Ivan-balvan/iStock via Getty Images

Trends to consider and Lessons learned

2022 was an incredibly difficult year in financial markets. Not much went right for our portfolios other than Elon Musk buying Twitter for what was likely far too high a price. The year began with the Omicron wave of Coronavirus and questions about whether we would experience further COVID lockdowns and ended with China abandoning their “Zero COVID” policy, decisively marking an end to the pandemic. The NASDAQ led markets out of the COVID Crash, yet last year, over half of the NASDAQ was down by more than 50%. In effect, 2022 was a mirror image of 2020 insofar as the same factors exerted themselves on our positions in opposing directions during these periods that bookend the COVID-19 pandemic. Both the COVID-19 related closures and re-openings created unprecedented challenges in forecasting business trends and opportunities.

Many businesses and investors alike, ourselves included, over extrapolated early pandemic trends while underappreciating the impetus towards normalcy and the related challenges that would present for comparables in “COVID beneficiaries.” In some respects, every single economic datapoint of the last two and a half years should have an asterisk next to it, much like has been done in baseball stats that are called into question by the contours of the time.

Here are a few examples and some of the consequences to consider:

Oil and energy prices

As evidence of the forecasting challenges during this period, crude oil is the perfect starting point. Oil’s price spike is one of the most important stories behind the inflation of. In April 2020 spot oil prices went negative, meaning one could get paid simply to accept delivery. During 2022, Crude oil was up 64% on the year at one point, surpassing $110 for the first time since 2011, yet oil still ended the year essentially flat. To what degree Russia’s invasion of Ukraine and accompanying supply crunch exacerbated inflationary pressures, we will never know; however, we do know that anyone operating a business in this environment had to make difficult decisions on how to handle such volatility on a critical input cost.

One of our hardest hit portfolio companies on account of energy price spikes was Fever-Tree Drinks (OTCPK:FQVTF). The company delivered well on its revenue growth but faced a combination of rising input costs and logistical challenges which pressured margins. Fever-Tree warned about their margins immediately on the heels of the Russia invasion of Ukraine, saying they could face force majeure from their glass and bottling partners due to elevated natural gas prices and restricted supply in Europe. his required a second major reset in margins in short order, frustrating already challenged investors. Pre-COVID the margin structure was incredibly predictable. At some point these forces will come into balance, but for 2022 this created a considerable source of pain.

E-commerce

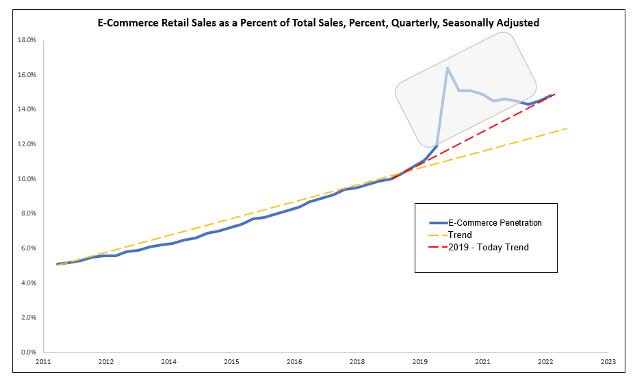

One chart sums up the forecasting challenges of this period clearer than any other: e-commerce sales as a percent of total retail sales:

fred.stlouisfed.org/series/ECOMPCTSA[1]

Pre-COVID, the trend was clear: e-commerce would steadily gain share each and every year in a fairly linear march. COVID led to a step-change, which has been followed with modest reversion but stalling share gains. As a result, businesses that formerly grew at consistent GDP+ rates grew at GDP or lower in the past two years.

The question becomes: moving forward, does e-commerce return to its pre-COVID trend or was too much growth pulled forward during the pandemic? If it returns to trend, does that play out over the next year or over a series of years? We do believe that the blue and yellow lines on the chart above will get closer, though not converge in the coming years. Further, we believe that e-commerce growth will be slower than pre-COVID, but meaningfully faster than it has been in the past two years. These beliefs stems from the ways in which e-commerce has simplified purchasing and security, expanded delivery capabilities to previously untouchable merchandise and continued to progress in solving the curation problem. Importantly for the near-term, we can already see the resumption of the growth impulse for e-commerce relative to retail sales in the latest datapoint in the chart above (Q3 2022). It is certainly plausible a new, steeper trend began with COVID, exhibited by the dotted red line above, though it will take some time to truly know whether this is the case.

There is unfortunately one stubborn problem that cannot be solved with a resumption of growth: the average company which experienced the surge increased investment pace. Amazon’s (AMZN) CEO, Andy Jassy summed it up well:

You just look in 2020, our retail business grew 39% year-over-year, at a $245 billion annual run rate, which is unprecedented, and it forced us to make decisions in that time to spend a lot more money and to go much faster in building infrastructure than we ever imagined we would. We built a physical fulfillment center footprint over 25 years that we doubled in 24 months. We made that decision even though we knew we might be overbuilding….but we decided we were going to shade on the side of consumers and sellers.[2]

From Amazon’s perspective, had they not made those investments and e-commerce share gains persisted, the company would have risked losing market share to others with the temerity to invest. The silver lining for a company like Amazon is although they did not immediately grow into the substantial investments, they likely will do so over the coming years. Time will be the necessary condition to ease these investments that today are pressuring the margins of so many companies, including some in our portfolios.

PayPal (PYPL) suffered with the slowdown in e-commerce, yet still will have outgrown e-commerce when we see final 2022 numbers. Much like Amazon, PayPal invested far too aggressively on the expectation of sustained elevated growth rates in e-commerce and unfortunately, unlike with Amazon, PayPal’s investment was on ancillary product excursions from which the company is already retrenching. The good news is that with this retrenchment, the company should once again return to its recipe of healthy top line growth and incremental margin leverage, but rather than grow back into their old margin structure they will have to cost-cut their way there.

Inflation

This question as to whether anything has structurally changed is as applicable to e-commerce as it is to 2022’s most talked about economic datapoint: the CPI. Before the pandemic, people would speak about “secular stagnation” and the strong disinflationary forces that kept the economy from experiencing a robust post-Great Financial Crisis recovery. Today, we are far more likely to hear about stagflation than “secular stagnation”, yet the economy is growing faster today than it was in the past. We must therefore ask ourselves, what are the biggest changes from before the pandemic to now that would change our economic outlook from disinflation to inflation. The largest change is what people now call “The Great Resignation” whereby Boomers who entered the workforce in the 1970s finally retiring en masse.[3] This can have consequences for wages, though we would caution against fearing a wage price spiral as underinvestment in efficiency due to an overabundance of labor during the past decade can finally commence with lower levels of fear for labor unions and politicians alike. In fact, investments in productivity might even be encouraged now with fears of inflation front-and-center. As we have pointed out several times in the past, Cognex (CGNX) stands to benefit considerably from this change.

Forex

At one point this year both the euro and the pound sterling reached parity with the US dollar. The Japanese Yen was down a whopping 23% against the dollar. Multinational companies whose cost bases are not aligned with their revenues could hedge some portion of FX pain but the magnitude of the moves made that impossible. Hedging Could only temporarily dull the pains of these dramatic changes.

Match Group (MTCH), a long-term holding of ours offers an important illustrative example of these effects. Tinder grew reported revenues 6% year-over-year, accelerating a debate about whether this particular asset has reached a plateau in its growth curve; however, revenues grew 16% on an FX neutral basis. Has this asset stalled or is it a mid-teens grower? Other factors will determine the one true answer to this question, though FX and the stated headline make the answer seem obvious when it is not. When foreign exchange movements are modest, people tend to focus more on FX neutral assuming those changes will normalize over time, yet when movements are extreme the headline takes prominence.

Interest rates

The Fed first raised rates in March of 2022, though that first hike feels like way more than a year ago. In December of 2021, in the FOMC Summary of Economic Projections, the Central Tendency for PCE inflation was 2.2-3% for 2022 and 0.9% for the Fed Funds rate at the end of the year. In November, the last datapoint we have, it was 5.5%. [4] It will be lower in Dec, but it will have peaked at just shy of 7% in June. In December 2022, the Fed forecast PCE of 2.9-3.5 for the coming year and a year-end Fed Funds rate of 5.1%.[5] If even the group that sets interest rates can end up so far off target, who is supposed to get these forecasts right in such a challenging environment. Due to these interest rate changes, mortgage rates jumped from 3% or less to upwards of 7% at their worst this year. This was the first time in over 20 years that mortgage rates registered such high levels, effectively stifling the pandemic-induced boom in home prices and housing.

Forecasting and extrapolation

One aspiration of our strategy is that it should be less exposed to the precise contours of forecasting than the prelude to this letter makes it seem. The reality is that we did not meet our expectations on this front and learned some painful and valuable lessons about grappling with immense uncertainty and moving beyond stock selection to portfolio management. Portfolio management plays an important role in mitigating these inherent risks. Importantly, in the next section we share the most important lessons learned this past year and how we have and will continue to deploy this knowledge going forward.

Lessons learned

We learned some of the wrong lessons during the pre-pandemic decade and we acted with far too much complacency as a portion of our portfolio ascended to extraordinary levels. We had been far too confident in the notion that long-term, low-turnover investing meant holding through periods of even heightened valuations with inevitable rewards on the other side of valuation corrections. Through it all, our security selection framework has largely been sound and outside of a few mistakes, we have a good tendency to identify and buy the right stocks. Our process and what we look for in portfolio companies has remained the same throughout–we want growing companies, at reasonable valuations with demonstrable business quality.

Our investment process and the depth to which we research and analyze investments has only gotten better over time. We have learned some great lessons throughout the last year, and we’ve used these learnings to better structure the portfolio – both from a position weighted and valuation standpoint, affording ourselves more latitude to trim winning positions and a quicker eject button when long-term holdings become overvalued and show signs of cracking.

Long-term, low turnover, but not no turnover + Tax Derangement Syndrome

Holding for the long-term, through periods of heightened valuations is not the right strategy. We formerly thought it was. There are two significant problems with our prior thinking:

- When several positions trade at high multiples at the same time, the simultaneous correction of all positions to more reasonable valuations create too drastic a drawdown for the portfolio as a whole, and;

- Even if we believe that a singular position will trade sideways for several years, sideways is far more likely to decline, perhaps even substantially, prior to regaining its peak price level. Holding through high valuations requires discretely identifying why a position will not be vulnerable to something worse than an inline correction with the market in the interim. These situations are far rarer than what we previously believed.

We also suffered from what a friend and industry peer calls “tax derangement syndrome.” Given most of the assets we manage are held in taxable accounts, we have always targeted after-tax rather than gross returns. We recognized the overvaluation in a few cases and started selling a small portion of our positions but held on to the majority. Our specific intent was to spread the tax hit over years and minimize the impact of tax drag on the aftertax returns. We had some lamentations in 2020 and 2021 about the high tax bills delivered; however, in hindsight, we clearly should have delivered even higher tax bills. Mr. Market did not afford us the opportunity to defer our tax hit into out-years and instead atrophied away a good chunk of our unrealized gain. In the future, we will always abide by our focus on after-tax returns; however, when the opportunity presents itself to sell something that we view as expensive, we will not play it cute and instead sell more forcefully.

Factors

We have always been cognizant of diversifying the risk factors in our portfolio. Unfortunately, in 2022 we left ourselves exposed to one factor that critically affected our performance: interest rates. Although we did not have any one business specifically hurt by interest rates through the most obvious of channels–rising interest rates–we did have three kinds of companies that experienced worse performance as a result of the change in US rate policy in. To make matters worse, two of the sub-factors below were supposed to be sources of diversification away from factor concentration as it was conceived in our portfolio management framework. The allocations hurt by rising rates were the following:

- Growth

- International

- Real Estate Small-Cap Equities

Growth and real estate were the most similar insofar as rising interest rates translate to a higher cost of capital and bring down valuations. Small cap securities, even ones not of a growth orientation, disproportionately underperformed the S&P and their larger cap brethren. Although not as closely tied to interest rates as the others in this list, we do believe their underperformance is a function of liquidity which is largely driven by interest rates. We felt our real estate holding (Kennedy Wilson, KW) would fare better given its high cash flows and capital lean asset management business, yet that was not the case. [6] The international positions were especially challenging.

Two of the holdings were up decently in their domestic currencies (Safran , OTCPK:SAFRF, and Nintendo, OTCPK:NTDOY), though the dollar’s strength masked the entirety of those gains. The remainder of the international positions can also be labeled as growth and therefore the FX problem compounded the growth one. In the future we will pay far more attention to the factors our portfolio is exposed to and be more thoughtful about how to either hedge out some risk or find positions that can counterbalance it.

Immature companies face greater challenges in volatile environments

One lesson we learned the hard way is that younger companies, with more streamlined business and fewer revenue streams face more challenges than larger companies in turbulent environments. These challenges may be difficulties in achieving growth plans or operational in nature. Age is a source of resiliency as far as corporate operations are concerned and although more layers of complexity may stifle innovation, they do deliver consistency. Going forward, we will be more thoughtful about the balance between old and young companies and the degree to which our young companies are built for resiliency in a turbulent economy.

Company engagement

During the course of the year we were far more proactive engaging with our portfolio companies. We learned several lessons on this front. Early in the year we reached out to several of our holdings and expressed our concern about investing heavily into a more uncertain revenue environment. We fault ourselves for sticking with some of these investments, though we also did not expect the magnitude and willingness of these companies to invest into tougher revenue comparables and slowing growth. Two companies we spoke with about planning with prudence and making strategic but limited investments did the exact opposite. As a result, these companies experienced far greater margin pressure than we anticipated and a much worse year in the stock market than we thought likely. In each case, there were two distinct points where we could have sold and greatly mitigated our pains. First, we could have sold when the companies’ respective responses emphasized the areas they wanted to invest rather than addressing our points directly. Second, we could have sold on the first earnings report delivering slower growth and margin pressures. In each case, even in the later event, the stock was down meaningfully though still decently higher than where it ended the year. Although we are far more focused on long-term value and whether companies can continue to do more for their customers, it is critically important for management teams to balance the cadence of investments and understand the risks they might be exposing themselves to should the world not play out as planned.

On the more constructive side, we had two interactions where we feel our engagement was important in guiding prudent capital allocation at our portfolio companies. These companies spoke thoughtfully about their investment priorities, consideration for shareholders and responsibilities as stewards of our capital. These signals are incredibly powerful and help build stable, long-term shareholder bases and we are confident these positions will play an important role in our portfolios going forward.

We expect to continue engaging with our portfolio companies, as we know in leveraging our growing network of investors and industry experts that we can be an important channel of information. Companies value our ability to capture the sentiment of current and prospective investors as well as the openness with which we share prevailing questions that many are asking. We also know that companies who we have nurtured a long-term relationship value our perspective and we do not require that management teams listen to us in order to stay invested, though we do require a thoughtful response when we are passionate about specific points.

Valuation Spreads

We always appreciated the notion first shared by John Maynard Keynes that “markets can stay irrational longer than you can stay solvent,” and to that point, we have observed valuation spreads though not acted as one to put pressure on them. Our approach to capitalizing on such spreads is to use sharp divides in the fortunes of two related classes to seek out opportunities where sentiments are less dear. Two notable valuation divides accelerated in this past year, and we find them interesting and notable.

Tech vs not tech

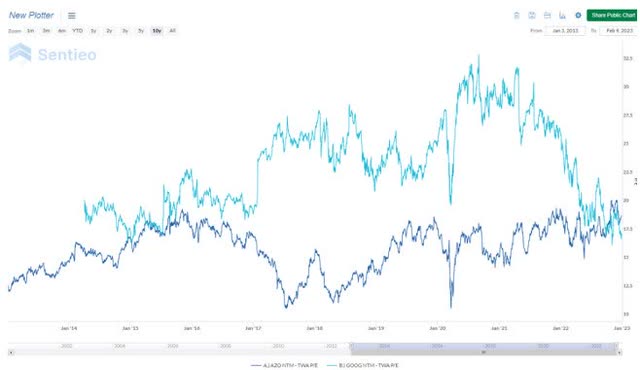

Below is a chart of Alphabet’s (GOOG, GOOGL) P/E ratio plotted against Autozone’s (AZO). Any number of examples between large cap tech companies and more mature companies could illustrate this very same point, but we find this specific case most interesting because of its history.

Note that in late 2014/early 2015 these multiples crossed one another. The relative harmony between Alphabet and Autozone lasted for just shy of a year at that time, before Alphabet’s shares surged and Autozone’s shares slumped. This relationship need not matter for markets, though we think there is some signal for investors. Autozone today trades at the highest multiples of its recent history, while Alphabet trades at its lowest. Meanwhile, despite growth estimates dropping considerably at Alphabet and appreciating modestly at Autozone, Alphabet will outgrow Autozone by a wide margin over the next five years.

There are other factors at play here, including margin and capital allocation considerations that the market may be isolating on. Markets tend to drive narratives, and as such, this is merely the consequence of “growth” overcorrecting to the downside and “value” overcorrecting to the upside. Autozone is an optimized company from a capital structure and margin standpoint, while Alphabet has numerous pathways to optimize, including evolving from a substantial net cash position to a neutral position and rationalizing the expense base to drive more margin. For Alphabet, this is an opportunity, not a risk. Beyond growth vs value, the proverbial knives are out for tech companies and their profligate spending with slowing growth. Not every tech company is cheap, but Alphabet is screamingly so and we think some of the same investors who found Autozone a great buy at low double digit P/Es will find themselves saying “would I rather own Alphabet at 17x earnings or Autozone at 18x.” The answer is obvious.

Small vs big

In our Q1 2022 commentary we spoke about the extreme relative undervaluation between small and mid-cap stocks and their large cap brethren. Since that time, the S&P 500s P/E has fallen modestly and the S&P 400 (mid cap) and S&P 600 (small cap) P/Es have risen modestly. The change has to do with a combination of slumping forward estimates and slight underperformance of the S&P vs the small and mid-caps since publishing that letter. Nonetheless, smaller capitalization companies have experienced an atrocious five years compared to larger caps. We were recently introduced to an interesting datapoint from the legendary small cap investor Chuck Royce on what happens after challenging periods for small caps:

Related to this is the fact that small-cap’s historical performance patterns show that below-average longer term return periods have been followed by those with above-average longer-term returns—and the subsequent periods have enjoyed positive returns most of the time. Subsequent annualized three-year returns from three-year entry points of less than 5% have been positive 99% of the time—that is, in 75 out of 76 three-year annualized periods—averaging 16.1% since the Russell 2000’s 12/31/78 inception. The Russell 2000 also had positive annualized five-year returns 100% of the time—that is, in all 81 five-year periods—and averaged an impressive 14.9% following five-year periods with annualized returns of 5% or less. We think this is especially relevant now because the respective three- and five-year annualized returns for the Russell 2000 as of 12/31/22 were 3.1% and 4.1%.[7]

Certain structural forces have hurt small caps in the recent past, including growth companies staying private longer, large companies experiencing tremendous margin expansion and an increasingly large cadre of small caps operating unprofitably, but we think the seeds are now planted for a better future ahead for the following reasons:

- When large and mid-cap companies decline 60+%, a portion of bigger companies enter the small cap universe who previously were not there.

- The M&A landscape has changed dramatically whereby previously high valuations kept some well capitalized companies from pursuing acquisitions. This great reset now has some bigger players looking to shop. It takes time for acquisition targets to accept new realities, but the fact that these valuation spreads have now persisted for upwards of a year sets the stage for action ahead.

- Valuation spreads within small caps are wide creating a great opportunity for those with stock picking acumen.

- Unprofitable companies will face considerable pressure to rationalize their businesses and deliver sustainable cash flow to shareholders. The inflection from unprofitable to profitable can result in tremendous value creation.

The Silver Lining:

Amidst it all, in 2022, we saw our lives return to a degree of normalcy many of us had not experienced since February 2020. This is a major accomplishment fueled by heroic first responders, last decade’s tremendous advances in science, and human resilience. We are inspired to see travel resume, friends and families reunited after spending far too long apart. The coordinated global lockdowns to combat COVID are one of the few things we can appropriately describe as “unprecedented” and we now are dealing with the unprecedented consequences of reopening. We deeply believe that the challenges we face today in the economy and in markets is a consequence of the turbulence involved in reigniting normalcy for the global economy. Reopening starts locally, then cross borders. China, the world’s most populous country, only in the past month fully embraced a post-COVID policy structure. Every passing day takes us one step closer to a new normal and this turbulence will eventually recede.

Along these lines of optimism, we’d like to conclude our commentary by re-emphasizing our position on forward returns as laid out in our last quarterly note:

- Today is a great time to invest for the long run, though the market may very likely experience more volatility before once again resuming its march higher.

- Our portfolio companies are built to come out of a recession stronger than they enter it. The businesses we invest in have strong balance sheets and the mandate to pursue constructive actions ranging from organic investment to acquisitions to repurchases. We expect meaningful market share gains from most if not all of our investments.

- Returns from here will be powered by a combination of growth and free cash flow, with the potential for modest multiple appreciation. On a forward basis, this is the best set-up for returns that we’ve seen since the inception of our firm during the depth of the credit crisis.

- We believe that the Biotech and life science tools and instruments verticals are the most interesting areas to hunt in today’s market for opportunity and they are likely the very sectors that will lead the next bull market. We have made a handful of investments through the past year that we think will support our next five years of returns.[8]

New Actions

During the fourth quarter, we made Azenta (AZTA) and META substantially larger investments and started a new undisclosed position in the heavily beaten down semiconductor space.

Thank you for your trust and confidence, and for selecting us to be your advisor of choice.

|

Jason Gilbert, CPA/PFS, CFF, CGMA, Managing Partner, President Elliot Turner, CFA, Managing Partner, CIO |

| Past performance is not necessarily indicative of future results. The views expressed above are those of RGA Investment Advisors LLC (RGA). These views are subject to change at any time based on market and other conditions, and RGA disclaims any responsibility to update such views. Past performance is no guarantee of future results. No forecasts can be guaranteed. These views may not be relied upon as investment advice.The investment process may change over time. The characteristics set forth above are intended as a general illustration of some of the criteria the team considers in selecting securities for the portfolio. Not all investments meet such criteria. In the event that a recommendation for the purchase or sale of any security is presented herein, RGA shall furnish to any person upon request a tabular presentation of: (i) The total number of shares or other units of the security held by RGA or its investment adviser representatives for its own account or for the account of officers, directors, trustees, partners or affiliates of RGA or for discretionary accounts of RGA or its investment adviser representatives, as maintained for clients. (II) The price or price range at which the securities listed. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment