Background

Mark Wilson

Fannie Mae junior preferred (OTCQB:FNMAS) are worth multiples of the current market price in my opinion, building momentum toward an IPO and an exit from the conservatorship.

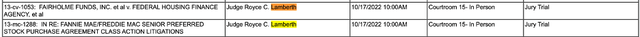

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) have been Government Conservatorship for the past 14 years. The companies are building capital by retaining earnings that were previously swept into Treasury under the infamous Net Worth Sweep. When the White House learned in 2012 the valuation allowance contra asset account was going to be reversed and the Deferred Tax Assets would be written back up, the housing adviser’s team initiated the sweep in late 2012, bringing in $191 Billion in the next 6 quarters, $112B from Fannie, $79B from Freddie ((Quarterly draws table)). Overall, the Government reaped over $300 Billion in profits after injecting $191 Billion into the companies. This is by far the most profitable conservatorship in history and the Gov’t isn’t done yet. It can monetize its warrants representing 79.9% of the company’s equity to generate another $100 Billion in the next 12-24 month period.

To write down the Deferred Tax Assets, the Gov’t had to assume the 2008 crisis level home prices were not going to recover for the foreseeable future. That assumption was wrong, and by 2012, the reversal of the write-down was inevitable. However, the same asset write-downs that forced the companies into conservatorship were not credited back to the GSEs’ balance sheets when home prices started to recover. Those assets went to the Treasury instead, and the companies ended up being severely undercapitalized under the perpetual net worth sweep. Every quarter, the companies were making billions and were promptly sending the check to the Government. They were in winddown mode, to be replaced with some kind of system deemed favorable by the Administration and special interest groups.

Junior Preferred Shareholders, with contractual rights to dividends and par value liquidation preference per share, were kicked to the side. Shareholders sued the Government and its implementation of the Net Worth Sweep and the lawsuits are still winding through the legal path, with a potential trial on contractual fair dealings set for October in Judge Lamberth’s court.

Senior Judge Lamberth Calendar

FHFA

What Changed?

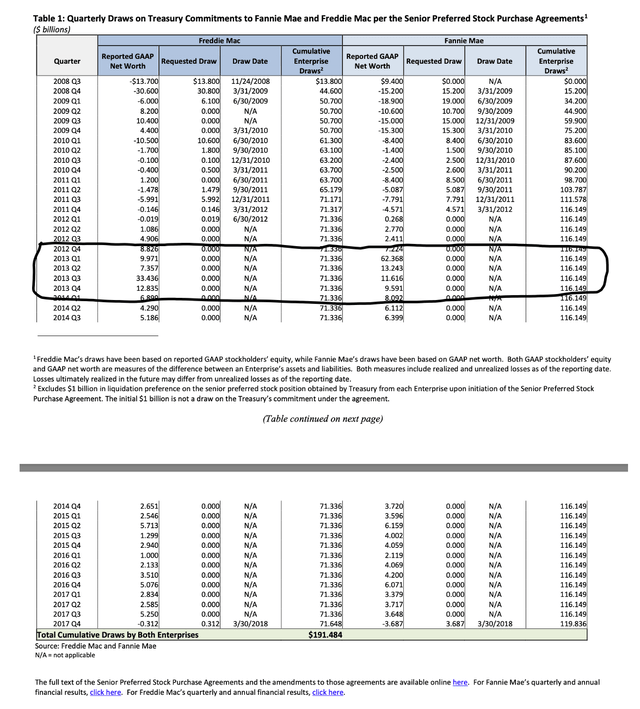

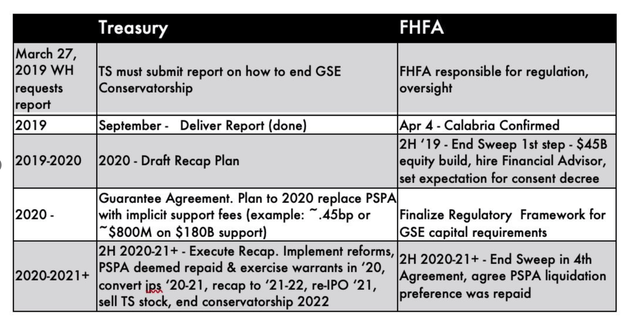

The Trump Administration’s plan for the GSEs was vastly different from the previous Administration. The companies were going to be recapitalized and released to the private shareholders. Director Mark Calabria was confirmed in the Spring of 2019 and the White House urged the Treasury to come up with a recapitalization plan to return the companies to the public markets. Bloomberg Intelligence’s Ben Elliot produced outstanding updates along the way. It’s a nice memento to read through and see where the recapitalization process was moving.

Bloomberg Intelligence

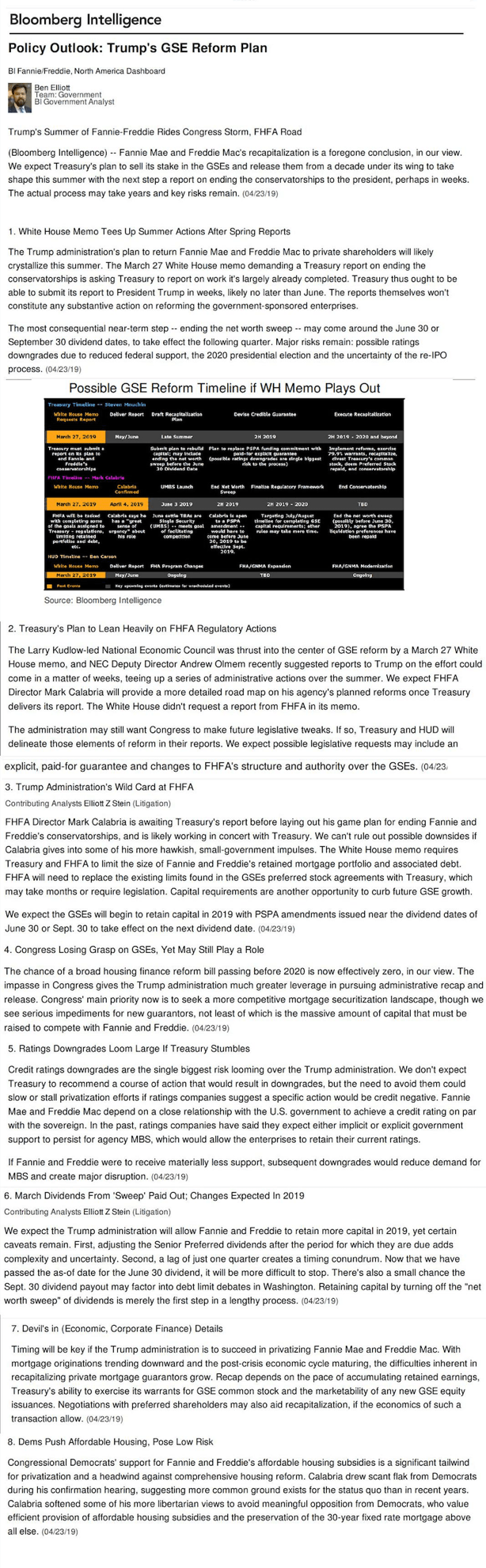

Maria Bartiromo interviewed Steve Mnuchin ((Treasury Secretary)) early on in the Trump Administration and he clearly indicated his desire to move the entities out of conservatorship.

Baritomo Mnuchin transcript

RECAPITALIZATION begins

The companies started to retain earnings in September 2019 after the 5th Circuit En Banc ruled the Net Worth Sweep was illegal, violating the Administrative Procedures Act (APA). The court also ruled FHFA to be unconstitutionally structured with an independent director at the helm, whom the President could not fire without cause.

While the companies were about to retain earnings and Mark Calabria was going on television talking about an IPO in 2020 or early 2021, the Gov’t appealed the 5th Circuit decision to the Supreme Court. The Administrative solution timeline is outlined below…

Administrative solution track

TURMOIL

And then something happened that threw the whole process in turmoil. (1) Mark Calabria approved a capital rule that was far too stringent and unnecessary for insurance companies like Fannie/Freddie – 4% minimum capital, (2) After President Trump lost his 2020 election, the Treasury Secretary amended the Preferred Stock Purchase Agreement without writing off Senior Preferred Shares, and (3) SCOTUS ruled the Net Worth Sweep to be legal within the context of the Administrative Procedures Act. Here’s a little more color on these topics.

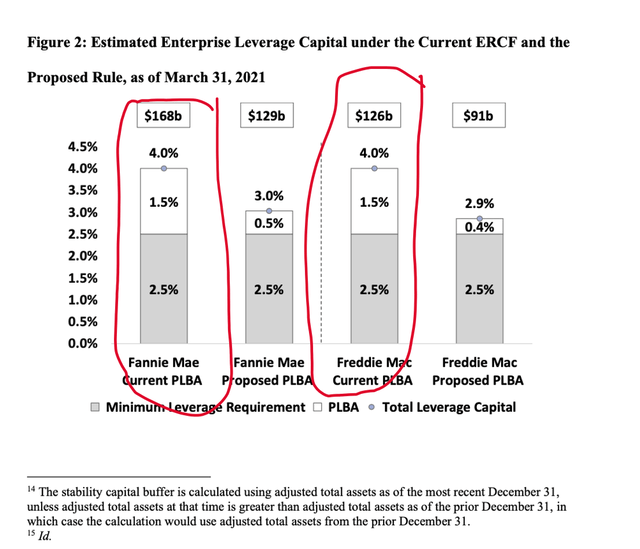

FHFA’s updated ERCF – Sandra Thompson

- Calabria’s capital rule: 4%. The 2020 rule required Fannie Mae and Freddie Mac to retain 4% minimum capital to exit the conservatorship- $168b for Fannie, $126b for Freddie, and $294b total. The previous capital framework proposal (in 2018) targeted ~3%. Calabria decided to stray away from that proposal. The increased capital requirement guaranteed the GSEs would stay in conservatorship for years before approaching the public markets to bridge a reasonable gap between retained earnings and required capital. The Administrative solution timeline exhibited above became untenable. Calabria blew it up by making the capital gap too wide, and his TV interviews about the IPO in 2020 or early 2021 became financially impossible. His appointment to lead FHFA with the main purpose of getting the companies out of conservatorship became moot. He was not going to do it with a 4%+ capital requirement.

- Secretary Mnuchin amended the Preferred Stock Purchase Agreement (PSPA) in January 2020. Instead of writing off the $191 Billion liquidation preference representing the Gov’t senior preferred shares after the companies paid back over $300 Billion, Mnuchin revised the PSPA for the 4th time ((first three were done by the Obama Administration)) by allowing the companies to build needed capital to exit the conservatorship. But he also made certain that every dollar of retained earnings was offset with a dollar increasing the Gov’t liquidation preference. Thereby shifting the incentive structure to favor a resolution when enough equity capital was built up on the balance sheets. The Government was “sweeping” the profits on paper, increasing the amount owed to them. Practically, the sweep was finished because the earnings stayed at the companies instead of being transferred to the Treasury as in 2012- late 2019.

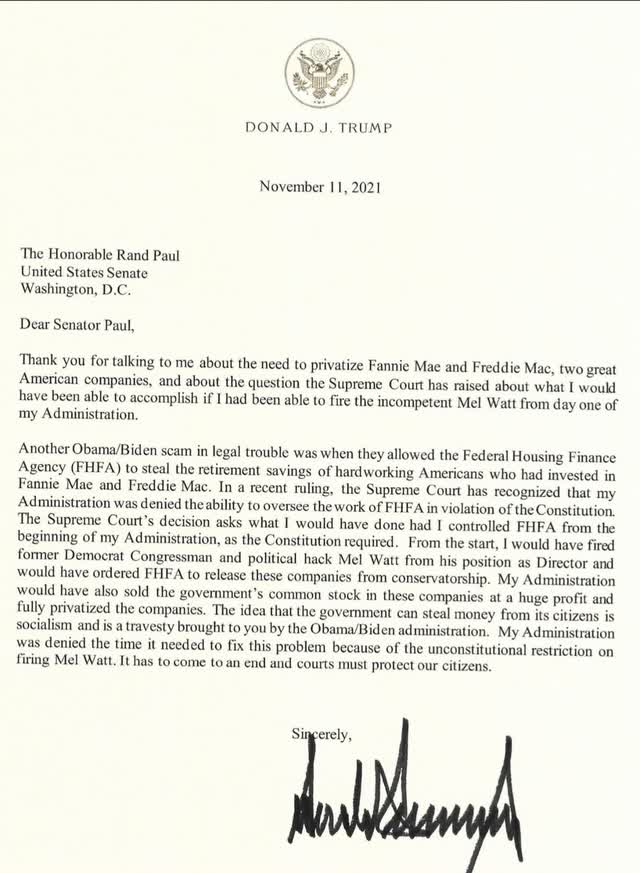

- The Supreme Court, in a surprise Collins lawsuit decision, wrote that the Net Worth Sweep was legal and FHFA could do whatever it thought was necessary in the interest of the public. It also ruled that the FHFA structure was unconstitutional and The President could fire the independent director at will. President Biden did just that, firing Mark Calabria in June 2021, less than 24 hours after the Supreme Court Decision. It’s important to note that SCOTUS did not address shareholder contract rights in the Collins lawsuit. When the case was remanded to the 5th Circuit, former President Trump penned a letter to the judiciary explaining his position on the conservatorship (attached below). He ran out of time to privatize the GSEs because he couldn’t fire the previously appointed FHFA director earlier.

Trump letter to Rand Paul, Nov 11, 2021

Capital requirements, profitability, valuation

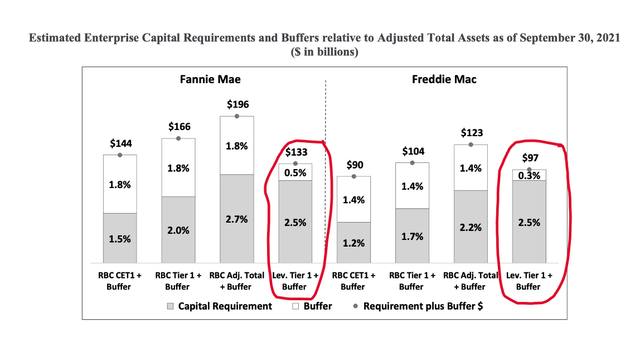

In September 2021, FHFA’s acting director Sandra Thompson released a tweaked Enterprise Regulatory Capital Framework (ERCF), dropping the needed capital at the GSEs to 3%. While the new capital framework is based on Calabria’s framework in principle, the final number resembles the 2018 ~3% rule proposed by director Watt. When Fannie Mae hits $125b, give or take a quarter of earnings, recapitalization will be effectively complete.

Prior to September 2021, Fannie Mae had a binding tier 1 2.5% leverage capital + 1.5% PLBA buffer. 4.0% common equity tier 1 (CET1) requirement.

In September 2021, FHFA amended the Enterprise Regulatory Capital Framework Rule (ERCF) by reducing the fixed 1.5% PLBA with a dynamic leverage buffer determined annually and tied to the stability capital buffer.

2021 FHFA amended capital rule

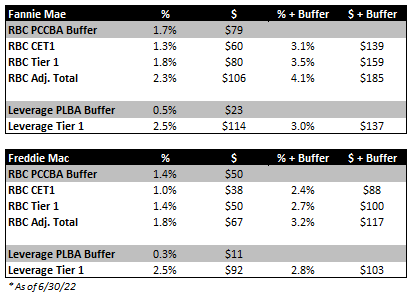

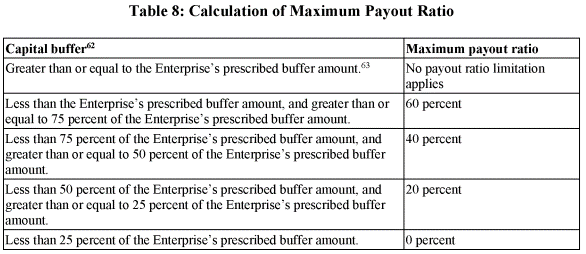

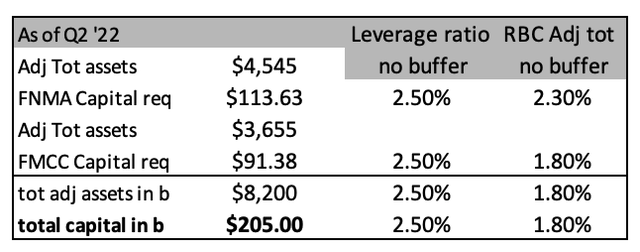

Sandra Thompson’s adjustment lowered the capital requirements at Fannie and Freddie by favoring the Risk-Based Capital framework as the dominant capital requirement. The GSEs must use the higher of the two frameworks, leverage ratio or risk-based capital ratio, to exit the conservatorship. Buffers are then added to the leverage and risk-based capital ratios to arrive at the targeted earnings payouts to shareholders.

The big banks’ dividend payout ratios are 20-40%. Wells Fargo (WFC) pays 22%, (JPM) – 32%, (C) – 26%, (BAC) – 26%. Normalized, Fannie Mae’s dividend payout ratio should be similar.

Technically, Fannie Mae can leave the conservatorship with the 2.5% leverage ratio because it is the larger of the two frameworks, RBC Adj total, and Leverage Tier 1.

twitter: familymang format of FNMA/FMCC 2Q 2022

But Fannie Mae will not be able to reach a 20% dividend payout ratio until 25% of the 1.7% PCCBA buffer is added to the capital requirement, and a 40% payout is limited until 50% of the buffer is reached.

FHFA’s GSEs capital rule

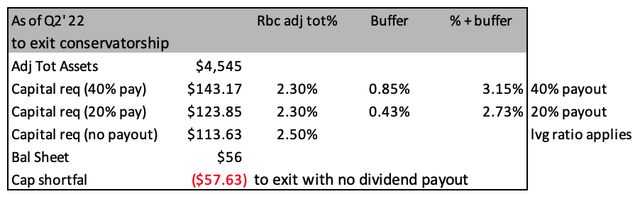

In total, here are the binding capital requirements for Fannie Mae alone to (1) exit from the conservatorship, (2) 20% dividend payout ratio, and (3) 40% dividend payout ratio using FNMA’s Q2, 2022 asset base.

FNMA capital requirements for exit, dividends 20%, dividends 40%

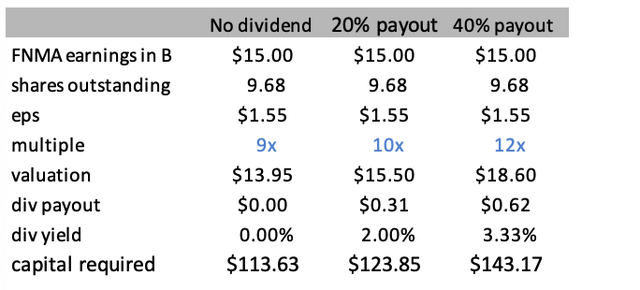

When Fannie Mae exits the conservatorship with ~$114b in capital, it can use a few quarters to build up to a 20% dividend distribution and then take a few years to hit a 40% dividend payout. Valuation multiples will expand with the dividend payout.

valuation multiples and dividend yields with capital requirement

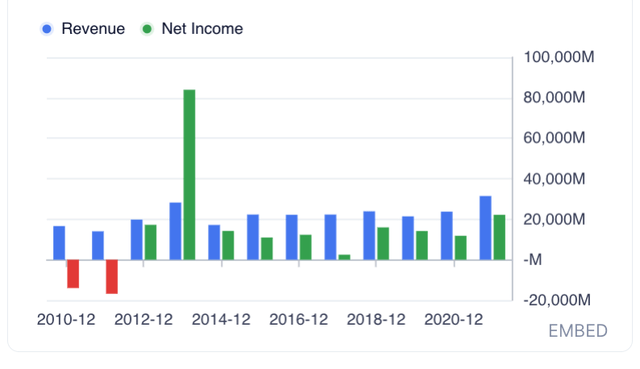

Fannie Mae earns $12-15 Billion a year on average (~$23b+ combined GSEs). The commons trade for 60 cents with multiple preferred stock issues trading at 10-15% of par value.

Gurufocus Fannie Mae profitability

The Government can generate $100b+ from warrant conversion and sale of the corresponding stock on the open markets. The junior preferred shareholders should convert their shares into commons alongside Government’s warrants, clearing the deck for a commons IPO and a new junior preferred issue. Out of conservatorship, the GSEs will function similar to public utilities, with limited rates of return – 10-12% ROE.

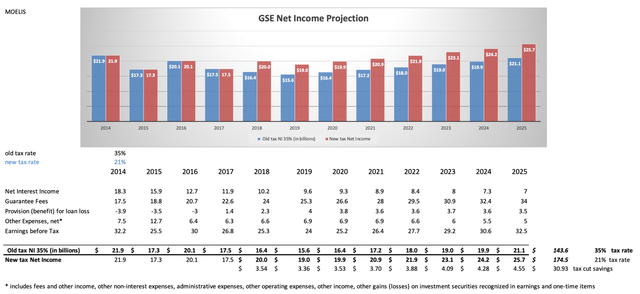

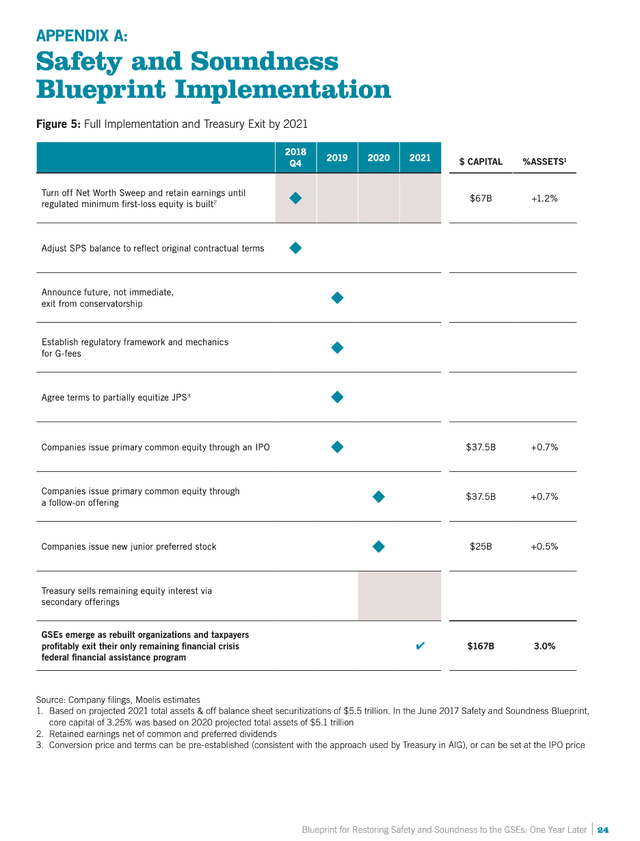

In 2018, Moelis Investment Bank put together a “Blueprint for Restoring Safety and Soundness to the GSEs” and highlighted Fannie’s and Freddie’s profitability. It suggested steps the Treasury could take to monetize its share in the companies. I reframed it with the new tax rate. In 2021, the companies outearned the projected $22.8b by about $10b and the GSEs are likely to beat the $23.7b projection in 2022, a housing recession year.

Moelis IB earnings projections w/new tax rate

GSE earning power was projected by Moelis Investment Bank in 2018 as part of the blueprint to get the companies out of conservatorship.

Moelis Investment Bank Gov’t exit steps

The GSEs’ business evolved since entering conservatorship in 2008. The companies wound down their loan portfolio business. Fannie and Freddie are generating profits on guarantee fees assessed on mortgages prior to packaging them into securities and selling them to investors. The increase in g-fees is notable, going up from 20bps to over 50bps now. The asset base generating g-fees also grew from under $4T in ’08 to over $8T now.

There are no direct comps for Fannie and Freddie’s business, but we can apply TBTF financial institution 10x-12x earnings multiples.

Banks trade at 1-2x book value. If Fannie Mae’s ~$120b in equity is scaled to a $144b market cap, the 1.2x book multiple is comparable to BAC 1.2x, JPM 1.36x, and WFC 1.1x.

RECAPITALIZATION PROCESS NOW

The companies have $90b in capital. In 2020 CBO projected $185 Billion of capital needed for both enterprises. Today, this number is closer to $205b with 2.5% capital for the combined $8.2T in mortgage assets. The gap is $115b and will be ~$100b by the end of the year after two-quarters of earnings.

Adj total assets from GSE 10Q’s

Govt options:

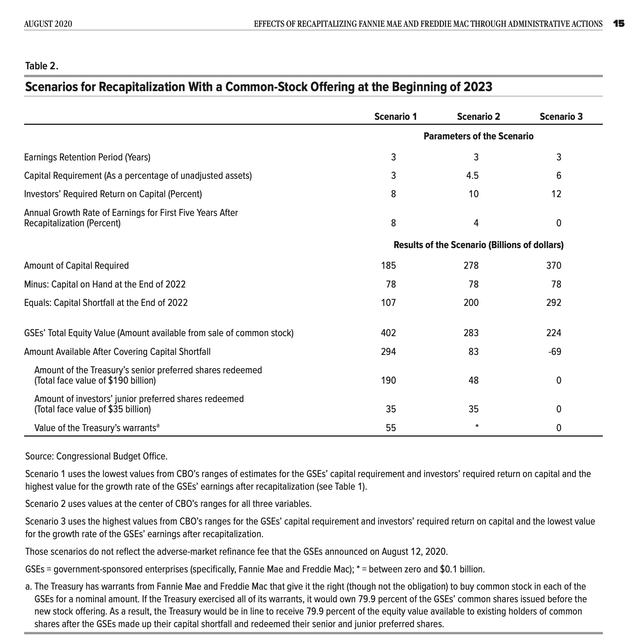

- The Congressional Budget Office (CBO) ran a model that assumes the Government would exercise warrants and would convert senior preferred shares into common equity. Scored in late 2020, CBO projected $78b on the GSE balance sheets by the end of 2022. The companies will outperform that projection by $20b+.

2020 CBO GSE recapitalization model

The mechanics of the CBO model are to be determined but their version expects the Gov’t to reap $190b in Senior Preferred shares and $55bin warrants value for a total of $245b. The junior preferred shareholders of FNMAS and FMCKJ would be redeemed at $25 par ((likely converted into commons and reissued to raise funds for the exit)). Today, FNMAS and FMCKJ are $3.20 and $3.05 respectively. Commons are worthless in this recap template.

I am not certain how realistic the CBO recapitalization projection is because wiping out legacy commons while attempting to raise $100 Billion in new common and jr. preferred shares could present an insurmountable roadblock to the Government. A roadshow presentation would provide clarity on this question and investor feedback could be: “How can we be sure that the new commons are money good when the legacy commons are wiped out after the GSEs sent $300B in profits to the Treasury, well in excess of $191B injected by the Gov’t?” The Government would need to show good faith for the new commons investors to step in.

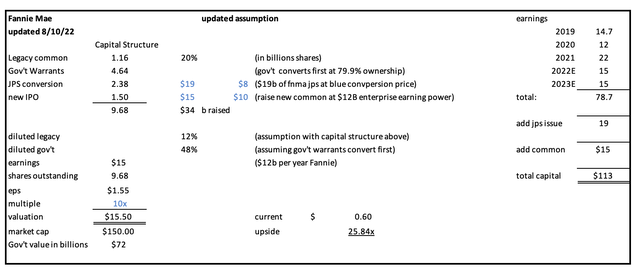

2. Warrant conversion model is the most straightforward approach for the Government to monetize its stake in the companies. Fannie Mae alone can yield $72 Billion with the conversion of the warrants, then legacy junior preferred conversion into common equity followed by a $15b commons IPO and a $19b new Junior Preferred issue to get to $113 Billion equity capital in 2023. When a similar process is followed with Freddie Mac, the Government could monetize $100b+ on its warrants, diluting the legacy commons to 12% of the stake in the companies. The commons are down dramatically over the past year and the potential return on a 10x p/e with a 9.68 billion share base is over 20x the investment.

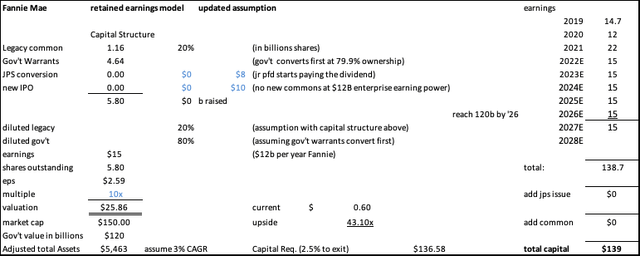

2023 equity capital structure w/IPO

3. Earnings retention model is another approach to reaching the required capital. Fannie Mae earns $15b+ a year. Assuming 3% asset growth, Fannie Mae would retain $139b on $5,463b adjusted total assets by year-end 2027. Coincidentally, the Gov’t warrants expire in 2028 and the Gov’t could monetize $120b in Fannie and $80b in Freddie for $200b total. The Gov’t could convert the warrants to sell their shares on the market after settling all lawsuits, taking the GSEs out of conservatorship, and running them like public utilities. Time value of money would favor the commons in this scenario, generating 40x+ return from the perpetual option by 2028. The jr. preferred could be turned back on to pay the dividend and would trade at par with an 11% IRR based on the 2008 $3.25 cost basis.

2027 equity capital structure

Risks

- Biden Administration doesn’t act, letting the companies capitalize through retained earnings and passing on status quo to the next Administration in 2024. This keeps investors locked in the investment for another 3-5 years.

- All court battles are resolved in Government’s favor and the special interests’ influence over FHFA and the Treasury could drag out the recapitalization process over 3+ years irrespective of warrant monetization incentives for this Administration.

- An unprecedented housing collapse could erode homeowners’ equity in the United States and loan-to-value (LTVs) ratios could deteriorate to a level the Government would need to step in to stabilize the GSEs, injecting taxpayers’ money again. This point could also be a catalyst for the Biden Administration to re-IPO soon. By capitalizing the companies, the Gov’t could avoid bailouts.

- The Financial Establishment lobby prefers the status quo, which kept the GSEs in conservatorship for 14 years. Without FHFA and Treasury agreeing to write off the Senior Preferred shares and converting their warrants, the companies will not be able to tap private markets.

- Optics could be shaped by Fannie/Freddie detractors. Senator Warner (D) says greedy hedge funds would be making a killing with a Fannie Mae and Freddie Mac privatization, but that is untrue. The preferred issues have been weak for the past 14 years and if FNMAS at a $3.25 cost basis returns $25 par, the 2023 IRR starting from 2008 – entry into conservatorship – is 15%, hardly a windfall considering S&P’s performance is 10-12% in the same period. Many investors have held these shares since the start of the conservatorship and many others purchased the junior preferred ranging $7-12 per FNMAS share when President Trump promised to privatize the entities, carrying a 50%+ loss on their cost basis. Making retirees whole and factoring in the time value of money expense is politically digestible.

Catalysts

- Midterm elections serve as a catalyst for this Administration. The Democrats are widely expected to lose Congress and probably the Senate to Republicans and gridlock is guaranteed for the ensuing two years prior to the 2024 Presidential Elections.

- The possibility of a 2024 Trump or DeSantis presidency should incentivize the Biden Administration to monetize the GSEs for their affordable housing agenda. A $100 Billion affordable housing fund is achievable. If Biden doesn’t act, Trump is on record (in the letter to the 5th Circuit En Banc) about his desire to privatize the companies. With another 12 quarters of earnings, the companies will have ~$150-170 Billion on the balance sheets and a bridge IPO could be accomplished within a few months of taking office.

Conclusion

Fannie Mae and Freddie Mac are increasing their net worth with every quarter of retained earnings. Currently, at $90b, the companies are building capital at a combined $23b+ annual rate. The undercapitalization gap stands at $110b, and the plans to IPO and convert the warrants need to be set in motion in the next 6 months. By the end of the process in 12-18 months, the GSEs will retain $30b+ and the IPO bridge of ~$80b is within reach. Fannie Mae, Freddie Mac, and FHFA hired financial advisors to assist with the recapitalization.

Investors can choose where on the risk scale they want to invest, with the commons being the riskiest, perpetual options potentially worth 20-40x if the Gov’t writes off the Senior Preferred and converts the Junior Preferred. The Junior Preferred shares are tied to contract rights and may be suitable for long-term portfolio positions. The jr. pfds are selling at a deep discount to intrinsic value, 13% of face value (OTCQB:FNMAS) at $3.25 of $25 par, with over 7x return potential.

Be the first to comment