Chinese Trade Balance, Asia-Pacific Markets, NZD/USD – Talking Points

- Asia-Pacific markets weighing Chinese data and regulatory concerns

- Chinese March trade balance in focus to gauge global trade situation

- NZD/USD in focus as price attempts to overcome Rising Wedge resistance

Discover what kind of forex trader you are

Tuesday’s Asia-Pacific Outlook

Asia-Pacific markets may see a neutral open on Tuesday’s trading session following broad losses through regional indexes on Monday. Chinese shares moved lower despite a rally in Alibaba (BABA) shares following a landmark fine of 18.2 billion Yuan by Chinese regulators. The Chinese technology giant rallied on hopes that its regulatory troubles are now in the rearview mirror.

However, investors shifted the focus to other technology stocks, fearing that they may come under the same regulatory scrutiny that befell Alibaba. Those fears dragged on Chinese equities, with the CSI 300 and Hang Seng Index (HSI) dropping 1.74% and 0.86%, respectively. The Chinese Yuan traded nearly unchanged against the US Dollar overnight.

The concern over an increasingly strong regulatory environment combined with woes over a tightening in stimulus efforts from the Chinese government weighed on stocks. New Yuan Loans data for March crossed the wires on Monday, showing banks across China continued to inject liquidity into the economy at a high rate. Chinese banks facilitated 2.73 trillion Yuan in new loans and 3.34 trillion in aggregate financing, according to the DailyFX Economic Calendar.

While China’s credit conditions did show a sharp surge on a monthly basis, when viewed annually versus last March, a time when China was pumping liquidity into markets during the initial Covid pandemic, the figures are more moderate. Outstanding loan growth crossed the wires at 12.6% compared to last year, down from February’s 12.9%. The PBOC is walking a delicate line with the amount of credit in the economy, stating before that it will not let the economy overheat due to excess money in the system.

Today will see more Chinese economic data cross the wires, this time in the form of trade data. China will release its balance sheet on trade for March at 03:00 GMT, with economists expecting a $52.05 billion print, down from $78.2 billion in the prior month. Both imports and exports are expected to pick up, but analysts are expecting an outsized pickup in imports relative to exports. A country’s balance of trade is calculated as exports minus imports.

Outside of China, Australia will see home sales and business confidence data for March released. South Korea’s import and export prices for March are due out. Late Tuesday, New Zealand will release visitor arrivals data for February. A meaningful increase isn’t likely for February, but traders will soon key in on New Zealand tourism and flight data for any upticks in the economy through travel now that a travel bubble between the island nation and Australia has been implemented. Earlier this morning, New Zealand’s electronic retail card spending hit 5.1% YoY for March.

NZD/USD Technical Outlook

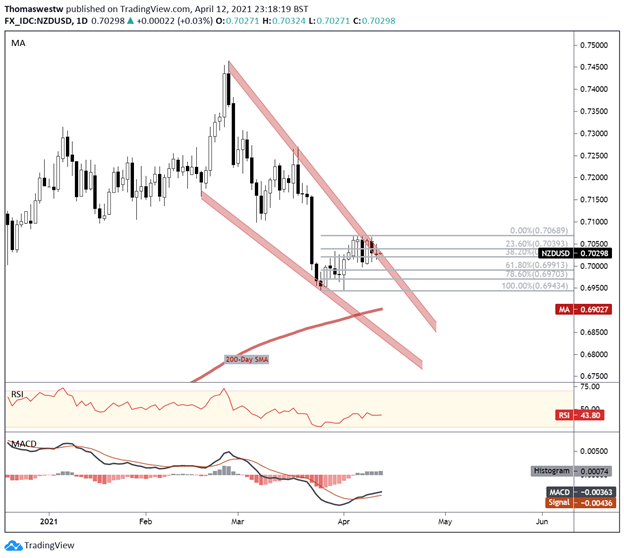

The New Zealand Dollar is attacking the upper bound of a Falling Wedge pattern after an early month surge in the Kiwi saw NZD/USD rise to the key resistance level. The currency pair is at the 38.2% Fibonacci retracement level, which may offer support if bulls continue to pressure the trendline. A drop lower would see the 200-day Simple Moving Average (SMA) begin to shift into focus. Overall, the path higher appears like it may play out, with the MACD rising after breaching above its signal line.

NZD/USD Daily Chart

Chart created with TradingView

NZD/USD TRADING RESOURCES

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

Be the first to comment