Marc Dufresne

In an unexpected move, Camping World (NYSE:CWH) cruised past expectations, even as the U.S. reopened. The company focused on RVs saw business weaken, but Camping World hasn’t seen demand fall off the cliff similar to some other businesses that benefited from COVID lockdowns. My investment thesis remains Neutral on the stock after the 15%+ rally following the solid Q2’22 results.

Tough Comps

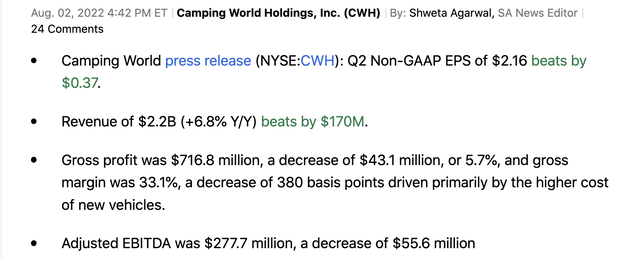

Camping World reported a solid quarter by overcoming tough comps from 2021 when Q2 revenues surged 28.2%. The recreation dealer reported June quarter revenues grew 5.2% over the already elevated levels from 2021 as follows:

The headline number is impressive, but Camping World was hit by higher costs hurting the bottom line. Gross profits were down 5.7% to $716.8 million while adjusted EBITDA slumped 16.7% to $55.6 million. The company reported a strong adjusted EPS of $2.16, but the number was down from the $2.33 reported last year.

Camping World is constantly adding new stores via acquisitions, so the quarterly revenues are always going to rise over time. As with any retailer operating stores, the same store revenues are important to watch.

The recreation dealer reported roughly flat comp sales at $1.87 million per store even with units sold down 3,315 in total. Camping World now operates 168 same store locations with the Service bays up 5.2% YoY to 2,613 to match the sales growth.

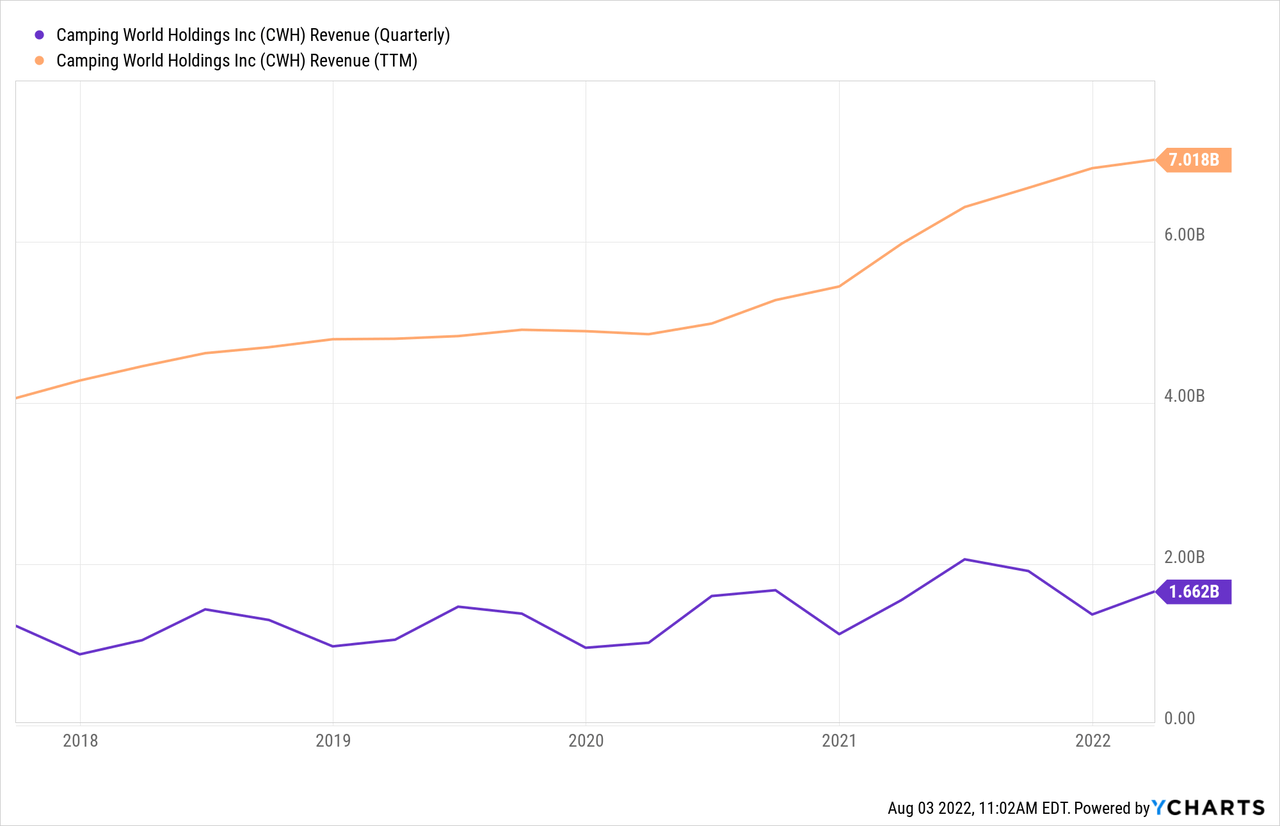

As the below chart highlights, Camping World saw a sudden jump in sales beginning in 2020 with a leveling off period expected over the next year. Analysts forecast sales roughly flat at $6.9 billion over the next couple of years in what appears aggressive.

With the high inflation environment, the lack of same stores sales growth is what drove the dip in earnings and adjusted EBITDA. The biggest hit came from a reduction in gross margins by 380 basis points to 33.1% while SG&A expenses were somewhat constrained at growth of only $8.9 million.

Camping World has overcome what was supposed to be a tough RV market where sales were down. According to Baird, May saw a 31% dip in RV retail sales. The market forecast was for a 450K unit decline in 2022 followed by another 420 unit decline in 2023.

Camping World grew average selling prices by over 10% in the quarter with crucial new vehicle sales up 13.8% to $46K. The increased selling prices helped offset the 8.5% dip in vehicles sold.

In most scenarios where unit sales dip, the prices eventually roll over. One might assume these vehicle prices will dip as inflation dips and RV sales struggle.

The company has new vehicle units per location down to 175 units. Per CEO Marcus Lemonis on the Q2’22 earnings call, Camping World had the following inventories in the past:

As of today, our average new unit count per location is about 175, totaling approximately $6.4 million. That number is down compared to pre-pandemic levels, which averaged around 197 new units between 2016 and 2019 around the same time a year. I’ll point to this benchmark. The highest level in the last six years were 2017 with a 207 average new units per location and 2018 with 214. Look we’re very confident that with our current consumer demand levels, coupled with our on-order position with the manufacturers that we are in a very solid position.

As always, Camping World is an exceptional operator in the RV space snapping up dealer locations on the cheap and expanding into new products while shifting inventories between new and used vehicles depending on demand.

Normalized Valuation

While hoping for a lower entry point in Camping World, the stock has already surged to over $30. The stock market appears to have hit a bottom and Camping World is up over 15% on the big Q2’22 earnings beat.

The stock still faces a tough environment ahead where earnings are at risk. Most retailers and tech stocks benefiting from COVID pull forwards have seen results absolutely crushed.

Before the Q2’22 earnings report, the consensus analyst EPS target was $4.42 for 2023. Management continues to suggest a solid 2023, though market data presents a vastly different position.

If Camping World can report a $4+ EPS next year, the stock is definitely still cheap at $30. The big question is whether this actually occurs with new vehicle sales set to decline and pricing ultimately due for a reduction as inventories improve in the sector while demand slacks.

Over the long haul, investors will do just fine buying Camping World at these levels. The company has the business plan and product expansion to generate the returns for shareholders with the stock valuation this low.

In the short term, investors can probably get a better value or buy a stock already beaten down where the business is completely reset from the 2021 pull forwards. The stock might never fall from these levels, but the odds appear mixed making an entry here not specifically appealing.

Takeaway

The key investor takeaway is that Camping World cruised right past expectations for a bigger hit to revenues and profits. The RV market still appears set for a very weak year ahead suggesting the stock is likely to provide a better entry point during the winter.

Be the first to comment