naphtalina/iStock via Getty Images

Intelligent Living Application Group (NASDAQ:ILAG) is a $65 million market cap business that sells locksets under the Kambo and Bamberg brand. The company is a holding company in the Cayman’s that owns subsidiaries based in Hong Kong and China. They are subject to numerous risks, including demand and supply side risks, but also regulatory risk in China and risks related to delisting. This IPO was for the purpose of funding development of software for their smart-lock products, which are soon to come out. Ultimately, they are a small player among plenty of competitors with more developed products and better financial positions. As cash becomes a more valuable resource, and as problems that are tougher for a smaller player to deal with persist, its competitors are more attractive than they are for people interested in the lockset market. Still, it’s good to know what’s out there, so here’s a breakdown of ILAG.

When did ILAG go public?

ILAG went public through IPO on July 13, 2022 on the Nasdaq Capital Market with an initial valuation of $4 per share equaling a $72 million market cap. The purpose of the IPO was to move forward with R&D on smart locksets that had to be put on pause over the last couple of years such that work on the software was not completed.

Most of our research and development on smart locks have been done internally by our technician and engineers, except that Hing Fat hired outside services for approximately $25,000 in 2017. Because of tariff war and outbreak of COVID-19, we haven’t made further progress on the software for our smart locks to save more working capital for our core operation.

Prospectus ILAG – ‘Our Business Section’

The business isn’t listed on any other market, which constitutes one of the first potential issues. Many companies that are substantially Chinese have listings in Hong Kong or Shenzhen, and this mitigates the impact of the HFCAA regulation that came into effect under President Trump as part of the set of moves designed to crack down on Chinese companies in the US market. Currently, ILAG does not have a problem in the face of this regulation, because the Auditors it retains are in the US. However, if for any reason they would be assessed as unable to fully complete their duties by the regulatory authority the PCAOB, they could run afoul of the HFCAA which would lead to the delisting concerns that are putting a lot of pressure on other companies like Alibaba (BABA). As far as we understand it, ILAG is so far in the clear as it works with a NYC headquartered auditor (called Wei, Wei & Co., LLP), but various decisions by China or the US could change whether or not that is enough. If they were to be identified as a potential problem (a.k.a a Commission-Identified Issuer), in several years they could face delisting unless they were able to comply, which would depend not only on them but also agreements between Beijing and Washington over auditor access and accountability. A resolution there is not assured. Because they don’t have a listing elsewhere, this would affect their liquidity a lot and create a lot of price volatility and forced selling. This is something that investors in Chinese companies need to be aware of, and it’ll be detailed in 10-K or prospectus risk sections.

ILAG Markets

What are ILAG’s markets? Geographically, almost all the sales are in the US market and the model is to sell wholesale. They’ll likely continue to do this and do so in the APAC market, where they are hoping to expand their markets. However, they have acknowledged substantial price competition in APAC markets, which limits marginality in this market, while in the US it is quality-based competition and there is more scope for pricing and building significant contribution.

End-markets are property developers, leisure and hospitality markets (especially with the smart lockset foray), but also residential markets. There is a reopening element that is unwinding some of those markets that were hamstrung by COVID-19 like leisure and hospitality. But new business development in APAC for these markets will be somewhat limited as China is still in lockdowns, perhaps a signal for what’s to come for the rest of us given they were ground-zero for the pandemic. While reopening is restoring markets in the US, other markets may be in more trouble. ILAG customers may dial back purchases if property markets and development rates suffer. Developers are already struggling in terms of volume with the supply chain shortages, but it could become a demand problem as well since interest rates are rising. Office real estate might be going into secular decline, so those markets are a bit shaky too.

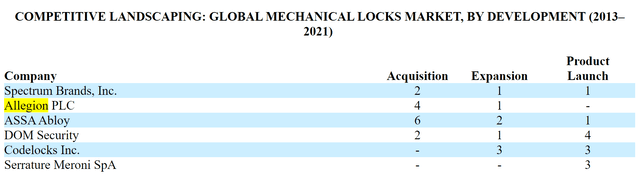

The following are some of ILAG’s competitors in their markets, excluding companies like Dormakaba, AB ABLOY and others.

Most of these companies also operate in other businesses, but some like Allegion plc (ALLE) are closer to ILAG which is a lockset pureplay. Allegion is in the market of company security and building security, and it deals with a lot of door features including locksets and ID systems. Its mechanical products segment is about 80% of its business and meaningfully overlaps with ILAG’s markets. Allegion is ahead in terms of software and technology, where ILAG has only spent some $20k on contracting R&D in addition to in-house and has had to put those efforts on hold over the last couple of years to preserve working capital and deal with business troubles, which include more than just some end-market pressures related to COVID-19 and current China lockdowns. Allegion is not highly levered and has a lot of debt capacity with a cash-generative business model, while ILAG has had to resort to equity markets to finance their R&D. Moreover, they are less exposed to the power control issues that are hitting some of China’s manufacturers like ILAG, where power consumption from the factory floor is limited by government mandate as a measure to save power now that energy has become scarce. Also, with China’s continuing COVID-19 problem associated with the continuation of strict controls, manufacturing becomes further disrupted from time to time. All of this limits ILAG’s ability to scale and pose a threat to well-capitalised incumbents like Allegion.

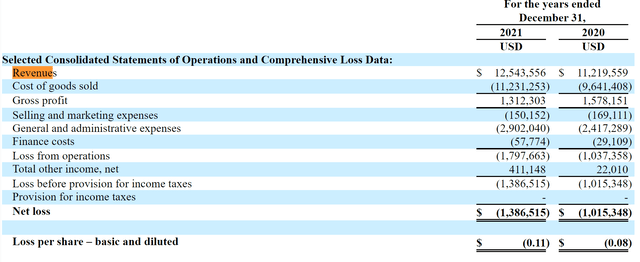

Financials

The financials reflect the troubles of a company that is dealing with tougher end-markets and is selling a product that is already established in the market. They are achieving growth, but the new forays like digital locks and the APAC market, in general, will unlikely supercharge growth that much further, especially with the end-market demand environment being ambiguous.

Statement of Operations (ILAG Prospectus)

The lack of scale is limiting their profitability, and the losses only grow as they make their first moves to scale operations. While there will be an inflection point, we don’t see any strong catalysts fundamentally to push them quickly to that point and avoid more capital market action. With the IPO, the company has raised around $20 million, which is great. This dwarfs their last disclosed cash position of $131k and will sustain the business for quite a long while. While R&D will start growing operating outflows, the current cash burn is about $1 million a year. Assuming that doubles, you’ll be covered for several years, given the debt position is only around $2 million. Leverage will not be a problem and dilution risks are minimal, but the company will need to grow quite a bit before it emerges from unprofitability, especially since the company has been keeping belts tight prior to the IPO, which does relieve the pressure.

Valuation

In light of this, the valuation at 6x P/S seems quite high. Taking Allegion as a comp, it makes sense that investors might be interested in this business on the basis of rather high margins and good cash flow generation. End-markets are generally solid, although they are going to go through some strain in the current macro environment. But with a 6x P/S multiple implying quite a lot of scaling and growth expectations in a period where there isn’t much frenzy in their end-markets, and their growth will primarily be attributed to the marginal benefits of starting small, we don’t think this is the right moment and price to invest.

Bottom Line

When investing in a company that is priced for growth, your hope from a valuation perspective is that the company is firing on all cylinders, so it can emerge quickly from a more uncertain stage in its life to a more solid one, which also puts a premium on it as more investors begin to ‘qualify’ for investing in it. Catching a theoretically profitable company early is a good strategy. We believe in the theoretical profitability of a lockset business, but don’t understand the edge that ILAG is supposed to offer in terms of product, and with the pie of their end-markets not necessarily growing right now, investors risk a slow growth of this company into its current valuation. Leverage and dilution aren’t a major concern, really just growth expectations implied by the market price. Moreover, it is a Chinese company in effect, and the delisting spectre is one to be aware of. Finally, operating substantially in China, there is regulatory uncertainty at all times that has already had an impact on the business. It is an emerging market company in the end. Being wary of the markets in general and realistic about the valuation and operating risks, a company that still emerging from profitability and operating in China worries us a bit. The market share is still tiny after all, not even a blip on these larger radars for now, and without a smart-lock product yet. We’d stay on the sidelines.

Be the first to comment