lucky-photographer

Macroeconomic Overview

It is not easy being a tech stock investor lately. Despite a decade-long bull run that saw tech-focused story stocks catapulted into media limelight, market gyrations have shifted. To the downside. It all possibly started during the outbreak of the SAR-COV2 pandemic.

At this stage, sovereign banks the world over pictorially put their heads in the sand, voicing upside price pressures as temporary and soon to be resolved. Dismissed as transitionary, national banking systems the world over engaged in monetary easing to aid a global economy reeling from the pandemic-induced shutdown.

During a time when taking the foot off the monetary-easing accelerator would have been optimal, most banks stepped firmly on it.

Fast-forward a few years down the line and the end results are glaring. Double-digit inflation in most developed economies and sovereign banks is playing catch up through unwavering monetary policy hikes. Consequently, restrictive monetary policy has thrown equity, credit, and even real estate markets into a tailspin.

That leads us to today’s ETF analysis. Invesco Nasdaq Next Gen 100 ETF (NASDAQ:QQQJ) follows a modified market cap weighted narrow index of 100 non-finance focused stocks primed to join the Nasdaq 100 index.

It is not exposure to the Nasdaq per se, but rather what may be next for the ever-evolving mega-cap tech focused index. Presently, my outlook remains bearish for the Nasdaq listed equities in general, including securities that may find themselves part of it in the future.

It is therefore hard to get enthusiastic about this newish, alternative option to technology leaning equities. Let us find out more.

QQQJ has slightly outperformed the trading Qs (QQQ) but it is assuredly nothing to write home about.

Product Overview

QQQJ tracks an index on non-financial stocks listed on the Nasdaq. The nuance here is those underlying securities are listed on the Nasdaq but do not make-up part of the renowned Nasdaq 100. Think the little cousin of the Qs (QQQ) – the mega cap cohort of principally technology stocks heavily geared towards the future.

With many technology and innovation focused securities leaning heavily towards the future, price-to-earnings ratios often remain lofty. High PE ratios, a lot of future assumptions, and a general positive outlook are key characteristics of underlying securities.

The problem here is the same securities are often the first to suffer any monetary policy tightening. As risk premiums increase along with discount rates, the present value of future cash flows becomes increasingly important.

In simple terms, money managers prefer real earnings now than any future earnings assumptions. Low book value, more mature industries become more favored, souring investor appetite for technology or innovation securities. This is the underpinning problem with both QQQJ and its bigger counterpart, QQQ presently.

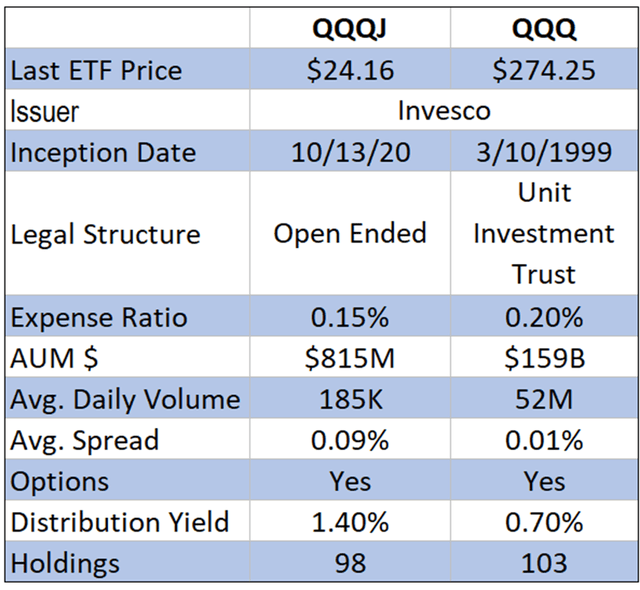

Invesco does, however, provide a compelling pitch. Very low expense ratios (0.15%) on a broad-based US large-cap basket of securities are appealing. The package covers large-cap tech-focused growth equities as mentioned earlier, with underlying assets under management topping out at around $800M. In the ETF world, this is marginal – consider it a niche product if anything.

Options markets are available for investors looking for a tailor-made risk profile, but volumes and liquidity are low, possibly increasing trading costs accordingly.

Equally of interest is the presence of a dividend, albeit small (1.4%) All in, this is an ETF that is appropriate for mid to long-term holding dependent on investment objectives.

Product Structure

Looking under the bonnet provides us with a better idea of exposure. 98 holdings make up the fund with information technology (31.8%), health care (19.92%), and consumer discretionary (13.51%) making up the lion’s share of underlying securities. In terms of industry, that means semiconductor and equipment (9.8%), software (8.33%), and even biotechnology (8.10%) make an entry.

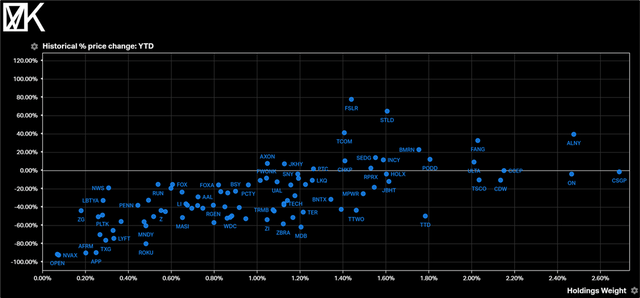

A glimpse of the scatter graph of underlying securities shows just how negative market activity has been, with most finding themselves deep underwater.

The biggest contributors to ETF returns include Alnylam Pharmaceuticals, Inc. (ALNY) with a 52-basis point contribution generated by its 2.48% weighting. The pharmaceutical company’s underlying equity itself has generated +39.71% returns this year.

Not far behind is Steel Dynamics, Inc. (STLD) with a 42-basis point contribution (1.61% ETF weighting) and First Solar (FSLR) delivering +46 basis points off a 1.44% ETF holding.

On the flip side, the laggards have been numerous. Doghouse standouts include AppLovin Corporation (APP) – its measly 0.25% weighting still took -158 basis points off overall ETF returns. Year-to-date, the stock has lost -89.58% of its value. Others include MongoDB, Inc. (MDB) that represented -142 basis points off total ETF returns and streaming-box company, Roku (ROKU) with its -141-basis point deadweight.

All 3 main laggards lost more than -60% of respective stock prices and a represented in the above scatter diagram as the equities at the bottom left of the chart.

Spreadsheet developed by author

Comparative Analysis (QQQJ) v (QQQ)

As evidenced, in the comparative analysis, QQQJ – Invesco Nasdaq Next Gen 100 ETF remains marginal. Assets under management, volumes, and spreads are all bettered by the more well-known Qs. The ETF is much newer but appears to have garnered any real interest over the past couple of years.

Risk Profile

The risk profile for Invesco Nasdaq Next Gen 100 ETF is similar to its bigger technology counterpart (QQQ). Heavily skewed towards technology, healthcare, and consumer discretionary, the ETF suffers markedly during times of restrictive monetary policy and dampened consumer demand.

Unfortunately, that time is now. Structurally, this ETF is appropriate for long-term holding, with no leverage nor use or derivatives playing a part in the fund’s composition.

Key Takeaways

Nasdaq Next Gen 100 ETF groups a bunch of underlying securities listed on the Nasdaq that are yet to make the A-league (AKA be listed on the bigger Nasdaq 100) Underlying securities, and the performance of the ETF itself is anchored to a technology bias that fares poorly in times of recession. That means that despite having all the structural attributes of a long-term holding, your money may be spent better elsewhere.

Be the first to comment