Olemedia

In a year that has been characterized by declining stock prices, rising interest rates, skyrocketing inflation, and predictions for a painful economic recession, Livent Corporation (NYSE:LTHM) stock has gained just over 20%, beating the market handsomely. Livent has topped Wall Street earnings estimates in each of the last 3 quarters and the company boosted its guidance for the upcoming quarter based on projections for higher prices across the lithium product spectrum. Livent’s robust earnings have had a lot to do with the market outperformance of LTHM this year. As a pure-play lithium producer that operates one of the lowest-cost lithium carbonate production facilities in Argentina, Livent is well-positioned to benefit from rising lithium prices as the company realizes higher margins than most of its peers when end prices rise. This understanding among investors has been key to Livent’s market success this year, but with the demand environment changing, it’s time to evaluate whether Livent can continue to beat the market in the coming quarters. As I have highlighted in previous articles, I do not doubt that Livent will be a big winner in the long term, so the focus of this analysis is to project LTHM stock movements in the foreseeable future.

The outlook for lithium prices

Lithium is likely to be in short supply through 2030 and beyond because of several reasons. The primary reason behind rosy long-term projections for lithium is the rise of electric vehicles. Lithium-ion batteries are gaining efficiency, and these performance improvements are creating a level playing field for EVs to take on gasoline-powered vehicles. With leading automakers unveiling ambitious plans to electrify their fleet of vehicles, the EV industry is continuing to gain momentum, thereby resulting in strong demand for lithium batteries. Lithium miners and refiners are striking lucrative long-term deals with large-scale automakers today thanks to the important role lithium plays in the electrification strategy of these automakers.

Lithium-ion batteries are used in grid energy storage facilities as well, and with the world moving toward a greener more sustainable future, there is a robust demand for energy storage systems. As renewable energy goes mainstream, therefore, lithium producers will come out as big winners.

The lack of meaningful competition to replace lithium-ion batteries with more sustainable solutions is another driver of growth for lithium. It would likely take decades to develop alternatives to lithium-ion batteries that offer comparable performance efficiencies at a similar cost.

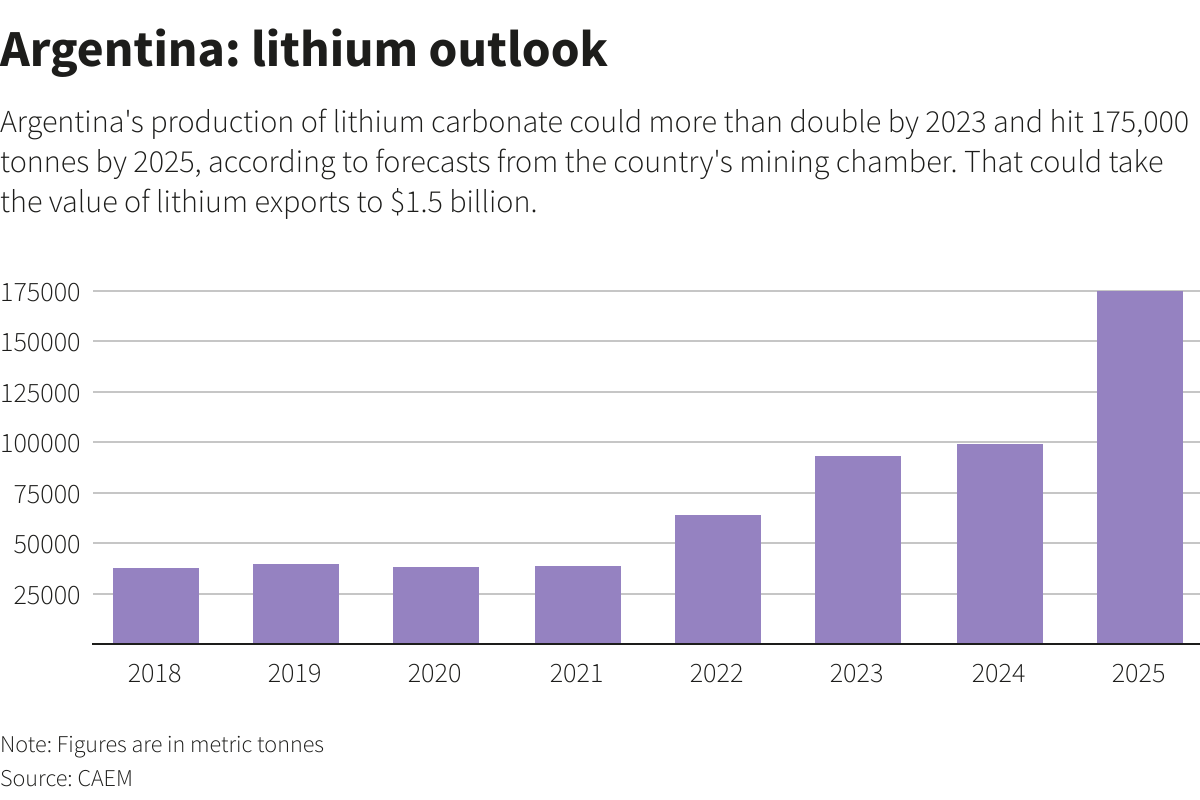

According to the Boston Consulting Group, the supply of lithium will fall short of the demand by 2030 even in the best-case scenario. The shortages, according to BCG, will become visible beyond 2025 as planned new extraction facilities will also fail to contribute enough to the global supply of lithium to meet the rising demand.

Exhibit 1: Forecast for lithium demand and supply

Source: Boston Consulting Group

The aforementioned tailwinds will push Livent’s earnings higher in the long run, which in return should lead to higher stock prices. But will there be a sharp pullback in LTHM stock before taking off?

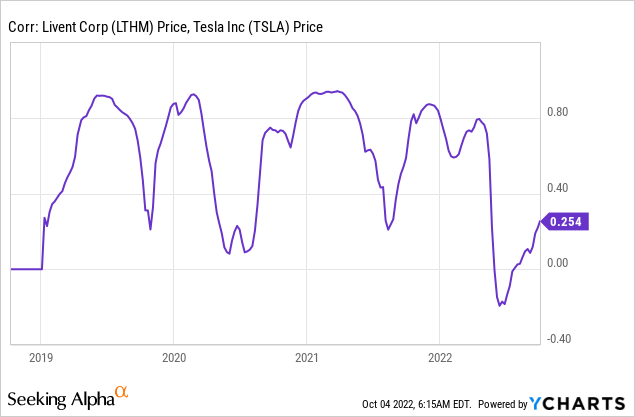

The rally in lithium prices started in mid-2021 with the global economy coming back strongly from the virus-induced recession. From around $14,000/tonne in mid-2021, spot prices increased to over $75,000/tonne earlier this year before cooling down. Making matters worse (or better if you are a Livent shareholder), the supply of lithium could not keep up pace with the rising demand as new capacity additions remained limited in the last 15 months. According to data from Fitch Solutions, only 4 mines with an expected capacity of 75kt will begin production this year but 11 new projects are expected to go online next year.

Exhibit 2: Battery-grade lithium prices

Source: Fastmarkets

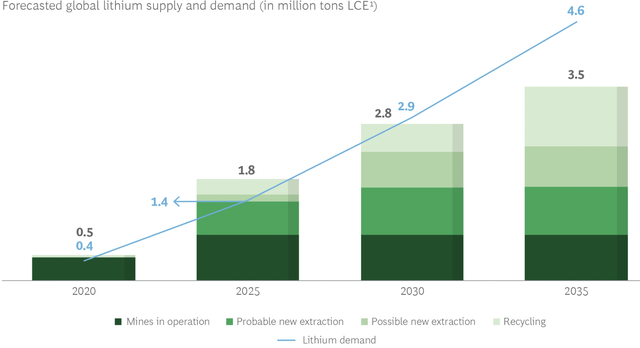

With new projects coming online in the next few quarters at a time when global economic growth is slowing, I am not ready to rule out the possibility of a notable yet temporary decline in lithium prices in the coming quarters. Argentina recently announced an investment of $4.2 billion to double its lithium carbonate production capacity by 2023, and 13 new projects are expected to go online as the country achieves this objective.

Exhibit 3: Argentina’s lithium investments

BNamericas

Source: BNamericas

Bolivia is also aggressively investing in lithium production while China is focused on boosting the availability of lithium through investments in Africa.

The current forecasts in circulation, in my opinion, fail to factor in the negative impact on lithium demand that may occur as a result of a further slowdown in global economic growth. This leaves room for lithium demand to come lower than expected at a time when supply is increasing, leading to a short-lived oversupply of lithium. If this risk materializes, I believe Mr. Market will punish Livent and its peers given that Livent, at a forward P/S multiple of around 7, is pricing in a lot of future growth already.

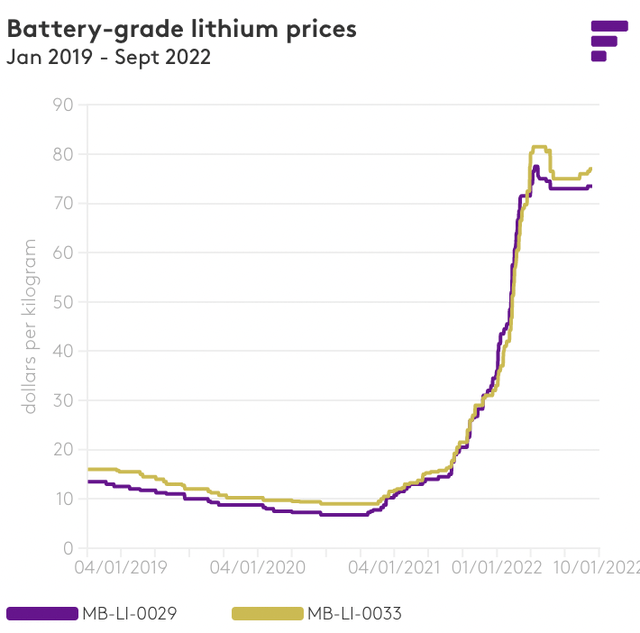

Investors should also keep an eye on the prospects for the EV sector as soaring inflation could force consumers to press pause on purchasing new vehicles in the coming quarters. If the demand for EVs falls short of analyst expectations as a result of a slowdown in consumer spending, investors may look down on EV stocks. As illustrated below, Livent stock, in the past 5 years, has had periods of high correlation with Tesla, Inc. (TSLA) stock. Today, the correlation between these two securities is once again rising. A slowdown in demand for EVs that impacts Tesla could therefore impact Livent stock as well.

Exhibit 4: Correlation between LTHM and TSLA

The long-term demand picture for lithium is promising and Livent seems well-positioned to make the most of the opportunities present in this market. However, the company may come under pressure in the short run.

Takeaway

Long-term-oriented investors should keep an eye on the lithium market in the hopes of identifying attractive entry points to invest in Livent stock. Although I am not planning to invest in the company today, Livent is my number one pick in the lithium sector and I am planning to add LTHM to my portfolio when the risk-reward profile improves.

Be the first to comment