Opla

The recent share price collapse of iShares MSCI Global Metals & Mining Producers ETF (BATS:PICK) amid deteriorating fundamentals may mark just the beginning of a prolonged period of weakness. Recession in Europe and the United States combined with weaknesses in China’s manufacturing and real estate sectors are likely to contribute to prolonged metal price declines. Mining companies would also have difficulty in maintaining their recent cash generation trends. Consequently, iShares MSCI Global Metals & Mining Producers ETF seems like a risky investment to add to your portfolio ahead of a share price slump and a potential dividend cut.

Economic Collapse Undercuts Prospects for Supercycle

From the second half of 2020 through the end of the first quarter of 2022, commodity prices rose at one of the fastest rates in the last few decades. Many have argued that the sharp rally, backed by solid demand and low supplies, suggests that markets are about to experience a supercycle, a sustained price rally lasting years. Nevertheless, I think that the circumstances for the supercycle are waning, whereas prospects for sustained low prices are increasing. The reason for this includes the risk of recession in the United States. US GDP has contracted for two consecutive quarters, and reports indicate the contraction will continue into the second half of 2022 before reaching a low single-digit growth rate in 2023. In July, the US Composite PMI Output Index plunged for a fourth straight month to 47.5. Moving forward, with high rates and slow economic growth, the construction, automotive, and manufacturing markets, the three largest end markets for metals, would be negatively impacted.

Apart from concerns about US demand destruction, the biggest headwind for the metals market is the economic situation in China, the world’s largest metal consumer. China’s GDP growth fell below expectations in the first half, and analysts’ median forecasts of 3.5% suggest the full-year growth target of 5.5% will be missed. In addition, July’s data shows more cracks than expected. Industrial production decreased month over month, while retail sales rose only 2.7% compared to expectations of 5% growth. Over the past couple of months, the Chinese real estate market, which accounts for a quarter of the economy, has been in a state of meltdown. S&P Global forecasts that property sales in China are likely to see a whopping 30% drop in 2022 from the past year, which would add fuel to the already troubled metals market. In the last month, Chinese new construction starts dropped to their lowest level in more than a decade.

It appears that the growth cycle for metals that began in 2020 peaked early in 2022, and a dramatic reversal is underway. In the June quarter, base metals posted the largest quarterly loss since 2008 with Tin, aluminum, iron ore, steel, and copper among the biggest laggards.

A Dividend Yield Trap

With a recent share price selloff and record cash returns to investors, PICK’s dividend yield jumped above 9%. The metals and mining-focused ETF, however, is likely to cut its dividends ahead because its top two holdings, such as BHP Group (BHP) and Rio Tinto (RIO), comprise over 20% of the portfolio, have already cut their semi-annual dividends drastically. The weakening market conditions and forecasts for steep declines in profits and cash flows drove BHP to cut its dividend by 25% while RIO reduced its dividend by half. In the first half of 2022, RIO’s net earnings fell 28% year over year and its free cash flow dropped 30% to $7.14 billion. The situation is the same for the rest of the top 10 stocks. Its sixth largest stock holding, Anglo American (OTCQX:AAUKF), reported year over year earnings decline of 28% and slashed its dividend by 27% amid waning commodity demand. Vale SA’s dividend yield of 20% also seems unsustainable, and dividend cuts are likely.

As mining companies have aggressively started lowering cash outflows to align with changing market trends, PICK’s dividend yield of over 9% appears unsustainable. In other words, chasing PICK due to its high dividend yield might be a dividend yield trap.

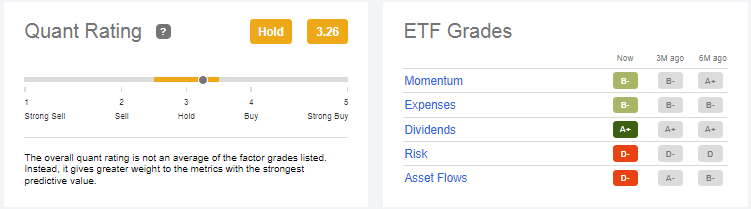

PICK ETF Quant Ratings

Quant score (Seeking Alpha)

The use of quantitative techniques to analyze stocks and ETFs eliminates the risk of emotions as quant analysis focus only on data. According to Seeking Alpha’s quant grading system, which takes into account five factors, PICK is rated as a hold with a quant score of 3.26. Due to its high volatility and high standard deviation, PICK earned a negative D on the risk factor. Also, SA quant data shows a sharp decline in asset flows for the metals & mining ETF, indicating low confidence and an acknowledgment of economic headwinds. Although the dividend factor received a strong quant grade, there is a high risk of a dividend cut and price depreciation ahead.

In Conclusion

It appears that fundamental conditions for metals are deteriorating rapidly and will remain challenging for some time to come. Therefore, instead of buying iShares MSCI Global Metals & Mining Producers ETF right now, investors should wait for a better entry point. Since most of its holdings have either announced or plan to cut dividends in the months ahead, its dividends are at risk. In addition to the dividend cut, lower profits and deteriorating fundamentals would keep its shares under pressure.

Be the first to comment