DNY59

Investment Thesis

In my last note for Seeking Alpha on Organon (NYSE:OGN) ahead of the company’s Q222 earnings, I expressed some reservations about the company and its ability to replace the falling revenues within its Established Brands Division with new product launches within its Women’s Health and Biosimilars Divisions.

The good news at least is that the yield on Organon’s dividend has increased since my last note – from ~3.5%, to 4.3%, but the bad news is that’s because the share price has fallen – by 28% across the past 12 months, and by 18% across the past three months.

As a reminder, Organon was formed as a result of Merck spinning out its Women’s Health, Established brands and Biosimilars division – good news for Merck, which realized a ~$9bn tax windfall – but a tricky challenge for Organon, given revenues from the established brands are in terminal decline due to the age of the products, the Women’s Health division has been low revenue, low profit for several years, and the biosimilars division is very small.

Nevertheless, after the spin out, the market gave Organon a low enough valuation to suggest shares were significantly undervalued, and that argument still persists. Announcing Q222 revenues of $1.59bn, Organon management forecast for full year revenues of $6.1 – $6.3bn, which is only a few hundred million dollars less than the company’s current market cap valuation of $6.7bn.

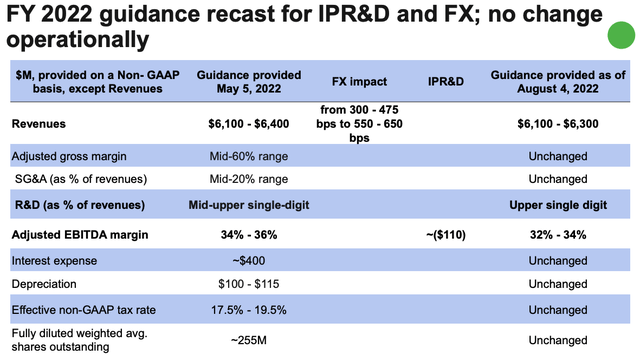

Organon FY22 Guidance as of Q222 (Organon presentation)

Looking at the full guidance, and doing the math, Organon appears to be anticipating net profit of ~$1.1bn, which works out at FY earnings per share (“EPS”) of $4.3 – more or less the same as in FY21 – and a forward price to earnings ratio of ~6x.

As I discussed in an article on Viatris (VTRS) – the product of a merger between Pfizer’s Legacy Brands division Upjohn and generic drug maker Mylan – earlier today, only 50 companies out of the 500 largest listed companies had a Price to Sales (“P/S”) ratio lower than 1 in 2021, and only a handful had a price to earnings ratio below 6x.

That could imply that Organon stock is cheap and due to grow, but the issue is that top line revenues at the company are shrinking, not growing, and that’s plain for everybody to see, as is the fact that these brands’ sales are in terminal decline.

Does that therefore mean that Organon shareholders should think about dumping their stock? Many shareholders would likely not have bought Organon stock out of choice, but given they were holding Merck stock, inherited a tenth of a share on Organon for every Merck share held.

It’s a tricky situation and frankly, in my view, it may be some time before Organon is able to deal with its shrinking revenues, and a debt burden inherited from Merck that stood at $8.3bn as of Q222, and start growing the share price.

That possibility should not necessarily be ruled out however – in this post I will first briefly review Q222 earnings, discuss what to look out for when Q322 earnings are released in 3 days’ time, and speculate on a reasonable price to pay for Organon stock, and a reasonable price at which to sell.

Reviewing Q222 Earnings

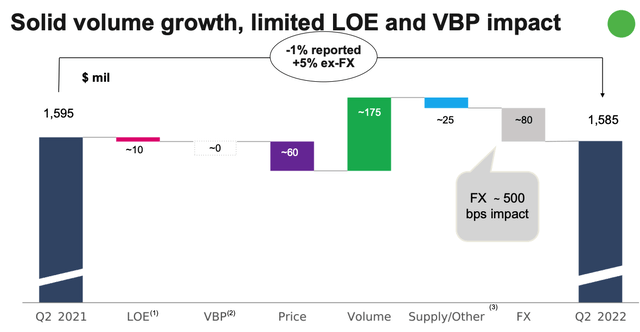

Organon earnings walk Q222 (earnings presentation)

As we can see above Organon’s year-on-earnings walk is quite favorable, with FX headwinds – an element of the business outside of management’s control – being the main reason that revenues did not actually grow year-on-year. If prices declined, then volume appears to have more than offset any losses.

Organon achieved ex-FX revenue growth in all of its geographies – it makes the vast majority of its sales overseas, in Europe and Canada – 28% of all Q222 revenues, Asia Pacific and Japan – 18%, China, 15%, and Latin America – 14%.

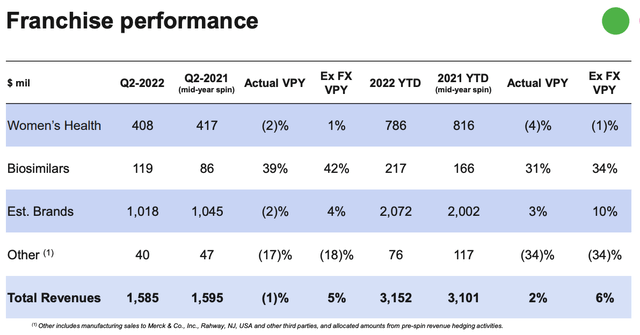

Organon franchise performance Q222 (Organon earnings presentation)

Looking at franchise performance, however, it’s clear how heavily dependent Organon is on its established brands division. Although this division’s revenues seemed to grow between 1H21 and 1H22 these comparisons may be unreliable since Organon stock only began trading in May 2021, making year-on-year comparisons tricky. As I wrote in my last note:

Established brands mainly consists of cardiovascular medicines, which accounted for $1.6bn, or 26% of product sales in 2021, Respiratory – $1bn sales, 16%, dermatology, bone health and non-opioid pain management – $830m, 13%, and other established brands such as benign prostatic hyperplasia (“BPH”) therapy Proscar – $117m of sales in 2021. These products are sold by a global network of ~4k sales people.

These drug products sales are unlikely to grow – frankly, if Merck management had thought they would, they would not have been spun out – so Women’s Health and biosimilars will be expected to offset any declines.

Here, the news is not so good. Women’s Health revenues were down by 1% year-on-year in 1H22 after discounting FX headwinds, and this is a traditionally tough market.

Organon has made some strategic acquisitions to spark revenue growth – which I discussed in more detail in my last note – and target markets for new products e.g. bacterial vaginosis, contraception, endometriosis, pre-term labour and postpartum hemorrhage add up to >100m patients.

There is competition from the likes of Myovant’s (MYOV) MYFEMBREE in endometriosis, although peak sales expectations for that product are >$1bn, so perhaps Organon can make strides in this field provided it can compete against a newer product.

Finally, although it’s an exciting industry with reasonably strong growth prospects, Organon’s biosimilars division is small, with only five approved products. Organon will have high hopes for Humira biosimilar Hadlima, given the $20bn per annum selling Humira loses patent protection next year, but Hadlima will compete against other generics in a market that could shrink as low as ~$10bn per annum based on lower pricing, and newer products.

It’s therefore difficult to see Hadlima – approved in August – generating more than a few hundred million in peak sales, but with that said, a $500m overall revenue contribution would certainly help off-set any Established Brands losses, and Biosimilars shipped in $217m of revenues in 1H22. A >$1bn per annum contribution by, say, 2024, ought to keep Organon stock from declining too steeply, and perhaps even revitalize it.

Looking Ahead To Q322

Unfortunately, given the strong dollar, FX headwinds are likely to be a drag on performance for Organon in Q322. To hit its FY22 target of ~$6.2bn, Organon will need to match or very nearly match Q222 performance, and currency headwinds may well make that challenging.

On the plus side, some analysts believe that performance of Established Brands ought to remain robust for a good while yet, whilst conceding that longer-term decline is inevitable.

If Established Brands performance is robust, and Women’s Health and Biosimilars revenues grow by double digits operationally as they did in Q22 then there are ground for optimism, however if management revises guidance down again as it did in Q222, then that could have negative implications for the share price.

Debt management is another key metric for Organon. Initially saddled with ~$9.4bn of debt, the figure stood at ~$8.9bn as of Q222, which is ~4x expected FY EBITDA – an indisputably high amount of leverage. Organon is not especially cash rich, reporting $545 available cash as of Q222.

In Q321, Organon reported $1.6bn of revenues – up $5m sequentially – and gross profit of $991m, with net income of $323m. In the following 3 quarters revenues were $1.603bn, $1.567bn, and $1.585bn with net income $202, $348m, and $234m. I would expect Q322 earnings to closely mirror Q222, with profit margins relatively narrow, but I would certainly expect profitability, and that at least is a good sign.

Conclusion – Still Profitable, Still In Transition, Still Indebted – I don’t Anticipate Much Uplift From Q322 Earnings

As I suggested in my note on Viatris, spin-outs are all the rage at Big Pharma’s, with Sanofi (SNY), GSK (GSK), and Johnson & Johnson (JNJ) all following Merck and Pfizer’s lead. The reasoning is simple – developing new drugs is more lucrative and drives higher profit margins.

As such, these spin-out companies are given tough challenges – maximize revenues from brands whose best days are behind them, tackle a high net debt leverage, and try to find the value in struggling divisions where the parent company could not.

The market recognizes these challenges and prices spinouts accordingly. Initially, the low valuations look like jaw-droppingly good investment opportunities, but then the underlying issues present themselves and investors understand that P/S and P/E ratios may widen significantly owing to falling revenues, rather than a rising share price.

Nevertheless, every problem is also an opportunity and Organon shareholders benefit from a high yielding dividend, excellent, pre-built infrastructure, experienced management, and a certain volume of more-or-less guaranteed revenues from older brands.

That explains why I am personally not giving up on Organon. So long as Women’s Health and Biosimilars drive double-digit revenue growth and Established brands sales do not decline by too much – look out for the latest figures in the Q3 earnings when they are released on Thursday – Organon has breathing space, and management has the opportunity to grow the business, on an admittedly tight budget.

Profitability is a rare thing in the pharmaceutical industry outside of big pharma, health insurers, and life sciences, but Organon still has it – just. If that’s still the case in a year’s time, and the debt burden has shrunk, and the new product launches in Women’s Health and Biosimilars are making meaningful contributions, the share price accretion ought to come. It’s unlikely to happen overnight, however.

Be the first to comment