Torsten Asmus

Intro

The predominant way investors and traders both make money in the financial markets is through capital appreciation of the underlying security. This is achieved through a rising stock value or through delta if a trader is utilizing options. However, it has been proven that stocks, for example, spend far more time trading in a sideways manner compared to either rallying or breaking down. Therefore, when an opportunist believes that “sideway share-price action” can indeed be taken advantage of in a respective stock, the prudent play is to take advantage of this phenomenon for profit.

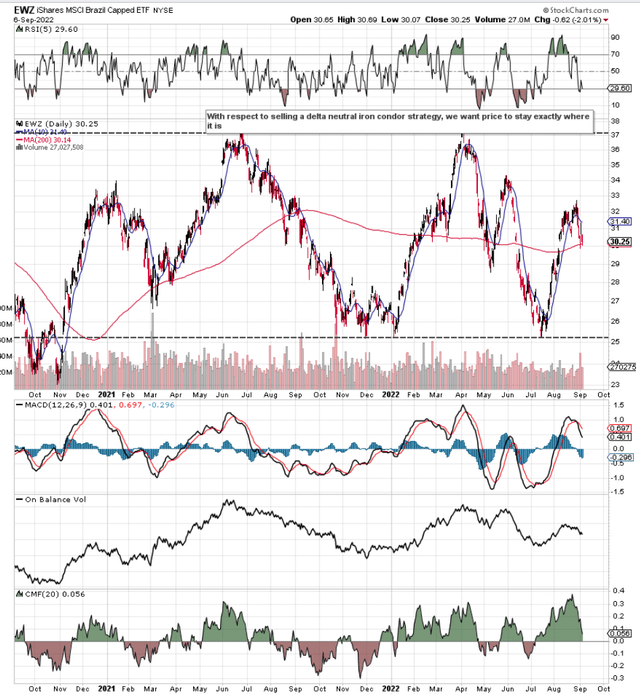

The opportunity we are eyeing up is in iShares MSCI Brazil ETF (NYSEARCA:EWZ) where we believe a delta neutral iron condor is the most appropriate strategy. As we can see from the technical chart below, the ETF is trading right in the center of its trading range, plus it is also very close to its 200-day moving average. This demonstrates that over a short-term basis, EWZ is neither overbought nor oversold. Suffice it to say, for all delta neutral strategies, we want EWZ to stay exactly where it is at present, so we can make money from both theta (time decay) and vega (volatility collapse) over time.

EWZ Technical Chart (StockCharts.com)

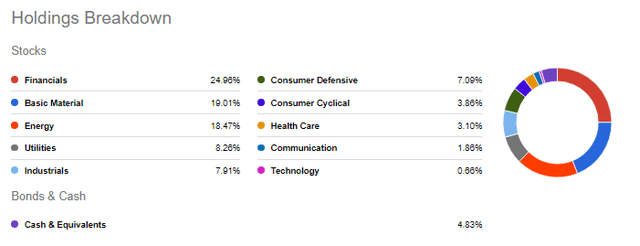

Delta neutral strategies in ETFs such as EWZ attract us because, usually, they are slow-moving instruments with strong liquidity profiles. As we can see below, EWZ is made up of a diverse breakdown of holdings, where financial stocks with almost a 25% stake are the largest segment and iron-ore player Vale S.A. (VALE) with a 13% stake is the largest individual player. Suffice it to say, when you have this level of diversification, earnings reports from some of the mainstays in the fund cannot affect the trajectory of the fund to any great degree. This makes funds such as EWZ ideal for delta neutral strategies.

EWZ Holdings Breakdown (StockCharts.com)

Healthy option volume is always beneficial as tight bid-ask spreads enable us to both enter and exit positions as efficiently as possible. This is especially important when trading spreads where multiple legs make up the respective position. An iron condor, for example, requires four simultaneous option trades (2 spreads) to open up the position. Furthermore, given the fact that we may be in this position for a while which would then lead to rolling the position out in time, liquidity is key in these setups. Bottom Line: Whereas poor liquidity invariably means losing money right off the bat, strong liquidity means you are setting yourself up for success.

Volatility

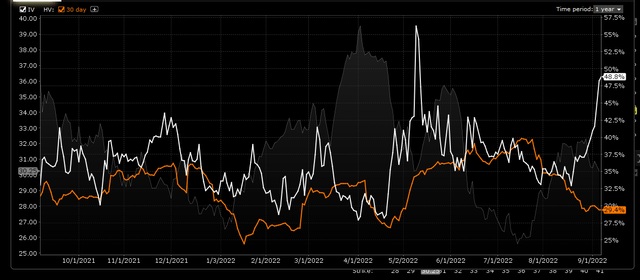

If we pull up a chart of EWZ’s implied volatility and span it out over 12 months, we can see that EWZ’s implied volatility comes in at almost 49%. This means (all things remaining equal) that EWZ over the next 12 months is “expected” to trade in a range roughly 50% north of the current prevailing share price of the fund ($30.25) down to 50% south of this price. This is quite an expectation for a $5+ billion fund with the above-mentioned holdings breakdown. Why do we believe this? Well, look at EWZ’s historical volatility (29%) which is a precise figure that lets us know how much EWZ has moved in the past. This begs the question – why is implied volatility (future volatility) so high compared to previous behavior?

EWZ Implied Volatility (Interactive Brokers)

Strategy

Whereas the fundamentalist will try to figure out why this ETF is expected to be more volatile going forward and obviously the fund’s future correct direction, our job is to take advantage of the inflated option premium on offer by selling iron condors. The advantage of this strategy is that day by day, we profit predominantly by means of vega and theta. If EWZ remains rangebound, we stand pat. If the fund moves significantly, we adjust to once more keep our delta neutral strategy in check. Opening the position with the end in mind is imperative. This means ensuring we have enough strike prices to work with from the outset to ensure any potential adjustments can be precise.

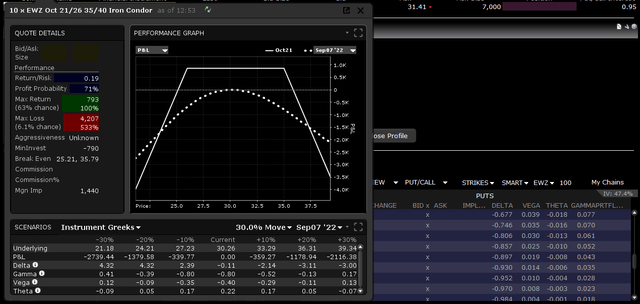

For example, the sale of 10 ($5 wide) October iron condors with put strikes at $26 and $21 along with call strikes at $35 and $40 have a margin implication of $1440 and a maximum return of close to $800 (probability of profit of 71%). Investors and traders should be conscious of the risk involved, which is basically the width of the iron condor minus the credit received multiplied by the number of contracts.

EWZ: Trade Setup (Interactive Brokers)

Conclusion

iShares MSCI Brazil ETF attracts us at present from a delta neutral standpoint. The fund has enough liquidity, continues to trade in a narrow range, and has high implied volatility which is currently well over historical. We look forward to continued coverage.

Be the first to comment