alvarez/E+ via Getty Images

Published on the Value Lab 7/4/22

Woodside Petroleum (OTCPK:WOPEF) is probably one of the sharpest ways to invest your money in oil and especially the gas markets. It has several installations on gas fields and is one of the largest semi-pure play gas picks to play the commodity situation that has arisen in response to the Russian invasion. Our opinion on oil is that it is more shaky as a consequence of geopolitical factors and OPEC, but gas is much more robust. Indeed, this is the hand that Putin is playing, and the tight prices in the gas markets are going to be a boon to companies like Woodside as long as political capital is stacked against Russia. Their exposures are only growing, and with realized prices potentially coming in higher in 2022, their already excited income could grow even further in contrast to the low multiple. We think Woodside might have some more upside despite its already substantial rally, and label it a buy.

A Look at the FY 2021

The story for 2021 has been all about prices, while volume increases are more in the future for Woodside as new projects and the BHP (BHP) petroleum division merger comes through.

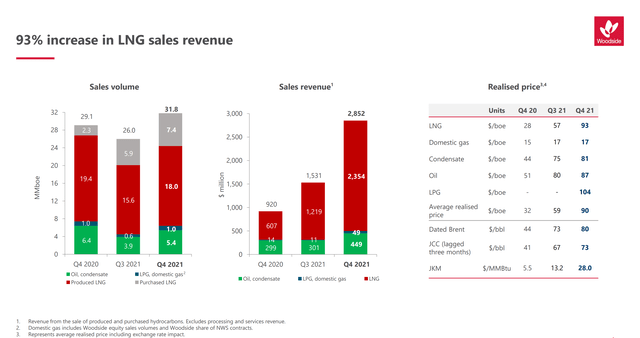

Highlights (Woodside Q4 2021 Pres)

LNG represents about 70% of the company’s revenue. The rest is essentially oil and condensate which is just more crude oil similar hydrocarbons. Let’s look at the evolutions in the price of LNG.

LNG Price (Tradingeconomics.com)

2021 saw the substantial rise of LNG prices along with the rest of the commodity boom. In 2022 we are starting at above half the average level for FY 2021 and have already reached new highs in connection with trading conditions and speculation around gas prices due to the Russian invasion of Ukraine and the sanction threat. Prices are currently peaking at around 50% above the 2021 average.

Crude Price (Tradingeconomics.com)

Oil saw a similar astronomical growth in 2021with prices going from $60 to $80 and then peaking at $120 at the onset of the invasion of Ukraine. Prices are currently about 50% above the 2021 average.

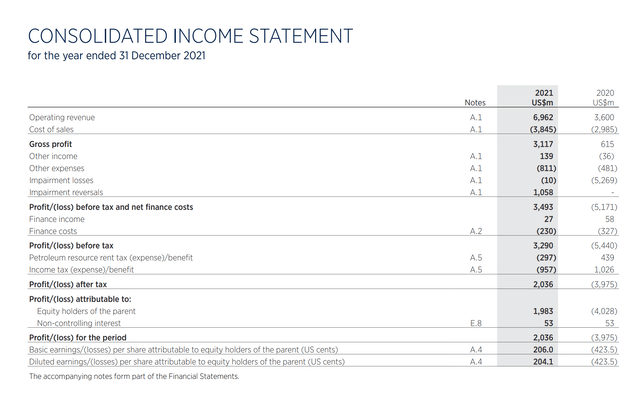

Income Statement (Annual Report 2021 Woodside)

Substantial sales growth had come from 2021 due to higher realized prices, leading into a major increase in gross profits by a 5x factor, and to adjusted EBIT where the company was barely scraping through with profitability in 2020 to a $3.5 billion profits in 2021.

Valuation

2021 has already been a superb year, with EBITDA at around $5 billion with a $37 billion EV as of the annual report. Even assuming that the company does not achieve realized prices for 2022 ahead of 2021, and just using 2021 figures, we have a multiple of 7.4x EV/EBITDA. Prices are currently ahead of 2021 levels by about 50% in both oil and in LNG. While oil may not hold out for reasons related to major geopolitical actors courting new production into the market from previously sanctioned countries, gas prices are much more robust. The key reason is that so many households are dependent on gas. Certainly in developing countries where electricity is less reliable, and therefore gas becomes essential, but also in Europe where millions of households in Germany and Italy use gas, enough to where at the initial phases of sanctions, these countries were holdouts to impairing relations with Russia. In other words, Russian oil, now less attractive to markets and thus dislocating them into having a higher price, is replaceable. This means the oil premium might not hold as long. However, Russian gas is much less replaceable, so the tension in that trade relationship, and therefore the premium given by traders buying gas for their terminals, is likely to sustain further. With prices having started at a higher point in both segments in 2022 though, and with a quarter well in passing already, these elevated levels are already starting to get locked in for 2022, meaning an EBITDA substantially higher than $5 billion thanks to operating leverage is likely.

While Russian supply of gas is strategically necessary even for hostile nations in the immediate horizon, Woodside is also involved in expanding its assets to be able to add more gas to the market.

Scarborough is in our opinion a world class project with an expected internal rate of return of greater than 13.5% and a globally competitive cost of supply of approximately $5.80 per MMBtu.

Scarborough was one of the major new project approvals this year, and the 13.5% IRR is estimated on the basis of a $5.8 price for LNG, where the price is 10% higher than that currently. It’s good to see reinvestment opportunities into LNG despite political pushback, and they IRRs are clearly value accretive.

Also the Pluto projects are being expanded. While this was met by resistance in Australia due to the powerful green influence in politics, the complaints have been thrown out by judges, so the expansion moves ahead and allows for further reinvestment opportunities into the very robust LNG situation.

In oil production, they are progressing with the Sangomar field which will be operational starting next year, and they are also merging with BHP’s Petroleum division in an all equity transaction valuing it at around 10x, which is maybe a little high compared to other producers’ multiples on the market as consequence of Woodside’s recent run-up in price. This merger has yet to be voted on and approved and will affect shareholders in the months to come. The higher Woodside is valued, the less economic this transaction becomes unfortunately, but a 10x as a benchmark based on current value neither hurts nor helps the Woodside investment case at this point.

Conclusions

The prices for the commodities are starting much higher in 2022 than in 2021, and the commodity boom has been elongated by market dislocation as a consequence of the Ukraine invasion. Risks to this thesis are peace in Ukraine, or any other situation where political capital will be less invested in an anti-Russian stance, which will cause the premium to dissipate on these commodities. Other risks are the decline in oil prices due to releasing of the taps by OPEC or due to the introduction of previously sanctioned nations’ oil into international markets. However, the 7.5x multiple is assuming income from last year. It could get substantially better if prices continues to hover at current levels for the full year. With high degrees of operating leverage, we think that a 50% increase in EBITDA for 2022 is possible. However, even absent that or in the event of declines in the commodity prices, there is a margin of safety in the multiple.

Be the first to comment