John Moore/Getty Images News

Introduction

As a dividend growth investor, I constantly seek new income-producing investments to increase my income stream. Sometimes I allocate capital to existing positions, and other times I acquire shares in new companies to increase my diversification. The current bear market can be an opportunity to gain more income for a more attractive price.

One elusive segment for many dividend growth investors is the basic materials sector. Companies there tend to rely heavily on the prices of commodities and become highly profitable when commodity prices are up but may lose money during recessions when demand is low. This high volatility makes the sector less attractive for dividend growth investors seeking consistency. Shares of Albemarle (NYSE:ALB) may be a suitable addition for dividend investors.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Albemarle Corporation develops, manufactures, and markets engineered specialty chemicals worldwide. It operates through three segments: Lithium, Bromine, and Catalysts. The company serves the energy storage, petroleum refining, consumer electronics, construction, automotive, lubricants, pharmaceuticals, and crop protection markets.

Fundamentals

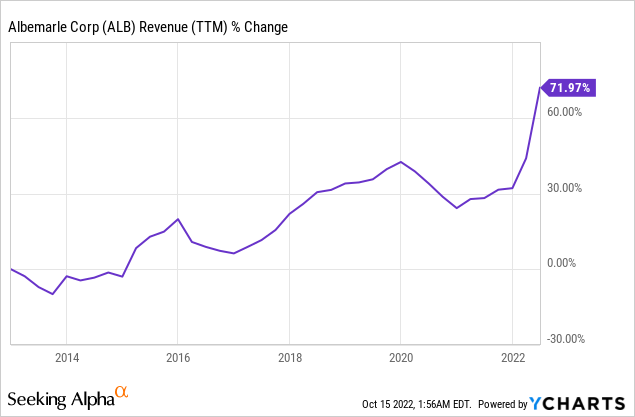

Sales of Albemarle have increased steadily over the last decade. Sales are up 72% over the previous ten years. Sales have grown organically as the company increased capacity and enjoyed commodity prices increasing and inorganically as it was active in the M&A field, primarily in the acquisition of Rockwood Holdings for $6.2B in 2014. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Albemarle Corporation to keep growing sales at an annual rate of ~10%+ in the medium term.

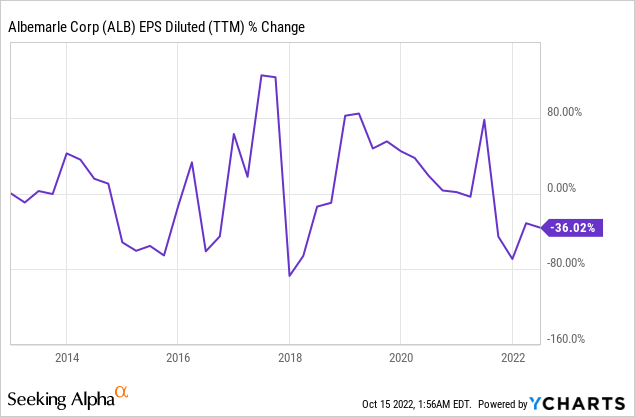

The EPS (earnings per share) may be a bit more misleading. It looks like the EPS has been down significantly in the last decade. However, this is GAAP earnings taking into account the significant Capex investments that the company is executing to increase capacity. Non-GAAP EPS shows that EPS is down 18%, but with the substantial increase expected in 2022, it will be up almost 300%. It shows how volatile the basic materials sector can be. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Albemarle Corporation to keep growing EPS at an annual rate of ~12%+ in the medium term.

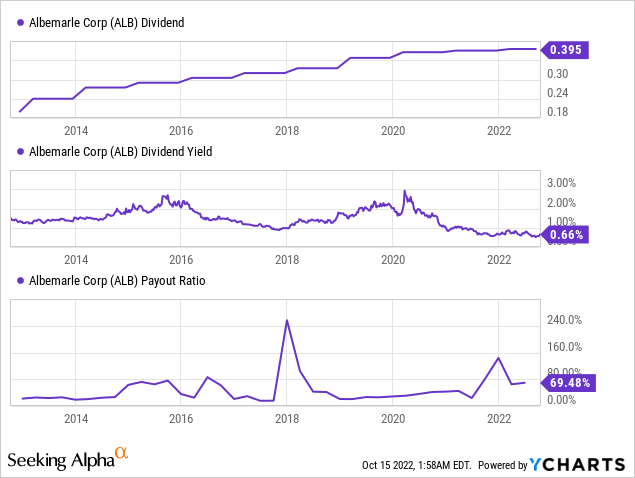

Albemarle is a dividend aristocrat who has raised the annual dividend it pays for 27 years. The company does it by having a conservative payout ratio. While it looks high at 70% of GAAP EPS, it is below 20% when considering the 2022 non-GAAP forecast. The GAAP figure is affected by significant CAPEX to increase capacity. The company’s dividend yield stands at 0.66%, with much room to grow.

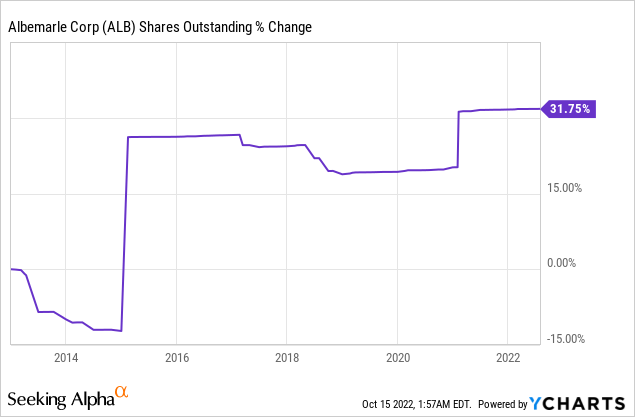

In addition to dividends, companies tend to return capital to shareholders via buybacks. Buybacks are highly efficient when the share price is low. Thus they improve the EPS significantly. Albemarle Corporation has not been executing a significant buyback plan. The number of outstanding shares increased considerably in the last decade. However, this was due to mergers and acquisitions accretive to the EPS.

Valuation

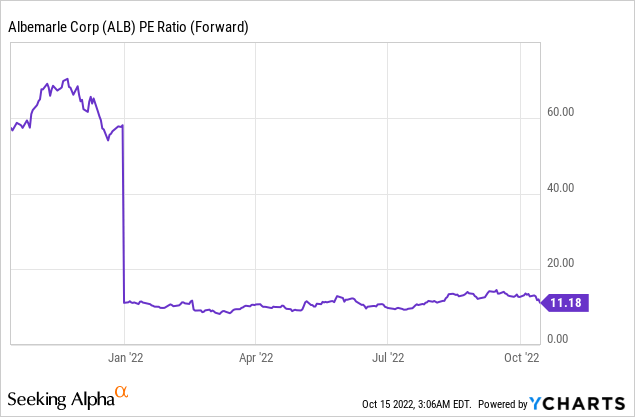

The P/E (price to earnings) ratio stands at around 11. It has declined significantly as the company expects significant EPS growth in 2022 due to price and volume increases across the board. Paying 11 times forward earnings for a company that is consistently growing in the long term seems promising. Yet, the cyclical nature of the business requires making sure that there is enough margin of safety.

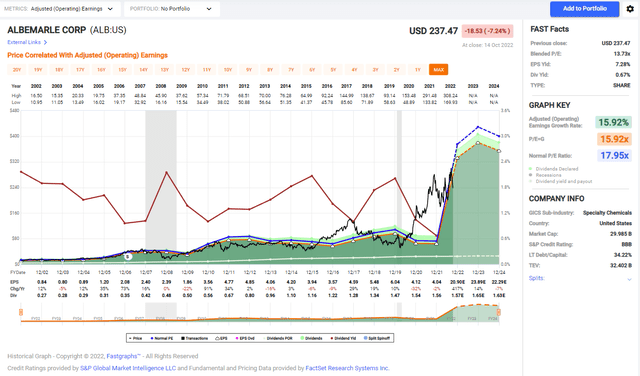

The graph below from FAST Graphs allows us to assess the safety margin better. Over the past two decades, the company has been trading for an average P/E ratio of 18. The current P/E ratio is significantly lower despite the expectation for medium-term growth. Therefore, it seems like the current price of Albemarle offers investors enough margin of safety to deal with the fluctuations in the price of Lithium and Bromine.

FAST Graphs

To conclude, Albemarle is probably one of the most stable and consistent companies in the basic materials sector. The company deals well with cyclicality and manages to improve sales and EPS over the long run. It also pays a growing dividend annually despite the high volatility in commodity prices. This package comes at what seems to be an attractive price with a decent margin of safety.

Opportunities

Electric cars are the primary catalyst for the increasing demand for Lithium. The Lithium-ion battery is a crucial component in most electric vehicles today, and it is the predominant technology to store electricity in cars. As sales of electric vehicles are increasing globally, so is the demand for Lithium, and since it is a fast-growing industry, the long-term trajectory is positive.

Another significant opportunity is the regulatory support that the company gets for building new facilities in the United States. Most of the company’s business is in China, which holds most of the Lithium industry. Albemarle is working on expanding in the United States as it plans to build integrated lithium operations in the US, including the Kings Mountain, NC, spodumene mine, and a lithium conversion plant in the southeast. It will diversify its exposure and increase its capacity in the future.

Another opportunity for Albemarle is its size and integration. The company is operating in the volatile basic materials sector. Size and economics of scale allow the company to reduce costs and be more profitable and efficient compared to smaller peers. As the company grows, this advantage will become even more apparent. Moreover, the company is also integrating across the Lithium supply chain. It offers a complete vertical integration from lithium resource to conversion, which makes it less reliant on commodity prices, as it offers a more processed material.

Risks

Commodity price fluctuations are a primary risk for the company. Lithium and Bromine have recently enjoyed an increase in their prices, contributing to the company’s growth. However, the company is operating in a cyclical environment, which means that less demand may lead to a significant reduction in price. Despite the company’s full vertical integration, it is still a price taker, similar to fully integrated oil companies.

When we see that the interest rates are on the rise and there is a growing risk of a recession, investors shouldn’t assume that Lithium prices will continue to increase steadily. If the downturn significantly affects the job market, we may see lower demand for new cars, including electric ones. Therefore, a recession may be a short-term risk for the company’s growth prospects.

Tech disruption is another risk for the company. Right now, there is a high demand for Lithium in the electric vehicle industry. However, unlike oil, used across the transportation sector, electric transportation using batteries is still a niche. Therefore, if a new technology emerges which will not require batteries or will not require Lithium for the batteries, the switching cost will be relatively low, and it will hurt its long-term prospects.

Conclusion

Investors seeking exposure to the basic materials sector with a relatively high level of confidence and safety should consider Albemarle for their portfolio. The company showed consistent growth in its top and bottom line, which led to the dividend steadily increasing. The company does have some growth prospects and risks that fit the current valuation.

Dividend growth investors must beware of the cyclicality as this dividend aristocrat has a beta of over 1.4. The company may be more volatile than you are used to, thus requiring more discipline during bearish periods for commodities. Still, if you can handle the volatility, I believe Albemarle is BUY for investors seeking exposure to basic materials.

Be the first to comment