hapabapa

The Rivian stock (NASDAQ:RIVN) has been slowly, but surely, sustaining its uptrend since hitting an all-time low after the company last reported earnings in mid-May. A few positive catalysts for Rivian observed in recent months include meaningful improvements to ongoing supply chain constraints, resilient demand for electric vehicles (“EVs”) despite looming recession risks, and more recently, the introduction of a new $7,500 tax credit aimed at boosting the industry’s growth.

Heading into Rivian’s second quarter earnings call, investors will look to management’s qualitative commentary for clues on how the EV maker plans to achieve its reaffirmed production target of 25,000 vehicles by the end of the year. Specifically, investors will be looking to see if any significant risks exist to derail such plans, especially considering Rivian’s poor credibility from past narratives of repeated delays due to ongoing chip supply shortages, as well as EV peer Lucid’s (LCID) recent decision to slash guidance again, which underscored the difficulty for upstarts in ramping up productions within today’s supply-driven automotive industry.

And although the broader automotive industry has yet to sound alarms on any signs of demand destruction in the face of a cooling economy, investors will likely focus on how Rivian plans to weather the near-term macro risks to its internal operations. This includes updates on how the EV maker’s latest decision to downsize its workforce will impact its long-term business plan, as well as whether it has sufficient liquidity to facilitate ongoing capital-intensive growth efforts that include the construction of a new plant in Georgia.

In the growing list of positive catalysts mentioned above which has benefited the Rivian stock’s performance in recent months, the EV maker’s ability to meet its production target for the year remains the most important one for investors. Although Rivian’s second quarter production results have demonstrated positive progress in ramping up output, the EV maker’s near-term outlook on achieving its annual production target remains a big question mark. As such, we remain cautious on signs of further volatility for the Rivian stock ahead of its second quarter earnings call (August 11th) and over coming months. While any positive commentary during today’s earnings call after the bell on Rivian’s reaffirmed forward guidance would be helpful, we consider its actual September quarter production results to be the key tell-tale in determining whether investors’ confidence in the stock can be restored to sustain further upsides.

Here’s Why Demand is Not the Focus

As mentioned in the earlier section, the automotive industry remains a supply-driven environment. This is further corroborated by resilient growth in Rivian’s order book, which has gradually recovered since its pricing mishap earlier in the year – the EV maker had more than 90,000 reservations for its electric pick-up and SUVs across North America as of May 9th, up from 83,000 reservations in the two months prior. So demand really is not the biggest problem here for Rivian, or any other reputable automaker.

And while Rivian’s R1T and R1S EVs are both priced below the $80,000 cap for eligibility in the $7,500 purchase tax credit, it is likely not expected to be a key beneficiary of the incentive – at least not in the near-term. But nonetheless, the stock has benefited from a nice boost thanks to industry’s improved sentiment on the announcement of such favourable policy support for domestic EV adoption, so no complaints there.

First, order completion and delivery timelines are likely still years away on new reservations, considering the widening gap between Rivian’s backlog and product availability. According to the Rivian website, new reservations are not expected to be delivered until at least late 2023 (you might as well see this as 2024 or later – it is just like how “priced under $10” really means “$9.99”). This means purchase decisions made today on Rivian vehicles are nothing more than a $1,000 deposit. The tax credit does not take effect until Rivian reaches out to the car buyer in the months preceding production to finalize the order and payment, so the latest tax benefit will likely do little to incentivize immediate purchases.

Also, Rivian’s selling point is really its vehicles’ “lifestyle” add-ons. This means most who are looking to buy a Rivian will be opting into the add-on features – like the camp kitchen, tow hooks, and customized tent – which will likely bump it out of the price cap for eligibility in the $7,500 tax credit.

Production Remains the Key Focus Area

Resilient demand for Rivian’s vehicles continues to highlight that its ability in ramping up productions and converting reservations into recognized revenue remain a key focus area and driver in reviving the stock’s uptrend momentum.

Rivian produced 4,401 vehicles (+72% q/q) and delivered 4,467 vehicles (+264% q/q) in the second quarter, representing continued improvements in ramping up productions as we had previously expected. The results beat the average consensus estimate on deliveries of 3,500 vehicles, improving confidence that the EV upstart’s reaffirmed guidance to produce 25,000 vehicles by the end of the year will be reached. Yet, when combined with Rivian’s first quarter production and delivery figures, the EV maker has only produced a total of 6,954 vehicles in 1H22, which only slightly exceeds a quarter of its annual target.

In the following, we turn to three key areas where investors will be looking for an update to determine the viability of Rivian’s production progress ahead:

1. Update on Additional Shift

This is critical, especially after Rivian’s decision to slash its headcount in non-manufacturing capacities to better manage costs ahead of a looming economic downturn, which has raised questions on whether its production efforts will be impacted. Going into the second quarter earnings call, investors will focus on whether the additional production shift that CEO RJ Scaringe had mentioned during the first quarter earnings call has come online yet, and/or how it is ramping up to determine if the 25,000 vehicle production target for the year is still viable.

Rivian had previously disclosed during its first quarter earnings call that approximately 1,400 vehicles were produced between April 1st and May 9th (i.e. approx. 5,000 vehicles produced since inception as of May 9th, less 1Q’22 and 4Q’21 production volumes). This represented a weekly production run-rate of about 280 vehicles per week at the time, which has since improved to an average weekly production run-rate of about 340 vehicles per week by the end of the second quarter, and suggests an even higher weekly production run-rate of more than 370 vehicles per week in the days leading up to period end.

Continued acceleration of Rivian’s production efforts, paired with its reiterated production guidance of 25,000 vehicles for the year points to a back-end weighted year for the EV upstart. With a production requirement of more than 18,000 vehicles over the next six months to meet its target, Rivian will need to ramp its manufacturing run-rate up to about 687 vehicles per week.

Considering the wide production gap that needs to be narrowed still, Rivian’s planned expansion of its annual capacity with the addition of a second shift will be a critical catalyst. Any reversal or delays to such plans will almost definitely derail Rivian’s current year production plans, and put the stock’s near-term performance at greater risk.

2. Supply Chain Woes

Although second quarter production and delivery results indicate that the worst of supply chain snarls might be over for Rivian, the situation remains volatile across the broader auto industry. The stock’s early-month pullback dragged by EV peer Lucid’s declines following a decision to slash guidance also underscores the fragility of investors’ confidence in Rivian’s ability to adequately manage its supply chain and achieve its production goals.

The fluid situation over ongoing supply shortages across the automotive sector will remain a prominent downside risk for Rivian. Rivian’s production volumes have been largely a “function of supply availability” over the past three quarters, rather than its production capacity at the Normal facility as evidence by repeated delays to its start of productions timeline. The requirement to ramp up productions on three models at the same time has likely added complexity to the situation over supply management for Rivian. As such, positive updates on Rivian’s undertakings in actively managing ongoing supply chain disruptions remain one of the keys to restoring its credibility.

3. Capital Efficiency

The company’s recent announcement on slashing headcount by 6% in non-manufacturing roles also draws concerns that the company may have expanded too fast over the past year to support productions that did not ramp-up nearly as fast as initially expected. More importantly, Scaringe’s comment in his internal memo to employees is drawing additional skepticism over whether Rivian’s capital structure is strong enough to sustain operations in coming years – a critical time for ramping up productions to capacity and capitalizing on growing EV demand against rising competition.

We need to be able to continue to grow and scale without additional financing in this macro environment… To achieve this, we have simplified our product roadmap and focused on where it is most impactful to deploy capital.

Source: Bloomberg

Rivian boasts a net cash balance of more than $15 billion, but consensus currently estimates a cash burn rate of more than $19 billion through 2024 to support its ongoing expansion initiatives, which include the build-out of its vertically integrated system of charging infrastructure, addition of a new Georgia plant, penetrating new geographic markets, and ramping up productions on the R1T, R1S and EDVs.

While the company’s potential plans on eliminating duplicate functions could be just a pre-emptive decision to insulate against near-term macroeconomic uncertainties and spur greater operational efficiency to aid margin expansion, it could imply slower-than-expected growth in the near-term, which makes a downside risk to watch for at the upcoming earnings call and monitor over coming months.

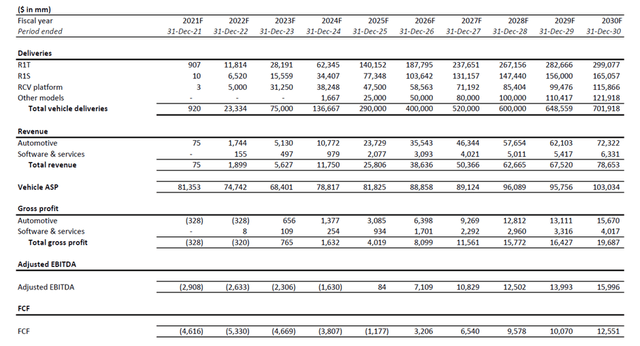

Fundamental and Valuation Forecast

Assuming Rivian will double its current production run-rate with an additional shift coming online some time in the current quarter, and maintain its ongoing success in navigating through unprecedented automotive supply chain bottlenecks that are now seeing signs of gradual easing, we remain positive that it will meet its production target of 25,000 vehicles by the end of 2022. Our forecast projects end-of-year deliveries to total 23,334 units, which is consistent with Rivian’s improving production-delivery ratio in recent quarters as supply chain and logistics constraints gradually ease. This is expected to generate consolidated revenues of about $1.9 billion by the end of the year, considering a higher sales mix contribution from its retail consumer offerings (i.e. R1T and R1S sales) over its commercial offerings (i.e. Amazon delivery vans).

Rivian Delivery and Financial Forecast (Author)

Rivian_-_Forecasted_Financial_Information.pdf

On the valuations front, the Rivian stock has dipped below $40 as we had previously expected, given its decision to increase prices earlier this year foreshadowed heavier-than-expected input cost pressures while investors’ confidence in the consumer sector also pulled back amidst the uncertain global economic growth outlook. With investors still looking for signs of consistent and sustained improvements to Rivian’s production ramp-up in the near-term, we expect further volatility in the stock and have decided to maintain the price target at $39.

The Hot Take Before Rivian’s Moment of Truth

Although the second quarter production and delivery results underscore improvements in Rivian’s supply chain management abilities, such an achievement will need to persist in order to support its 25,000-vehicle production target for the year. As such, we see positive commentaries regarding Rivian’s production capacity and supply chain management abilities at its upcoming earnings call as near-term supporting factors for the stock’s performance. But the ultimate determinant for the stock’s near-term direction – specifically on whether its valuation multiple can resist further contraction – will remain on its actual September quarter performance.

Be the first to comment