in the business.

Looking about Paramount’s strong IP portfolio and continued creativity in producing AAA movies, I have little concern that Paramount will fail to attract a viewership for its content. For reference, in 2022 Paramount published the biggest box office hit Top Gun: Maverick, as well as other successes such as Sonic the Hedgehog 2, Smile and The Lost City. These four movies generated cumulative movie theater ticket sales of almost $2.5 billion.

Valuation Too Attractive To Ignore

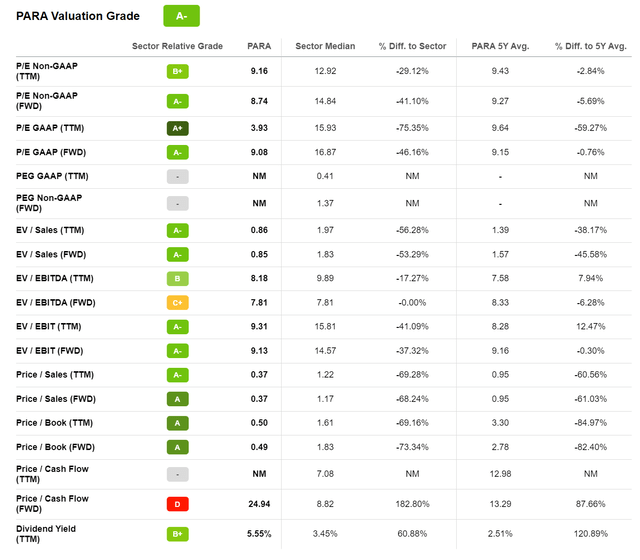

PARA stock is clearly valued attractively – consistently trading at a discount versus the communication sector with regard to all multiples. For reference, PARA stock is priced at a one year forward P/E of x9, versus x16.8 for the sector median, implying a 46% discount. The stock’s P/B is x0.5 versus x1.8 for the sector, a 73.3% discount respectively.

Residual Earnings Model

To estimate a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

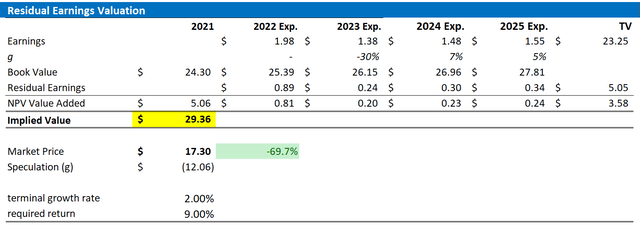

With regard to my Paramount Global stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on PARA’s cost of equity at 9%.

- For the terminal growth rate after 2025, I apply 2%, which is slightly lower than the estimated long-term nominal GDP growth (to reflect prudent assumptions).

Given these assumptions, I calculate a base-case target price for PARA of about $60.24/share.

Analyst Consensus EPS Estimates; Author’s Calculation

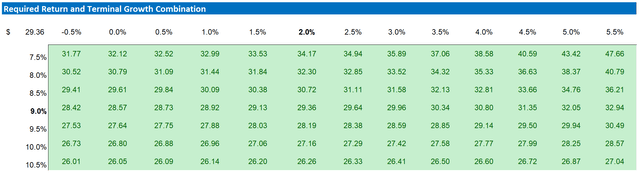

My base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of PARA’s cost of equity and terminal growth rate, I have constructed a sensitivity table. Note that the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus EPS Estimates; Author’s Calculation

Risks

In this article I have presented what I believe are PARA’s three major challenges: (1) broad slowdown in advertising spending; (2) lack of investor confidence in the DTC streaming business model; (3) and rising interest rates in combination with a high financial debt position. Although I believe that the market has discounted these challenges excessively, the headwinds might persist stronger and for longer than what readers might expect.

Moreover, investors should also consider that much of PARA’s share price volatility is currently driven by investor sentiment towards risk assets and stocks in general. Thus, PARA stock price might show strong price volatility even though the company’s business fundamentals remain unchanged.

Conclusion

I am certainly a buyer of PARA stock below $20/share. In my opinion the narrative surrounding the DTC streaming business model has assumed an excessively negative color, and macro headwinds (including >4% interest rates and depressed advertising spent) will eventually improve.

Personally, I calculate that PARA stock should be fairly valued at about $29.36/share (which indicates almost than 70% upside). Buy.

Be the first to comment