Filipp Borshch

Investment Thesis

NuScale’s (NYSE:SMR) IPO was in September 2020 and currently trades about 10% above the issue price. The company develops and sells modular light water reactor nuclear power plants for power generation, hydrogen production, or water desalination. The company hardly generates revenue, so it is a bet on the future. Although it is an exciting company that offers several advantages over classical nuclear power plants, I think that an investment does not make sense yet, since commercialization is not expected until the end of the decade.

Business Overview

The global energy market is fascinating at the moment. On the one hand, there is the goal of transitioning away from fossil fuels, but on the other hand, it is also apparent that pure renewable energies will not be sufficient for a long time. For this reason, uranium energy has been moving more and more into focus since the worldwide reserves are sufficient for at least 50 years, and it is a low-CO2 technology. The safety aspect is also better than many assume. For more information regarding reserves, I recommend my article on Cameco.

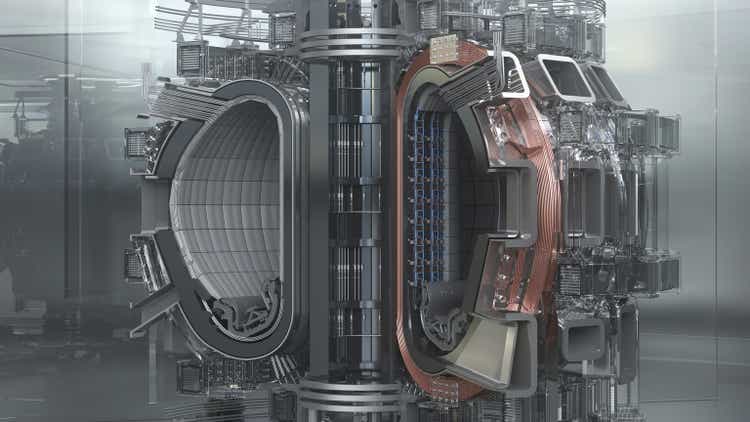

NuScale wants to simplify the concept of nuclear power plants. Make them smaller, simpler, and more flexible to use. According to the company, many components can be saved (e.g., pumps, motors, valves, piping). This should make the system cheaper to build and operate. The smallest system has a capacity of 77MWe, which covers approximately the annual power consumption of 30k – 40k households). These systems can be assembled in modules; the flagship system consists of 12 units and thus generates 924 MWe. A customer could also start with one module and expand later as needed.

NuScale’s flexible design is redefining nuclear. Our NuScale Power Module™ is premised on well-established nuclear technology principles with a focus on integration of components, simplification or elimination of systems, and use of passive safety features. This results in a highly reliable operation underpinned by an extremely strong safety case and unparalleled asset protection, making it suitable to be sited at locations closer to where electricity or process heat are needed, providing the added benefit of being resilient during storms and outages.

Electricity at a lower cost

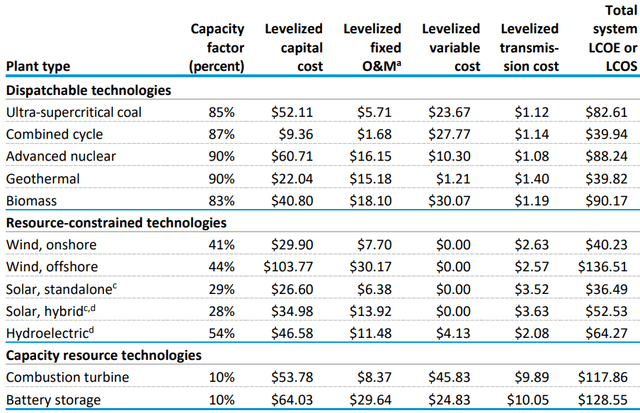

A figure that makes it possible to compare the electricity production costs of different systems is the so-called Levelized Cost of Electricity (LCOE). This figure includes the cost of construction, maintenance costs over the estimated life span, and use efficiency. For total electricity generation in the U.S., this figure was $61/MWh in 2019. In the United Kingdom, it was approximately $210/MWh. According to EIA data, offshore wind and hydropower are expensive, while solar is cheap.

EIA

NuScale estimates its figure as they do not yet have a complete system on the actual grid, but only test reactors. The LCOE of their systems is said to be $40/MWh to $65/MWh. This would make power generation cheaper than coal, offshore wind, and current nuclear power plants. However, it would be more expensive than onshore wind or solar. But due to their fluctuating power generation, these systems always need stable supporting systems to keep the power grid reliable.

Timeline for commercialization

NuScale’s SMR is a mature technology and we will be ready to provide modules to clients by 2027. We are not in the conceptual stage of development, but rather finalizing the design to prepare for the manufacture and construction of our first VOYGR power plant in the United States.

But that’s not all. The first module online for power generation is not expected until 2030. I can’t explain why this is taking so long when at the same time, they say they are only finalizing the design. There is probably still a lot of work to be done to build the systems in large quantities: the transition from research to actual commercialization. So far, there are many projects around the world in cooperation with local energy authorities or universities. As far as I can tell, these are primarily non-binding intentions to collaborate or do joint research. An overview can be found here.

Cash-burn rate

2Q22, the net loss was $21.4 million compared to $24.7 million in 2Q21. Annualized, this should result in a loss between $70M and $100M. Currently, they have $351M in cash and no debt. As far as I understand the information on the company’s website, they have not yet started building reactors, especially in large numbers, so the cash burn rate should increase in the future, and some form of refinancing will have to come.

But revenues will be achieved before the end of the decade; even in 2022, revenues are expected to be $16M. Seeking Alpha’s earnings estimates for next year are $96M. These revenues come from projects as mentioned here:

On June 26, the U.S. government committed $14 million toward a Front-End Engineering and Design study in Romania that could lead to the deployment of a NuScale VOYGR™-6 SMR power plant. Additionally, on May 23, the United States announced that it would provide the University Politechnica of Bucharest with a NuScale Energy Exploration (E2) Center, which is a simulator of NuScale’s SMR power plant control room. This project is already under way. In Poland, KGHM, a leading copper and silver mining conglomerate and large industrial energy user, recently submitted an application to their national regulatory agency to assess NuScale’s technology.

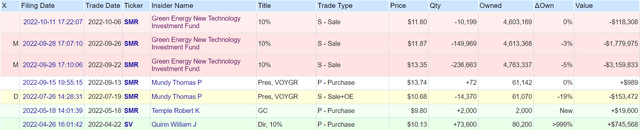

Share dilution and insider selling

One thing I always want to look at, especially with companies that are not yet profitable, is stock dilution and whether there is insider selling. There have been some mutual fund sales lately, but nothing spectacular. The number of outstanding shares has remained unchanged since the IPO. However, the number of fully diluted shares is 15% higher due to share-based compensation and warrants.

openinsider

The long timeline creates risks

The biggest problem I see is that there is still a long time until 2030. This means that competitors have a lot of time to build different or better systems, or in general, another technical disruption could happen. Currently, the company estimates its LCOE to be 40/MWh to $65/MWh, but who guarantees that this will still be the case in 2030, and what does this figure look like for solar and wind? What battery technologies will be available by then? Could solar and wind possibly be sufficient for power generation at some point because the storage capability is good enough so that fluctuating generation is no longer a problem? The longer the time frame, the more uncertain questions like this become.

Conclusion

What I generally don’t like about such investments is the uncertainty and the fact that I can hardly estimate many things. In the text, I wrote that the future cash burn rate should increase. But I don’t know this for sure; it’s just my assumption. The company is supposed to generate revenue before 2027. Will this mean the cash burn rate won’t increase in the following years? There are many uncertainties, and I have to make assumptions as an investor who is not an insider or an expert on the technology. And just about everyone reading this is not an insider or an expert on light-water reactors. This is not a position I want to be in.

If there was more information and maybe the first reactors would be delivered in 2024, deciding whether this is a good investment would probably be much easier. But with this long timeline, it is hard to estimate what position the company will be in then. The company could become quite attractive in the future, and I will keep it on my venture capital watchlist. But for the moment, I don’t see reasons to invest here.

Be the first to comment