ArtistGNDphotography

On Thursday, August 11, 2022, Canadian renewable power and utility group Algonquin Power & Utilities Corp. (NYSE:AQN) announced its second quarter 2022 earnings results. At first glance, the company’s results were quite impressive as the firm did manage to beat the expectations of its analysts in terms of both revenues and earnings, although the stock’s performance following the release was rather tepid.

One common thing that we frequently see among the earnings reports of utility companies tends to be relatively slow and steady growth, but Algonquin Power & Utilities is very different because it is also a major developer of renewable power plants. This second thing is something that may be appealing to the managers of the numerous environmental, social, and governance funds around the world that have become incredibly wealthy over the past few years. Algonquin Power & Utilities certainly does not sacrifice its dividend for the renewable credentials, though as the stock yields 4.85% as of the time of writing. Thus, this company appears to have a lot to offer to any investor but let us investigate further in order to verify that.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Algonquin Power & Utilities’ second quarter 2022 earnings results:

- Algonquin Power & Utilities Corporation reported total revenue of $624.3 million in the second quarter of 2022. This represents an 18.35% increase over the $527.5 million that the company reported in the prior-year quarter.

- The company reported an operating cash flow of $268.6 million in the reporting period. This represents a significant 160.01% increase over the $103.3 million that the company reported in the year-ago quarter.

- Algonquin Power & Utilities received approval for its proposed acquisition of the Kentucky Power Company from the necessary regulators. This could allow the transaction to close sometime in the second half of 2022.

- The company completed the construction of the Blue Hill Wind Facility in Saskatchewan. The facility began operations in April.

- Algonquin Power & Utilities Corporation reported a net loss of $33.4 million in the second quarter of 2022. This compares very unfavorably to the $103.2 million that the company reported in the second quarter of 2021.

The first thing that we notice is that Algonquin Power & Utilities saw its revenue and operating cash flow increase substantially year-over-year, which is something that management seemed quite pleased with during the earnings conference call. This is certainly not something that is at all unusual for a utility company as most of them tend to show this exact thing. One of the biggest reasons for this is that a few of the regional utilities owned by the corporation were able to obtain higher rates from their various regulators. The entire regulated utility arm of the company’s operations saw its operating profit increase by $24.8 million year-over-year, $7.1 million or 28.63% of which was due to the rate hates alone. The company did not specifically state the cause of the rest of the increase except to state a “normalization of operations” and an acquisition, which we will discuss in a moment. In the end, the exact cause does not matter really as it was not a one-off event. Overall, then, investors should certainly appreciate this.

Another way in which Algonquin Power & Utilities grows its operating profit is through acquisitions. That was another factor that benefited the company during the quarter. The company acquired Liberty New York Water back in January. As it was purchased in January 2022, this utility was unable to contribute to the company’s performance in the year-ago quarter but, of course, did have an impact on the $24.8 million in operating profit growth that we saw in the second quarter. Algonquin did not state what exactly the impact was, unfortunately. The company did state that this utility will likely earn much more during the third quarter than any other period of the year. Thus, we should see this business have a strong impact on Algonquin Power & Utilities in the firm’s next earnings report.

Algonquin Power & Utilities is likely to see further growth via this method in the near future. This is because the Kentucky regulators recently approved the acquisition of Kentucky Power Company, which serves 228,000 customers in the state of Kentucky. It should be fairly obvious why this should result in growth. After all, this will give the company a large group of people that consistently pay their utility bills, which is one of the reasons why investors tend to like utilities. These companies provide a product that is generally considered to be a necessity for our modern way of life so they typically prioritize paying their utility bills ahead of other more discretionary expenses. These characteristics will of course extend to Algonquin Power & Utilities following the acquisition. This acquisition is expected to be consummated sometime in the second half of the year so we can expect that this acquisition will have a noticeable impact as we enter the new year.

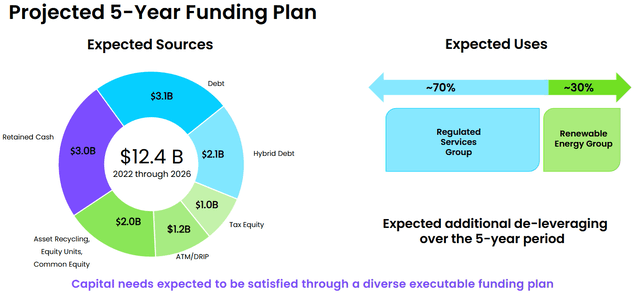

As hinted at earlier, Algonquin Power & Utilities has yet another way to grow and that is by increasing the size of its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase in the size of the rate base allows the company to increase the prices that it charges its customers in order to earn that specified rate of return. The way that the company grows its rate base is by investing money into modernizing, upgrading, and expanding its utility-grade infrastructure. Algonquin Power & Utilities intends to do exactly this as the company plans to invest approximately $12.4 billion over the 2022 to 2026 period into exactly this:

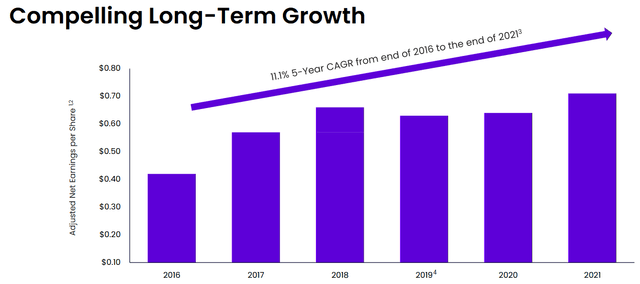

As mentioned earlier, Algonquin Power & Utilities is both a developer of renewable energy projects and a group of regulated utility companies. We will discuss the renewable developer in just a moment but approximately 70% of this spending is going to be on the regulated utility side. Unfortunately, Algonquin Power & Utilities has not broken down exactly how this money is going to be distributed amongst the various utility sub-sectors (water, natural gas, and electricity) nor to which utilities or which states and countries. Presumably, it will be spent with some degree of equity but without having this information, it is difficult to say with any certainty exactly the impact that it will have on the firm’s rate base or earnings. The only thing that we can be sure of is that both of these figures will increase. Historically, Algonquin Power & Utilities has grown its earnings per share at an 11.5% compound annual growth rate but this was driven by more than simply rate base growth and management has not made any definitive statement that the company will continue to grow at this rate.

Another way in which Algonquin Power & Utilities generates growth is by constructing renewable power facilities. It managed to complete one of these facilities during the second quarter, as stated in the highlights. This particular facility is the Blue Hill Wind Facility in Saskatchewan. This facility is capable of generating approximately 175 megawatts of power at full capacity but unfortunately, one of the biggest problems with making renewable power economic and profitable is its lack of reliability. After all, wind turbines do not work when the air is still and solar power does not work when the sun is not shining. It is very difficult for the company to sell any power when it is not actually generating any. In order to solve this problem and achieve economic viability is to use a power purchase agreement. In essence, a purchaser of power (typically a utility or some large industrial user) commits to purchase some percentage of the total capacity of the facility at some specified price. This guarantees that the facility will generate steady cash flow even if its actual output is somewhat sporadic. As stability is the primary reason that investors purchase a company like Algonquin Power & Utilities, this is something that should be appreciated by investors. The Blue Hill Wind Facility started operation back in April so we see the impact of the cash flows from the facility’s power purchase agreements reflected in the company’s results for this quarter and we will continue to see this going forward.

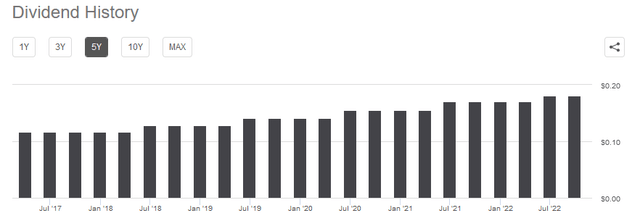

One of the biggest reasons that investors purchase shares of utility companies is because they tend to boast reasonably high yields. Algonquin Power & Utilities is no exception to this. As stated in the introduction, the company boasts a 4.85% yield at the current price, which is substantially higher than the 1.42% yield of the S&P 500 index (SPY). In addition to this, the company has a long track record of steadily increasing its dividend over time:

A record of dividend growth is something that is always nice to see, particularly during inflationary times like what we have today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that we receive from it. Thus, the fact that the company is increasing the amount of money that it pays us helps to offset this effect and keep our purchasing power relatively constant.

It is always important, though, to look at the company’s ability to afford the dividend that it pays out. This is because we do not want to be the victims of a dividend cut that reduces our income and likely causes the stock price to decline. The usual way that we examine a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow of a company is the money that is left over after the company pays all its bills and makes all necessary capital expenditures. This is the amount that is available to reward the shareholders through share buybacks, reducing debt, or paying a dividend. Unfortunately, Algonquin Power & Utilities does not look particularly good in this respect. During the second quarter, the company had a negative leveraged free cash flow of $168.1 million. This is obviously not enough to pay any dividend, let alone the $96.4 million that the firm actually paid out during the period.

However, it is not uncommon for a utility to finance its dividend using operating cash flow and finance its capital expenditures through the issuance of debt. This is mostly due to the incredibly high costs involved in building and maintaining utility-grade infrastructure over a wide geographic area. In the second quarter of 2022, Algonquin Power & Utilities had an operating cash flow of $268.6 million. This was more than enough to cover the $96.4 million that the company paid out in dividends with a great deal of money left over to cover other things. Overall, this dividend appears to be sustainable and investors probably have nothing to worry about here.

It is always critical that we do not overpay for any investment in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Algonquin Power & Utilities, we can value it using the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A ratio of less than 1.0 is a sign that the company may be undervalued relative to its forward earnings per share growth and vice versa. However, there are very few companies that have such a low ratio in today’s overheated market. Thus, it may make more sense to compare the company’s ratio against that of its peers in order to determine which firm offers the most attractive relative valuation.

According to Zacks Investment Research, Algonquin Power & Utilities will grow its earnings per share at a 7.55% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 2.54 at the current stock price. Here is how that compares to a few of its peers:

| Company | PEG Ratio |

| Algonquin Power & Utilities | 2.54 |

| Hawaiian Electric Industries (HE) | 7.81 |

| DTE Energy (DTE) | 3.77 |

| NextEra Energy (NEE) | 3.35 |

| Eversource Energy (ES) | 3.64 |

| Entergy (ETR) | 2.84 |

As we can clearly see, Algonquin Power & Utilities appears to be remarkably cheap relative to many of its peers. This is a good sign as it should indicate that the stock is a buy at today’s levels.

In conclusion, there is a lot to like about Algonquin Power & Utilities in the latest earnings report. Most especially, the company is very well-positioned to deliver quite strong growth over the coming few years due to both acquisitions and organic growth. When we combine this with a large and apparently sustainable dividend yield and an attractive valuation, the company looks like an excellent buy today.

Be the first to comment