hh5800

Despite softness in some of its markets, Power Integrations (NASDAQ:POWI) managed to deliver strong results for the quarter. Second quarter revenues were up 2% y/y to $184 million, which was slightly below its previous guidance range. Where the company really impressed was with its non-GAAP earnings per share, which grew 24% y/y to $1.03 driven by a significant expansion in gross margin.

The company had been warning since the previous quarter that there were emerging concerns regarding the near-term demand environment, particularly in the mobile segment. The weakness in the smartphone market has been confirmed and had a significant impact in Q2 results. Revenues from the company’s communications category were 30% lower sequentially and driven entirely by Chinese handset customers. Revenues from other smartphone OEMs were up slightly from the prior quarter. Softness in the computer category was also significant, but was cushioned by recent market share gains in notebooks, resulting in a modest decrease of ~5%. Industrial revenues were the star segment in the quarter, increasing ~20% sequentially.

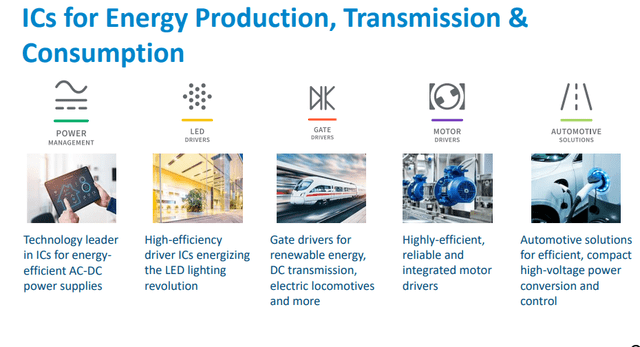

While softness in several of the company’s markets can be a source of worry, the good news about the company is that it has a history of gaining significant market share during downturns. They tend to see it as an opportunity to go after more design wins and come out of the downturn stronger. The other thing is that even if some cyclical headwinds are starting to appear, the company continues to have very strong secular tailwinds that should help it continue to grow over the long-term. It also has a strong competitive advantage with its GaN technology, which has many benefits when it comes to efficiency, and low-power consumption, and this is becoming increasingly important in a large number of applications. The slide below shows just some of the main applications.

Power Integrations Investor Presentation

Q2 2022 Results

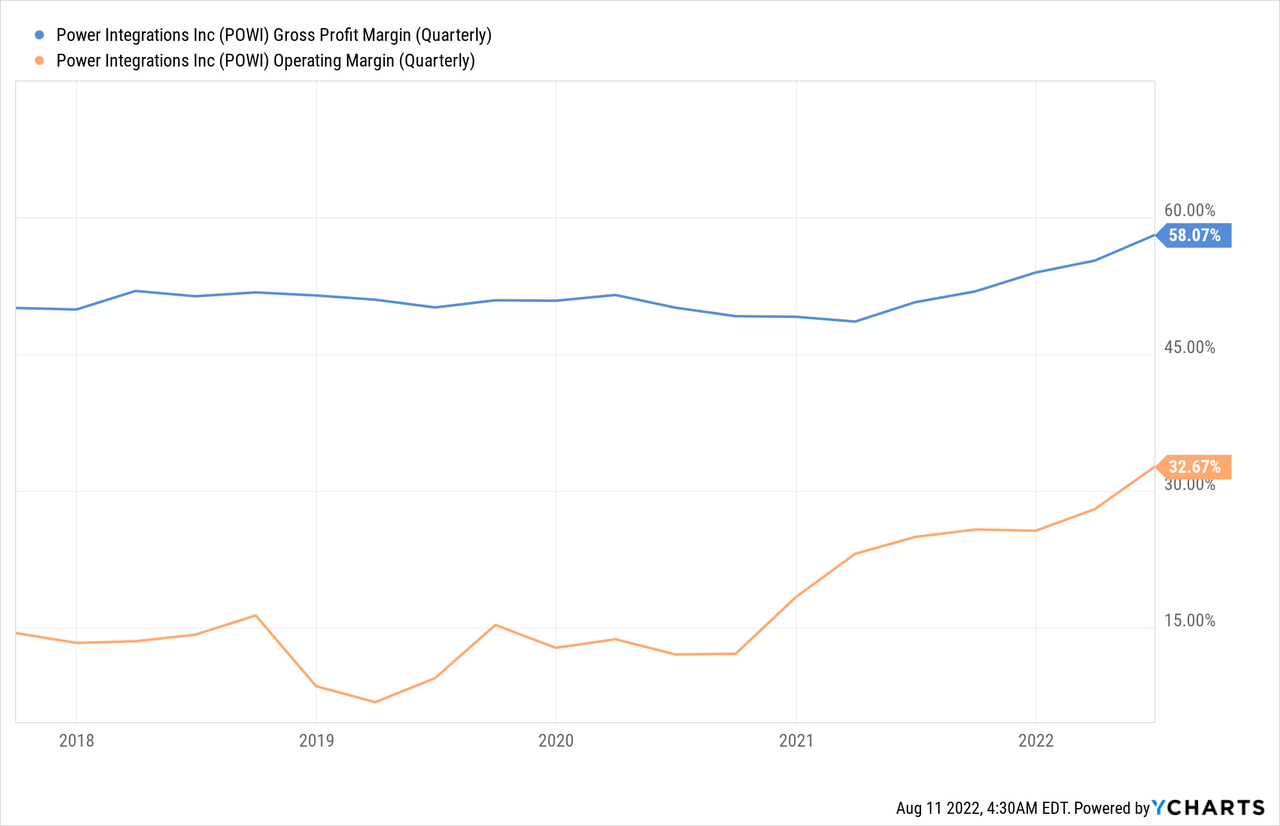

Revenues increased two percent year over year to $184 million. GAAP earnings were $0.96 per diluted share, while non-GAAP earnings per diluted share grew 24 percent y/y to $1.03. Manufacturing efficiencies have been helping them a lot. Power Integrations believes that some of the gains in operating margins, in large part thanks to operating leverage, are sustainable and has updated its target model for non-GAAP operating margins to a range of 25%-30%.

Revenues from the communication category fell nearly 50% compared to H1 last year, reflecting the recent weakness in smartphones but also the unusually strong demand in the first half of 2021. Computer revenues were up 15% y/y driven mainly by notebooks. Consumer revenues were up mid-20s driven by appliances, while industrial revenues increased nearly 40% y/y. Revenue mix for the second quarter was 38% consumer, 35% industrial, 18% communication and 9% computer.

Financials

During the quarter, the higher-margin industrial and consumer categories accounted for 9 percentage points more than in the prior quarter, driving non-GAAP gross margin up to 58.5%. The company expects gross margin to remain above the high end of their target range for the next several quarters, thanks to favorable mix and manufacturing efficiencies, and the strength of the dollar versus the yen.

Power Integrations repurchased 1.9 million shares during the June quarter for $158 million, exhausting the company’s repurchase authorization.

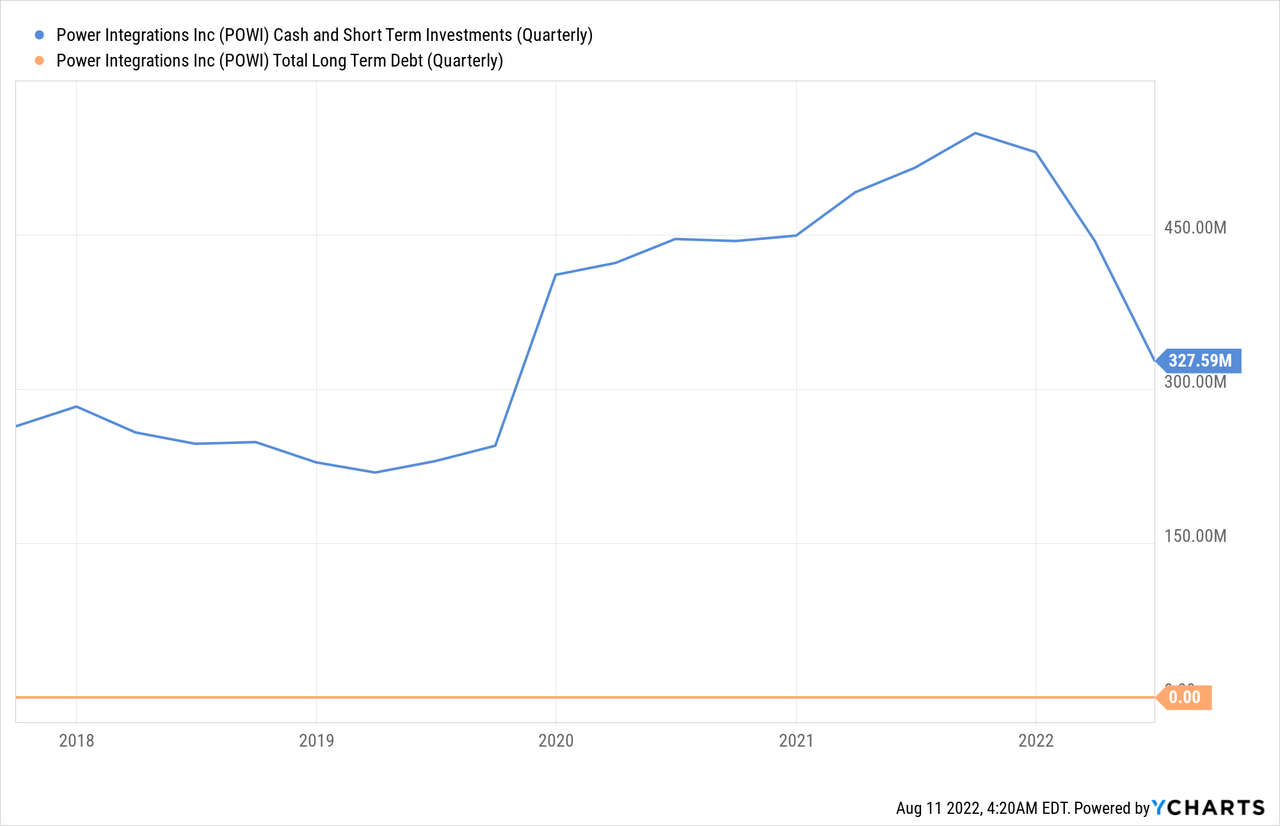

Balance Sheet

Cash and investments on the balance sheet fell by $116 million during the quarter to $328 million. Despite this reduction, the company continues to have a significant net cash position, with basically no long-term debt. We view the balance sheet as still extremely solid, and it continues to provide optionality for the company should it decide to make more aggressive investments or pursue M&A.

Guidance

The company expects revenues for the September quarter to be $165 million, plus or minus 5%, and non-GAAP gross margin for Q3 to go down slightly to about 58%, reflecting the seasonal slowdown in air conditioning, which will result in a slightly less favorable mix.

Valuation

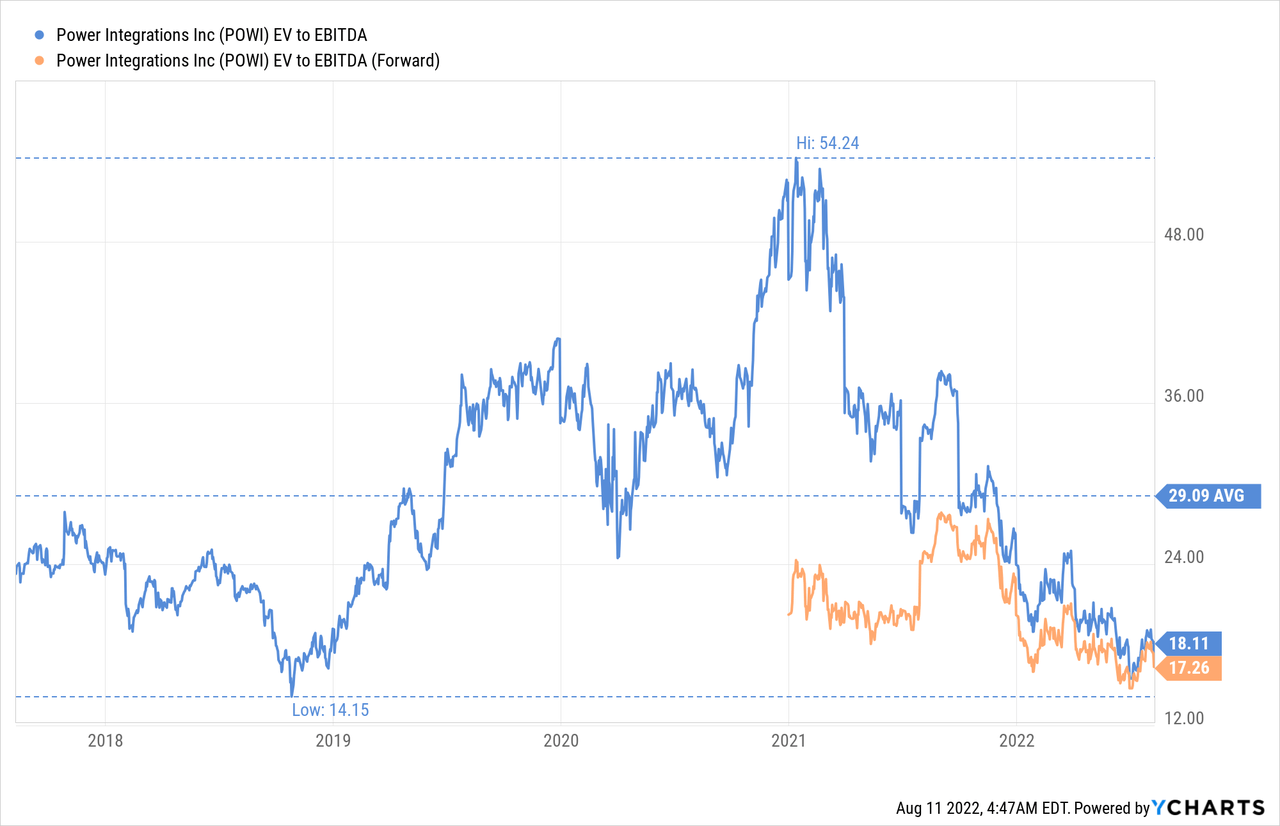

Thanks to the strong results the company has delivered the valuation is getting a lot more attractive. On an EV/EBITDA basis shares had not been this cheap since the market crash of late 2018. Both the EV/EBITDA and the forward version are both considerably below the five year average for the company.

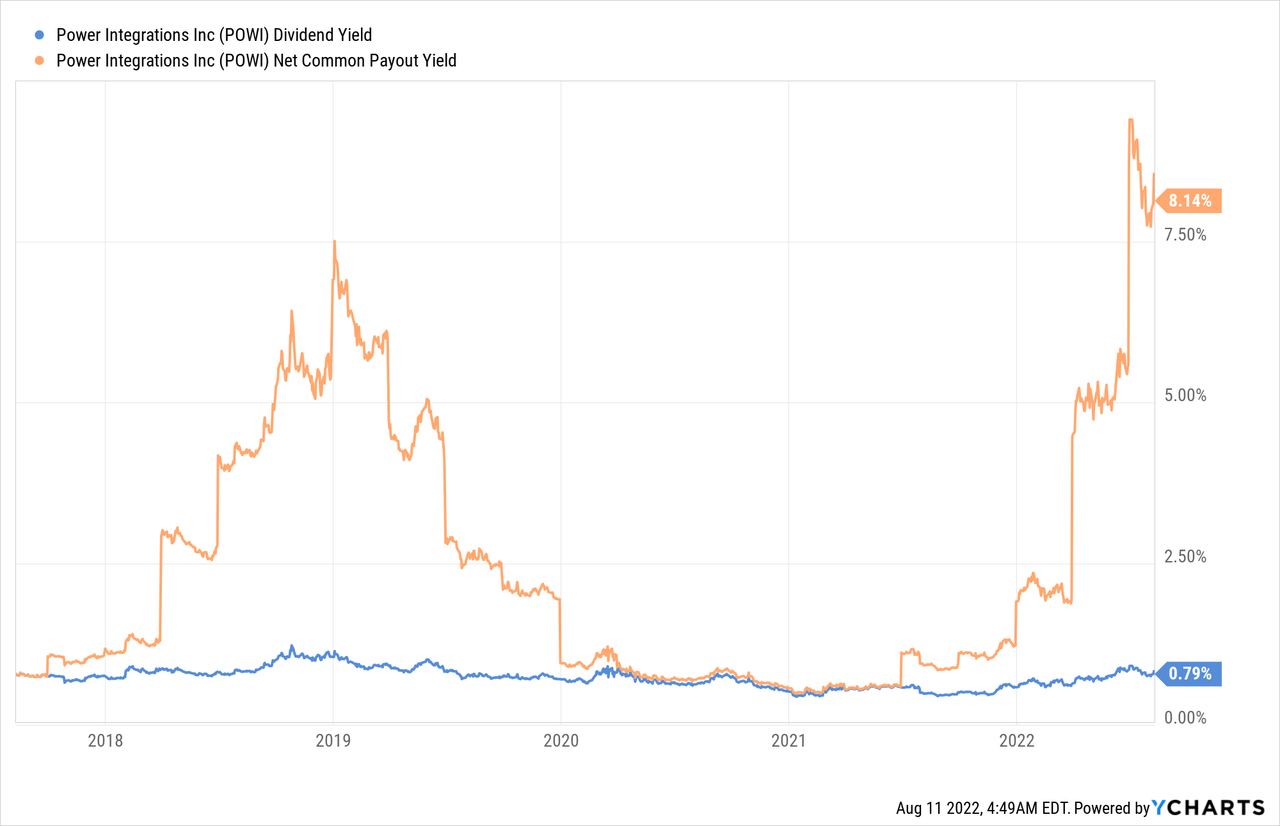

The company seems to agree that shares are currently trading at an attractive valuation given that they have been buying back shares in a significant manner. While the dividend yield remains low, the net common payout yield, which incorporates net buybacks, is currently very high.

Risks

In the short term the biggest risk we see is that the current downturn turns out to be much worse than expected. The expectation right now is for some softness in some of the markets, but there is always the risk of a significant crash in demand.

Longer term the biggest risk we see is technological risk. Power integrations is greatly benefiting from its strong technological position, especially with its GaN technology, but there is always the risk that competitors will come out with something even better.

Conclusion

While Q2 revenues were below the range, reflecting the downturn in demand, Power Integrations nevertheless had an excellent quarter from an EPS standpoint, driven by a strong gross margin and lower than expected operating expenses. The strong results have reduced the valuation metrics, and the company is currently trading at multiples that look quite attractive. In particular EV/EBITDA had not been this low since the market crash of late 2018. The company seems to agree that shares are at an attractive valuation, given the significant repurchases the company has been doing lately. All in all, the recent results reaffirm our belief that shares are attractive at current prices, even if it is becoming increasingly likely demand is going to be soft for the next few quarters.

Be the first to comment