Taned Tiplerlerd/iStock via Getty Images

Dear Partners,

For the second quarter of 2022, Rhizome Partners generated a net loss of 9.1% versus a 16.1% loss for the Standard & Poor’s 500 Index and a 14.7% loss for the National Association of Real Estate Investment Trusts (NAREIT) Index. During the quarter, our hedging efforts generated about 5.5% of gains. The hedging gains were the primary contributor to Rhizome’s outperformance to the S&P 500 and the NAREIT. Our portfolio was down broadly across the board during the quarter, as expected in a bear market. Since inception, our portfolio has had 62% general market exposure, 23% cash/SPAC (special purpose acquisition company) holdings, and 11% market-neutral investments.

FTSE NAREIT

|

Time Period |

S&P 5001 |

Hypothetical 10% Absolute Return |

All Equity REIT Total Return2 |

Rhizome Partners Class B Net Return3,4 |

|

April 10th thru Dec 31, 2013 |

18.2% |

7.2% |

-4.9% |

19.50% |

|

Full Year 2014 |

13.7% |

10.0% |

28.0% |

19.2% |

|

Full Year 2015 |

1.4% |

10.0% |

2.8% |

-5.8% |

|

Full Year 2016 |

12.0% |

10.0% |

8.6% |

11.5% |

|

Full Year 2017 |

21.8% |

10.0% |

8.7% |

5.6% |

|

Full Year 2018 |

-4.4% |

10.0% |

-4.0% |

-7.2% |

|

Full Year 2019 |

31.5% |

10.0% |

28.7% |

17.8% |

|

Full Year 2020 |

18.4% |

10.0% |

-5.1% |

23.7% |

|

Full Year 2021 |

28.7% |

10.0% |

41.3% |

24.9% |

|

Q1 2022 |

-4.6% |

2.4% |

-5.3% |

-9.9% |

|

Q2 2022 |

-16.1% |

2.4% |

-14.7% |

-9.1% |

|

Year To Date |

-20.0% |

4.8% |

-19.2% |

-18.1% |

|

Cumulative Return Since Inception |

185.0% |

141.0% |

97.8% |

118.8% |

|

Annualized Return Since Inception |

12.4% |

10.0% |

7.6% |

8.9% |

Class B Net Return also includes 11% of investments that are workouts/special situations/hedged. Total market exposure was only 62% since inception. |

Hedging Results

Year-to-date, we’ve generated roughly 4% gross returns from shorting fixed income ETFs. We have exited our short positions in the U.S. Treasury ETF but kept our short positions in three other ETFs. After a 22% sell-off in 2022, the Treasury ETFs may rally if the market continues to sell off and investors seek a safe haven for their capital. The remaining ETFs may continue to sell off if credit spreads widen. Buying out-of-the-money (OTM) puts has contributed to 2% gross profit so far in 2022. The bulk of the gains come from the Prologis (PLD) puts.

This strategy has been more difficult to execute this year. During the Covid sell-off in 2020, individual companies and indexes sold off in dramatic fashion, resulting in large gains for us. This year, some of our puts experienced 3-5 times mark-to-market gains during 10% sell-offs followed by periods of recovery. This led to our options to lose value quickly as the market rallied following the sell-off. We are recalibrating our strategy to be more methodical in the sale of our put options.

Setting sale prices at different multiples of our cost basis, from 3x to 20x, is a good way to remove the emotion and timing of selling. We believe this layered approach is a good compromise between achieving tail risk hedging and monetizing hedging gains.

Some of our investors added capital this year. Given our cautious views regarding the impact of rising interest rates on asset pricing, we have largely held off deploying the cash balance. This has helped to buffer the drawdown in the portfolio year-to-date. We did allocate an additional 3% of our partners’ capital to Ardagh Metal Packaging (AMBP) which has the potential to generate 100-200% return in the next three years. We are working diligently to identify good businesses with the potential for returns in the 100-300% range in the next three years.

We are actively re-underwriting our existing positions to account for new risk factors such as potential gas supply issues in Europe and sustained levels of high inflation. Deploying capital during a bear market is an art. The most logical time is when our tail risk hedges pay out a windfall following a selloff and a spike in the VIX Index, commonly known as the fear gauge. It will also be a time when it feels emotionally uncomfortable to deploy capital. There are two main reasons why we still hold a cash balance.

The VIX Index reached a peak of 39 this year versus over 80 during the Covid selloff. We could be wrong, but we believe the market has not properly priced in the risk of higher interest rate and potential recession. Second the estimated forward returns for certain opportunity sets have become more attractive. However, we want to buy at bargain basement prices like Univar (UNVR) at 6x normalized earnings during Covid.

Operating Company Updates

Many of our portfolio companies recently sold off to attractive levels. We are stress testing our portfolio companies for new risk factors such as geopolitics, inflation, and recession. Our objective is to systematically compile a target price for each company at which it may generate 100-300% returns in three years. The following chart presents an overview of the valuations of our top positions. You may notice that we use metrics from different years. We have picked the years that each individual company will reach stabilization following a growth ramp or acquisition integration.

In short, we picked a year in which the company will demonstrate normalized earnings power. We also show a range for valuation multiples because it is important to be broadly correct than precisely wrong. The growth rates in the charts are long term estimates measured over multiple years. They can very well trend negative in the near term. These attractive opportunities are available because most investors are worried about the next two to six quarters of underperformance. Our partners’ long-term investment horizon allows us to take three-to-five-year views. With the longer time horizon, these opportunities have excellent risk-adjusted returns.

|

Name |

Industry |

Country/Region |

% of Portfolio |

Leverage |

Valuation |

Long Term Earnings Growth Rate |

|

|

1 |

Ardagh Metal Packaging (AMBP) |

Packaging |

US/Euro |

5% |

4x EBITDA |

6-7x 2024 P/FCF |

7-10% |

|

2 |

Berry Global (BERY) |

Packaging |

Worldwide |

4% |

4x EBITDA |

7x 2022 P/FCF |

2-3% |

|

3 |

Univar Solutions (UNVR) |

Chemical |

Worldwide |

4% |

2x EBITDA |

9-10x 2022 P/FCF |

5-7% |

|

4 |

Cross Country Healthcare (CCRN) |

Staffing |

US |

4% |

<0.5x EBITDA |

7-10x 2023 P/FCF |

7-10% |

|

5 |

HireQuest (HQI) |

Staffing |

US |

3% |

<0.5x EBITDA |

8-10x 2022 P/FCF |

7-10% |

|

6 |

Ashtead (OTCPK:ASHTF) |

Equipment Rental |

US, Canada, UK |

2% |

1.5x EBITDA |

12x 2022 P/FCF |

7-10% |

|

Total |

22% |

Univar recently sold off about 25% and is now trading at 9-10 times its 2022 price-to-free-cash-flow (P/FCF) multiple with a little over 2 times net debt/EBITDA. Univar, Brenntag (OTCPK:BNTGF), Tricon (TCN), IMCD (OTCPK:IMCDY), Helm, and Azelis (OTCPK:AZLGF) are the largest chemical distributors in a fragmented industry. Like many distribution businesses, route density is critically important. A truck that can make multiple stops on a route will have structural advantages over its smaller competitors. Univar has dense routes in North America, its key market.

This unique advantage tends to compound over time. Traditionally, chemical distribution is a “pick up the phone and call your sale representative” business. Around the world, there are different degrees of digital penetration in the sales process, with Asia at the leading edge of technology adoption. Univar Solutions and Brenntag are the two leaders that have invested heavily in technology and e-commerce solutions for their customers. Smaller mom-and-pop operators lack the financial and human resources to invest in technology solutions.

On the other hand, a purely digital marketplace for purchasing chemicals often struggles to gain critical transaction volume because of the lack of logistics and fulfillment capabilities. Customers can place their orders, but they cannot receive the orders in reasonable time. Dense routes consisting of warehouses and trucks located under 60 minutes driving distance are the “atoms” that prevent “bits” players from attacking the chemical-distribution business.

Over time, we believe that the top players will consolidate the smaller mom-and-pop operators. A recession will likely accelerate the consolidation trends in the industry. At today’s valuation, shareholders can generate a 10-11% internal rate of return (IRR), assuming no growth in earnings, no accretion from acquisitions, and no multiple expansion. This is a bear case scenario where the business merely accumulates the free cashflow generated for the next few years.

In a base case, the return is likely 25% IRR over three years after emerging from the recession, assuming a modest 5% growth in free cash flow per year and multiple expansion to 15 times P/FCF. Univar will likely gain market share from undercapitalized competitors and make attractive acquisitions in a recession. In a counterintuitive way, Univar may emerge from a recession with higher free cashflow. We believe 15 times P/FCF is reasonable for a high-quality company like Univar with 5% growth rate. It equates to 6.7% free cashflow yield and can lead to about 12% long turn sustainable return to shareholders due to the 5% growth rate.

We are monitoring the share price of Univar and will likely add to our holdings at the right time. At a certain price, we may also invest in Brenntag, because we believe both companies are structurally superior to smaller competitors and will continue to take market share.

Ardagh Metal Packaging is another portfolio company that has us salivating. Aluminum can producers like Ardagh Metal Packaging, Ball Corporation, and Crown Holdings operate in a clubby oligopoly. The top three producers exercise price discipline and their addition to capacity means multi-year take-or-pay contracts which ensure all new build capacity will be absorbed. There are strong environmental, social, and governance (ESG) mandates that favor the use of aluminum cans because they can be recycled indefinitely without degrading the cans.

Cans are also more energy efficient than glass bottles and have much higher recycling rates than plastic bottles. Currently, demand exceeds supply, resulting in shortages of aluminum cans in Europe and the U.S. Importing cans is not practical, because empty cans take up a large volume of space, leading to shipping mostly empty air. Hence, cans are often produced and sold locally. Ardagh Metal Packaging shares have sold off this year after investors grew wary of whether the company had the financial means to invest heavily in growth projects and pay a cash dividend.

The completion of a recent green bond offering and preferred investments by the parent company, Ardagh Group, have solved the funding gaps. At quarter-end, Ardagh Metal Packaging was trading at an estimated 6-7 times 2024 stabilized P/FCF multiple, with roughly 4 times net debt/EBITDA ratio. The earliest debt maturity is in 2027 and amounts to less than 1 times the estimated 2027 EBITDA. The company currently pays a 6.5% dividend and has a stock-buyback program in place.

The key risk, we think, is Russia turning off natural gas supplies to Europe. That would cause a severe recession and impact beverage sales. In a true black swan case, we can see European countries rationing natural gas solely for residential heating and shutting off energy/power to manufacturing use. In this severely bearish scenario, Ardagh Metal Packaging might still be able to access power, since beverages are consumer staples and deemed essential.

From an energy-intensity perspective, the process of melting recycled aluminum to make cans is very energy efficient. Energy scarcity may even force European governments to curtail energy-intensive glass-making and increase the demand for cans.

Berry Global sold off during the quarter and now trades at 7 times P/FCF, or a 14% free cash flow yield. Unlike previous years, when Berry was focused on deleveraging the balance sheet, Berry can now direct 30-50% of its free cash flow into share buybacks. We believe Berry can buy back 4-7% of the shares outstanding each year at the current share price while also paying down 0.2-0.3 times EBITDA of the debt per year. This is a good setup for future stock returns.

Our smaller positions in both HireQuest and Cross Country Healthcare are trading around 10 times normalized P/FCF multiples. Both companies have long growth runways and are led by talented CEOs. The ongoing maintenance capital expenditures of both companies are minimal. We keep looking for ways to disprove both investment theses and have a hard time coming up with valid reasons. HireQuest is more cyclical because it’s tied to blue collar temporary staffing. But HireQuest has the unique know-how to acquire staffing companies and convert them into high-performing franchises.

HireQuest has consistently paid about 5 times P/FCF multiple for the acquisitions. Adjusting for sales of branches locations to franchisees, the P/FCF multiple falls even further. The current acquisition strategy is better than a greenfield approach as the acquired free cashflow yield is over 20% and HireQuest does not have to compete for market share. We believe the company can grow to five times its current size, with little share-count dilution. Investors are concerned that Cross Country Healthcare is a Covid beneficiary and will eventually revert to its pre-Covid performances.

But the bulk of the operational improvements that increased EBITDA margin from low single digits to high single digits during Covid are structural and permanent. Both companies are ideal candidates to add to if they continue to sell off.

Ashtead, which does business in the U.S. as SunBelt Rental, sold off almost 50% from its all-time peak. It is currently trading at an estimated 12 times earnings. For one of the highest-quality companies we know, Ashtead’s share price tends to gyrate. The market is clearly worried about a recession. Unlike its position during the Great Financial Crisis (GFC), Ashtead is a structurally better company today. First, its revenue is eight times the size it was in 2008, which translates into Ashtead having scale advantages in purchasing equipment.

This results in large savings versus smaller mom-and-pop operators. Second, about one-third of Ashtead’s business is classified as specialty, such as HVAC, emergency power, and maintenance and repair. The specialty category is less economically sensitive. Third, the Infrastructure Bill should create a nice baseload demand for equipment rental in the coming years. Lastly, Ashtead’s net debt/EBITDA ratio is around 1.5 times today versus 3 times during the GFC period. We are eyeing Ashtead as another candidate for increasing our investment.

Real Estate Company Update

REITs broadly held up well in early 2022. The Vanguard Real Estate Index Fund (VNQ) was down only about 3% until late April. Suddenly, VNQ sold off about 22% in about two months. This illustrates the difference between the public markets and the private markets. In our experience, public markets tend to be more forward looking and tend to lead the private markets by several months. Price discovery occurs in the public markets via the daily bid/ask price of the stocks. Large price movements can happen rapidly.

Contrast this with the private markets, where sellers are often reluctant to accept that when fundamental drivers such as interest rates change, their assets are no longer worth the price they were three to twelve months earlier. Private investors only sell in response to debt maturity, good pricing, or mandates associated with investment hold periods. Hence, price discovery can be delayed in the private market.

FRP Holdings (FRPH) continues to execute well. The city of Washington, D.C., removed the Covid rent freeze during the first quarter. Dock 79 renewed 72% of the leases, with an average rent increase of 4.7%. The Maren renewed 61% of the leases, with an average rent increase of 2.3%. Both buildings will benefit greatly from higher baseball game attendance this year. At the end of Q1, 65% of Bryant Street’s apartments and 82% of its commercial space were leased.

The Verge, at 1800 Half Street, is expected to be completed in the third quarter of 2022. Riverside in Greenville, SC, has likely reached stabilization, with over 90% leased as of this writing. Another multi-family development in Greenville, SC, .408 Jackson, will begin leasing in the third quarter of 2022. While the multi-family assets are performing well, higher interest rates will negatively impact the mortgage cash-out amount and lower the ongoing operating cash flow of the soon-to-be-stabilized assets.

This will lower our net asset value (NAV) estimates and we will continue to monitor private market pricing. Rest assured, the private liquidation value of FRP Holdings is still much higher than the current share price.

New Riverside apartment building in Greenville, SC

The aggregate business continues to perform well, and aggregate price increase percentages should be in the teens while expense increases will be minimal given the royalty structure. The aggregate business is ideally positioned to benefit from higher inflation. During the quarter, the company purchased a mining royalty property in Astatula, FL, for $11.6 million.

The new property consists of 1,549 acres adjacent to the company’s site in Astatula. It contains 22.5 million tons of sand reserves and generates almost 12% unlevered cash yield on day one. We estimate that the unlevered IRR will be around 14-15% over the lifetime due to price increases. This is an incredible acquisition and further demonstrates the deal-making savvy of the Baker family in the aggregate space.

Demand for single-family homes has cooled off significantly because of rising mortgage rates, which have reached 5-6%. FRP Holdings has already received $9.6 million back from its $16.2 million capital investment in the Amber Ridge lot project. The company has an additional $31 million commitment for a new lot-development project.

Given the sharply rising rates, these two projects are on our watch list. FRP Holdings’ warehouse portfolio continues to be well leased. Upon the completion of a new, fully leased, built-to-suit warehouse, FRP Holdings will have 91% occupancy in its warehouse portfolio of half a million square feet. The company has additional development parcels to bring the portfolio up to 1.4 million square feet.

Year to date, FRP Holdings’ share price is up 4% versus the NAREIT All Equity Index, which is down 19.2%. We believe this is because FRP Holdings traded at large discounts to its intrinsic value coming into 2022. As inflation becomes a more pressing issue, the investing public has found the company increasingly attractive.

Investors also appreciate that the Baker family is an extraordinary steward of the minority shareholders’ capital. FRP Holdings even found a loyal following in the investing community in Spain. Given that the euro has reached parity with the U.S. dollar, buying FRP Holdings in early 2022 would have generated a 20% gain—in euro terms—for the Spanish shareholders.

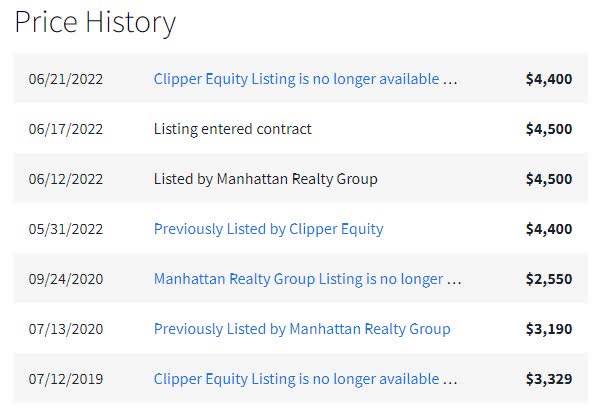

This price history chart of apartment 8A at the Clover House, owned by Clipper Realty, is worth a thousand words. It perfectly captures the extreme impact Covid has had on the New York City apartment market. In the summer of 2019, this specific unit asked for $3,329. By September of 2020, the asking rent had dropped to $2,550 as Clipper and other landlords offered large price cuts to fill vacant units.

This was about the time that author, comedy club owner, and former hedge-fund manager James Altucher famously proclaimed that New York City was dead forever. Today, the asking rent for this unit is 32% higher than the 2019 level and 72% higher than the 2020 level—a stunning recovery from the dire situation in early 2021. As Clipper continues to renew existing leases and sign new leases, it will experience dramatic revenue and net-operating-income increases.

We are eager to see updates in the coming quarters. In 2020 and early 2021, it seemed as if the U-Haul trucks would only move people out of New York City and Covid would stay with us forever. In 2022, it seems obvious that New York City will recover and Covid headlines will fade. The new headlines now feature chronic shortage of housing and bidding wars on apartments. This is precisely why we focus on normalized earnings power 2-5 years out. Our partners’ patience allows us to take long-term views and take advantage of temporary interruptions in earnings powers.

I recently attended Clipper’s in-person annual shareholder meeting in Brooklyn with a fellow value focused investment manager.

Being the only two investors who showed up, we were able to chat with the management team for over an hour. We had a very informative and productive meeting. Clipper Realty (CLPR), like many of our smaller family-controlled real estate companies, suffers from investor misconception. Investors generally question the intention of the management. We found the management team to be very amiable, cordial, and attentive to our suggestions. We chatted about the business and learned more about Clipper’s plans. We encouraged Clipper to allocate more resources to investor outreach and suggested hosting an investor day coupled with a property tour.

There were three key takeaways from the meeting:

- Clipper has invested in digital tools to streamline apartment leasing and financial reporting. This effort was spearheaded by the young chief operating officer.

- Clipper’s new development project at 1010 Pacific is anticipated to finish by yearend 2022 and the lease up will take only one quarter, versus the twelve months we had previously modeled.

- The family cares a lot about the large gap between the share price and the private market value. They want to close this gap and potentially use Clipper’s public equity as a low-cost currency. This creates alignment between the controlling family and minority shareholders.

This last point seems obvious, but there can be strange situations where the controlling family cares very little about public share price.

The public market has a weird dynamic. Suppose a billionaire said, “You can buy into our private real estate holdings at 70 cents on the dollar and at 40% of the equity value. On day one, you’ll receive a 5% distribution, which will grow over time.” There would likely be a line stretching out the door to invest in such a deal. But because such a dynamic is available in the publicly traded stock market, people are skeptical and often complain about some misconstrued actions of the management team. Our job is to investigate the truth and pick the situations where our knowledge significantly differs from what the public understands.

We sold down our positions in INDUS Realty Trust (INDT) and initiated a short position in Prologis (PLD). During the Amazon Q1 earnings call, the CFO stated, “We currently have excess capacity in our fulfillment and transportation network.” We sold more of our INDUS Realty Trust position to below 1% in the portfolio. I took some walks on the beach and thought about the implication. The warehouse REIT space has experienced seven years of relentless rent growth and capitalization rate (cap rate) compression.

You can no longer find an investor with a bearish view in the warehouse space. Prologis now routinely touts how it adds value by managing third-party warehouses and installing solar panels on warehouse roofs. We believe Prologis was trading at roughly 2.5% current cap rate and around 3.73.8% cap rate on full mark-to-market rents. Prologis was priced to perfection, given the backdrop of a higher interest rate environment combined with potentially rising vacancy rates due to recessions.

Given our seven years of experience investing in warehouses, we thought we should leverage that knowledge on the short side. We promptly shorted 1% in Prologis common shares and allocated 50 basis points toward Prologis puts, with 20% out-of-the-money strikes that expire in November of 2022. Shortly after, Prologis sold off from $163 to $122 per share and our puts have tripled in value. Our short position and puts in Prologis have added roughly 2% gross return to the fund this year. We will continue to monitor the warehouse space and may initiate long positions in the future.

Howard Hughes Corporation (HHC) experienced a 34% sell-off during the quarter. We believe the market is now worried about Howard Hughes’ land lot business since higher mortgage rates have slowed housing demand. The market also reacted negatively to Howard Hughes’ decision to acquire a stake in Jean George’s hospitality business, because it potentially muddles the investment thesis of a pure-play real estate company. First, we do not yet know the multiple of cash flow that Howard Hughes paid for the business.

It will likely turn out to be very reasonable, once Howard Hughes discloses it in earnings. Second, the decision makes more sense if one views Howard Hughes’ core business as creating the most desired communities to live, work, and play in. Adding a Jean George restaurant concept in The Woodlands, Summerlin, or Hawaii has strategic value. As Howard Hughes has demonstrated with the Las Vegas baseball team, better amenities result in better pricing for land lots and faster velocity.

First quarter results were spectacular, which was expected. But the market is forward looking, and shares have been punished. Although the perception, interest rate, and share prices have changed dramatically since Q1, the attractiveness of the communities and the real estate assets have not changed.

Condo pre-sales in Hawaii continue to be robust. BlueCross Blue Shield recently leased 80,000 square feet of space at a 320,000-square-foot office building in Columbia, MD, bringing the total leased space to 97%. This milestone is significant in that Columbia was an unproven concept for a densification project in a mature suburban community a few years ago. Since then, the Merriweather district in Columbia has built multi-family, office, ice skating, and created a dense mini-city.

The concept has been proven and the risk profile has declined. We are more confident about Columbia’s progress as a densification project in a suburban community. This will translate into sizable net operating income (NOI) growth in the future for Columbia.

Organization Updates

We recently ran a recruiting campaign on Twitter that went viral. Our tweet highlighted the opportunity to work closely with the portfolio manager at a beach house in New York City. We stressed passion as the most important qualification, which we rank above intelligence and skills. Our tweets generated 300,000 impressions on Twitter and more than 25,000 engagements. As a result, we received almost 40 applications with impressive stock pitches and resumes.

In addition to local applicants, we received applications from Brazil, Peru, Italy, and the U.K. The applicants have a wide range of experience, including Ivy League students/graduates, state school students/graduates, and even mid-career individuals with backgrounds in food trucks, poker, finance, and video games. The search was an incredible experience. We moved quickly to interview about ten local applicants and decided to take on three summer interns—Matthew, Calvin, and Henry—despite our original intention of taking on just one.

Matthew is a recent Wharton undergraduate with extensive buy-side internship experience. He will be joining Alliance Bernstein in January 2023 and will be with us until the fall. His investment thesis on California Resources, a spin-off of Occidental Petroleum, demonstrated his readiness to contribute immediately. Matthew will also help me organize investor meetups and idea pitches at the beach house. Calvin is a scrappy twenty-year-old entrepreneur, who is already working on a $1.5 million project converting an office building into student housing for SUNY Binghamton students.

He is a young Sam Zell in the making and has already helped me aggregate more than 500 individual addresses for a publicly traded company. With this information, I was able to quickly determine the feasibility of liquidating a target company. I’m confident he will be a force in the real estate industry. He is currently working with Rhizome on a flexible project basis. Henry’s investment thesis is a rebuttal to Jim Chano’s short thesis on data centers.

His has deep understanding of technology and his intelligence is off the charts. More important, Henry is deeply curious and wants to swap his knowledge of “bits” (technology) for my knowledge of “atoms” (physical world/old economy). He is already doing a deep dive into specialty chemicals.

It has been great to add such powerful youth and energy to the Rhizome team. Our day starts with an hour-long chat, discussing current events or interesting market developments over breakfast. During lunch, we have another hour-long discussion on investment ideas, macro trends, portfolio companies, hedging strategies, portfolio allocations, and Gen Z trends. This has been personally rewarding for me because it fulfills a deep personal desire of mine to coach and mentor young investors. We are having a lot of fun and collectively accelerating our learning. We have great team chemistry and are already functioning like a well-oiled machine.

The most incredible dynamic of this recruiting process is how well the candidates fit the role. Our goal is to mentor our interns and provide an accelerated learning experience. In return, the talented interns convert their curiosity into idea generation and company research for us. There are many high-quality companies trading at reasonable prices. I am actively working with our interns on conducting deep dives into the moat, pricing power, industry structure, and growth prospects of our target companies.

For example, we are conducting a new underwriting process on DuPont (DD). The company recently disposed of lower-margin, cyclical, and lower-growth companies and has reallocated capital to more stable businesses with higher growth and higher margins. Yet the multiples received for the disposed businesses and the multiples paid for the new businesses are roughly the same. DuPont may re-rate higher because of the selective “high grading” of its business lines.

Even if DuPont’s multiple stays the same, an investor can earn 13-15% IRR in the long run because we believe the EPS can grow 6-8% for a long time. We are also researching various REITs and performing bottoms up valuations. Lastly, the interns are acting as “red team members” focusing on attacking the investment theses of our existing companies. Their job is to find weaknesses of our portfolio companies and identify overlooked risk factors.

This is a great time to have three talented interns helping me cover more companies. We want the beach house to become an incubator of investing talent. This campaign also created a pipeline of talented candidates for the 2023 summer internship. We are also interviewing fully remote candidates located overseas. Later this summer, we will host barbecues and idea pitches. Investing in research talent during a bear market is the kind of hallmark countercyclical behavior you can expect from Rhizome Partners.

Parting Thoughts

Bear markets are more exciting for stock picking. While we have not fully deployed our cash balance, we are working diligently on researching companies that can generate 100-300% returns in the next three years. With our recent Twitter recruiting campaign, we are building a research infrastructure that could include multiple interns and analysts. We are building a culture based on mentorship, curiosity, and teamwork.

Sincerely,

Chong Tong “Bill” Chen

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment