claudio.arnese/E+ via Getty Images

Article Thesis

VICI Properties (NYSE:VICI) is a quality REIT that has performed well throughout the pandemic and that has made a range of major deals in the recent past, including the MGM Growth Properties acquisition that closed during Q2. The company’s results for the second quarter were very solid as well, but the company has now become somewhat pricey, following a strong year-to-date performance. Some investors may want to consider locking in gains, e.g. by using an options strategy called covered call writing.

VICI Continues To Deliver Solid Results

During its fiscal second quarter, VICI Properties performed well. The company generated revenue of $660 million, which was up by a massive 76% year over year, and which beat the consensus estimate by more than 10%. It should be noted that this growth was driven by acquisitions to a large degree — underlying/comparable growth was weaker. When VICI Properties makes acquisitions, these are generally either financed via debt or via the issuance of new shares. In the case of acquisitions being financed by debt, interest expenses for the company climb, which is why additional revenue or gross profit does not flow through to the bottom line completely. In the case of acquisitions being financed by the issuance of new shares, company-wide profits are distributed over a larger number of outstanding shares, which is why earnings per share are growing at a slower pace compared to VICI Properties’ overall net profit. Management knows this and only makes deals where profits on a per-share basis have a high chance of rising despite these headwinds, but investors naturally can’t expect earnings per share or FFO per share growth at a similar level to the company’s outstanding revenue growth rate in an acquisition-heavy quarter.

In Q2, the company managed to grow its funds from operations per share by 3.7% year over year, as a 68% company-wide FFO increase was mostly offset by a big increase in VICI Properties’ share count. FFO per share growth of around 4% is far from bad, especially for an income vehicle such as a REIT that offers a solid 4%+ dividend yield. But a 4% FFO per share growth rate also isn’t too exciting, at least relative to the way higher company-wide revenue and profit growth rate.

Looking toward the second half of the year, VICI Properties’ management believes that performance will be solid and relatively on par with what we have seen during the most recent quarter. The company guides towards funds from operations of $1.67 billion, which equates to funds from operations of around $1.90 on a per-share basis. The company generated adjusted funds from operations per share of $1.82 during 2021, thus the current guidance implies a growth rate of around 4% — again, that’s pretty solid for a REIT or income stock in general, but it’s not extraordinary.

VICI’s Longer-Term Outlook Is Healthy, But Valuation Has Run Up

VICI is an absolute leader in the gaming real estate space and benefits from scale and cost of capital advantages versus smaller peers. VICI Properties is well-positioned to continue to consolidate the space, by making either larger takeovers such as the recent MGM Growth Properties deal or by making tuck-in acquisitions of smaller assets. I do believe that M&A will be a positive factor for the company’s future growth, although it’s hard to prognosticate how many deals, and at what size, the company will make over the next couple of years.

Organic growth is another driving force for higher FFO in the coming years. VICI Properties has locked in rent increases via the contracts it has with its tenants. A large portion of those contracts is CPI-linked, although unfortunately oftentimes with a cap in place. The MGM Grand/Mandalay Bay rents, for example, are CPI-linked with a cap of 3.0%. While those caps seemed irrelevant a couple of years ago when inflation was running in the 2% range, they are a disadvantage now — CPI is running with a 9% handle, but VICI Properties only gets a 3% rent increase due to the cap it agreed to when crafting a contract for this property. Organic rent growth will thus likely be somewhat subdued, relative to inflation, in the foreseeable future, although VICI Properties still will benefit from rising rents that should lift its funds from operations, all else equal.

Between M&A and some organic growth, VICI will continue to deliver reliable revenue and FFO growth, I believe. Analysts are currently predicting that the FFO per share growth rate will be in the 15% range next year, and around 4% in the year after. When we include this year’s forecasted FFO growth, that comes out to an average 7% annual growth rate, which is quite attractive. It remains to be seen whether next year’s increase will really be as large as expected. The capturing of synergies following the MGM Growth Properties acquisition could allow for an above-average growth rate for sure, but actual growth may still be below the 15% level.

Overall, I do believe that VICI has a very solid growth outlook and that investors can expect reliable performance from this strong management team that has been executing well throughout the pandemic.

But not every company with a solid outlook is necessarily a buy all of the time. Valuation has to be considered as well, and VICI has become somewhat pricey in recent months. While I was pretty bullish on VICI earlier this year, as shown in this article from March, I’m less bullish now — the company has offered a total return of 30% in those five months, whereas the market has pulled back by 8% over the same time, which means that VICI has outperformed the broad market by around 40% since that article was published. Naturally, I’m less bullish now, following this outsized gain relative to the broad market.

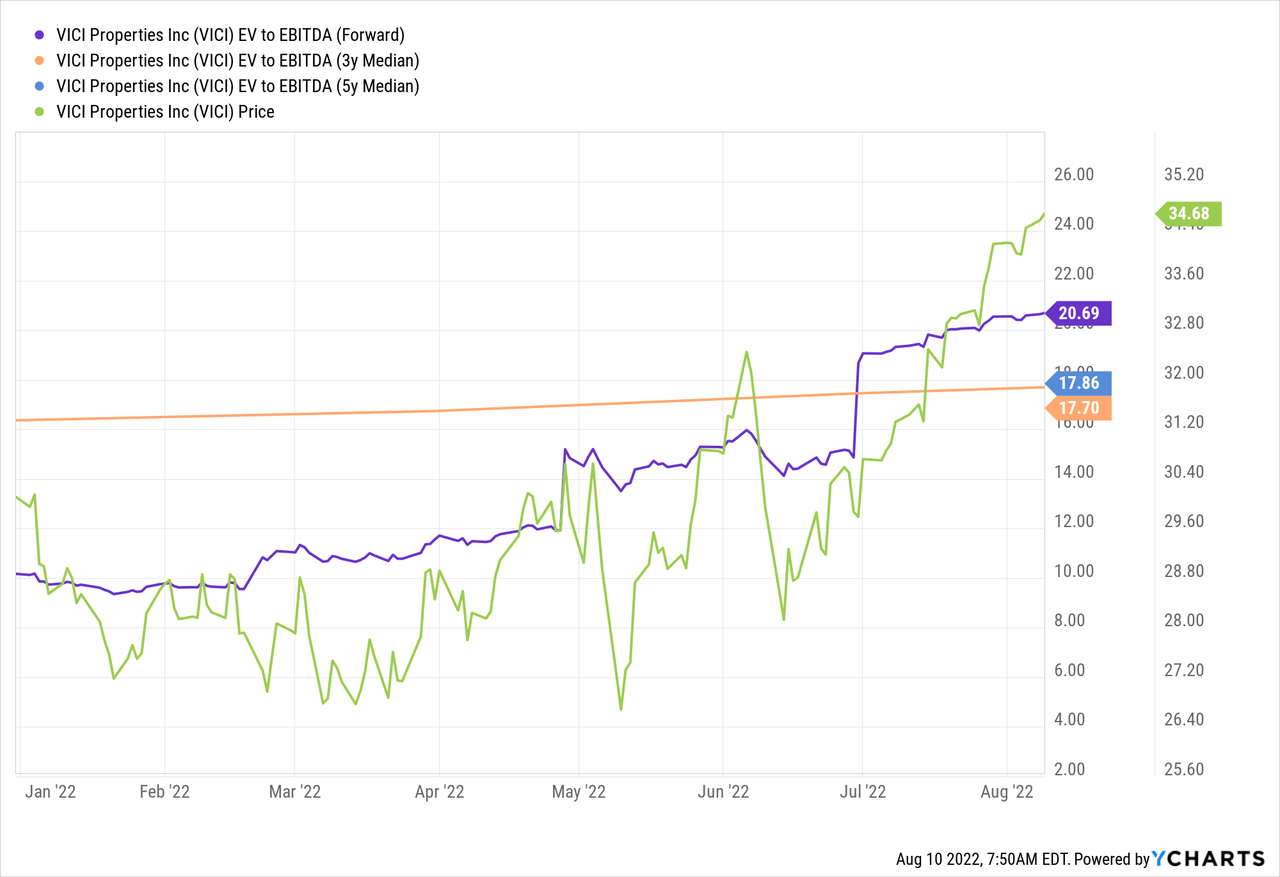

VICI’s valuation has also climbed considerably in that time frame:

While VICI Properties traded at a below-average valuation earlier this year, shares have now climbed to an above-average valuation. Today, VICI Properties is trading with an enterprise value to EBITDA multiple of around 21. That’s 15%-20% higher than the longer-term median EV/EBITDA multiple. In other words, VICI is trading on the expensive side, relative to the company’s history. An EV/EBITDA multiple above 20 also is pricey in absolute terms, I believe. Naturally, I think it’s best to buy when valuations are low in absolute terms and relative to historical trading patterns. That’s not the case today, as we can easily see above, although it was the case at the beginning of the year. With shares trading at a premium relative to what the company’s trading history shows, some investors may want to think about locking in gains.

One way to do so could be an options strategy called covered call writing. If an investor is willing to sell VICI at a specified price, e.g. $37.50, the investor could sell a covered call with a strike price at that level. The January 2023 calls for VICI Properties with a $37.50 strike price trade with a premium of $1.10 right now, which means that an investor could generate an additional $1.10 per share over the next five months by selling these calls. This equates to an additional 3% in income over that time frame, or more than 7% annualized. Combined with the dividend yield of 4%, that would make for attractive income potential. If shares get called away, that happens at a price of $37.50, which is around 7% higher than the current share price — which is somewhat elevated already. Of course, by selling covered calls, one’s upside potential is limited — if VICI were to soar above $40 over the next couple of months, for any reason, then the gains of the covered call-selling investor would be worse than the returns of investors that do not sell any calls on their position. But for investors that agree that VICI is somewhat pricey today, selling covered calls could be a good idea to boost their income, I believe.

Takeaway

VICI is a high-quality REIT with strong management that has delivered strong business growth. Growth on a per-share basis is way less compelling, but still solid. Overall, VICI is a very solid income pick, but it has become somewhat pricey in recent months. Following hefty outperformance versus the broad market so far this year, investors may want to consider locking in some gains, although continuing to hold onto VICI as a long-term buy-and-hold investment could be a reasonable choice as well for those that prefer not to trade their investments too much.

Be the first to comment