tolgart

Energy Transfer (NYSE:ET) is a popular pick among dividend investors due to its high distribution yield. With energy stocks being one of the few sectors showing record profits, some may be wondering if ET is a compelling investment pick. The units appear undervalued, and the company continues to retain significant cash flows. In spite of the attractive metrics, I remain wary of management execution risk, as this is a company which has struggled to grow its distribution over the long term in spite of spending billions on growth projects.

(Heads-up: ET issues a K-1 tax form – consider the tax ramifications before investing.)

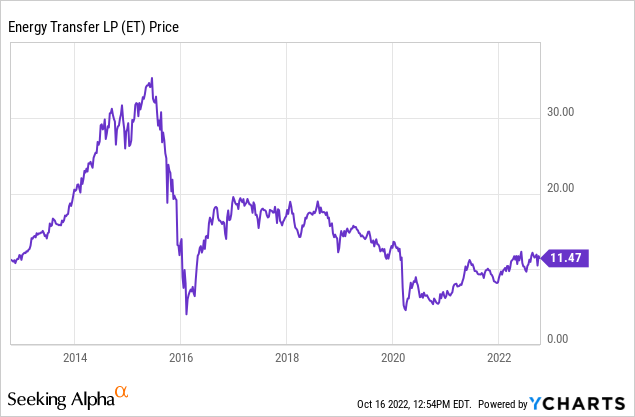

ET Stock Price

After crashing amidst the 2016 oil crash, ET stock has never quite returned to former highs.

I last covered ET in July, where I recommended investing in lower risk peers. ET has returned double-digits since then, though my investment opinion remains the same.

ET Stock Key Metrics

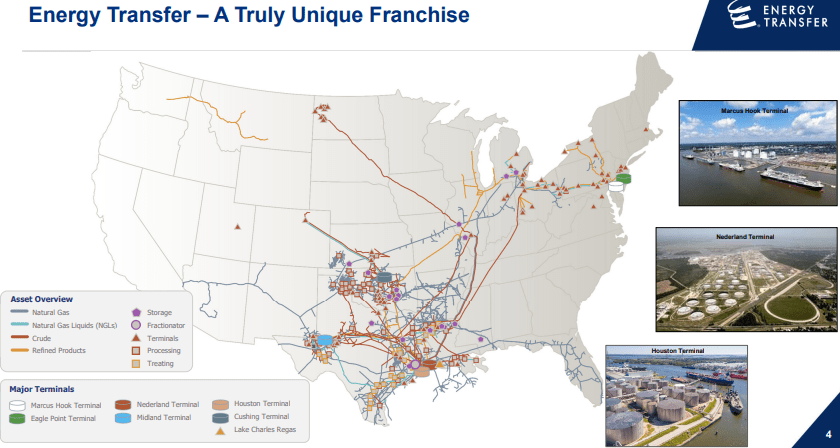

ET owns one of the largest energy infrastructure systems in North America today.

2022 September Presentation

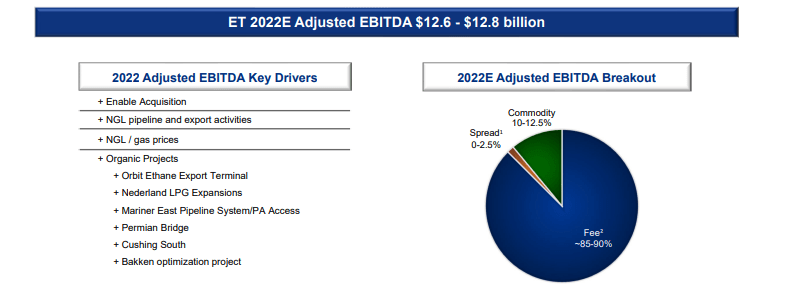

As typical with midstream operators, ET derives the vast majority of its cash flows from fee-based revenues, making it a “toll-road-like” investment in the energy sector.

2022 September Presentation

The latest quarter saw ET show strong growth in cash flows, with distributable cash flow growing YOY from $1.39 billion to $1.88 billion and adjusted EBITDA growing from $2.62 billion to $3.23 billion. That represented a 2.65x DCF coverage of the distribution.

The results were so strong that ET increased guidance for adjusted EBITDA to end up between $12.6 billion and $12.8 billion (previously it was $12.2 billion to $12.6 billion). ET left its growth capital expenditure outlook unchanged at up to $2.1 billion.

ET also announced a $0.23 quarterly cash distribution per unit, representing 50% growth over the prior year’s distribution. Management reiterated its goal of returning distributions to the previous level of $0.305 per unit. On the conference call, management stated that it will weigh distribution growth while balancing “leverage target, growth opportunities and unit buybacks.” That said, ET has not been a material buyer of its own units over the past several years, in spite of the huge apparent discount in valuations (more on this later).

ET has paid down $1.1 billion in net debt this year. On the conference call, management stated its expectations to reach its leverage target by the end of this year. That target was defined as 4x to 4.5x debt to EBITDA in a previous earnings call.

Is ET Stock A Buy, Sell, or Hold?

On paper, ET looks like an obvious buy. ET is trading at a generous 8% forward distribution yield. I continue to expect around $6.9 billion in free cash flow this year – units trade at a 19% FCF yield. ET is very, very cheap.

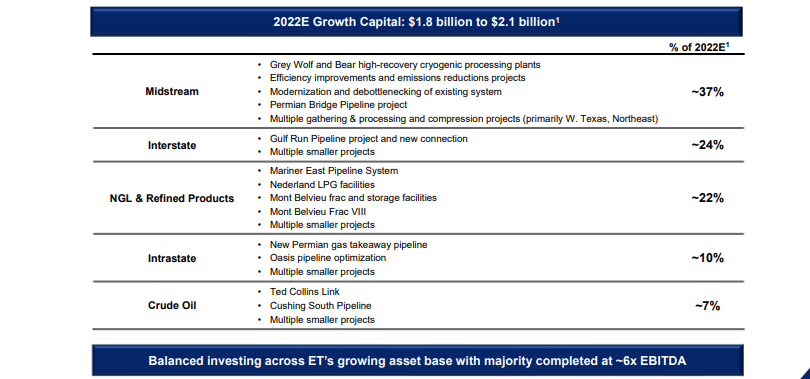

But perhaps therein lies the problem. Unlike many other midstream operators, ET has not yet embraced unit repurchases and is instead moving full steam ahead with growth projects. ET has guided for a 6x EBITDA return on the majority of such projects – the key word is majority.

2022 September Presentation

It isn’t exactly clear what the exact overall projected return is, but perhaps it is around 7x EBITDA. ET units trade at 7.6x forward EBITDA estimates. There is great execution risk in growth projects and zero execution risk in repurchasing units. For that reason, it makes sense to repurchase units even if they offer slightly less accretion. What’s more, I have discussed in the past how ET has derived lower returns from its growth projects and has also had a high level of impairments. Those shortcomings are fully visible by the fact that distributions remain lower than 2016 levels, in spite of the company having spent around $45 billion on capital expenditures since then (the current market cap stands at around $35 billion).

Seeking Alpha

Unlike top tier operator Enterprise Products Partners (EPD), ET is not necessarily the kind of company that unitholders should be hoping for more growth capital projects from.

Why does ET continue to invest so heavily in growth projects when its units are so cheap? I mentioned previously that ET has often floated the idea of unit repurchases, but failed to execute on them. Perhaps the reason is due to misaligned incentives.

As I stated in my prior article:

“As stated in its 10-K filing, ET rewards its executives a bonus payout based on adjusted EBITDA and distributable cash flow targets. MMP, on the other hand, uses distributable cash flow per share as the target for its equity plans. The absence of per-share metrics in the ET compensation plan may help explain why the company has historically been so set on increasing the asset base.”

ET has much of the ingredients needed to generate strong returns from here, and it is all in management’s control. Instead of aggressive growth projects, a mix between debt paydown and unit repurchases would strike a perfect balance between reducing leverage (key for multiple expansion) and increasing cash flow per share. From my view, investors may do well by avoiding ET until they see clear execution on improved commitment of cash to unitholders – returning the distribution to pre-pandemic levels would be a good first step, as that would bring the yield up to 10.6%. Yet with EPD and Magellan Midstream Partners (MMP) trading at a 7.6% yield and 8.4% yield, respectively, ET is likely to always sustain a relative discount until there is a drastic change in capital allocation policies – a committed unit buyback seems like the most obvious catalyst.

Be the first to comment