RealPeopleGroup/E+ via Getty Images

Resolute Forest Products Inc. (NYSE:RFP) is being acquired for $20.50 and a CVR – contingent value right – by Paper Excellence Group’s Domtar. Resolute is currently trading at $20.48, implying the CVR is probably worth something as the spread is nearly non-existent. The first thing to note is that this is often a preferable strategic deal. The value of the CVR is important here but is highly unclear. The CVR is predicated on refunds on approximately ~$500 million of deposits made by RFP on estimated softwood lumber duties through June 30, 2022. The value of this thing will ultimately be determined by the terms and timing of the resolution of the softwood lumber dispute between Canada and the United States. The CVRs won’t be tradeable.

The dispute between the U.S. and Canada over lumber goes a long way back. I’m citing a quotation from the Wikipedia description linked above as it seems to describe the matter reasonably:

The heart of the dispute is the claim that the Canadian lumber industry is unfairly subsidized by federal and provincial governments, as most timber in Canada is owned by the provincial governments. The prices charged to harvest the timber (stumpage fee) are set administratively, rather than through the competitive marketplace, the norm in the United States. In the United States, softwood lumber lots are privately owned, and the owners form an effective political lobby. The United States claims that the Canadian arrangement constitutes an unfair subsidy, and is thus subject to U.S. trade remedy laws, where foreign trade benefiting from subsidies can be subject to a countervailing duty tariff, to offset the subsidy and bring the price of the commodity back up to market rates.

The Canadian government and lumber industry dispute this assertion, based on a number of factors, including that Canadian timber is provided to such a wide range of industries, and that lack of specificity makes it ineligible to be considered a subsidy under U.S. law. Under U.S. trade remedy law, a countervailable subsidy must be specific to a particular industry. This requirement precludes imposition of countervailing duties on government programs, such as roads, that are meant to benefit a broad array of interests. Since 1982, there have been four major iterations of the dispute.

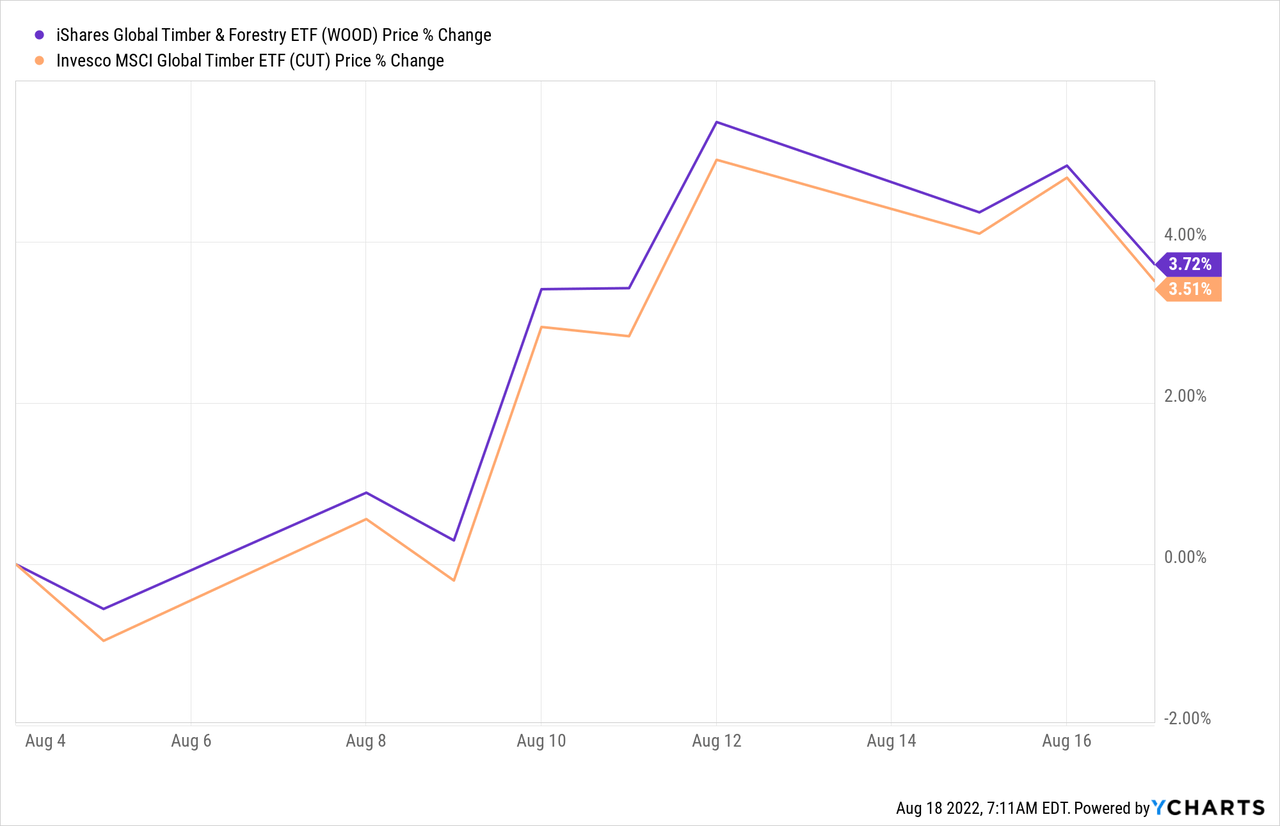

The latest iteration of this conflict seems to be resolving. The Commerce Department is dropping the tariffs from 18% to 8.6%. Canada is still challenging the tariffs via USMCA. iShares Global Timber & Forestry ETF (WOOD) and Invesco MSCI Global Timber ETF (CUT) are both up quite a bit after being in a prolonged downtrend before that date. It could be a coincidence or perhaps it isn’t.

RBC Analyst Paul C. Quinn figures the CVR is worth over $3 per share:

There have been no substantive discussions on a potential resolution since the CVD and AD duties were implemented in 2017, so the timing of an eventual resolution is unclear. However, we would value the CVR at over $3/share.

Two transactions provide a baseline. In June 2019, Conifex sold its deposits at 42.5% of face value, and Eacom Timber sold its deposits at 55% to Interfor.

Some transactions that may provide color as far as the value of softwood lumber deposits include in June 2019 Conifex monetized its deposits to date at 42.5%, while in November 2021 Interfor agreed to acquire Eacom Timber and valued Eacom’s softwood lumber deposits at 55%, Quinn wrote.

At the Conifex mark, this implies $2.17 per share. The Interfor mark implies $2.8 per share.

What’s also really interesting is how major shareholder Fairfax Financial wanted $25 per share and considered not going along with anything less, according to the merger filings:

In this discussion, Mr. Martin advised the Board that it was the view of Fairfax that the Company should seek a deal price of $25.00 and that Fairfax was not then prepared to commit to support a lower price. The Board, its advisors and Company management discussed extensively the implications of proposing a $25.00 per share price, including the risk that the proposal could cause Paper Excellence to terminate discussions. Following such discussion, the directors expressed their support for Messrs. Lalonde and Davies to propose the $25.00 per share price and a timeline that would result in signing by June 20, 2022.

The ask for $25 was countered with $20.50 per share AND this contingent value right. This implies Fairfax likely also pegs its value at several dollars. So did investment bank Barclays:

In this discussion, Mr. Martin advised the Board that it was the view of Fairfax that the Company should seek a deal price of $25.00 and that Fairfax was not then prepared to commit to support a lower price. The Board, its advisors and Company management discussed extensively the implications of proposing a $25.00 per share price, including the risk that the proposal could cause Paper Excellence to terminate discussions. Following such discussion, the directors expressed their support for Messrs. Lalonde and Davies to propose the $25.00 per share price and a timeline that would result in signing by June 20, 2022.

The absolute maximum value should be around $5 per share (full refund of the deposits), which should be discounted for time value lost. The nice thing with a CVR and buying the shares below merger consideration is that you’re effectively not tying up any funds. The timing of any payment is also separate from any market conditions, which is another feature I’m always looking for.

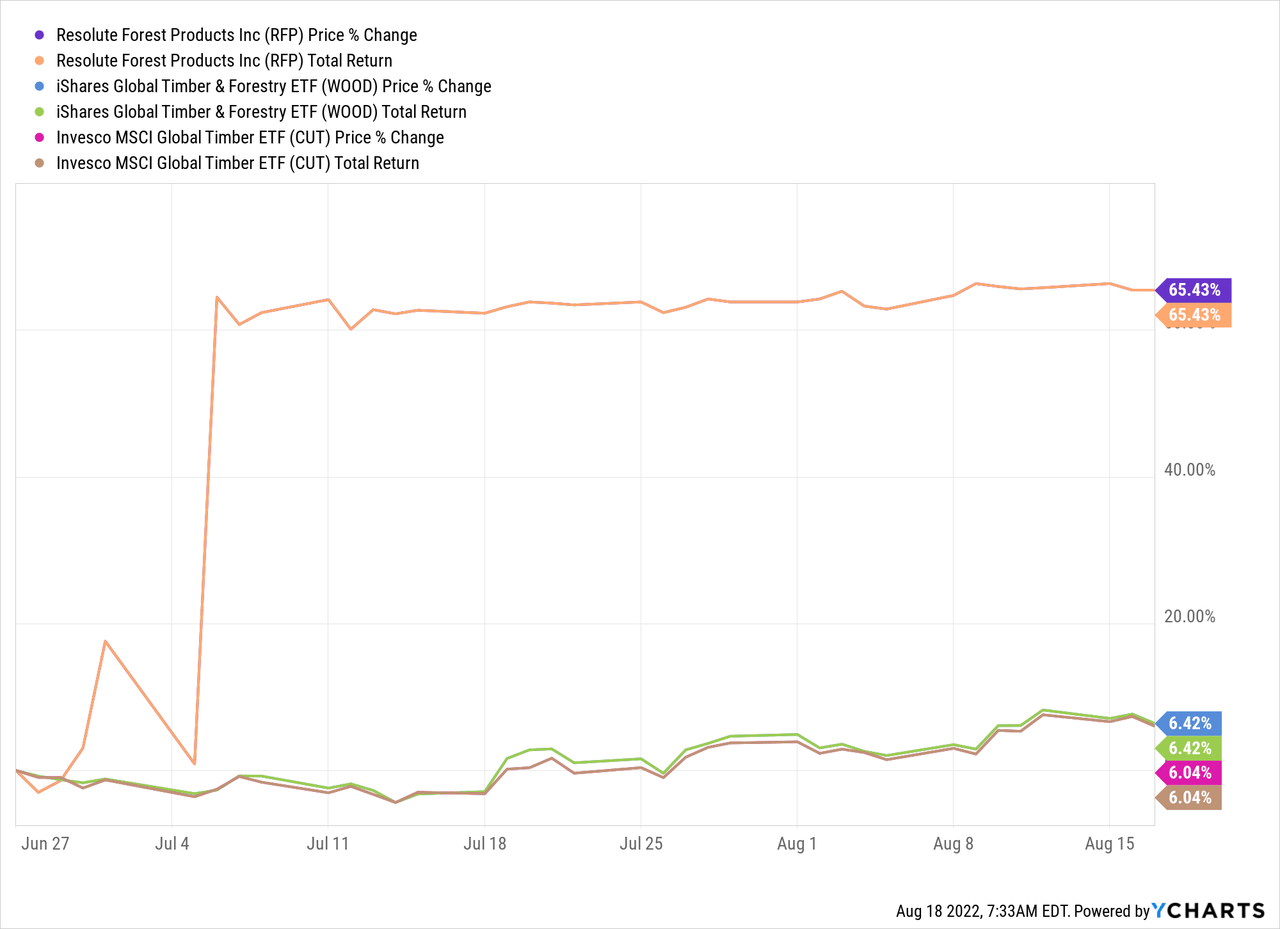

The downside is fairly intimidating here. RFP sold off a lot in June. It went down from about ~$16 to ~$12.30. The bid came at the lows. For good measure, timber ETFs are only up 6% from that level. It is hard to say where the downside should be pegged exactly. Something like $12-$13 is likely a conservative bet. There is a 41% loss if RFP drops to $12.

It seems highly unlikely to me that this strategic deal will break but it is possible. I’ve found some consolation in the shareholder list. Fairfax is the key shareholder, but besides them, the Morningstar ownership list (Chou, Dimensional Advisers, Donald Smith, Cambria) shows an unusual number of value-investing-focused firms with an interest here. Take it for what it’s worth, but it could suggest the fundamentals are attractive at pre-deal levels offering some support to that valuation.

At the lowest CVR valuation, I’ve derived from 3rd parties here, the spread is around ~9%. Meanwhile, the deal likely closes in the next 6-8 months. Note that the deal closing will only take my risk off the table. I won’t receive the CVR payout yet. Expect that’s going to take quite some time. But straight away, this is looking quite attractive to me. In the best case scenario ($5 refund per share), this looks like a 19.67% spread). The best-case scenario seems a highly unlikely outcome to me. Besides the worst-case scenario of a deal-break resulting in a big fat loss, there’s the chance I’ll have some capital tied up here with nothing to show for it (or $0.02 per share). That outcome seems unlikely to me and not substantiated by the facts I’ve been able to gather. Yet, if that happens, it is not the end of the world in this market. I’m unsure whether we’re going up or down in the next six months. I’m leaning towards down and love to have some of these non-market-related risks in my portfolio.

Be the first to comment