Lemon_tm/iStock via Getty Images

With the market crashing at the same time as the cost of living is soaring, retirement nest eggs are looking smaller and smaller, understandably unsettling many retirees.

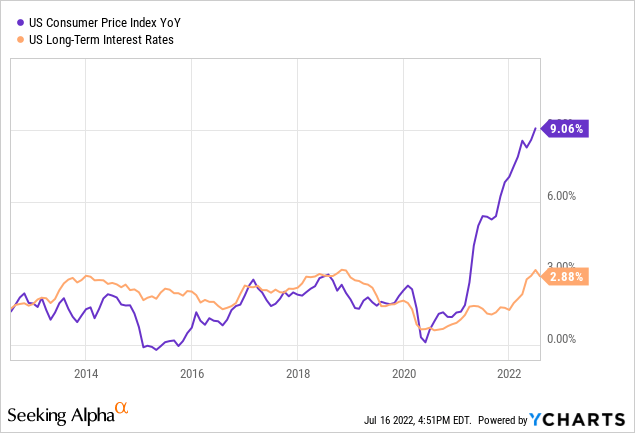

While interest rates are rising, they still lag far behind the inflation rate, making bonds an inadequate core investment for all but the wealthiest of retirees.

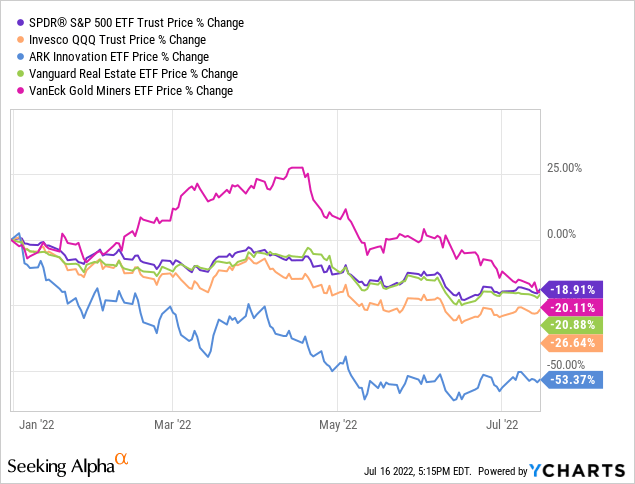

As a result – unless they want to roll up their sleeves as an entrepreneurial landlord – retirees are all but forced to buy stocks in the hopes of generating sufficient returns to fund their retirement dreams. However, that approach is backfiring at the moment as well, with the S&P 500 (SPY), the Nasdaq (QQQ), growth tech (ARKK), and even real asset-oriented REITs (VNQ) and gold miners (GDX) all down sharply year-to-date:

Such sharp drawdowns in the stock market – especially if they wind up being prolonged – can be not only unsettling for retirees, but actually very disruptive. For retirees operating under the 4% Rule or something similar, selling shares to fund living expenses during market crashes has an outsized impact on retirement planning. For example, if someone retired on January 1, 2022, and planned to live off of 4% of their retirement savings indefinitely would be currently living off of a 5% annualized sale of their original share count at today’s SPY price. This means that their long-term living standard expectations will likely need to be altered or they will need to find some additional income to make up for the difference.

However, there is an alternative course that retirees can take with their stock market investing that will enable them to sleep well at night and not have to alter their spending habits, regardless of how volatile the stock market becomes. In our view, the best way for retirees to weather market volatility is to have a lucrative income stream that they can count on through good times and bad. On top of that, by building a portfolio that pays out a safe high yield that also regularly increases its payout, investors can retire earlier. For example, our Core Portfolio at High Yield Investor currently yields over 6%. Instead of retiring on the 4% Rule, investors following our strategy can retire on a 5% Rule (and therefore retire with 20% less in savings) while still saving that extra 1% cash flow return each month to reinvest opportunistically in stocks to further grow their income stream, cover unforeseen expenses, and/or to serve as a margin of safety against one of their income streams being reduced.

In this article, we share five picks that can provide a strong foundation for such a portfolio.

#1. Enbridge (ENB)

Midstream giant ENB boasts utility-like cash flows thanks to nearly all of them being fixed to long-term commodity price resistant take-or-pay contracts with investment grade counterparties. It also has one of the largest and best diversified asset portfolios in the industry, with some of the most impressive natural gas and crude oil pipeline networks in North America.

Meanwhile, its balance sheet is rock solid with a BBB+ credit rating and plenty of liquidity, its dividend is very safe thanks to a conservative 64% expected distributable cash flow payout ratio in 2022, and dividend growth momentum is phenomenal with 27 consecutive years of dividend growth and a 9.5% dividend per share CAGR over the past five years.

Perhaps best of all, its business model is quite inflation resistant thanks to virtually all of its pipeline contracts being fixed to inflation indexes and energy historically proving to be the best inflation hedge there is. On top of that, it is also very recession resistant, as distributable cash flow per share actually grew by 2.1% during 2020 and growing during the Great Recession. As a result, investors can buy shares today to lock in a 6.4% forward yield and sleep well knowing that it has a very high probability of reliably growing over time, securing a prosperous retirement.

#2. STORE Capital (STOR)

STOR is an investment grade triple net lease REIT that also has a proven track record of weathering economic storms. While it did not exist during the Great Recession, fellow investment grade triple net lease REITs like Realty Income (O). W.P. Carey (WPC), and National Realty Properties (NNN) continued to grow cash flows and dividends per share through the crisis. Meanwhile, in 2020 – despite massive lockdowns that impacted the fundamentals of its tenants – STOR continued to grow its dividends per share at a healthy 4.4% clip in 2020.

With a BBB rated balance sheet, a well-laddered debt maturity profile, very long and conservatively structured leases with an extremely well-diversified basket of tenants and properties, STOR makes for an excellent retiree pick. Those who buy shares today lock in a 6% current yield that is very well covered by very stable cash flows and can sleep well knowing that this income stream will not only continue to flow, but actually grow, in good times or bad.

#3. Blackstone (BX)

BX is the world’s largest alternative asset manager with nearly $1 trillion in assets under management. As a result, it has enormous competitive advantages and also benefits from a very well diversified set of assets. While BX’s asset-lite model and dividend payout policy of distributing 85% of distributable earnings to shareholder each quarter will lead to some income volatility from quarter to quarter, BX has proven to be a dividend growth monster over time and is projected to remain one for the foreseeable future.

With an A+ credit rating and a wide moat around its business, investors in BX can sleep well knowing that buying today earns them a projected 4.9% forward dividend yield and a dividend per share level that is expected to grow at a 10.8% CAGR over the next half decade. On a risk-adjusted level, BX’s dividend plus growth profile is one of the most attractive there is today.

#4. Enterprise Products Partners (EPD)

Perhaps the best overall retiree pick on this list, midstream business EPD has it all:

- A sector-leading BBB+ credit rating with a very well-laddered debt maturity profile and plenty of liquidity

- A proven management team that has delivered market-crushing returns over time and remain heavily invested alongside investors (~1/3 of the company is owned by insiders).

- A very stable cash flowing business model that saw EBITDA remain flat during the 2020 energy and COVID-19 crises and continued to grow at a robust pace through the Great Recession.

- A 24-year distribution growth streak that has put it on the cusp of Aristocrat status. Meanwhile, EPD has hiked its payout twice already this year and is accelerating its pace of distribution growth even as the broader economy braces for a recession

- A projected 1.77x distribution coverage ratio in 2022, making its distribution extremely safe despite yielding a mouthwatering 7.8% current yield to investors and growing at a mid-single digit pace.

- Similar to ENB, its business model is quite inflation resistant thanks to virtually all of its pipeline contracts being fixed to inflation indexes and energy historically proving to be the best inflation hedge there is.

There really isn’t more to say here. While Mr. Market likes to sleep on EPD, preventing its unit price from experiencing any meaningful and lasting appreciation, retirees focused on income have nothing to worry about here. They can kick back, relax, and let the near 8% distribution yield roll in through good times and bad while also counting on annual income growth to help offset the impact of inflation.

#5. Ares Capital (ARCC)

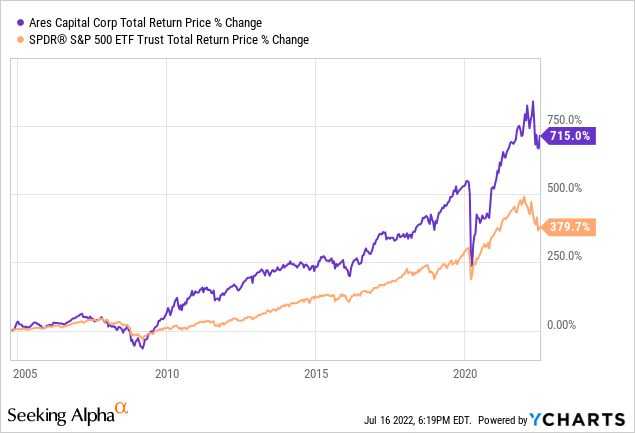

While the BDC space is hardly a place for conservative investors given its heavily leveraged nature and the riskier categories of debt that companies invest in, it is also hard to argue against ARCC’s track record of delivering market-crushing returns:

Meanwhile, the company consistently pays out a high single digit yielding dividend (currently hovering around 9%) on a quarterly basis which it has grown by 45% since inception with numerous special dividends on top of that.

The company is also well-positioned to weather both inflationary periods and recessions as its investment portfolio is mostly invested in floating rate senior secured debt that is expected to generate significant growth in earnings in the current environment while its track record during both the Great Recession of 2008-2009 and the COVID-19 era of 2020-2021 were very strong. ARCC generated a core ROE of 11.2% and a realized ROE of 9.5% during 2008-2009 and a core ROE of 10.9% and a realized ROE of 11.4% during 2020-2021. In contrast, BDC peers generated a core ROE of 9.3% and a realized ROE of -0.1% during 2008-2009 and a core ROE of 9.0% and a realized ROE of 6.2% during 2020-2021.

The company also has an investment grade balance sheet with plenty of liquidity, an exceptionally well-diversified portfolio, and plenty of spillover income that should make its dividend safe for the foreseeable future. For a 9% yield that is favorably exposed to rising interest rates, ARCC is an excellent pick right now.

Investor Takeaway

Retirement is looking more daunting than ever with inflation rates soaring and the economy racing towards recession. Meanwhile, the stock market is in a tailspin and long-term interest rates remain well below the inflation rate. As a result, investors looking to retire are caught between a rock and hard place.

However, by focusing on safe high yields that also have a strong distribution/dividend growth outlook, investors can not only retire with confidence, but also potentially retire even earlier than they thought they would be able to. At High Yield Investor, we are focused on filling our portfolios with undervalued stocks that pay out attractive income yields during good times or bad, so we can wait patiently and reinvest excess dividends through market turbulence and emerge on the other side in even better financial shape than we entered it.

Be the first to comment