JJ Gouin

REX American Resources (NYSE:REX) is a corn refiner and distiller, focused on ethanol production, based in Ohio. The company offers corn, distiller grains, plus non-food grade corn oil, gasoline, and natural gas. REX also provides dry distillers grains with solubles, a protein in animal feed. It owns a portion of 6 different refineries in the U.S. Midwest with production capacity of nearly 700 million gallons of ethanol yearly (280 million as a percentage owned).

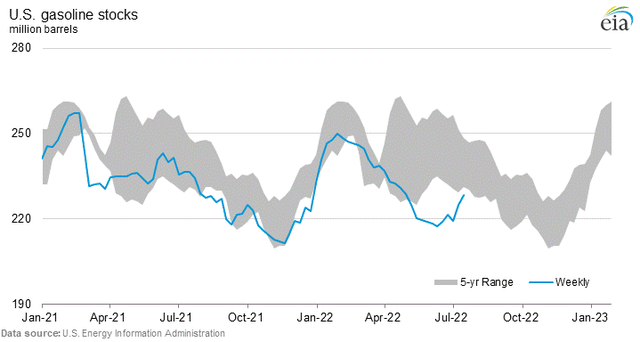

The investment thesis is developing shortages of U.S. gasoline supply (new oil/gas refineries are not being built) will increasingly be gap filled with biofuel product additives like ethanol. And, REX is one of the corn refiners best positioned to benefit with its existing low-cost infrastructure, utilizing no debt at the corporate level. U.S. gasoline stocks/inventories have been running materially below seasonal norms during the summer.

EIA Report, U.S. Gasoline Stocks – July 2022

REX does not pay a dividend. Instead, it has engaged in regular share buybacks with its outstanding cash flow generation, repurchasing 25% of float the last decade. A 3-for-1 stock split is coming on Friday. So, you may need to divide all my per share numbers by 3, when you get around to reading this article. The share count will move from 6 million to 18 million over the next week, as share price moves from $90 to $30.

December 2021 Investor Presentation

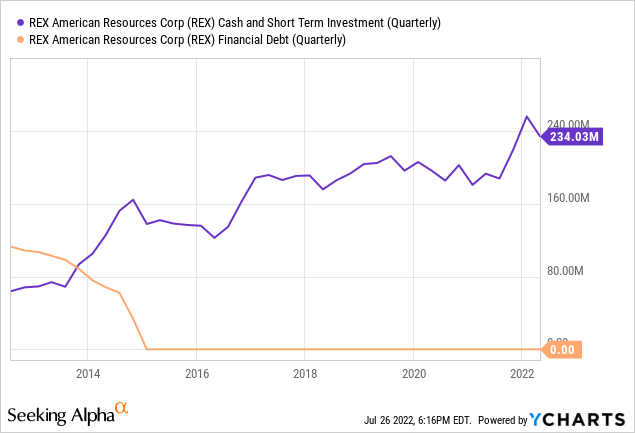

Fortress Balance Sheet

Outside of the bright demand future for renewable energy ethanol (similar to 2022 results for the company), the main attraction for investors is REX’s super-conservative balance sheet. At the end of March, $234 million in cash (nearly $40 per share) stands out vs. $540 million in equity market capitalization at a share price around $90 per share.

All told, $343 million in current assets were owned vs. just $54 million in “total” liabilities. That represents almost $50 per share in liquid book value, with another $148 million in depreciated plant & equipment, plus $58 million in long-term investments and tax assets held. With $73.65 per share in tangible, easy-to-sell book value vs. a $90 share quote, few other oil/gas related enterprises can be purchased as close to underlying cash-centered, zero debt, cost-accounting value. Below is a 10-year graph comparing cash holdings to debt levels.

YCharts

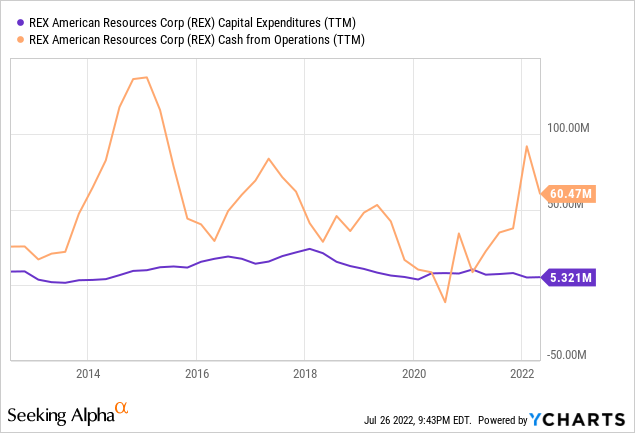

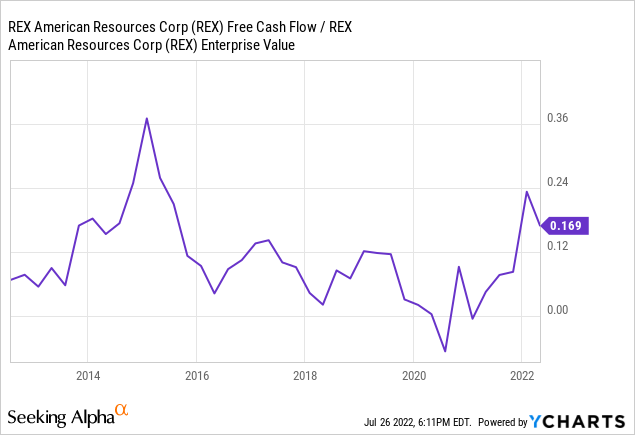

Free cash flow generation has been quite amazing for a cyclical business. One of the advantages of zero expense on debt, from an intelligently run enterprise, is profits and cash flow are typically far better than peer and competitor companies holding high debt levels. Below is a decade-long graph looking at cash flow generation vs. capital expenditures, with the difference representing the standard definition of “free” cash flow. Only a few quarters in 2020, during the COVID-19 economic shutdowns, could drag free cash flow into negative territory.

YCharts

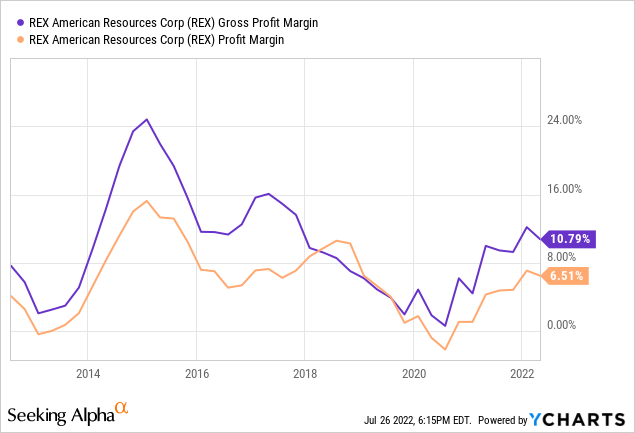

With no debt and tight cost controls on selling/marketing expense and general overhead, final profit margins closely track gross margins on the chart below. Notice how current margins are relatively average vs. the last 10 years. Plenty of room for improvement in profitability may be coming if gasoline inventories remain low for years in America (which may or may not come to pass).

YCharts

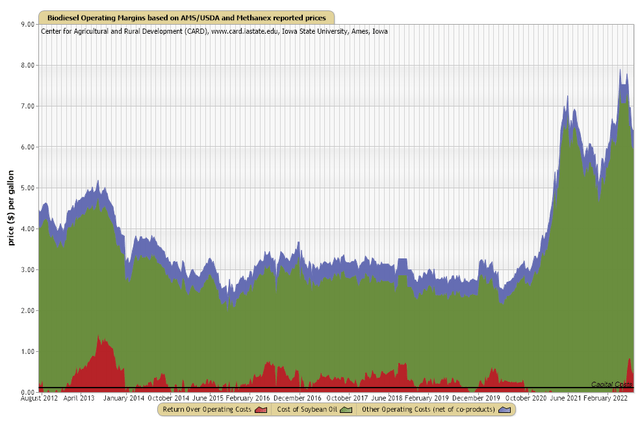

More good news for the REX earnings outlook, industrywide profit margins just turned positive in the middle of 2022, after several years of losses. (Red area over black line on graph below.)

Ethanol Margins Industrywide, Iowa State University – CARD

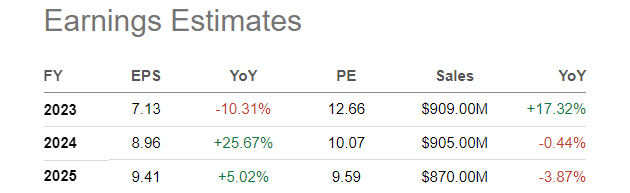

Wall Street analysts are projecting steady gains in EPS, even if sales stagnate at the current level. The thinking is ethanol refinery margins have been too low for years, and will grow to fill gasoline shortages.

Seeking Alpha, Analyst Estimates – July 26th, 2022

Inexpensive Valuation of Operating Business

Forward P/Es of 12x or 10x are absolutely worthy of extra research, especially from a stock valuation backed by 40%+ in cash. I figure today’s overall REX valuation on operating metrics is 30% to 40% below 10-year averages. Here are the reasons why investors should get excited about this bargain setup.

When we split the cash position from actual operating business performance, free cash flow generation (including almost zero interest income on the cash stash) measured against enterprise value is an exceptional 16.9% on a trailing 12-month basis. This number is nicely above the decade-norm closer to 10%, and represents 4x the equivalent S&P 500 index EV income yield under 4%.

YCharts

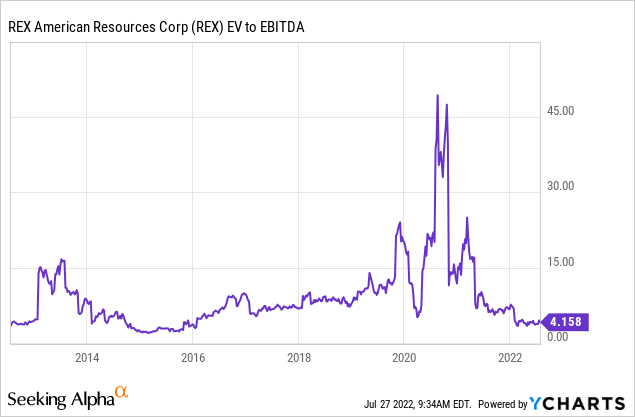

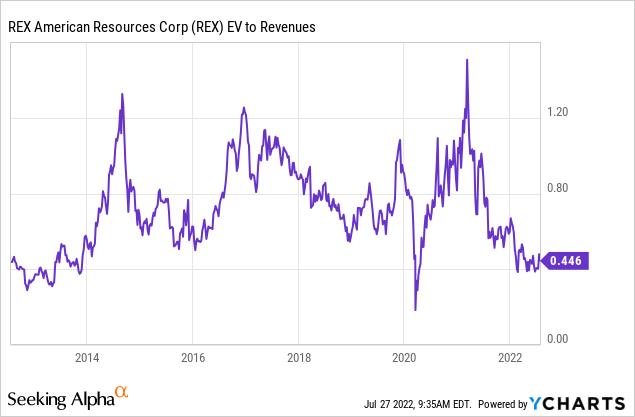

However, the asset-adjusted free cash flow story is only the beginning. Enterprise value calculations on EBITDA and revenues are a solid 40% discount to 10-year averages for REX.

YCharts YCharts

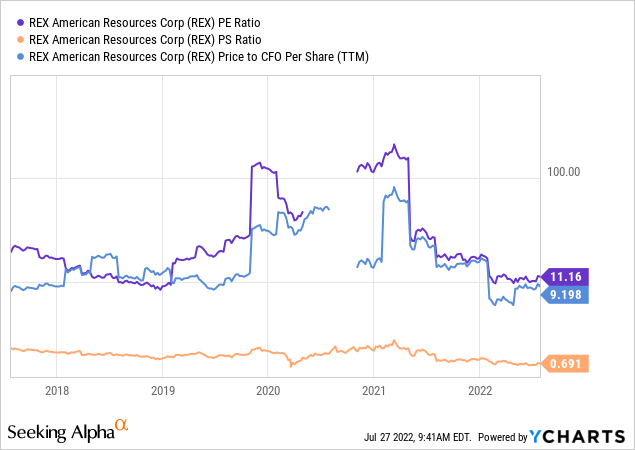

On a closer zoomed in review, price to trailing earnings, sales, and cash flow are trading at 5-year lows, even lower than the 2020 pandemic selloff in the stock.

YCharts

The intrinsic market-based price for company shares seems to be anticipating a decent downturn in refining margins and overall ethanol demand. A recession in the U.S. economy looks all but assured to me, but gasoline shortages may or may not remain. For example, a major hurricane hitting Texas later this summer could upend the gasoline market, as oil/gas refineries are shut-in for weeks or damaged for months. If this is the case, a real opportunity in ethanol could be open today.

Constructive Technical Chart

The trading momentum indicators I track are actually quite positive on REX in July. A flat share quote over the last 12 months is far better than the negative performance of the S&P 500 and other U.S. market indexes, for starters.

On the 18-month chart below, I have circled in green the low 14-day ADX score, which could be telling us a short-term base pattern is being completed, similar to August-October 2021. You have to go back to early 2021 to find another instance of rising Negative Volume Index and On Balance Volume readings. The red arrow points to a rapidly improving NVI score, and a blue arrow points to the big jump in OBV over the past 6 weeks. Taken together with the low ADX number, it appears buying pressure could soon push price into an uptrend, maybe with dramatically higher quotes in 6-12 months.

StockCharts.com, Author Reference Points

Final Thoughts

My quant-sorting momentum formulas are now highlighting REX American as a clear buy idea in July. It’s a defensive and growth play at the same time. A superior/conservative balance sheet with lots of cash and no debt are incredibly supportive of the $90 quote. I doubt a recession can pull price below its $76 and rising book value, at least not for long. On the growth side of the equation, continued tightness and shortages in U.S. gasoline supply should bring even stronger profitability in the years ahead. Lastly, a push for greener, more renewable energy solutions could encourage more investor attention in the ethanol sector, helping out the valuation of its business operations.

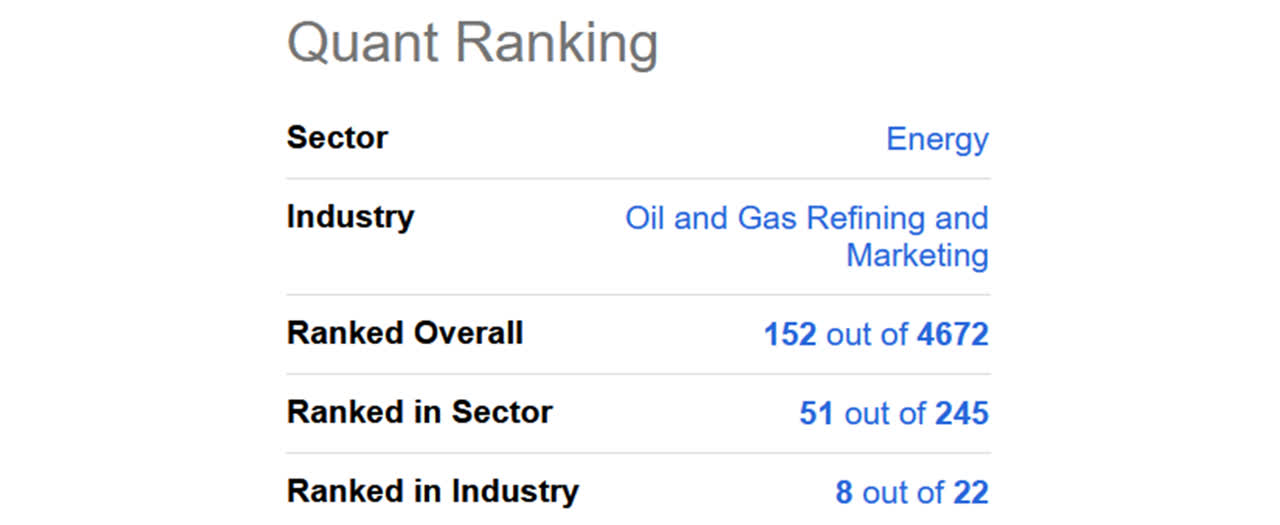

Seeking Alpha’s Quant Ranking of REX is equally bullish today. It sits in a Top 3% position, out of a universe of 4,600 stocks, when reviewing technical momentum, earnings revisions, and valuations.

Seeking Alpha, Quant Rank REX – July 26th, 2022

Given a normal 10-year valuation on static results, I have a simple upside target of $125 over the next year, with downside risk to $70 in a worst-case deep recession scenario. In this risk-reward analysis, potential 12-month upside of +40% vs. downside of -20% favors a bullish position. Of course, if corn refinery margins improve, while REX profits rise faster than anticipated, $150 is not out of the question in 18-24 months.

Something else to contemplate: Looking at all the cash on the balance sheet, zero debt, and leading margins in the industry, REX makes an appetizing acquisition, merger, or take-private candidate. With its small size, honestly hundreds of potential suitors might be interested, especially if ethanol profit margins continue to expand the rest of 2022.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment