ablokhin

Stocks – it’s the earnings, not the other stuff

People buy stocks for a lot of reasons:

“I see a catalyst in the next few weeks.”

“We’re going to squeeze the short positions of those elitist hedge funds.”

“The chart is showing a triple axel overlaying a Bonwit cross.”

“The CEO is a disruptor.”

But think about buying a business rather a stock. What is the first question you would have for the current owner? I’ll bet it’s “How much money are you making?” That is why financial theory (the dividend discount model) says that:

“The price of a company’s stock is…the sum of all of its future dividend payments when discounted back to their present value…If the value obtained from the DDM is higher than the current trading price of shares, then the stock is undervalued and qualifies for a buy, and vice versa.” (Investopedia)

My outlook for future earnings is why I enthusiastically recommend Pulte Homes’ (NYSE:PHM) stock. I will try to convince you of the same view by forecasting EPS for the next four years. I expect Pulte’s EPS to be $11 this year, $5 for next year and ’24, and $9 in ’25.

My EPS forecasts are based on four major themes:

- Earnings over the next year will be terrific.

- Pulte is a very well-managed company.

- The long-term outlook for Pulte’s product, new homes, is strong.

- The near-term outlook for new home construction is weak, and should get weaker.

Earnings over the next year will be terrific

Pulte just reported Q2 EPS of $2.73 per share, up by 59% from a year ago, and a company record. Q2’s earnings beat full year earnings as recently as 2017. Full-year ’22 EPS will very likely exceed $10 per share because Pulte’s “backlog” of homes (sold but not yet built and delivered) reached a record $11.6 billion. Backlog is an excellent forecasting tool for up to a year.

Pulte is a very well-managed company

My highlights are:

- High returns on equity. It was 31% over the past four quarters, and has been over 20% since 2018.

- Low debt. Pulte’s debt-to-equity ratio currently is only 21%, very low for a homebuilder.

- Use of capital. Pulte has consistently used its excess cash flow to reduce its shares outstanding. Pulte’s shares outstanding declined by 4% during Q4, 10% over the past year and by 39% since 2013. If Pulte’s share count were the same during Q2 as it had been in 2013, its EPS would have been $1.67 instead of $2.73.

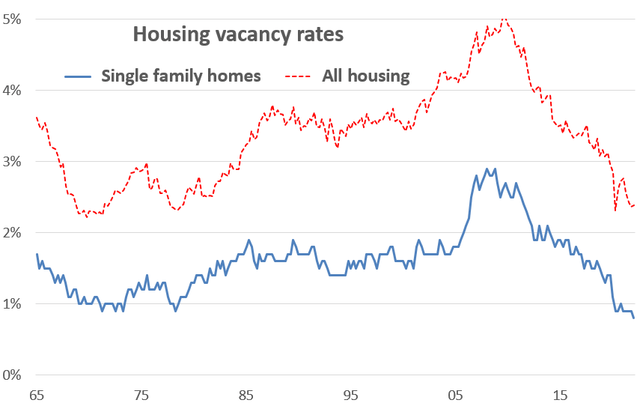

The long-term outlook for Pulte’s product, new homes, is strong

U.S. housing vacancies are at multi-generation lows, as this chart shows:

Source: Census Bureau

I estimate that the U.S. is short about 1½ million housing units. Freddie Mac believes the shortfall is more than double that. There is only one why to fix this major shortfall in supply – build more houses. Even with the rate of U.S. population growth rate slower today than it has been in the past, single family home construction will have to average at least 1 million a year to meet long-term demand, which is roughly the current pace of building.

The near-term outlook for new home construction is weak, and should get weaker

I’m certain you know this story. Housing affordability has dramatically declined over the past two years, due to a combination of sharp increases in home price and mortgage rates. The comparison of these numbers for this May versus the same month two years ago is dazzling:

- The S&P/Case-Shiller Home Price Index rose from 218 to 305, a 40% increase.

- The 30-year mortgage rate rose from 3.3% to 5.3%.

- As a result of the above, the average monthly mortgage payment on a home purchase rose by 124%.

- U.S. household income, excluding COVID payments, rose by 11%. Not bad, but not 124%.

As an obvious result, home sales have begun to slow and are likely to slow further, especially with a recession getting more and more likely. Home prices have surprisingly not started to decline yet, but they almost certainly will. But I don’t expect sales and prices to fall off a cliff, for three reasons:

- I don’t expect a serious recession, as I discussed in a recent piece for Seeking Alpha.

- The serious housing shortage that I discussed above.

- The recession should stabilize or more likely lower mortgage rates. For example, growing fears of a recession lowered the 10-year Treasury bond yield from a peak of 3.5% in mid-June to 2.8% today. And the “mortgage spread” – the yield premium on a 30-year mortgage versus a 10-year Treasury – is 100 bp above normal. That has occurred less than 1% of the time since 2000. Even a 50 bp spread above normal has only occurred 7% of the time. So mortgage rates are likely to decline even without a Treasury bond yield decline.

Putting the assumptions together – my Pulte EPS estimates

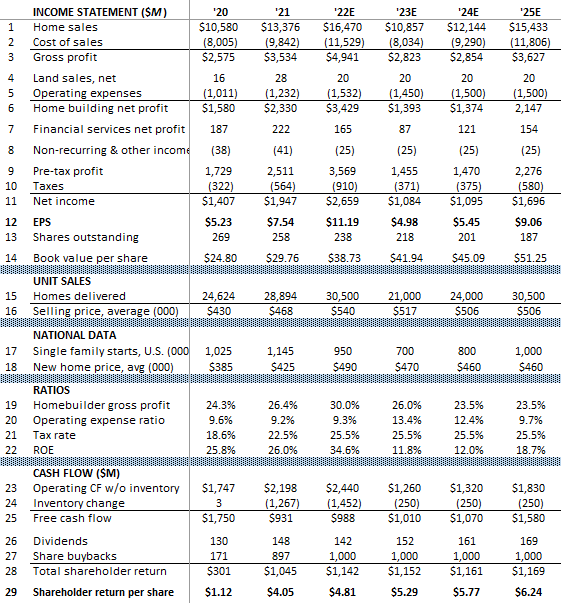

Here is my earnings model:

Pulte financial statements

Source for historical data: Pulte financial reports

A quick review of my assumptions:

- The big picture – national housing starts (line 17). I forecast a housing recession, with single family starts dropping to 950,000 this year (down 17% from ‘21) and to 700,000 next year (down 26%) before beginning a moderate recovery in ’24. Note that Fannie Mae is forecasting much higher numbers (1,023,000 this year and 852,000 next year), so I am being conservative. My home sale forecasts for Pulte (line 15) assume that it retains its current 3.0% market share.

- The big picture – home prices (line 18). I assume a 6% drop over the next two years before stabilizing. Fannie Mae assumes a 4% gain next year. Support for home prices will come from demand from the housing shortage, plus a modest decline in mortgage rates I just discussed. Again, I assume that Pulte’s average sale price tracks national trends.

- Home sale revenues (line 1) are a result of the first two assumptions.

- Homebuilder gross profit margin (line 19). Pulte’s historic average is about 22-23%. The sharp increase in home prices over the last two years made its land holdings very cheap, which drove margins to their current high rate. I assume a gradual return to normalcy over the next few years as Pulte uses up its cheap land. This assumption drives Pulte’s gross profit (line 3).

- Operating expenses (line 5). I assume that Pulte will pare expenses as sales decline. Since expenses were a third lower only two years ago, it is possible the decline will be steeper.

- Shares outstanding (line 13). As I reviewed above, Pulte has been aggressive for the past decade in reducing the number of owners of its business. How it proceeds with this strategy over the next few years will have a big impact on EPS as the recession recedes. I expect Pulte to stay aggressive, reducing its share count by 20% or more over the next three years.

My view that Pulte will continue to actively buy back shares is based on three assumptions:

- My estimate that earnings will not fall below $1 billion a year.

- My free cash flow estimates (lines 23-25). Operating cash flow generally runs modestly higher than net income. Then, Pulte has that $11.6 billion backlog at present. As it completes construction and closes the sales, the backlog turns into cash. Finally, the housing recession will certainly encourage Pulte to pull back on new land acquisitions, and when it does to option the land, which requires only a modest upfront deposit. I therefore expect Pulte’s current $11 billion of land and construction inventory to trend back towards the 2020 level of $8 billion. That will free up a lot of cash.

- Pulte’s stock is not about to rocket up any time soon, despite my optimism. I therefore expect Pulte to be able to buy back its stock at below $60 a share for quite a while.

The stock looks cheap based on this earnings outlook.

As you know, Pulte and its peer homebuilders are facing significant headwinds at present, headwinds that Wall Street analysts haven’t yet recognized. Seeking Alpha’s analyst survey says they currently expect Pulte to earn $9.81 next year and $10.58 in ’24, double my estimates. Their estimate cuts will weigh on the stocks for sure.

But the dividend discount valuation model looks at all future earnings. And I expect Pulte to earn $9 a share when the recession ends. And the severe housing shortage will exist for long after 2025, supporting earnings. So how should Pulte trade in three years from now?

A book value valuation suggests at least $75 per share – its historic average 150% of a $51 book value. A P/E ratio indicates closer to $90 – a 10 P/E times my $9 EPS estimate. So let’s say an $80 target price in three years. That means a 20% annualized return from Pulte’s current $44 price. Pretty good.

Be the first to comment